At the close of the 2019 trading year, the second largest investment bank in the US – Goldman Sachs – confidently declared the US economy “all but recession proof.”

Goldman now predicts 0% growth in Q1 of 2020 with negative 5% coming in Q2, although the bank along with rival JP Morgan Chase both predict the recession will be short-lived.

Other major players disagree. Deutsche Bank is predicting the US Q2 GDP will drop to a negative 13%.

Retail investors with the stomach to follow the daily doses of gloom and doom surely have noticed economists and market experts downplaying the recession risk are falling by the wayside.

Every day, however, those same news-hungry investors are treated to article after article on financial websites here and in the US suggesting stocks to buy right now. A few are supposed to benefit from the coronavirus downturn, although most haven’t. Others are supposed to have the potential for a rebound.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

To some this may seem foolhardy, given the gravity of the situation and the historic volatility driven by historic uncertainty as to when this will end. Investors with some experience in the markets are aware there is money to be made in times like these.

However, the new field of behavioral finance tells us what some investors have long known – the fear of a stock market loss is a greater behavioral driver than the joy of a profitable investment. If you have the patience and the time to wait, investing carefully now may be appropriate. If a further 10% fall or more will leave you with sleepless nights, stay away.

No one can answer the question when this will all end, but a likely catalyst is the return of the demand for the product or service provided by the company you are considering.

Central Banks cutting interest rates and pumping liquidity into challenged credit markets along with massive government economic stimulus packages to date have failed to calm rattled markets. Here in Australia it seems every day there is news of yet another government attempt to stop the bleeding. Relief rallies following some of these actions have been brief and now appear to be fewer as well.

The price of virtually anything is driven by supply and demand. When more investors want to buy a stock than sell, the price goes up due to the high demand. The debate over whether there will be a recession or not has largely subsided, shifting instead to the “shape” of the recovery.

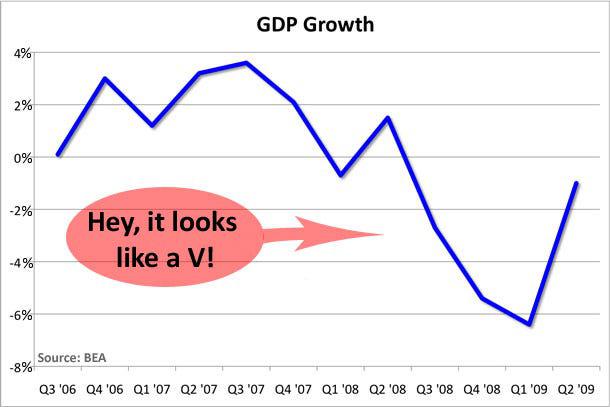

Both economic and stock market recoveries can be “V” shaped, “U” shaped, or “L” shaped. The V shape is characterized by a rapid rebound. From the website of Business Insider Australia:

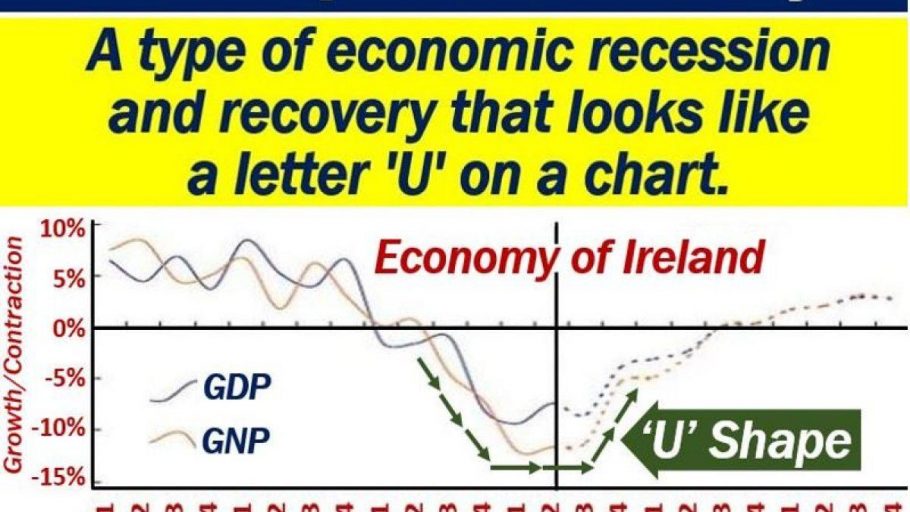

In a U-shaped recovery, the market or economy bottoms and flatlines for a period of time before resuming an upward trend. From the website marketbusinessnews.com:

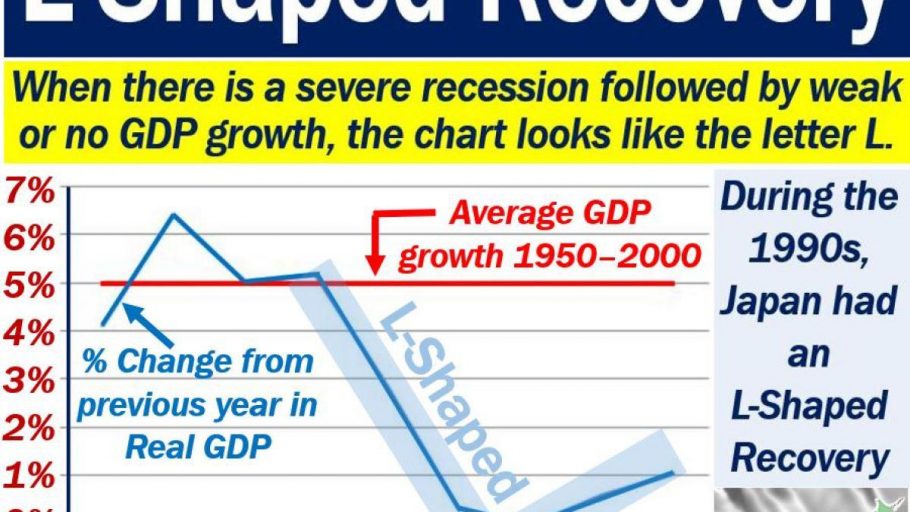

In an L shaped recovery, the economy or market enters a prolonged period of stagnation, as seen in this less than graphically perfect chart from of the Japanese economy from marketbusinessnews.com:

As one would expect from the debate going into the emergence of the bear in global stock markets, expert opinion on the shape of the recovery is mixed, with a growing number cautioning we could be in for a U-shaped recovery.

For a V-shaped recovery, quarantines and “stay at home” warnings and business closures have to be lifted and production and consumer spending needs to ramp up relatively quickly.

Those who are currently predicting consumers will stampede out of their homes to initiate a buying frenzy the likes of which we have never seen are forgetting a lesson learned from the GFC.

Today you have consumers all over the world facing a cash crunch. Going into the GFC savings were meager and credit debt was high, leading consumers both here in Australia and in the US to reduce their spending. Here in Australia:

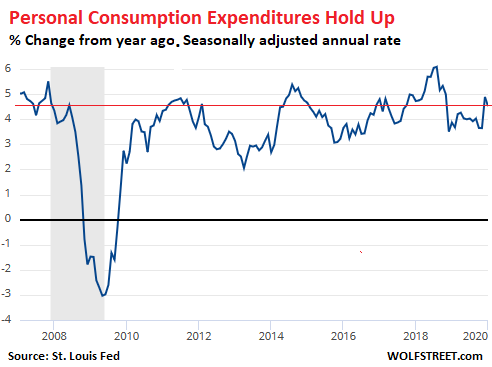

And in the US:

Some of the “buy now” articles appearing now tout dividend paying stocks, with the best advice including the caution dividends can be cut. Others advise looking to stocks that are currently resisting the extreme downtrend, like the ASX purveyors of groceries.

These may be safe choices but fail to offer the opportunities for major share price appreciation. Time is the key factor for any investment and for those willing to wait, the economy and the market will recover. Gauging demand once a recovery begins is a virtual impossibility since the “recovery” becomes clear after the fact. While common sense suggests travel and leisure stocks should recover, the spectre of changing consumer behavior looms over these stocks. Will shell-shocked consumers return to the air to seek solace at a resort somewhere?

However, reviewing stocks with an eye towards those for whom demand could snap back once the pandemic fears subside as “stay at home” conditions and healthcare restrictions on elective procedures abate seems a place to start. It is reasonable to assume stocks where demand is likely to recover more quickly are attractive targets. Researching the services or product a company provides is a starting point for finding those suffering from the kinds of restrictions which will eventually be lifted.

There are two ASX blue chips that fit that description, and further research could uncover more. From the healthcare sector there is Cochlear Limited (COH) and from the transportation sector there is Transurban Group (TCL).

With the stock price already in decline Cochlear management recently made the decision to withdraw its earnings guidance.

In the announcement, Cochlear stated that the number of hearing implant surgeries was declining significantly in many countries as a result of the global pandemic, stating “We are now seeing a growing number of health authorities either recommend or enforce surgery deferral.”

The company had already downgraded its guidance on 11 February and the elimination of any guidance at all was met with a raft of analyst downgrades. In unison, analysts point to the near-global restriction on the kind of elective surgeries Cochlear provides with it hearing implant devices as evidence the company from growing its revenues in the remainder of 2020.

Cochlear management tried to calm nervous investors that the problem would be short-term, with a quick rebound once hospitals around the world get back to normal business. Not even the announcement that the company’s business in China had experienced a small rise in implant surgeries there worked, with the share price dropping from a Friday 13 March closing price of $216.11 to a 16 Monday closing price of $174.51. The share price has dropped close to 35% in the month since the current downturn began in mid-February.

A cochlear implant is not something the average consumer selects. The gateway is the physician. Recent history confirmed what long-time Cochlear investors already knew – the medical community is loyal to Cochlear products as they are seen as “best of breed.”

In September of 2011 the company announced a recall of one of its flagship products. Analysts rushed in, predicting a loss of market share to rival manufacturers from which it might never recover. They were wrong, as Doctors went public to reassure their potential patients earlier models were just as effective.

While the Cochlear recovery may be U-shaped as implant surgery may not be the first thing to come to the mind of those who need one following what could be a long period of social restrictions.

Transurban designs, develops and operates toll roads here in Australia (13), the US (3), and Canada (1). The share price has dropped 37% in the last month. News websites around the world have shown pictures of roadways with scant traffic. Once the assorted restrictions designed to limit human contact are lifted, the public is highly likely to return to the roads quickly, suggesting a V shaped recovery for Transurban.

In addition to its steep share price declines and recovery prospects, the company is dividend powerhouse, approaching the status of bond proxy for investors looking for income as well as share price appreciation with the relative safety of fixed income bonds.

Toll road revenues are secure, ongoing, and subject to legislatively approved increases. Tolls don’t go down; they go up. Transurban’s current dividend yield is 6%. In FY 2019 the company paid dividends of $0.59 per share with a planned increase for FY 2020 to $0.62 per share. Over five years dividend growth averaged 11.6% and 11% over ten years.

At the close of the trading week on 20 March, the ASX recorded its worst week in eleven and a half years. In the US, the Dow Jones Industrial Average (DJIA) recorded its worst week since 2008.