Beta – A Trading Tool for All Investors

When first-time investors in stock markets set off to educate themselves on how to successfully navigate the universe of available publicly traded stocks for potential investment, they soon learn there are a wealth of analytical stools available to shape their decision making.

Many are mathematical or statistical calculations examining the relationship between two market issues, or variables, such as stock price and earnings. Although lacking the popularity of the ubiquitous collection of ratios, Alpha and Beta values are nonetheless valuable investing tools.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What is Beta?

Both are statistical measures with Alpha comparing the investment return accumulated by an individual stock with the return accumulated in the overall stock market within which it trades.

Markets go up and they go down, day after day , week after week, and year after year. During those time frames upward and downward movements can be extreme with the extremes characterized as market volatility. Volatility is the frequency and magnitude of market movements, up or down. Highly volatile markets can produce wide swings of varying degree.

Beta copares the volatility of an individual stock against the volatility of the stock market index in which it trades. US markets follow the US S&P 500 Index while Australia uses the ASX S&P 200 Index as comparison standards.

The overall market has a volatility of 1.0. An individual stock with a Beta of 1.0 would move in harmony with the ASX 200, going up when the market goes up and going down when the market goes down, generally with minimal difference in percentage movements.

Beta values over one means the stock price is more volatile than the overall market while Betas under 1.0 are less volatile. What that means in plain language is when the market is going up, a high Beta stock will go up more than the market and when the market drops, the high Beta stock is likely to drop more than the market. Low Beta stocks are less influenced by market movements.

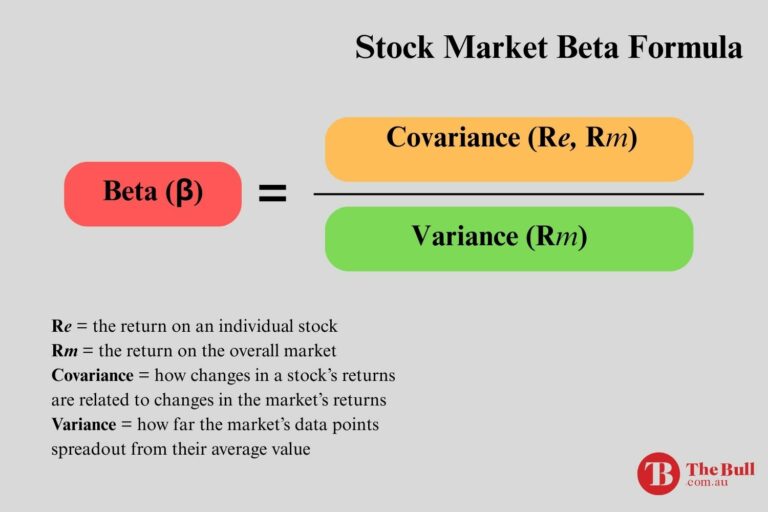

How are Beta Values Calculated?

Beta values are calculated using a statistical analytical tool called linear regression. The formula takes the covariance between the performance over time of an individual stock and the performance of the index in which it trades and divides that by the variance of market outperformance over time against its average performance. Website financialstrategists.com provides the following graphic.

Variance and volatility are related, with variance being the spread of returns around the average asset return while volatility is a measure of variance over time.

Many analytical tools used by retail investors do not require the investor to perform the calculation, as they are readily available in the majority of online Australian financial websites via the Stock Search feature.

Unfortunately, Beta is not always among them, but yahoo finance Australia includes Beta values in its stock statistics section and most of the better online trading platforms do include a stock’s Beta value.

It is possible, albeit complicated, to use Excel for the calculation. You would need historical stock price data for both the stock and the index, readily available on yahoo finance Australia. An alternative is to use websites that offer lists of individual stocks and their betas, either stand-alone or via a stock screener. Here are some Australian stocks with high beta values.

How Do Investors Use Beta?

Beta provides investors with a tool to manage systematic risk in their portfolio of holdings. Early on in the game investors learn of the risk/reward trade off. Investors shooting for the moon with high growth stocks need to understand they come with greater risk of missing the mark, sometimes by painful amounts.

Investors whose temperament does not tolerate the risk of loss need to understand their returns will be lower with a stable, low risk portfolio.

Beta measures risk in individual stocks trading in a market index. A stock with a Beta value of 2.0 trades at twice the pace set by the index in which it trades. In markets trending upward, the returns of stocks with Betas 2.0 or above can be staggering. Even stocks with a Beta value of 1.5 trade with 50% more volatility than its market. In theory then, when the ASX 200 rises by 1% on a given day, a stock with a Beta value of 2.0 might rise 2% and the stock with a Beta of 1.5 could rise 1.5%.

In contrast, stocks with Beta values near or below 1.0 will either follow the market lead or trail it. In downward trending markets, the risk is reduced with low Beta stocks.

Investors can rely on Beta as a tool for portfolio management, mixing holdings by their Beta values, allowing for greater rewards with high Beta stocks and lowered risk with low Beta stocks.

Beta is also a valuable tool for investors diversifying their individual stock portfolios with mutual or exchange traded funds, or relying solely on fund investments

Mutual funds and ETFs are constructed of equities trading in markets and thus Beta values can be calculated for both. The Beta will appear in the fund specifications from the sponsoring firm. Descriptions on fund provider websites often highlight the Beta value of a fund as “suitable for risk tolerant” investors, or suitable for investors looking for stable returns, with low Beta values being the enticement.

The Pros and Cons of Beta

The Beta value is one of many tools available to retail investors to assess potential stocks for investment. The biggest advantage of using Beta in investing its risk management potential.

Beta values can provide a road map for portfolio diversification, balancing high Beta growth stocks with reduced risk low Bet stocks.

There are disadvantages. Like most investing tools, Beta is not a standalone to be used in isolation from other assessment tools.

Beta values are time sensitive, focusing exclusively on historical performance and historical volatility, The adage that past performance does not guarantee future results applies.

Of the many analytical tools available to Australian investors, the Beta value is ideally suited to manage risk. High Betas suggest price movements in excess of what the underlying market is doing. Low Beta values suggest the stock price is less susceptible to market volatility. Risk averse investors will look for stocks with low Beta values while risk tolerant investors will look for stocks with high Beta values.

Beta values can be found on some financial websites like yahoo finance Australia, on online trading platforms, and via stock screeners.