Investors in both the United States and Australia have turned on former “market darlings” in both countries with a vengeance.

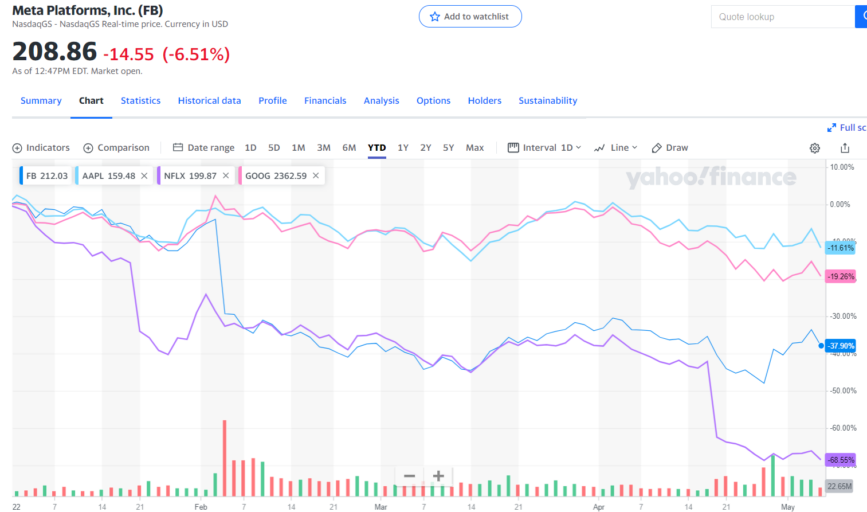

When market participants couldn’t buy sector leaders fast enough, someone coined the acronym for the big players in the US – the FANG stocks (Facebook—now Meta, Apple, Netflix, and Google – now Alphabet.

From Yahoo Finance, here is the year-to-date share price movement of the former darlings.

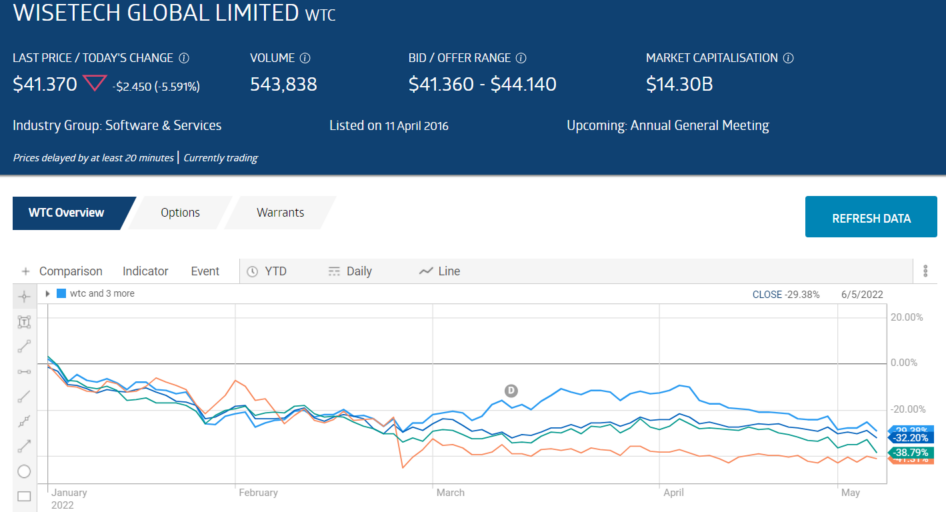

To pique investor interest as the Americans had done with FANG, here in Australia top tech market darlings were anointed as the WAAAX stocks – Wisetech Global (WTC); Afterpay Group (APT); Altium Limited (ALU); Appen Limited (APX); and Xero Limited (XRO). Afterpay no longer trades as APT so the group is down to four stocks. From the ASX website, here is how those stocks have fared year-to-date.

Top Australian Brokers

- City Index - Aussie shares from $5 - Read our review

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

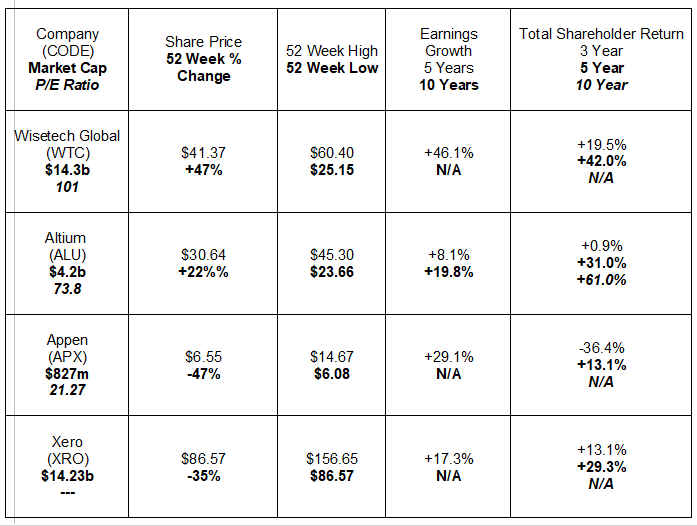

All these stocks roared out of the gates in the impressive global market recovery following the initial steep declines once the initial impact of the COVID 19 Pandemic on global markets subsided, although Altium remained flat over three years and Appen stuttered handily, down 72% over a three year period. However, over five years the WAAX members earned the status of market darlings:

- Wisetech Up 585%

- Altium Up 281%

- Appen Up 155%

- Xero Up 388%

To unravel the takedown of the tech sector year-to-date, many of these stocks are now facing two interrelated and powerful headwinds – inflation and interest rates.

Tech stocks generally have lofty Price to Earnings (P/E) ratios that often far exceed the company’s current financial status. Investors are willing to pay more for the growth they expect to come in the future.

Around the world governments responded to COVID 19 by keeping both businesses and consumers awash in capital to prop up demand and remain in business, while maintaining or in some cases lowering already low interest rates. Inflation was not on anyone’s radar, but the groundwork was laid.

Consumers spent handily, driving up demand for goods that were becoming scarce due to the impact COVID lockdowns had on production. Equally important was the massive disruption in global supply chains. Goods from factories either shuttered or operating with skeleton work forces were slow to reach their end user as the transport and logistics companies also suffered from lockdowns and reduced work forces.

Arguably it was inevitable that all that money chasing goods that were hard to come by would begin to drive prices upward. Businesses found themselves facing higher input costs as well as higher transport costs. Few economists and experts were accurate in predicting how high inflation would go, particularly in the US.

In response, governments – again primarily in the US – belatedly began to raise interest rates to cool inflation growing red hot. The latest 0.5% rate increase in the US was the highest in that country since the year 2000.

Rising costs are not good for any business sector, but the technology sector is acutely susceptible to inflationary cost increases as they cast a dark shadow over their growth expectations. Add to the mix, the fact that rising interest rates make fixed investments, particularly bonds, an attractive alternative to worried investors, and they increase borrowing costs for businesses.

Risk averse investors may choose to avoid the WAAX stocks until the path inflation and interest rates take becomes clearer. Investors with varying degrees of risk tolerance may see the falls these stocks have taken as a buying opportunity.

Although many investors rely on outside expert opinions on the future prospects of these companies, the outlook from the people running the company may be equally important.

The vast majority of corporate executives try to set realistic expectations for their investors. Throughout the COVID Pandemic, financial reporting and market updates have stated both the impact the business is feeling and the path they expect to see going forward.

The following table lists some key metrics for the four remaining WAAX companies.

All of these companies operate in the software and services business sector and all cater to the needs of businesses struggling during the pandemic.

- Wisetech Global serves an industry deep in the throes of the supply chain crisis – logistics.

- Altium provides software for designers of printed circuit boards (PCB) needed in industries suffering from parts availability.

- Appen offers artificial intelligence (AI) software platforms for collection and analysis of multiple data sources.

- Xero provides cloud based accounting software platforms to small businesses, many in near-survival mode due to COVID 19 related lockdowns.

In theory, every one of these companies could conceivably regain their market darling status in time due to their product offerings and market penetration.

The average Price to Earnings Ration (P/E) for the software and services sector is 28.02, making Appen with its P/E of 21.27 a potential target for bargain hunters. However, the company’s historical performance badly trails the other remaining WAAX members as the only stock to show negative shareholder return over three years.

Appen is an ultra-high tech company catering exclusively to the needs of businesses developing AI platforms for data collection, sourcing, analysis, and “real-world” modeling. The company offers more than 270 pre-labeled data sets for customers in industries ranging from technology and automotive, to retail and government, to financial services and healthcare. Appen also works with customers to create custom data sets to meet their unique needs.

Appen’s market cap has fallen far enough to open the possibility the company might be dropped from the ASX 200, an outcome almost certain to ignite another round of selling. Note the current share price is very near its 52 week low.

The company lowered its Full Year 2021 guidance in its Half Year reporting, and then failed to meet the downwardly revised targets in its Full Year Financial Report, posting a modest revenue increase of 8% and a 20% decline in net profit after tax (NPAT). Management stated it would no longer provide future guidance, focusing instead on long term strategic goals.

Some of Appen’s impressive list of customers are also struggling. Facebook (now Meta) reported weaker advertising demand and revenue, with its advertising operations supported by Appen.

Wisetech Global offers a broad range of software platforms for use by logistics and transport companies worldwide, beginning with its flagship product, CargoWise. The company operates in more than 165 countries, serving an impressive total of 18,000 logistics customers around the world. The company claims as its customers “42 of the world’s top 50 third-party logistics providers and 24 of the 25 biggest global freight forwarders.”

In FY 2021 the company reported revenues of $507 million dollars, up from $429 million in FY 2020, and profit of $108 million, down from $160 million dollars in FY 2020. Half Year 2022 Financial Results reporting highlighted the ongoing challenges the company faces:

- continued capacity constraints

- port congestion

- supply chain labor shortages

- higher freight rates

Despite the headwind, Wisetech posted an 18% rise in revenue and a statutory NPAT (includes one off charges) up 74% and underlying NPAT up 77%. CargoWise revenue grew 29%. Thirty percent of Wisetech’s revenues went into R&D (research and development) activities.

Since the second half of FY 2017 the company has invested $625 million dollars in R&D activities, yielding more than 4600 product features and enhancements.

For the Full Year 2022 the company raised its EBITDA (earnings before interest taxes depreciation and amortisation) guidance by between $10 million and $15 million dollars and reaffirmed its existing revenue guidance. In the uncertain and volatile markets investors face, forward looking analyst estimates should be moderately suspect, but Wisetech does have a two year earnings growth forecast of +34%.

Investors who rely heavily on analyst stock recommendations will find little comfort researching Xero. UBS and Macquarie have SELL and UNDERFERFORM ratings on XRO while Credit Suisse, Goldman Sachs, and Morgan Stanley have BUY and OVERWEIGHT ratings.

In addition to its core small business customers, Xero serves independent accountants and bookkeepers with its flagship XERO accounting software platform and mobile apps.

The platform goes beyond the traditional accounting functions of billing, invoicing, expensing, payment acceptance, payroll, and banking reconciliation to include sophisticated project tracking and contact and asset management.

Xero is New Zealand based and closes its Fiscal Year at the end of March. Although for the most part the financial results for FY 2021 were strong, the revenue increase of 8% failed to meet guidance estimates. While revenues missed estimates by only 0.9%, EBITDA came in 16.2% below guidance. In addition, management announced operating expenses as a percentage of revenue for the coming year could increase between 10 and 15%.

Half Year 2022 results showed a similar pattern, with continued revenue and subscriber growth and a 19% decline in EBITDA, a 72% drop in operating profit, and a 42% increase in operating expenses. The share price closed at a 52 week low to end the first week of trading in May. Goldman Sachs and Morgan Stanley are bullish on Xero.

In March of 2021 Xero acquired Planday, a workforce management platform operating in the UK and Europe. In May of 2021 Xero acquired global e-invoicing platform Tickstar. The 2021 acquisitions supplemented the earlier acquisition of Waddle, an Australia based small business financing platform. The acquisitions are part of Xero’s strategy of expanding its footprint and service offerings. The company’s earnings per share (EPS) are forecasted to drop from a reported $0.121 per share in FY 2021 to an estimated $0.037 In FY 2022 before rising to $0.587 in FY 2023.

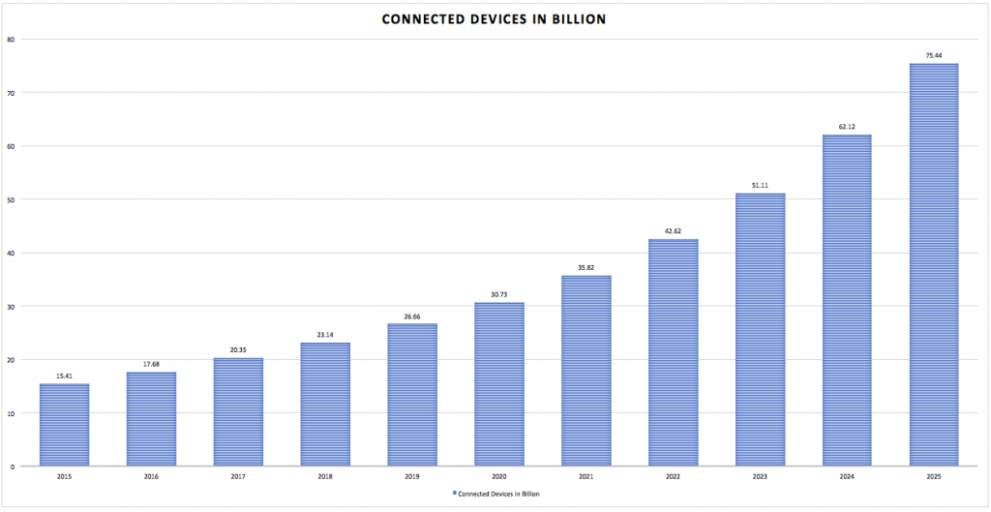

Altium is in the business of providing multiple software platforms for professional designers of printed circuit boards. In an already digital world with a ravenous appetite for even more digital wonders in the future, the PCB is at the heart of it all. Virtually every electronic device in both the consumer and commercial market today is powered by a PCB.

Investors who drool over stocks with mind-blowing growth potential should consider the following graph, from an India based PCB manufacturer CircuitWala:

Between 2015 and 2021 – a span of a mere six years – the number of digitally connected devices with printed circuit boards increased 132%, with a forecasted increase to 2025 – one decade – of 329%.

The world has evolved from transistor radios to smartphones, to smart cars, and smart kitchen appliances. What’s next?

Altium has a two year earnings growth forecast of +30.2%.