The yen was in freefall last year. But the yield curve control (YCC) adjustments by the Bank of Japan (BoJ) in December could be enough to reset that narrative, despite no further changes to policy this month. The yen is still undervalued, and we think the upside potential now outweighs the chance of further depreciation.

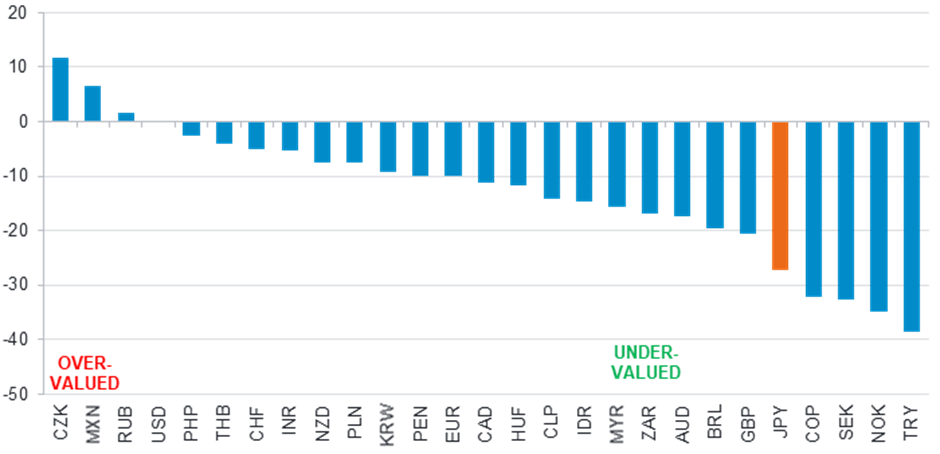

Fidelity FX Fair Value shows Japanese Yen could still go a long way

Source: Fidelity International, January 2023. Latest F3 Spot overvaluation versus USD.

As other developed markets central banks hiked rates last year, the BoJ was unmoved. The country has unique inflation dynamics and the BoJ saw no reason to deviate from its ultra-loose YCC policy. The yen bore the brunt of this policy divergence, ending the year -12% against the dollar after recovering from -23% in October.

But on 20 December, the BoJ made an unexpected change to YCC by widening the band in which it allows 10yr Japanese Government Bonds (JGBs) to trade by allowing them to fluctuate by +/- 50bps, rather than the +/- 25bps set in 2021. While the official rationale for this move was to improve the functioning of the bond market, some interpreted it as a first step toward YCC exit or policy normalisation.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Japanese banking stocks have surged in recent weeks and JGB yields have also increased meaningfully, but the rise in yen has been more muted. Despite the lack of further action by the BoJ this week, we believe that the recent relaxation of the YCC policy could change the narrative surrounding the yen. A more positive view of global duration now that inflation has peaked in the US and Europe should also support the yen, as will China’s reopening. The currency is still extremely undervalued, and it now appears to have strong risk-reward characteristics – we believe the potential upside outweighs the chance of further depreciation.