Why do many newcomers to share market investing seek the advice of history’s great investors and then ignore what they have to say?

Two of the most successful investors in recent memory both shared the same belief:

- Stay away from businesses you can’t explain.

Warren Buffet has earned the reputation of the Oracle of Omaha. His advice is simple. Never invest in a business you can’t understand.

Peter Lynch is now retired but his many books on the wonderful world of share market investing live on. He famously said never Invest in an idea you can’t illustrate with a crayon. In the classic One Up on Wall Street he goes on to make our case:

- There seems to be an unwritten rule on Wall Street: If you don’t understand it, then put your life savings into it. Shun the enterprise around the corner, which can at least be observed, and seek out the one that manufactures an incomprehensible product.

It seems many investors, retail and institutional alike, are attracted to “story stocks.”

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

A valuable resource to all investors – Investopedia.com – defines story stocks as a stock whose value reflects expected outperformance (or favorable press coverage) rather than its assets and income.

It is the story of what could be, not what is, that attracts investors of all stripes. Often the story is drenched in difficult to comprehend technology. In short, without some research, investors are not likely to understand the business in which they are investing. Some stories are more understandable than others, but all market entries require research beyond the casual reading of a PR press release or an article replete with breathless praise of the company’s potential.

Story stocks need forums to reach the investing public with their tale and investor conferences add an aura of respectability to what they have to say.

Here in Australia, the Financial News Network lays claim to be our largest provider of online business and finance news. FNN sponsors monthly CEO showcases in Melbourne and Sydney, connecting investors, brokers, and fund managers with company CEO’s with a story to tell.

The majority of presenting companies have yet to turn a profit and are generating minimal revenue, if any. December and November presentations included companies with stories arguably falling outside the mainstream of investor interest.

Given our status as a global powerhouse in the mining sector, it is little wonder that traditional miners of popular commodities like iron ore and gold are at the forefront of investor interest. However, there are ASX companies working in mining-related operations that go beyond the ordinary.

Investors are well aware of the assorted minerals that go into Lithium Ion batteries – lithium, graphite, copper, and cobalt. Less predominant on the radar screen is a recent entry – High Purity Alumina (HPA).

HPA is processed from refined aluminum, adding to the overall production costs. There are varying levels of purity of the finished product, with higher levels demanding premium pricing.

High Purity Alumina’s properties make it ideal for a variety of applications, with the key demand drivers currently being LED lighting and Lithium Ion batteries. Other applications include hybrid cars, optical lenses, sodium lamps, and smartphone and television sapphire glass.

Lithium Ion batteries remain the choice for contemporary smartphones and other electronic devices and as yet have no viable competition as a power source for EV’s (Electric Vehicles). EV adoption is growing and the incandescent light bulb is on its way to the scrap heap of history, boosting the already growing demand for LED lighting.

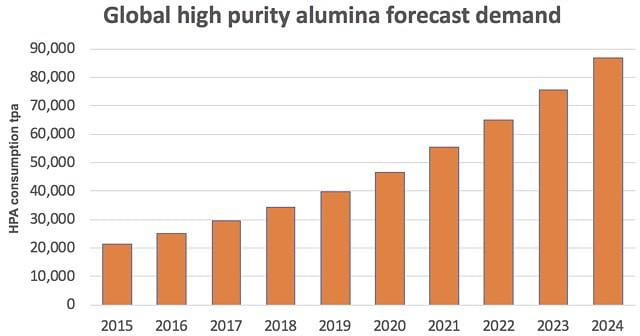

According to the website alliedmarketresearch.com, the value of the HPA market in 2016 was $1.1 billion with a forecasted value of $5.1 billion by 2026.

We can see the growth in tons per annum (TPA) in the following graph from Australian website smallcaps.com.au.

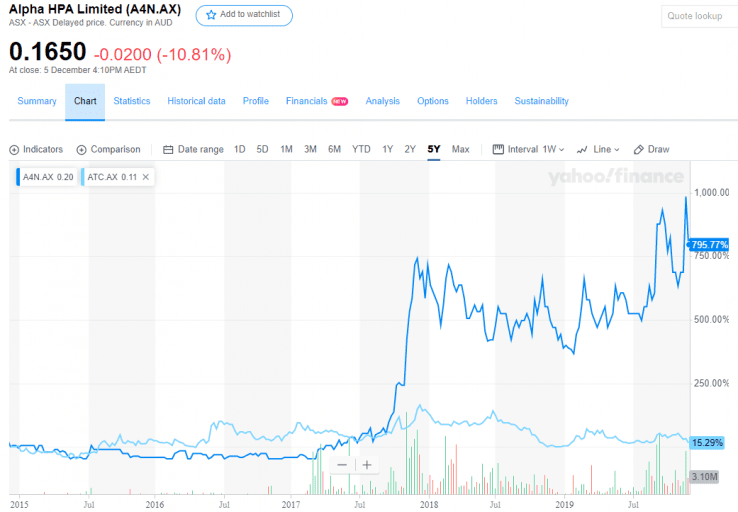

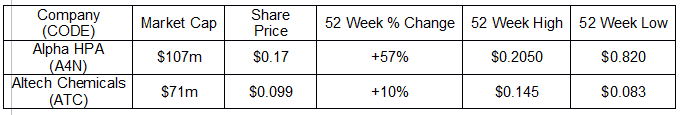

Two ASX entries working towards commercial production of HPA presented at recent FNN Investor Conferences – Alpha HPA Limited (A4N) and Altech Chemicals (ATC).

Both have respectable average daily trading volumes over the last three months and their share price appreciation suggests growing investor interest.

With a market cap of $104 million, Alpha HPA is the larger of the two. Altech’s market cap is $71 million and neither company is generating revenue or profit.

In addition to its HPA efforts the company is the sole owner of the Collerina Project, a nickel/cobalt deposit discovered in 2018 when Alpha went by the name Collerina Cobalt Limited. The name change reflects the company’s decision to move into HPA using its proprietary Solvent Extraction (SX) and refining process. SX does not need refined aluminum, relying instead on readily available acid-leaching industrial chemicals from its Collerina Project to produce the purest and most lucrative form of HPA.

A DFS (definitive feasibility study) is due this month, with the company claiming the use of a single operation site will enable faster permitting. Regulatory approvals are expected in Q1 of 2019 with plant construction to be completed by Q1 of 2022 with full production expected by the end of 2022.

Altech Chemicals also has a production method that does not rely on refined aluminum, making it more cost competitive than some rival producers. The company will use feedstock from Altech’s wholly owned kaolin (clay minerals) deposit in Western Australia which will then be shipped to a plant under construction in Malaysia. Like the HPA from Alpha, the Altech product will have 4N purity, the highest level. The company already has a ten-year offtake agreement with Japan’s Mitsubishi.

There are other ASX players getting into this space, as are some of the world’s leading aluminum companies including Alcoa in the US and Japan’s Nippon Light Metal and Sumitomo Chemical

The following table lists price movement information for the two companies.

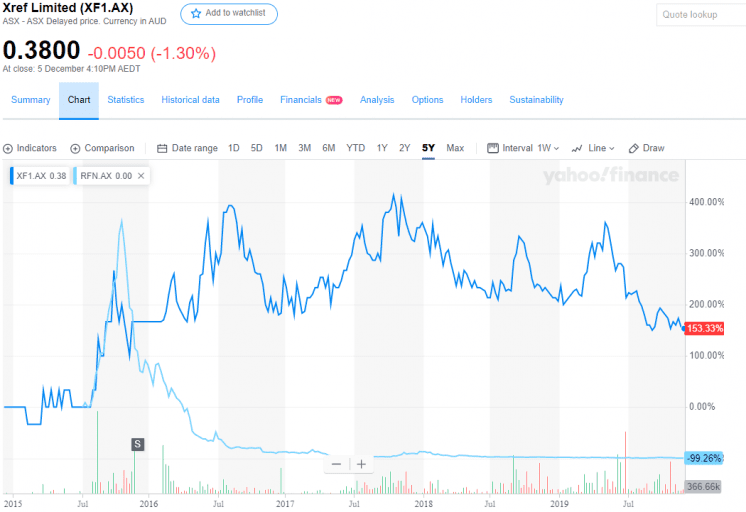

Human Resources is a sector surprisingly resistant to disruptors – companies introducing challenging traditional HR operations with new ways of doing things. Once promising 1-Page is gone and another hopeful, Reffind, has seen its share price dwindle from an all-time high of $1.97 within months of coming on the ASX to its current price of $0.0025.

Xref Limited (XF1) came on the ASX on 8 February of 2016 following a reverse takeover. Reffind listed around the same time with a business model of revolutionising the way companies communicate with their clients. Xref’s business model of automating the reference checking process in recruiting and hiring has fared better.

The company has offices here in Australia along with offices in Canada, Norway, and the UK, serving more than 700 organisations globally and 35% of ASX 50 companies with its online reference checking platform.

The company claims its cloud-based platform crushes traditional methods, collecting 60% more data, five times faster. The company generated $8 million in revenue in FY 2019, up 66% from FY 21018’s $4.8 million but remains unprofitable.

The company acquired rival RapidID in July of this year. From its origins, Xref’s business model called for partnerships integrating the Xref platform with global ATS (Applicant Tracking System) providers, now numbering 16.

Memphasys Limited (MEM) has developed a patented “bio separations” technology for cells and proteins, targeting the IVF (In Vitro Fertilisation) market. IVF has been around since the 70’s with minimal changes to its original technology. In particular, the unchanged process for preparing sperm cells is time-consuming, invasive, and is unable to detect DNA damaged sperm cells.

According to a new report from Allied Market Research, the global market for IVF in 2019 is around $13.7 billion, forecasted to come close to doubling by 2026, rising to $26.4 million.

Memphasys has a unique approach to improving male fertility by separating suspect DNA cells from healthy DNA cells called Felix. The patented approach is now under assessment by 13 global KOL’s – Key Opinion Leaders including IVF centres and laboratories.

Memphasys expects to begin commercial sales in select countries – Japan, New Zealand, India, Canada, and Iran – in mid-2020.

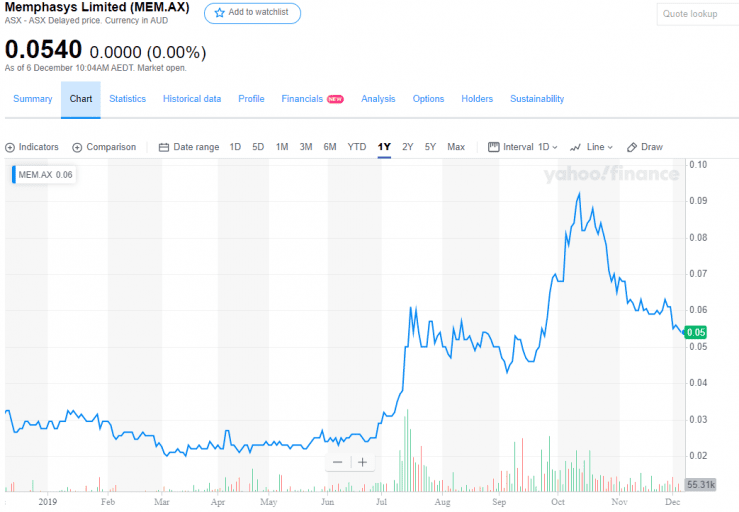

Investors are beginning to take notice, with the share price up over 100% year over year.

BluGlass Limited (BLG) is a clean tech company with an impressive sounding technology – remote plasma chemical vapour deposition (RPCVD). RPCVD is a new technology for creating semiconductors for use in high growth applications such as LED lighting, power electronics for power conversion, and utility scale solar cells.

The company has been at it since 2005, listing on the ASX in 2006 and has yet to excite investors, despite being named 2014’s top Cleantech company in Australia and in the Top 30 globally. The 2016 flurry of interest following some positive early news on RPCVD has faded away.

BluGlass did generate revenues of $660k in FY 2019, down from FY 2018’s $871k, with the lion’s share coming from a subsidiary, EpiBlu Foundry. The company does have commercial partners and launched a laser-diode business in FY 2019 targeting tunnel junctions for laser-diode (LD) lighting applications. The business is expected to turn profitable by 2025.

While the BluGlass technology may live up to its promise, for most retail investors it is not an idea you can illustrate with a crayon.

A recent presentation breaking the mold of minimal or no revenue and profitability being only a distant dream came from IVE Group (IGL). Although the company operates in the marketing communications and print business, its level of diversification and a business model combining teams of consultants with technological innovations makes it another operation difficult to illustrate with a crayon. However, its performance record since listing in 2015 makes up for the complex business model some investors might find difficult to follow.

IVE has grown both revenue and profit in each of the last three Fiscal Years. It has a current dividend yield of 7.2% with forecasted earnings growth of 10.4% over two years along with 2-year dividend growth forecasted at 4.8%.

The company has four operating divisions.

- Kalido is an integrated data analytics approach to improve customer branding

- BlueStar is a potpourri of print and web-based communications, product promotions, and logistical services

- Pareto is a suite of data analytic service provided to not-for-profits for fund raising campaigns

- Iveo provides consulting services to integrate customer marketing objectives and supply chains.

IVE Group listed on the ASX in 2015 with share price rising about 19% to date.