A 25 April article appearing here on thebull.com.au noted an observation buried in the latest Deloitte Access Economics Business Outlook – inflation here in Australia was “less risky than in other economies.”

Strictly speaking, that statement was true then and remains true today. Inflation here in Australia is at 5.1% trailing the US rate of 8.6% over the year. However, the RBA surprised forecasters with a 0.50% increase in the cash rate in June and set the expectation for another 0.50% increase in July.

The June increase was the largest in twenty two years and followed a 0.25% rise in May. Now the RBA is signaling warning signs for Australians, with the expectation inflation here will climb to 7% by the end of the year.

Conventional wisdom says risk tolerant investors looking to take advantage of declining markets in inflationary times should look for companies that can pass along their rising operating costs onto to their customers.

The Australian economy grew 0.8% in the March Quarter and is up 3.3% for the year, besting typical growth of 2.25%. The second biggest contributor to the solid performance was household spending.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The Post COVID 19 recovery in the US and here in Australia was driven by substantial increases in household spending. A question forefront in the minds of all investors considering making BUY decisions right now must be what will consumers do in the face of rising prices?

Economic theory tells us there is an upper limit to how much goods and services providers can raise prices before “demand destruction” sets in. In short, for many goods and services customers will alter their buying habits, either by cutting back on the amount they buy; eliminating the items entirely; or looking for cheaper alternatives.

There are goods that traditionally have defied the theory – things customer can simply not live without. The most common among them are food and life-saving healthcare treatments.

However, the world in which we now live has put new constraints on the ability of grocery retailers to hike prices endlessly. Consumers have always had the option to “do without” certain items and to buy less costly “generic” food items as an alternative to well known branded items.

In the distant past, discounting was limited to clipping coupons from printed media, but the ease of online coupon shopping has pushed coupon clipping from the forefront.

This, along with other discounting measures, has the potential to keep Australia’s giant grocery retailers – Woolworth’s Group (WOW) and Coles Group (COL) profitable.

The ability to discount merchandise could also preserve the profits of diversified food/liquor and hardware wholesaler Metcash Limited (MTS) and discount retailer The Reject Shop (TRS).

Of the major ASX listed healthcare providers, only CSL Limited (CSL) meets the standard of producer of things consumers cannot live without. Hospital operator Ramsay Healthcare (RHC) could see delays and cancellations of non-life threatening procedures, as will respiratory health company ResMed Inc (RMD) and hearing implant provider Cochlear Limited (COH.)

The following table lists relevant metrics for the four companies that supply things consumers cannot live without.

|

Company (CODE) Market Cap |

Share Price P/E P/EG |

Percentage Change Year over Year Year to Date |

Average Earnings Gains 5 Year 10 Year |

Average Dividends Gains 5 Year 10 Year |

Total Shareholder Return 3 Years 5 Years 10 Years |

2 Year Growth Forecasts Earnings Dividends |

|

CSL Limited (CSL) $130b |

$271.25 $319.78 $240.10 |

-5.36% -6.7% |

+18.4% +16.0% |

+18.2% +18.8% |

+9.2% +15.8% +23.0% |

-2.8% -12.9% |

|

Woolworths Group (WOW) $43b |

$35.46 $42.66 $32.62 |

+6.07% -6.7% |

-9.7% -5.9% |

+9.7% -0.3% |

+9.3% +12.8% +7.8% |

+9.2% -3.3% |

|

Coles Group (COL) $23b |

$17.81 $18.94 $15.67 |

+6.01% -0.72% |

N/A |

N/A |

+14% N/A N/A |

+3.5% +5.0% |

|

Metcash Limited(MTS) $3.9b |

$4.13 $4.90 $3.54 |

+13.1% -8.2% |

+4.0% -4.8% |

– -5.1% |

+22.8% +16.7% +6.8% |

+3.2% +3.2% |

|

The Reject Shop (TRS) $117m |

$3.05 $7.60 $2.82 |

-41.79% -57.46% |

-20.3% -10.8% |

N/A N/A |

+19.7% -3.7% -7.8% |

– – |

CSL did suffer from the COVID 19 Pandemic, but the impact came from the downturn in voluntary plasma donations as hospitals and clinics restricted access for non-life threatening procedures, which included the company’s vaccination products, with the exception of the AstraZeneca COVID vaccine, manufactured by CSL. The OMICRON variant lockdowns renewed the problems, but the company has begun to recover, although the stock price has not.

A glance at the average annual rates of total shareholder return could convince any investor looking for a long term hold CSL merits consideration. The company has delivered solid earnings and dividend growth over time as well.

For more than a century CSL (Commonwealth Serum Laboratories) has been at the forefront of medical innovation, with plasma therapies and vaccines. Check any financial website for a business summary of CSL and investors will find the term “lifesaving” and the phrase “saves lives” over and over again.

The company has two operating companies, CSL Behring for plasma therapies and Seqirus for influenza vaccines. CSL has a robust Research and Development (R&D) budget and has added therapies for iron deficiency, kidney issues, and cardio-renal issues through the acquisition of global pharmaceutical company Vifor Pharma.. Although the cost was in the billions, analysts see growth potential from the added revenue streams.

The company posted modest revenue and profit gains in both FY 2020 and FY 2021. Half Year 2022 Financial Results showed a 4% revenue increase and a 5% loss. Plasma collections increased 19% with the company reaffirming its Full Year 2022 guidance.

Woolworths has been Australia’s most recognised brand for three consecutive years, with its three operating units – Australia Food; New Zealand Food; and discount merchandise chain BIG W.

BIG W has 183 stores across Australia selling its own branded merchandise at “affordable prices”, according to the company website. BIG W has an eCommerce website and a mobile app for easy ordering.

Australia Foods is the largest grocery chain in the country, with 1,076 stores , supplemented by online and mobile ordering and home delivery. Woolworths also offers insurance and financial services and is in the process of acquiring an 80% interest in MyDeal.com.au, an eCommerce general merchandise site featuring “deals, discounts, and sales”. Woolworths is expanding into a B2B (business to business) segment to serve wholesale and export businesses.

Half Year 2022 Financial Results were negatively impacted by OMICRON related store lockdowns and closures as well as supply chain issues. The company did manage to post an 8% increase in sales, but net profit after tax (NPAT) declined 6.5%. The Full Year Outlook cites strong Australian Foods sales growth for the first seven weeks of the New Year but remains cautious regarding OMICRON challenges.

Coles is virtually identical to Woolworths, with a smaller store count and the added presence of company owned convenience retailers and liquor stores. There are 717 Coles Express convenience stores across Australia, along with 834 full service grocery and general merchandise retailers and about 900 Coles owned branded Liquor stores.

Like Woolworths, Coles has a robust online and mobile application presence along with home delivery services. Both companies have loyalty Rewards Programs, offering additional opportunities for consumer savings. What Coles lacks in comparison to Woolworths is an operation comparable to BIG W and MyDeal.com.au.

The company’s Half Year 2022 results reflected the impact of the OMICRON variant, with a meager 1% increase in sales and a 2% fall in NPAT. The largest revenue decline came from the Coles Express stores. Like Woolworths, Coles management cited lingering OMICRON impacts clouding the company’s future.

On 27 April Coles announced Third Quarter Sales Results. Despite OMICRON related employee absenteeism in January and flooding around Australia, the company posted a 3.6% increase in Group Sales.

Metcash is a wholesale distributor of food, liquor, hardware, and automotive parts. In theory, the diversification should bode well for Metcash in an inflationary environment, with the possibility of “do it yourself” home and auto repair. However, the company’s largest customer is the 185 IGA (independent grocers association) food outlets. The IGA locations along with other food retailers supplied by Metcash are smaller than the typical mega-stores of Coles and Woolworths. Independently owned operations should have more difficulty discounting merchandise to keep customers from travelling to Woolies and Coles locations.

On the positive side, typical food retailers supplied by Metcash are located in regional and local areas where they are less susceptible to competing with Coles and Woolies in capital cities areas.

On 2 May the Metcash share price hit an all-time high as the company announced a new five year agreement with a national network of supermarkets and convenience outlets – Australian United Retailers (UAR). In total, UAR counts among its members 540 independent grocery and convenience stores, with the largest group operating under the banner FoodWorks. IN FY 20201, sales from FoodWorks amounted to more than 900 million dollars. Metcash total sales for the year were more than $9.4 billion dollars.

Investors and analysts alike applauded the agreement. Another agreement with a $220 million dollar customer was extended on 17 May. The company’s Half Year 2022 Financial Results were announced on 6 December of 2021. Group revenues rose 1.3% while underlying profit rose 13.1%.

Metcash issued a moderately cautious outlook for the Full Year, anticipating continued supply chain issues and COVID related labour issues as well.

The Reject Shop seems an unlikely bedfellow with the likes of Coles, Woolworths, and Metcash, but the company operates strictly as a discount outlet with more than 370 locations in Australia. The Reject Shop offers everything from groceries and other home essentials to home décor to health and wellbeing products to fashion and clothing to pet care, available online as well as in their stores.

The Reject Shop offers its own private brands as well as branded products well-known and trusted by Australians. By the Full Year 2021 Financial Reporting, The Reject Shop posted a slight revenue decline of 5% but an astounding profit increase of 642.8%. OMICRON caught up with the company in the close of the calendar year, with the Half Year 2022 Financial Results showing a 2.2% decline in revenues and a 9.9% decline in profit.

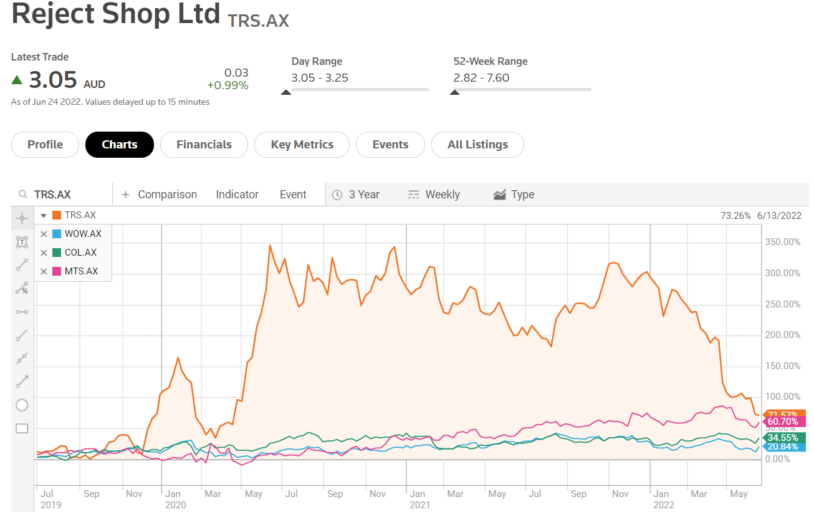

Due to its smaller size and less diversified revenue streams, The Reject Shop was hit harder by OMICRON than its larger, diversified rivals. For investors willing to tolerate risk the company’s share price action makes it a bet to consider.

From the Reuters financial website: