Of all the business sectors crushed by the COVID 19 Pandemic, the travel sector was at the top of the list. As international and state borders here in Australia slammed shut, domestic and international air travel became virtually impossible. Lockdowns and “stay at home” provisions saw domestic travel grind to a halt.

By November of 2020, the sector showed signs of improvement as border restrictions began to ease and the positive news about upcoming vaccines spurred hopes of better things to come. As the calendar year 2021 dawned Australia had earned the title of a “Pandemic Success Story” as the country had been relatively devoid of COVID infections since mid to late 2020.

Then in June of 2021 the Delta Variant of the virus came roaring out of India and began to make a home here in Australia. Restrictions returned and the country’s vaccination strategy began to fail.

Flash forward to October of 2021 and Australia is poised to reclaim its status as a success story. Expectations are that 80% of the population will be fully vaccinated in early November, with the federal government planning to lift the ban on overseas travel for vaccinated citizens, but as yet there is no time set for reopening the borders to international tourists.

Even in the US, the number of COVD cases are dropping and vaccination rates are climbing. As is often the case, investors return to beaten down stocks on the potential of an improving situation strengthening. Some analysts are already expressing caution that travel recovery is already “baked” into the share price of most ASX travel stocks.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The following price movement chart from the ASX shows the top three listed providers of travel-related services – Flight Centre (FLT); Corporate Travel Management (CTD); and Webjet (WEB). All three hit 52 Week Highs in the last month.

While there may be some truth in those analyst cautionary opinions, it is equally true that these stocks still are far below their pre-pandemic levels. The following three year price movement chart from the ASX website for the three makes the case.

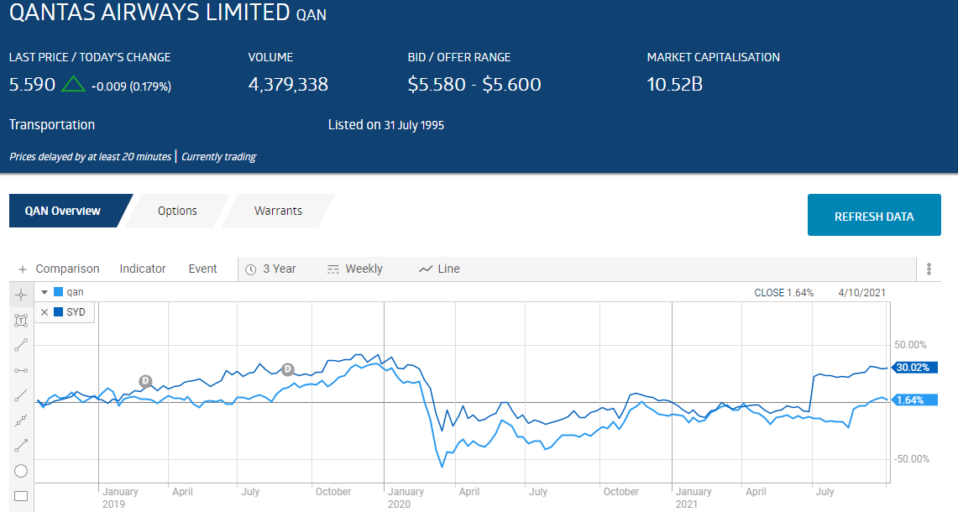

The same pattern exists for our largest airline – Qantas Airways (QAN) – and our largest airport – Sydney Airport (SYD), with this year’s high lagging behind the highest price over three years.

To sweeten the pot, all of these travel-related stocks have double digit two year earnings growth forecasts. The following table includes the forecasts along with share price performance and other metrics.

Every one of these companies saw dramatic drops in both revenue and profit since FY 2019, although Qantas and Flight Centre managed to reduce the size of their loss in FY 2021. The following table shows the revenue and profit picture for each over the last three fiscal years.

Historical earnings performance for this sector is heavily affected by the price of fuel. The current attraction of travel related stocks for investors is future expected growth back to a sense of normalcy from a low base.

The historical performance of Qantas, Sydney Airport, and Corporate Travel Management show the power of consistent dividend payments.

All three suspended dividend payments in the wake of the COVID 19 tsunami that engulfed them. Corporate Travel and Qantas paid dividends consistently since FY 2015, while Sydney Airport’s record of dividend payments goes back to FY 2011.

Investors who favor historical performance as a measure of future performance will look favorably on the average annual rates of total shareholder return of the three. Dividend payments can be a powerful boost to share price appreciation over time.

While Sydney Airport and Qantas rely on travelers of all kinds, Corporate Travel Management caters to the business sector. The company operates in the same general mode as the other travel service providers, Flight Centre and Webjet, focusing on business travelers exclusively.

Corporate Travel Management is global in scope and expanded its presence in both the US and the UK in FY 2020 through the acquisition of Corporate Travel Planners and Travel and Transport along with the international arm of T&T, Radius Travel. These acquisitions reportedly vaults the company into the top five of global travel planners and leaves the company larger than it was pre-pandemic.

The company serves the resources and sports industry as well as event and leisure travel arrangements for its corporate customers. Financial metrics across the board improved substantially in the fourth quarter of FY 2021.

Although Corporate Travel Management provided no guidance for FY 2022 due to uncertainties surrounding the COVID situation, management does expect underlying EBITDA (earnings before interest taxes depreciation and amortisation) to continue to improve in Q1 of 2022, citing record setting post-COVID revenue in July as evidence.

Flight Centre offers a full range of travel related service from flight bookings to accommodations to tours for both the public leisure and corporate sectors. The company has operations here in Australia/New Zealand as well as in North America, Europe, and Asia.

The brick and mortar retail travel stores that saw the company’s growth beginning with the first store in Sydney back in 1982 began to weigh on Flight Centre as the digital age opened the door to online travel booking sites like rival Webjet and a host of international competitors The company now offers its UK small business travel company customers online bookings through the HelloFBCT travel platform. In addition, the company has evolved its model into an omni-channel operation, with retail stores, eCommerce websites, call centres, and direct business to business (B2B) contacts.

The onset of the COVID Pandemic crushed the company, with impacts like the complete shutdown of US subsidiary Liberty Travel. Flight Centre is now closing eight hundred stores.

A 14 September investor presentation at the latest Bell Potter ELC (emerging leaders conference) event gave investors room for optimism on multiple fronts, from improving business conditions spurred by vaccination rates to expansion of the company’s digital presence and its 2022 entrance into the Japanese business travel sector.

Webjet is another company suspending dividend payments due to the pandemic. The company is strictly digital, serving both consumers and businesses with a variety of travel-related services, including hotel accommodations, motorhome and car rentals, travel insurance, tours, package vacations, and of course, travel bookings.

The company is global in scope, with a presence here in Australia/New Zealand, the rest of the Asia Pacific region, the Americas, Europe, and Africa and the Middle East. Webjet is the top OTA (online travel agency) in Australia and New Zealand.

Webjet expanded its OTA operation with the acquisition of car, motorhome, and cruise booking agent, Online Republic. The company then entered the B2B (business to business) space with an online platform connecting travel agents and hotels, first via its own offering followed by an acquisition. The operation now goes by the name WebBeds.

As is the case with all these companies, Webjet is expecting better days ahead as vaccination rates around the world are loosening the tight grip on both domestic and international travel in some countries.

Webjet reports that WebBeds returned to profitability in July and August of this year, with Webjet OTA and Online Republic returning to profitability at the close of FY 2021 before new lockdowns affected results. WebBeds is expected to remain profitable in September with the other two divisions expected to return to profitability as Australia and New Zealand continue reopening.