In February of 2022, a startup mining company with the stated goal of discovering Tier 1 (large, long life, low cost) deposits of essential metals for a clean energy future listed on the ASX. The company claimed it would focus its exploration efforts on underexplored regions of Western Australia.

The company is WA1 Resources (WA1) whose stock price has risen from a first trading day closing price of $0.22 cents per share to the current price of $1.50 per share, a rise of 581%. The following graph from the ASX website charts the path.

Even casual readers of Australian stock markets now know what happened – the company made a major discovery of a high-demand rare earth element – niobium – on its flagship West Arunta project. The company went into a trading halt following the insane jump, promising an upcoming announcement on 3 November. The ASX intervened with a “speeding ticket” – an inquiry for explanation for the out of the ordinary increase or decrease in stock price. On 2 November WA1 responded, highlighting information readily available in prior announcements. The share price dropped about 50% following the announcement but went on to finish at a near 25% increase at the close.

Looking at the price chart above suggests one possible explanation for the rise and fall. Note the trading volume going into the niobium discovery announcement on 26 October. The stock was attracting miniscule investor interest, which suggests on the day of the announcement some investors jumped in without knowing much about the company, other than the immediate discovery.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

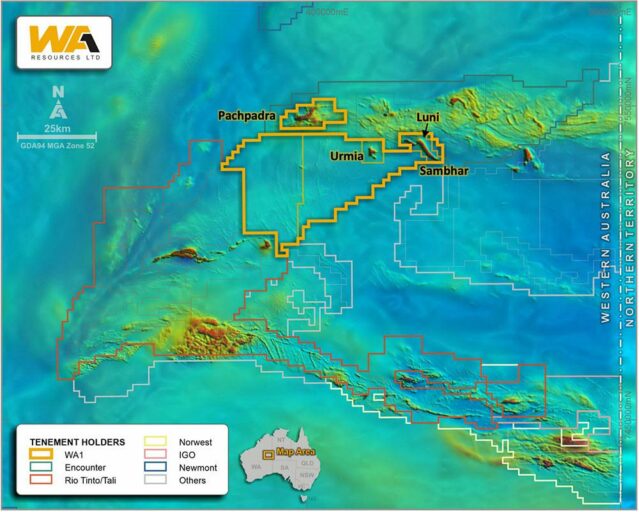

In truth, there was early evidence the company might be on to something included in its first presentation to the market on 16 February. That same evidence could make the case for some that staying the course with WA1 Resources is the right move. Here is a map of the West Arunta region in question, including other miners operating in the area.

The map appeared in a 31 October article on the website stockhead.com.au. The map enhances the original appearing in the WA1 Investor Presentation by including the larger area outlined in yellow that contains the company’s Madura and Hidden Valley assets. These have no exploration history and will await further development as the company pursues the three prospective areas within the flagship West Arunta Project – Pachpadra, Urmia, and Sambhar.

What is significant here is the presence of Rio Tinto as the largest tenement holder in the purportedly highly underexplored mining region. Tali Resources is a privately held project generator. Rio has a joint venture farm-in agreement with Tali to explore five prospective copper/gold tenements in the West Arunta and Madura regions, where WA1 has assets. The $58.5 million dollar agreement gives Rio the right to earn up to 75% of those tenements

Rio’s presence in the region since inking the JV with Tali in March of 2021 suggest there is a there there. Rio is exploring for copper/gold deposits, as was WA1. These deposits can become “carbonised” over time, containing rare earth minerals. It was in such a deposit that WA1 found the niobium.

There are other miners in the area, and two of the small caps there – Norwest Minerals (NWM) and Encounter Resources (ENR) caught a ride up with WA1 on the announcement.

Encounter is still up 14.1% over the five days since the announcement began to draw interest while Norwest is up 6.8%. Year over year Encounter has fallen 22.5% while Norwest is down 38.9%.

Encounter’s focus is on exploring for “copper-dominant” deposits, with a substantial product pipeline. The company relies on a more than $65 million in funding from other major and mid-tier mining companies to direct development effort at some Encounter assets. The partnering majors are impressive, including BHP, IGO, and South 32.

Encounter does have wholly owned assets, including the copper/gold Lamil Project in the Paterson Province of Western Australia and the Yeneena Project in conjunction with IGO.

In the Northern Territory the company has an earn-in Joint Venture with BHP at the Elliot Copper Project and farm-in agreements with South 32 at the Jessica and Carrara Projects.

Investors may be ready to focus more on Encounter because of the company’s entry into the West Arunta mining race – the Aileron IOCG/REE project – an iron oxide/copper/gold project with the potential for rare earth elements.

Newcrest Mining had been a partner in a JV with Encounter to begin exploration operations on the project which had no prior history of mineral exploration. When Newcrest bowed out in February of 2021. Encounter assumed sole ownership/.

One year later, in February of 2022, Encounter announced that gravity surveying together with reconnaissance surface geochemical sampling established potential rare earth elements in the region, specifically neodymium-praseodymium rare earths.

Later in the year lithium was found in an Encounter copper asset. In September, the company had a successful capital raise with proceeds to go towards exploration efforts at the Aileron Project, the Sandover Copper/lithium project, and other projects.

In a matter of days the company will begin large airborne magnetic-radiometric survey of Aileron to target sites for a drilling program to begin in 2023. Results from the first diamond drillhole found rare earth elements molybdenum and niobium along with copper and gold.

Encounter has another prospective lithium target to complement the discovery at the Sandoval Copper project. In addition to the five wholly owned assets Encounter is developing, the company’s partnering projects are gaining speed.

BHP will fund the drilling program at the Elliot Copper project.

South 32 and Encounter have identified drill targets at Jessica and Carrara, with a diamond drilling program to commence in 2023.

IGO is operating and funding the drilling program underway at the Yeneena Copper Project.

Led in large part by lithium producers and explorers, the ASX mining sector is booming, yet the top ASX rare earth producers are lagging behind. The following price movement chart from the ASX website compares the year over year performance of one of the top ASX lithium miners – Pilbara Minerals (PLS) – against the top two rare earth elements producers – Lynas Rare Earths (LYC) and Iluka Resources (ILU).

Over three years Lynas is up 255% and Iluka is up 90%, but Pilbra is up 1,500%.

This despite conventional wisdom reminding investors of the importance of rare earth elements and the potential for Australia to make a dent in the global rare earth element dominance of China.

From the Periodic Table of Elements total of 118, 17 are considered “rare” earth, although in reality they are not rare in the sense of uncommon. Rather they are deemed rare because of the challenges of extracting them from the ore in which they are often contained.

They are not recognisable to the general public by name, as is lithium due to its long-time presence in consumer batteries. Rare earth elements do not stand alone but rather become additives to components in critical sectors like energy and information technology.

Why should a casual retail investor get excited about an element he or she has never heard of and whose name they might not even be able to pronounce?

The neodymium Encounter may uncover is essential to the manufacture of strong magnets. Neodymium made the miniaturization of a variety of electronic devices possible due to the strength properties in small sizes. Beginning in 1983, mobile phones, loudspeakers, microphones, and industrial applications requiring magnets began to shrink in size, increasing their mobility.

Rare earth elements are included in national government’s listings of “critical minerals.” Does it not make sense then for investors to view opportunities in rare earths as potentially rewarding as investments in more recognised metals?

Norwest, like Encounter, has multiple projects in development, including two 100% owned copper/gold projects and one nickel project. Back in February the company announced soil samples from the Arunta West copper/gold (IOGC) project indicated the possible presence of copper/gold base metals with three rare earth elements – cerium, lanthanum, and yttrium.

In early September, the stock price shot up 33% intraday on the news of the discovery of veins of high-grade gold and copper bearing quartz at the company’s wholly owned Bali Copper project in Western Australia. Norwest has completed drilling of five holes in the project and is now beginning DHEM (Down Hole Electromagnetic) surveys.

The Western Australia government’s EIS (exploration incentive scheme) initiative awarded Norwest $180,000 towards the company’s upcoming drilling campaign to test both the West Arunta site’s rare earth and lithium anomalies. An anomaly in mining is an outsider within a core ore sample, such as the presence of a rare earth element within a base metal.

The company has $2.5 million dollars in cash on hand following a successful capital raise in September.

While it does seem rare earth explorers and developers remain under the radar of the investing community as a whole, the three explorers experiencing upward price movement from the rare earth potential in the Arunta West region of Western Australia, are startups. Cash can be a major problem for startup miners as drilling campaigns, sophisticated geological analysis, and site and infrastructure construction could be, and often times is, exceedingly expensive. This is especially true for under the radar stocks lacking a hard-core base of investors willing to accept repeated capital raises or rising debt. The following table includes some relevant metric s for the three companies.

|

Company (CODE) Market Cap |

Share Price |

52 Week High Low |

Total Cash Mrq Total Debt |

Current Ratio |

Average Trading Volume 10 Day 90 Day |

|

WA1 Resources (WA1) $78.8m |

$1.76 |

$2.91 $0.155 |

$3.68m N/A |

29.09 |

7.46m 1.17m |

|

Encounter Resources (ENR) $50.9m |

$0.145 |

$0.20 0.1125 |

$217m $116.9k |

5.76 |

1.95m 459.7k |

|

Norwest Minerals (NWM) $11.5m |

$0.054 |

$0.087 $0.025 |

$1.58m N/A |

3.44 |

217m 791.8k |

None of these companies are currently burdened by debt and the current ratios are more than adequate. A current ratio of 1.0 or above means the company’s current assets could cover its current liabilities.

Note the increases in average daily trading volume in the last ten days. Investors are paying attention and these stocks may stay on their radar.

A common response to the dip taken by the stock of WA1 is for the downward trend to continue, as investors take profits from the massive price appreciation.

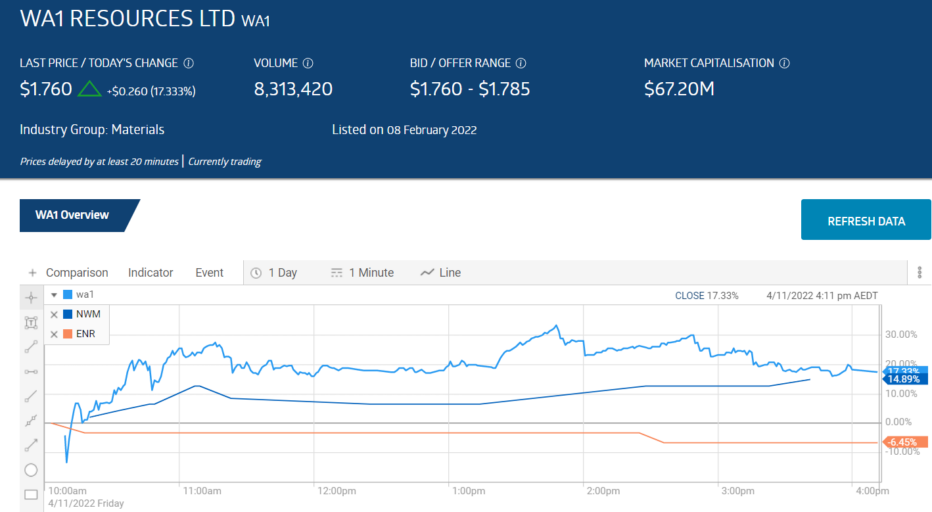

Yet the day after, WA1 recovered, rising 17.3% and Norwest’s stock price increased close to 14.89%.