A decade ago a tsunami in Japan wreaked havoc on a nuclear power plant in that country at Fukushima, dragging down with it global interest in promoting electricity generation from nuclear power.

Construction of new plants and refitting of existing nuclear plants slowed to a crawl and the price of uranium dropped, following rising concerns over the safety of the nuclear power sector. Japan shut down all of its nuclear plants.

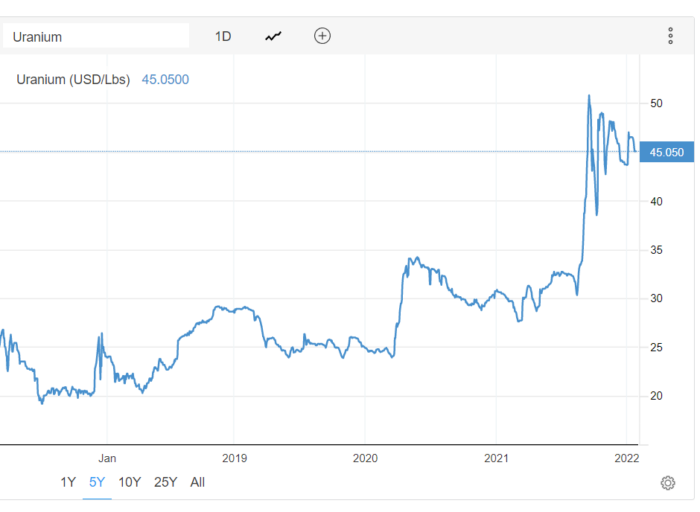

As the spot price of uranium spiraled down to US$20 per pound, exploration activities ceased.

Regular followers of global business news are aware the nuclear sector and the uranium that fuels it are reemerging as players in the global attempt to combat carbon dioxide and other emissions contributing to or causing climate change.

Countries around the world are moving towards a standard of zero carbon emissions. A growing number of experts are cautioning the existing renewable energy sources of electricity generation are insufficient to reach net-zero emissions reduction targets. Both gas and nuclear need to be part of the energy mix of the future, according to these experts.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

While not every investors digs into the details of nuclear power generation, all investors pay attention to rapid price rises in given commodities. In January of 2018, the spot price of uranium had clawed its way back close to US$22.00 per pound. As of 27 January of 2022 the price had more than doubled, rising to US$45.05 as of 26 January of 2022.

From the website, tradingeconomics.com:

Unlike other commodities, uranium does not trade in a futures market, where a buyer can lock in a price for the commodity for delivery on a future date. Futures prices are determined primarily by the spot price for the commodity, purchased for immediate delivery.

Demand drives up prices and a contributing factor to the rising spot price of uranium has been the massive purchases from a newly formed Canadian fund – the Sprott Physical Uranium Fund – and from the second largest uranium producer in the world – Canada’s Cameco Corporation. Cameco has also been stockpiling uranium supplies to fulfill existing contracts with its customers.

The supply of uranium was already constrained due to mine closures and the dearth of exploration activity.

These two organisations certainly seem convinced the world is going to need more uranium, and investors are following their lead, buying ASX uranium miners, and others, nearing production. A further surge in speculative pricing may come when Sprott lists on a US stock exchange.

Skeptics willing to explore this potential renaissance in nuclear power generation do not have far to look.

A massive infrastructure bill passed the United States Congress, with substantial investments in existing and future nuclear power generating capability, among them small modular reactors (SMRs). have seen substantial share price appreciation.

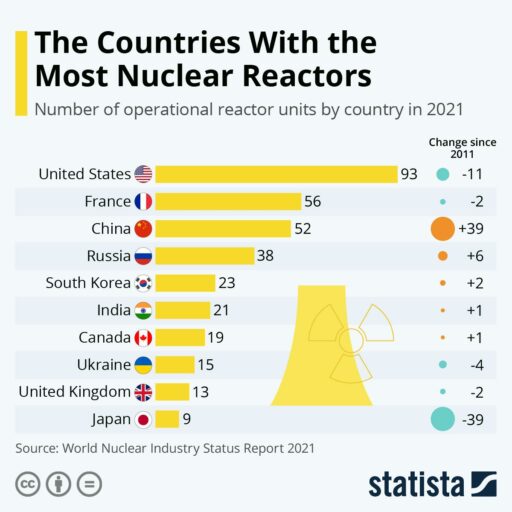

The European Union has issued a draft statement proposing designating nuclear and natural gas power plants as environmentally friendly “green” energy sources. Nuclear plants with construction, funding, and waste disposal plans have until 2045 to secure construction permits. Germany and Austria are both abandoning nuclear while France, Finland, and the Czech Republic favor the proposal with all three along with Poland having plans to expand nuclear generating capacity. The following pi

Japan has now set 2050 as that country’s net-zero carbon date, with plans to produce between 20% and 22% of its energy needs from nuclear power.

The actions of Sprott and Cameco are pulling supply off market, while unrest in the world’s largest uranium producer – Kazakhstan – are adding to the concerns over dwindling available supply.

There are thirty-one uranium mining exploration companies listed on the ASX with only one currently producing any uranium – BHP Group (BHP) at Olympic Dam. Beverly Four Mile is privately owned and the Ranger Mine owned by Energy Resources Australia (ERA) is closed.

Australia ranks second behind Kazakhstan in uranium production and has the third largest reserves in the world. There are four ASX listed uranium explorers approaching production status, with three of the four showing share price appreciation over five years in excess of 200%.

- Paladin Energy (PDN) has a market cap of $1.8 billion dollars, trading at $0.70 per share with a 52 Week High of $1.12 and a 52 Week low of $0.25.

- Boss Energy (BOE) has a market cap of $588 million dollars, trading at $1.96 per share with a 52 Week High of $3.08 and a 52 Week low of $0.66.

- Bannerman Energy (BMN) has a market cap of $277 million dollars, trading at $0.23 per share with a 52 Week High of $.43 and a 52 Week low of $0.06.

- Alligator Energy (AGE) has a market cap of $180 million dollars, trading at $0.06 per share with a 52 Week High of $0.12 and a 52 Week low of $0.01.

The share price of all four has slipped in the last few weeks, possibly due to an energy sector wide weakening as well as weakness in the ASX 200. In addition, the unrest in Kazakhstan appears to be returning to normal, at least for the time being.

Paladin has multiple exploration projects here in Australia as well as in Canada and Africa. The flagship project at the Langer Heinrich Mine in Namibia, Southern Africa, is the one to watch. Cautious investors should be looking at ASX uranium miners who are in latter stages of development, closing in on production.

Langer Heinrich is one of many shuttered uranium mines looking to restart production. The company has been releasing updates on its progress in bringing Langer back from mothball status, with the share price rising each time. In the December Quarter the company released its latest update, confirming Paladin’s confidence in the initial cost estimates, mine life, and ore reserves.

Heinrich had a ten year history of solid production before Paladin ceased operations in 2018 in the face of declining uranium prices. The company claims Heinrich remains a “world class asset.”

Technical work on the project is now complete, with the mine fully permitted to begin both production and exports. Paladin is now working on offtake agreements with global utilities providers. Investors should watch for any such agreements, as many experts have observed the next big jump in the price of uranium may come when electricity generating companies join the likes of Sprott and Cameco in purchasing uranium.

Boss Energy is another company readying the reopening of a shuttered mine – the Honeymoon Uranium Project in South Australia. The company claims its completed DFS (definitive feasibility study) shows the condition of the mine and processing plant, the surrounding infrastructure, the operating costs, and permitting could see Honeymoon resume production in twelve months. The DFS was released in January of 2020, prompting Boss management to predict Honeymoon would be the next Australian uranium mine in production status.

In June of 2021, the company released an Enhanced Feasibility Study, outlining the increased production capacity and lower operating costs from the proposed enhancements to the original study.

An 8 December of 2021 announcement highlighted continued progress on restart on multiple fronts, with the company reiterating its claim Boss could be producing uranium within twelve month of the Final Investment Decision. Some analysts believe the company could reach that decision as early as March of 2022.

Bannerman Energy has its flagship Etango Uranium Project located in the uranium mining region in Namibia. Bannerman has been working on “exploration and feasibility” activity on this open-pit mining project since 2005, completing two feasibility studies along the way -a Definitive Feasibility Study in 2012 and a DFS Optimisation Study in 2015.

The studies enabled the company to acquire the necessary environmental and external infrastructure permits for the project, as well as the completion of a demonstration processing plant for the proposed method to process the ore – heap leaching.

Heap leaching is a cost effective and efficient process for extracting uranium from the ore in which it is found. The demonstration plant operated until 2020, and the results along with the two DFS findings contributed to Bannerman’s 2020 scoping study, followed by a Pre-Feasibility Study (PFS) in August of 2021. The final DFS has been commissioned and is expected to be completed by the September Quarter of 2022..

Etango is a large scale project, with Bannerman management claiming the production rate anticipated makes Etango one of the largest prospective projects in the world. The company is confident in the outcomes of the final DFS, citing as evidence the contributions of the prior studies and the continuity of the study team from each phase.

Alligator Energy was a sub-penny stock prior to the resurgence of uranium stocks in 2020. The company has three uranium assets – all in very early stages of development – and one nickel/copper/cobalt asset.

The Alligator Rivers Uranium Province is located in a prospective zone for uranium mining, with the company having completed some geological studies.

The Samphire Uranium Project is a recent acquisition with favorable resource and reserve estimates. The company has reviewed favorable historical data on the project and has an airborne electromagnetic survey to guide the drilling efforts which have now begun.

Alligator also has an option for 100% ownership of the Big Lake Uranium Project in the Cooper Basin.

The company has six exploration licenses for the Piedmont Nickel/Copper/Cobalt Project in northern Italy.

Investors appear unconcerned over the company’s focus on multiple projects with exploration either in very early stages or with drilling yet to begin. The five year share price increase is +225%, but over three years, the share price has risen +1325%. Year over year the share price has outperformed the larger and more advanced rivals.

For patient investors with a long-term view, Alligator does have an attractive five year strategic relationship with Traxys North America LLC – a financial and marketing advisory firm to assist Alligator on several fronts, including marketing services once uranium production begins; assistance with long-term offtake agreements; financing; and acquisitions.