Investing on a Nest Egg from $500 to $5,000 Dollars

There is truth to the time-tested idiom that it takes money to make money, but a more relevant question for many would-be investors is how much is enough to get started?

Money management experts might be likely to begin with a different question if asked for advice – where did you get the money?

Why is that relevant? Behind the question is concern for the investor’s financial condition. Even “windfall” money from an unexpected bonus or excessive overtime must be considered in light of what should be the first concern of newcomers to investing – debt. It makes little sense to invest for the future if you are weighed down by credit card debt with interest rates in excess of 20%.

Savings is another concern cited by financial advisors. Conventional financial wisdom says households should hold sufficient income in savings to cover the unexpected, like job loss or medical expenses.

For many ready to take the investment plunge the ultra-conservative advice from financial experts is often ignored. Our superannuation system may be seen as sufficient for retirement, supplemented by investments promising better returns than employees adding to their own superannuation and pension accounts.

Top Australian Brokers

- City Index - Aussie shares from $5 - Read our review

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

With the caveats potential investors should take a hard look at both their debt and savings for emergency situations before looking into any investment option, and there are many.

Fixed Income Options

Fixed Income Options like certificates of deposit or bonds have the decided advantage of low risk.

However, as newcomers to investing quickly learn, low risk is accompanied by low reward. You will not lose your investment dollars in certificates of deposit or bonds, but your reward will be modest at best. Options for Australians include government and corporate bonds along with CDs and a specialised investment – the hybrid security.

Hybrid securities add some aspects of equity investment to fixed income debt securities, including convertibles, preference shares, and capital notes. These are complex and are best considered with the assistance of a professional financial advisor.

Equity Investment Options – ETFs, REITS, Stock Picking

The differences in the amount one has to invest become clearer when it comes to the different forms of equity investing. If you have saved or receive unexpectedly $500, $1,000, $3,000, or $5,000 dollars, the higher the amount the more options you will have.

Equities are shares of ownership in publicly traded companies. Investing in a company carries with it the inherent risk the company may falter, with the accompanying decline in share price and the possibility of ultimate failure – bankruptcy.

Portfolio diversification is the advised approach to lowering risk. This approach calls for multiple stocks from different business sectors. The higher the investment nest egg available to you, the greater will be your opportunity to diversify. Simply put, instead of putting $3,000 or $5,000 into a single stock – no matter how attractive – the investor can buy into several stocks representing different business sectors. In challenging economic times, some business sectors and companies perform better than others.

Investing in a stock based solely on its share price without considering company fundamentals is not a sound strategy. However, a portfolio diversification strategy suggests searching for multiple targets and allocating investment dollars to maximize shares in each target.

Investors who lack the time or temperament (or both) to engage in the extensive research required to build a portfolio of stocks, there is an option that allows for a measure of “instant diversification.”

Exchange Traded Funds (ETFs)

As opposed to mutual funds, ETFs have no minimum buy-in requirements and trade like an individual stock, bought and sold at any time of the trading day on the ASX.

These funds primarily focus on a single business sector, a market index, or a geographic area. A healthcare ETF will include ownership in stocks from a variety of different healthcare providers. A mining ETF will focus on companies mining a variety of different commodities.

Investors with a $500 investment budget could start with a single ETF or two lower priced funds. Investors with more ample available funds could invest in multiple ETFs, diversified across business sectors.

ETFs for Any Nest Egg Amount

The ASX has ETFs trading for under $10, making them candidates for a place in a portfolio of other ETFs also trading under $10. Given the diversification of companies inherent in all ETFs, investments here can start with fewer entries, as opposed to undiversified individual stocks.

BetaShares Asia Technology Tigers ETF (ASX: ASIA)

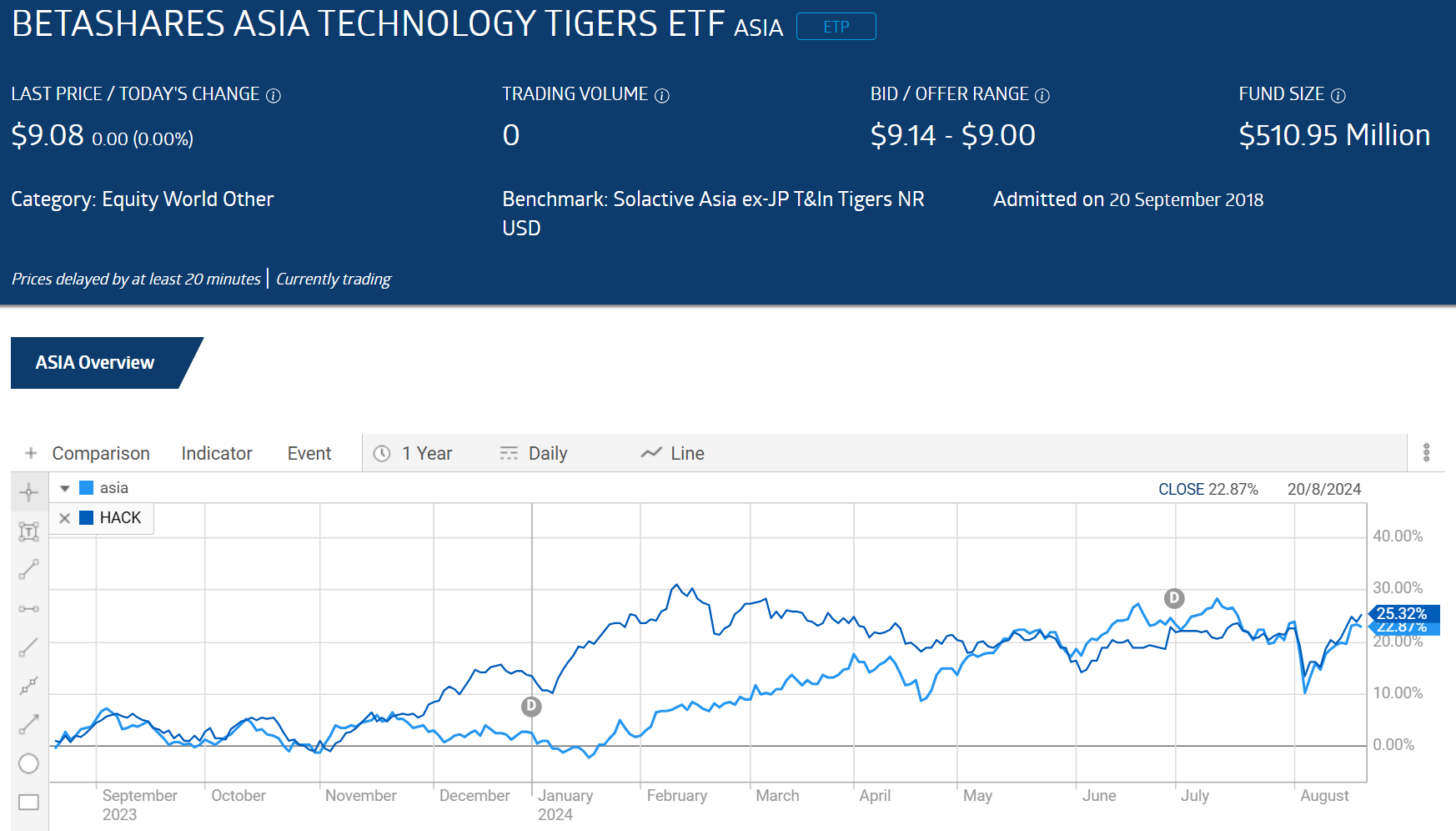

As of 20 August of 2024, shares of ASIA were trading for $9.08 per share. The fund tracks the top 50 technology and online retail companies operating in Asia, with the exception of Japan. Taiwan Semiconductor, Samsung, and Alibaba are among the fund’s top holdings.

ETFs collect dividends from portfolio companies and distribute them to shareholders.

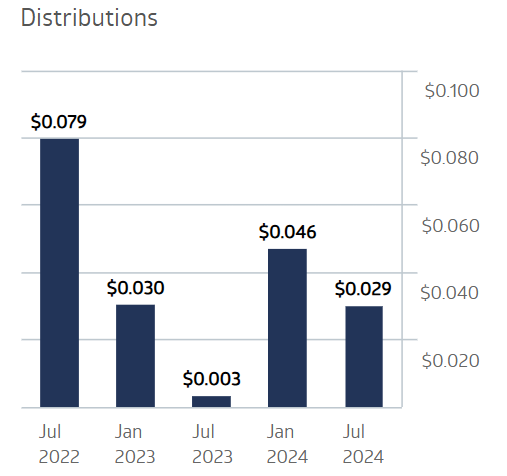

Asia Technology Tigers Distribution Performance

Source: ASX

BetaShares Global Cybersecurity ETF (ASX: HACK)

Shares of BetaShares Global Cybersecurity ETF were trading for $11.93 as of 20 August.

Technology holdings dominate the portfolio, accounting for 93%. Top companies in the portfolio include Infosys, Broadcom, Palo Alto Networks, Cisco Systems, and CrowdStrike.

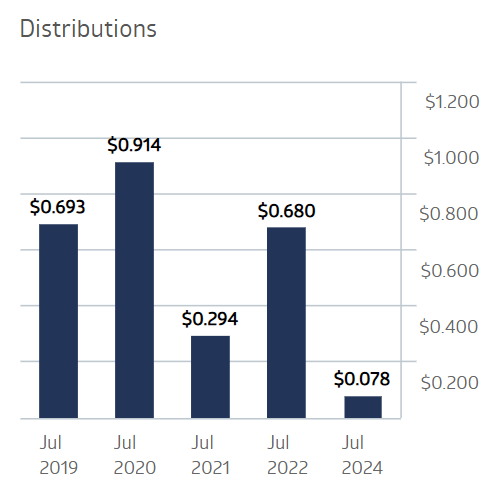

Global Cybersecurity Distribution Performance

Source: ASX

Year over year the respective share prices are up 25.3 % and 22.8%. Over five years shares of ASIA rose 77.3% while HACK shares were up 64.7%.

Source: ASX

Real Estate Investment Trusts

A REIT makes multiple investments in a single, or multiple classes of real estate –commercial, residential, or industrial. Many operate in more than one real estate sector. Real estate has long been considered one of the best investing opportunities available, but the upfront investment costs prohibited entry to those with substantial financial resources. REITs open the door to average retail investors.

REITs also trade like individual stocks, but unlike stocks, REITs are required by law to return substantial percentages of their profits to their investors in dividend payments.

The ASX is blessed with some of the best REITs in the world today.

ETFs for Any Nest Egg Amount

Like ETFs, the ASX features REITs from under $10 to under $50. With a market cap of $63.4 billion dollars, the Goodman Group is the largest REIT on the ASX.

Goodman Group (ASX: GMG)

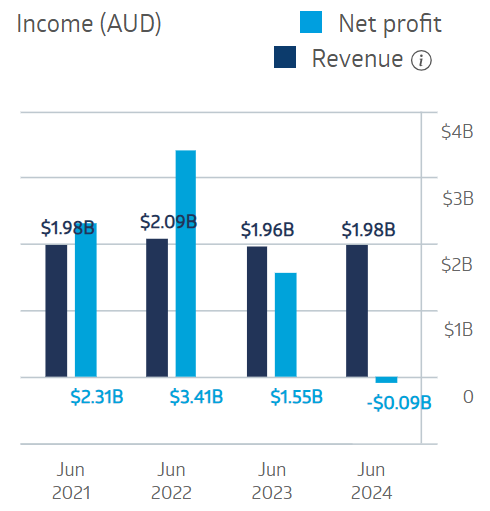

Goodman Group shares were trading for $33.40 as of 20 August. The company is global in scope, developing, owning, and managing properties for commercial and industrial sectors, with a focus on providing infrastructure needed for the digital economy.

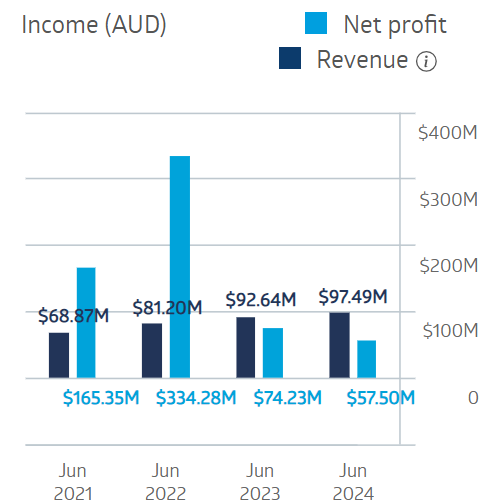

The company’s three-year run of multi-billions in reported profit stuttered in FY2024, posting a loss.

Goodman Group Financial Performance

Arena REIT (ASX: ARF)

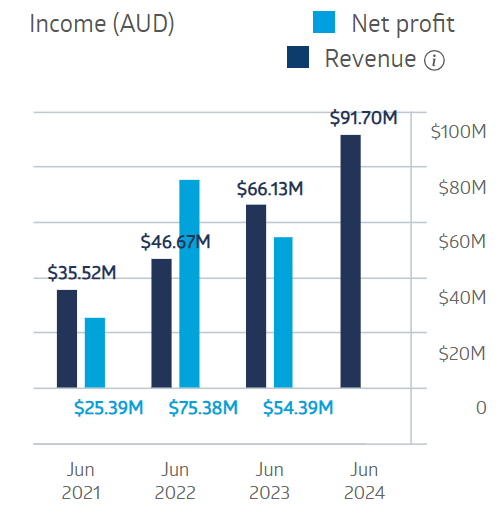

With a market cap of $1.5 billion dollars, ARF traded for $3.95 as of 20 August. Arena is a specialty REIT focusing primarily on daycare centres for children. The company provides education, daycare, and healthcare for children along with accommodations for specialist disabilities. Arena operates 276 facilities across Australia.

Arena Financial Performance

Source: ASX

Aspen Group (ASX:APZ)

Aspen Group is another specialty REIT, focusing on affordable residential, retirement, and park accommodations. The company claims its target market is “the 40% of Australian households that can pay no more than $400 per week in rent or $400,000 purchase price for their housing needs.”

Aspen Group Financial Performance

Source: ASX

Over five years all three REITs have seen their share prices rise.

Individual Stock Picking

Individual stock picking is not for the faint of heart. The effort requires extensive time to research potential stock picks and the time to monitor their share price movement.

The advantages are many. On the ASX quality growth stocks often trade below $1.00 per share as they progress on the road from revenue generation to profitability. For larger nest eggs there are shares trading under $10 and under $100.

Individual Stocks for Any Nest Egg, Large or Small

The ASX is known for strong biotech startups. Right now there are two companies trading for under $1.00 that have received clearance from the US FDA (Food and Drug Administration).

Botanix Pharmaceuticals (ASX: BOT)

Following successful completion of two studies on the company’s treatment for the third largest dermatological condition in the US — excessive sweating – the company received FDA clearance. Botanix expects its treatment to be released in the US market in the fourth quarter of 2024.

Genetic Signatures (ASX: GSS)

Genetic Signatures works on diagnostic solutions for gastrointestinal parasites. The FDA has issued clearance for the company’s EasyScreen Gastrointestinal Parasite Detection Kit and GS1 automated workflow.

Gastrointestinal parasites infect more than 3.5 million people around the world.

Both of these startups have seen their share prices up year over year.

Source: ASX

Australian investors can an investment journey with a budget of as little as $500. Larger starting nest eggs of $1,000, $3,000, or $5,000 increase available options.

Prior to investing, financial advisers stress the need for an assessment of the potential investor’s financial condition, focusing on debt and “rainy day” savings.

Investment options range from low risk fixed income investments like bonds and CDs to higher risk individual stocks. Diversification of investments is an essential strategy for lowering risk. Exchange traded funds offer “instant diversification with their portfolio of companies operating in a specific sector.

Real Estate Investment Trusts that develop and manage properties from commercial and industrial to residential give average investors the chance to invest in real estate on a modest budget.

Individual stocks offer the prospect of greater rewards at higher risk. No one should pick a stock because of a low price, but quality growth prospects with lower share prices allow startup investors more opportunities for diversification.