Investing in Exchange Traded Funds (ETF) – a Diversification Strategy

Prior to 27 August of 2001, Aussie investors following the advice of financial experts to build a portfolio of diversified stocks, bonds, and fixed income assets had two choices. Embark on the arduous task of researching potential buys in all individual asset classes or investing in Mutual Funds.

Mutual funds have other downsides besides higher fees, with many requiring minimum investment amounts and some closing to new investors at the behest of fund managers. Perhaps the most significant disadvantage is the price of the fund is not calculated until the end of the trading day, robbing investors of the opportunity to buy on the moment as opposed to finalising their purchase at the next day’s opening.

The Benefits of ETFs

ETFs wiped out those disadvantages, trading like stocks at any time markets are open. Liquidity is important to many investors, a key advantage of ETF buying and selling anytime the market is open. Early ETFs were almost exclusively “passive” – tracking the returns of all the stocks in a given broad index, like the ASX 200; or a sector index, like the ASX 200 Healthcare Index (XHJ).

ETFs were first introduced in the US market back in 1993 with most passively tracking different stock market indexes. Mutual funds employed managers to actively research and buy and sell holdings within the fund, resulting in significantly higher fees for investors.

Today available ETFs have exploded in numbers and expanded to include “active” ETFs, where a team of professionals make buy and sell decisions to outperform a benchmark index. Actively managed ETFs charge higher fees but maintain the advantages of no minimum buy requirement and the liquidity of trading anytime a market is open.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Choosing the Right ETF Categories for Your Portfolio

If diversification of assets within an ETF is a major benefit of ETFs, it stands to reason diversifying the exchange traded funds across asset classes is another major benefit.

Classic portfolio theory suggested investment portfolios ideally included 60% equity assets and 40% bond assets. In addition to bond ETFs investors with high risk aversion can choose fixed income ETFs.

The returns generated by bonds and fixed income investments over time may be guaranteed, but investing history shows over the long term they trail equity investments. However, a well balanced ETF portfolio should include a bond ETF and possibly a fixed income ETF, depending on the investor’s tolerance for risk.

The strategy for choosing the right ETFs for a diversified portfolio is the same as those for investment portfolios in general. The first rule is seeking multiple asset classes that respond differently to market conditions. When stocks drop, bonds go up, as do other fixed income assets. Sectors like healthcare, consumer staples, utilities, and real estate are less likely to fall in tough times than consumer discretionary, energy, financials, and industrial stocks.

Investors with high risk tolerance may shy away from ETFs targeting small cap stocks with higher growth potential and greater risk, preferring ETFs targeting more stable blue chip companies.

Although conventional wisdom suggests commodities ETFs should be part of a well balanced portfolio, that advice needs to be tempered against the investors risk tolerance. Commodities can be cyclical and are more dependent on conditions beyond company’s control like weather and demand for the commodity than other asset classes.

Investment horizon is a useful concept for risk averse investors, referring to the length of time an investor expects to hold an investment. Some financial experts advise setting an acceptable rate of return contributing to meeting an investor’s goals and then selling out.

However, one of the greatest investors of our time – Warren Buffet who built US listed Berkshire Hathaway – once stated his preferred holding period was forever. Time is the friend of investors who can afford to weather losses. The top two miners in the ASX – BHP Group and Rio Tinto – were crushed during the Great Financial Crisis of 2008. BHP shares returned to pre-GFC levels within two years. Fifteen years later both are trading at or near all-time highs, with additional declines and subsequent recoveries along the way.

Source: Reuters Markets

Implementing Your Strategy

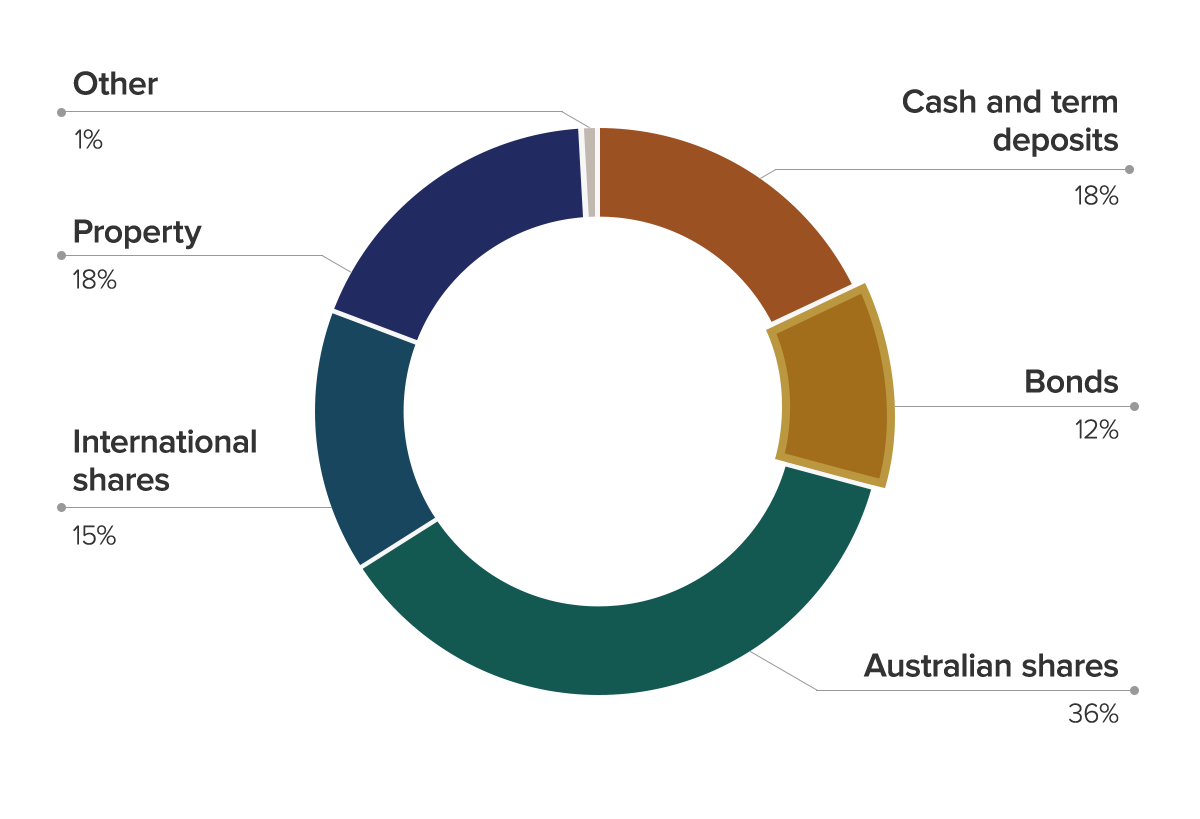

Investing website stockspot.com.au published this chart of investment trends in Australia as of 2018.

Source: SuperConcepts Investment Pattern Trends September 2018.

Following our fellow Australians suggests a strategy of building a portfolio heavy on Australian shares, along with bond, property, and international ETFs.

Beginning with the asset class most aggressive Aussie investors find supremely boring – bonds – an implementation strategy begins with a listing of ASX bond ETFs.

With list in hand the ASX website is a good starting point for researching options, followed by researching the ETF at the provider’s site.

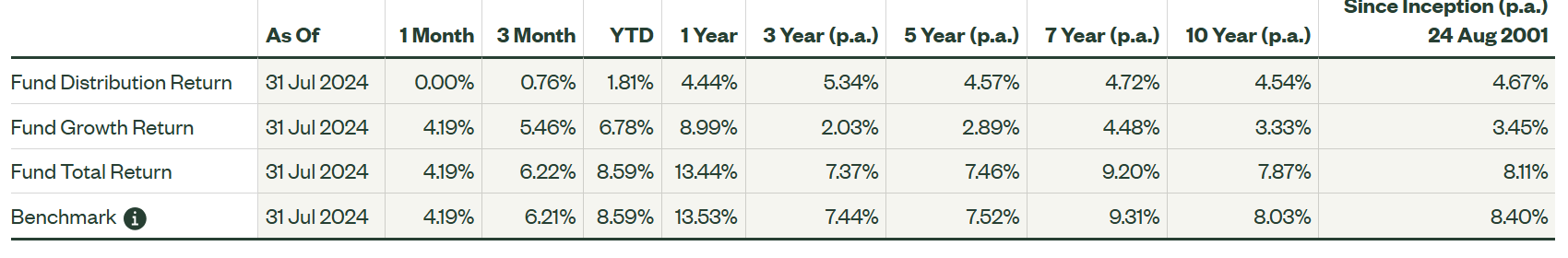

BetaShares is an ETF provider headquartered here in Australia. There are three relevant charts from the ASX website to begin researching their BetaShares Australian Government Bond ETF (ASX: AGVT).

Year over year the price of a share in AGVT has gone up 4.3%. The bond market had a rough 2022 and 2023, with AGVT dropping 15.6% over five years. Bonds and bond funds across the board showed similar declines.

Source: ASX

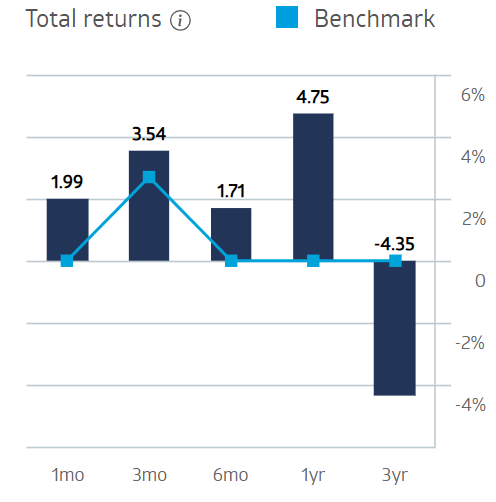

The next shows the fund’s total returns, including the share price and reinvestment of dividend distributions compared to a benchmark index.

Source: ASX

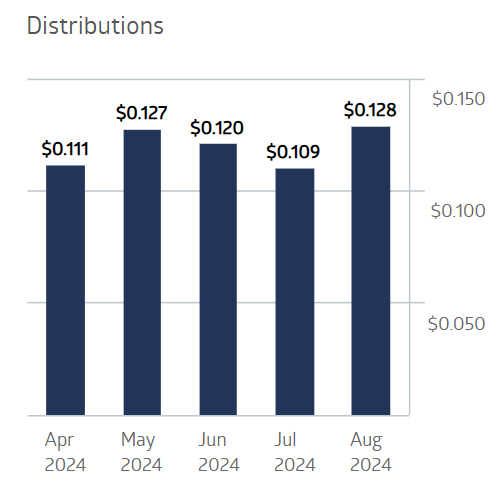

Finally, here are the funds monthly dividend distributions over the last four months.

Source: ASX

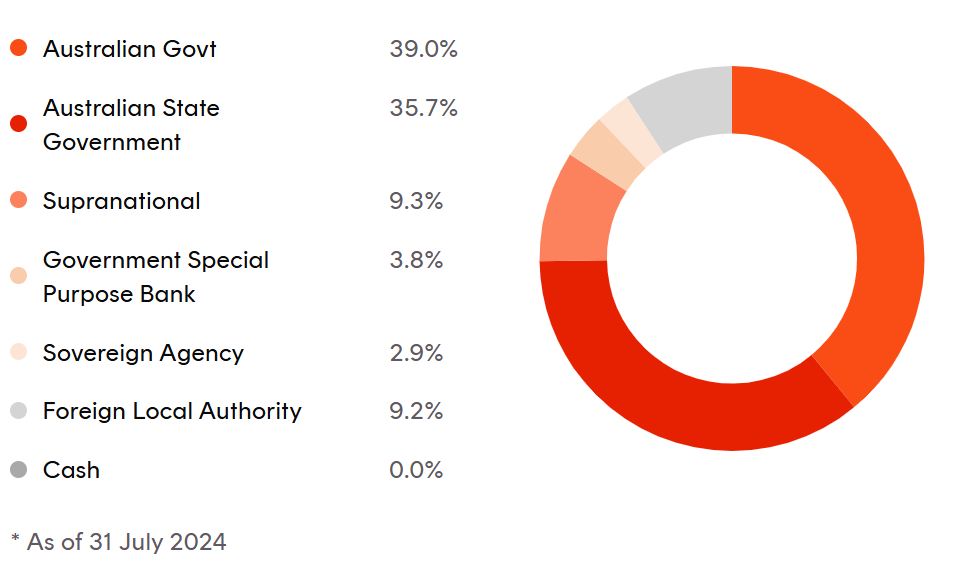

Finally a visit to the provider’s website for more information on the fund is an essential part of an investment strategy. We learned from the BetaShares website that the fund focuses on fixed rate bonds with longer term maturity of 7 to 12 years. Seventy five percent of the bonds in the fund are Australian federal and state government issued. Here is the fund’s allocation percentages by sector.

Source: BetaShares Website

For investors with a strategy allowing for some risk tolerance, both a small cap ETF and a blue chip ETF provide a nice balance.

From Vanguard, the MSCI Australian Small Companies Index (ASX: VSO) is the largest and most popular small cap fund on the ASX. It is also one of the few with positive share price appreciation since listing in 2011 – up 31%. The fund also managed positive share price momentum over five years – up 9.9% — including the dramatic decline in bonds in 2022 and 2023.

The first ETF on the ASX remains a top choice for blue chip – the SPDR® S&P®/ASX 200 Fund (ASX: STW) from State Street Global Advisers, with the share price up 57% since listing; 14.2% over 5 years; and 12.4% year to date. More than 96% of the stocks in the fund have market caps in excess of $1 billion dollars.

From the State Street website we see the funds outstanding performance metrics since listing.

Source: State Street Global Advisers Website

An investor’s favorite search engine would be the next stop in implementing a strategy for a diversified portfolio of ASX listed ETFs, with searches for property, commodity, and international ETFs.

Financial experts strongly advise investors embarking on building a diversified portfolio to avoid the “big buy” temptation. Prudence suggests spacing investments over time.

Portfolio Monitoring and Assessment

Conventional wisdom of monitoring and assessing an ETF portfolio opens the door to the temptation to rebalance during downturns. Declining share price, total returns, and dividend distribution during downturns may lead to exiting or cutting back on an ETF holding, depending on when the comparison is made.

A case in point is the Global X Tech Battery Tech and Lithium ETF (ASX: ACDC). Oversupply conditions and softening demand have devastated the price of lithium, dragging down the share price of ACDC by 14.2% over the last three months. In the opinion of many analysts the price of lithium will rebound as early as 2027, suggesting a rebalancing during FY 2024 may be premature.

Exchange Traded Funds(ETFs) opened the door to investing in a basket of stocks without the high fees, minimum investment limits, and liquidity delays associated with mutual funds.

ETFs have lower fees, no minimum entry limits, and can be bought and sold anytime a listing stock market is open. Newcomers to share market investing quickly learn of the importance of diversification as a means of lowering risk. To cite the adage, putting all your eggs in one basket can be devastating if you drop the basket.

A portfolio of diversified ETFs can be far superior to a portfolio of individual stocks and bonds. Today ETFs cover the investing gamut from bond ETFs to ETFs for small cap and blue chip stocks to commodity ETFs and business sector ETFs.

Building a solid ETF portfolio begins with first selecting the asset classes that best meet the needs of the individual investor. Implementing a strategy for building that portfolio starts with researching the funds share price, total return, and dividend performance using general investing websites like the ASX website and the websites of the ETF provider.