In early November financial websites in the US were citing the latest likelihood of a recession in the US from the Bloomberg Economics model projections. The reading has escalated from the prior 65% likelihood to near certainty status of 100%.

As a regular follower of global financial news would suspect, uniform consensus on the timing and severity of a recession in the US does not exist.

An 18 November report from global investment bank Goldman Sachs put the chance of a US recession at 35%, citing data on the US economy not consistent with a recession. Staff economists at the US Federal Reserve Bank estimate the chance of a US recession in the coming year at 50%.

Some investors may be following the advice to hope for the best but plan for the worst. The “hope for the best” camp may be looking for opportunities with stocks already dropping due to the fear of a recession.

Research following the GFC (great financial crisis) found that among activities considered gambling, only playing lotteries proved to be recession proof.

Top Australian Brokers

- eToro - Social and copy trading platform - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- Avatrade - Powerful trading tools - Read our review

In 2011 research from GBGC (global betting and gaming consultants) concluded that some sectors of the global gaming industry may be more resistant to recessions due to new and innovative technology and changes in the regulatory environment.

Online sports betting in the pre and post GFC environment was in its infancy, and non-existent in the US. In 2018 the US Supreme Court opened the door to a new opportunity when they ruled against a federal law that sports betting in states outside of the legal gambling environment in Nevada was illegal.

The sector in the US has caught fire, fueled by the pent up desires of fans of the country’s professional sports team to bet on their favorites. In May of 2022 an article in The Guardian claimed US sports betters have spent $125 billion dollars on sports and other forms of online betting. The article also cites the AGA (American Gaming Association) pointing to $1.3 billion dollars in tax revenues going to state and local governments where online sports betting was legalised following the 2018 Supreme Court decision.

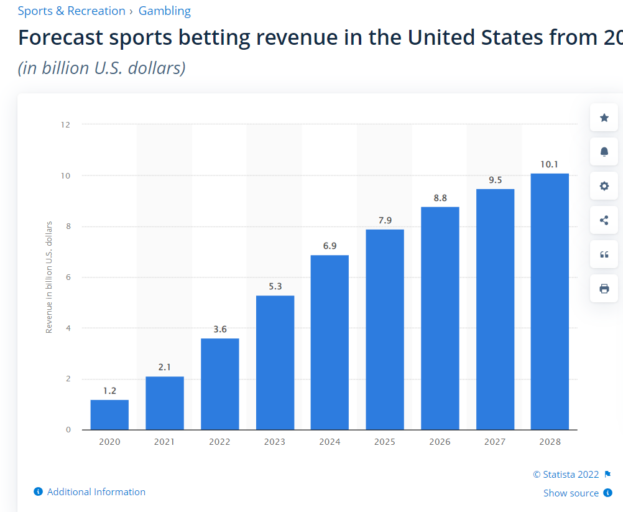

From global market and consumer data research firm Statista, here is a forecast for the sports betting sector in the US to 2027.

There are three sports betting and online gambling stocks on the ASX with a footprint in the US market – PointBet Holding (PBH), BlueBet Holdings (BBT), and Betmakers Technology Group (BET).

An Australian leader in the global gaming machines and gaming content and technology – Aristocrat Leisure (ALL) is reportedly casting a covetous eye on the US sports betting market.

A three year price movement chart from the ASX website shows that all four of these stocks were impacted by the COVID 19 Pandemic:

On 23 November PointsBet announced the beginning of online sports betting in its 13th location in the US – the state of Maryland. The launch follows the recent start of the PointsBet Retail Sportsbook at The Riverboat on the Potomac (a river system on the eastern coast of the US.)

The online platform is the extension of the betting option offered at physical locations. Gambling in the US prior to the Supreme Court 2018 decision striking down the federal ban on sports betting found a loophole in that law. It was a federal, law meaning states could legislate riverboat gambling on state waterways to raise tax revenues without the drawbacks of large land-based casinos.

The PointsBet Sports Book offers betting options on the major US sports – football, basketball, baseball, and soccer, along with collegiate sports in the US, World Cup matches, horse and dog racing, and gaming.

PointsBet now has launched its cloud-based desktop and mobile platforms in the following US states:

- Maryland

- Louisiana

- New Jersey

- New York

- Pennsylvania

- Virginia

- West Virginia

- Michigan

- Iowa

- Illinois

- Indiana

- Colorado

- Kansas

The company offers a wide range of betting options on its platform. The Maryland announcement led to a brief rally in the beaten down stock price.

PointsBet listed on the ASX on 12 July of 2019, with the share price dropping around 56% since listing. The share price began to fall in early November following the release of a quarterly the release of financial information for the first quarter of 2023.

The company has released a string of positive announcements, expanding in the US and Canada, and signing important partnership arrangements with major sports outlets like NBC Sports. The sole downside to what the company is doing is cost. Expansion is expensive and before revenues ramp up to stay ahead of operating and expansion costs, investors get very nervous. The share price has been in free fall since that release. PointsBet has a P/B ratio (price to book) of 0.80, making the book value per share of $2.42 well above the current share price.

BlueBet was founded in 2015 and listed on the ASX on 02 July of 2021. The share price closed its first day of trading at $1.77 per share and has dropped to its latest close of $0.415.

In its Australian market, BlueBet holds a competitive advantage over other Aussie outlets since BlueBet offers equal focus between racing and sports betting.

In the US market the company offers much the same betting options as PointsBet but is two years behind PointsBet in penetrating the US market. BlueBet states the company has “market access” in Iowa, Colorado, Louisiana, and Indiana.

The company is following its “capital soft” expansion strategy as outlined in the BlueBet IPO prospectus and is making its IPO metric targets. BlueBet is building partner relationships and joint ventures to operate the sports book operations of mid-tier casinos in the US.

The strategy appears to be working as on 28 June BlueBet signed a ten year market asset agreement with Caesars Entertainment headquartered in Las Vegas to operate a new online sportsbook in Indiana. The company is generating both revenue and gross profit but the FY 2022 yearly operating and expansion costs topped $32 million dollars, dragging the gross profit down to a loss and turning a positive EBITDA (earnings before interest, taxes, depreciation, and amortisation) in FY 2021 to a loss in FY 2022.

The most recent update for the first quarter of FY 2023 followed the pattern – positive gains in active customers and bet counts and high expenditures – over $12 million dollars in the quarter.

Management is confident in the company’s dual growth strategy of continued investment in the Australian market and expansion in the US.

Betmakers Technology Group finds itself in the top spot on the ASX Top Ten Short List, with short interest of 15.9%. Insider selling sends many investors scrambling for the exits, regardless of the reason for the sale. Betmakers share price was already on the Top Ten Short List following a year long decline when the market learned the company’s major shareholder had sold $11 million dollars of BET stock.

The Full Year 2022 Financial Results was a major disappointment. While total revenues rose 371%, the company’s loss was also up from last year – 411% — coming in at $89 million dollars. As was the case with PointsBet and BlueBet, operating expenses of more than $71 million dollars crushed the company. In FY 2021 expenses were $12.7 million.

First Quarter of 2023 results released in late October followed the pattern – revenues up 19% against operating expenses of $29.7 million dollars, up from $25.8 million dollars in the fourth quarter of FY 2022.

In addition to operating costs, some investors may be wary of Betmakers’ limited market – horse racing.

The company has an impressive array of “betmaker” software, data, and analytics to manage the wagering process end-to-end, beginning with the racing venues, to the wagering operators and bookmakers to the regulatory authorities and the betters.

Betmakers operates here in Australia and New Zealand, in the UK and the US and elsewhere internationally. The company has three operating divisions – Global Tote for pari-mutuel betting systems platforms, — Global Betting Services for bookmakers and wagering operators – and Global Racing Network providing software and services to venue operators, racing bodies and regulators.

In theory the company’s business to business (B2B) operations should shield Betmakers from any one racing network declining. The companies poor financial performance and smaller market may be offsetting the B2B advantage. All three of these companies were hit hard by the pandemic and the more recent inflationary environment and recessionary concerns.

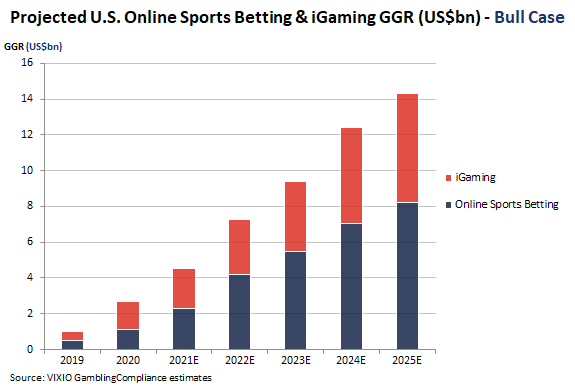

For PointsBet and BlueBet, the future looks promising given the growth potential of the US market. From the website vixio.com:

As of November of 2022, there were 30 states in the US with some form of legalised online sports betting with other states preparing to enter the space.

Aristocrat Leisure provides gaming machines for land-based casinos and develops mobile games but the gaming machines are the company’s major source of revenue. Casino closures during the course of the pandemic hurt the company, only to be followed by inflationary and recession fears.

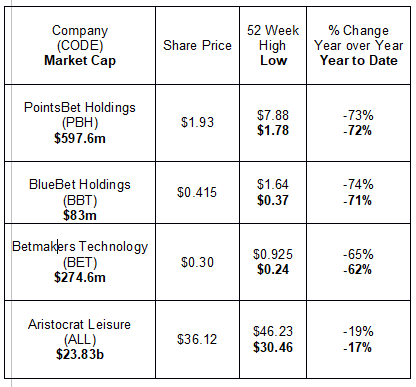

The company’s proposed acquisition of UK based gaming software developer Playtech recently fell through. The Australian is reporting the company is now considering entering the US sports betting market. The following table includes price metrics for the four companies.