On the morning of the 13th day of February in the United States, the Dow Jones Industrial Average (DJIA) futures market implied a loss of more than 150 points at the market open. This after the US market setting new record highs less than 24 hours prior, reportedly driven by the “on-again off-again” status of the severity of the coronavirus.

Investors around the world seem ready and willing to respond to positive news and pay scant attention to the negative, with market drops followed by a return to record-setting rallies.

The news today shouldn’t have shocked investors who had swallowed whole the view that the threat of the coronavirus was diminishing. There were multiple sources, including the CDC (Center for Disease Control) in the US, indicating the worst could be yet to come. Now we learn the number of people infected in China leaped to almost 60,000, with a reported 15,152 new cases reported, shattering the belief the spread of the virus was slowing. The increases were attributed to a change in the way the Chinese government diagnoses the disease.

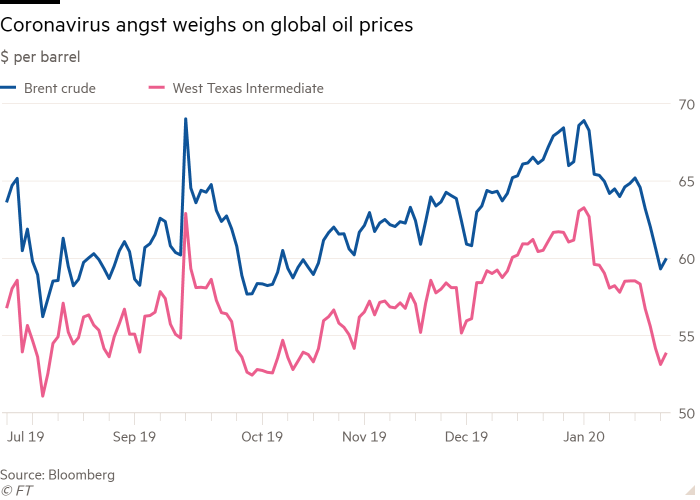

ASX stocks in multiple sectors have been hit, bounced back modestly, and could be hit again. The risk for the oil stocks has risen, with a 12 February report out of OPEC (Organisation of Petroleum Exporting Countries) crediting the coronavirus as a “major factor” in the organisation’s decision to reduce its outlook for global growth in the demand for oil in 2020 by 230,000 barrels per day.

The price of oil began to rise the following day in anticipation OPEC member nations and non-member Russia would cut oil production to shore up the price. Oil is down 20% since the January high due to the virus. The International Energy Agency (IEA) and others now expect oil demand to fall in the first quarter, the first decline in a decade, followed by a rebound in Q2.

Top Australian Brokers

- eToro - Social and copy trading platform - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- Pepperstone - Trading education - Read our review

For investors with an appetite for risk, crises like the coronavirus present buying opportunities. This is especially true in situations where history tells us the crisis will not last forever, although the time frame for resolution remains unclear.

The top three ASX oil producers – Woodside Petroleum (WPL), Santos Limited (STO), and Oil Search Limited (OSH) – have two other factors making them worthy of investor consideration.

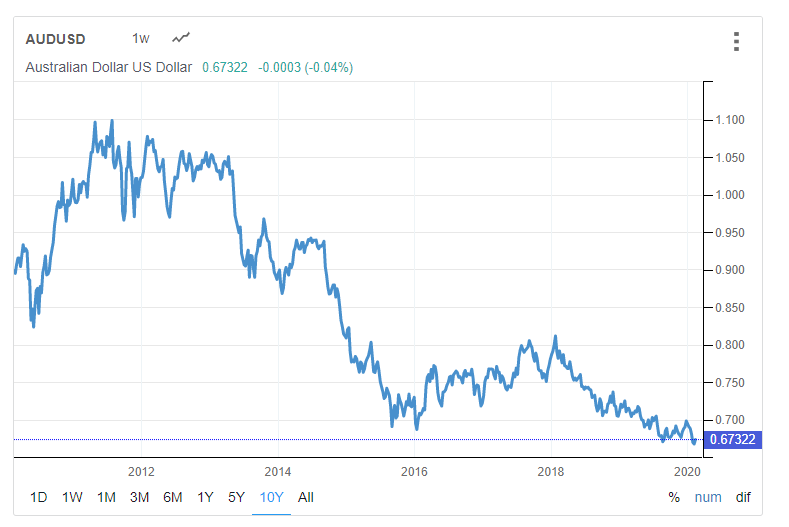

The first is the falling Australian dollar. From the website tradingeconomics.com/australia/currency we can see the dollar hitting a decade low against the US dollar.

ASX stocks that derive substantial revenue in US dollars get a boost when the AUD falls. Stocks of companies producing their offerings in Australia get a double boost, as their costs of doing business are incurred in Australian dollars but get paid in US dollars.

Miners who mine here and oil producers who drill here are among those receiving this double boost.

The second factor supporting a case for taking the risk with the big three oil producers is the outlook for liquefied natural gas (LNG).

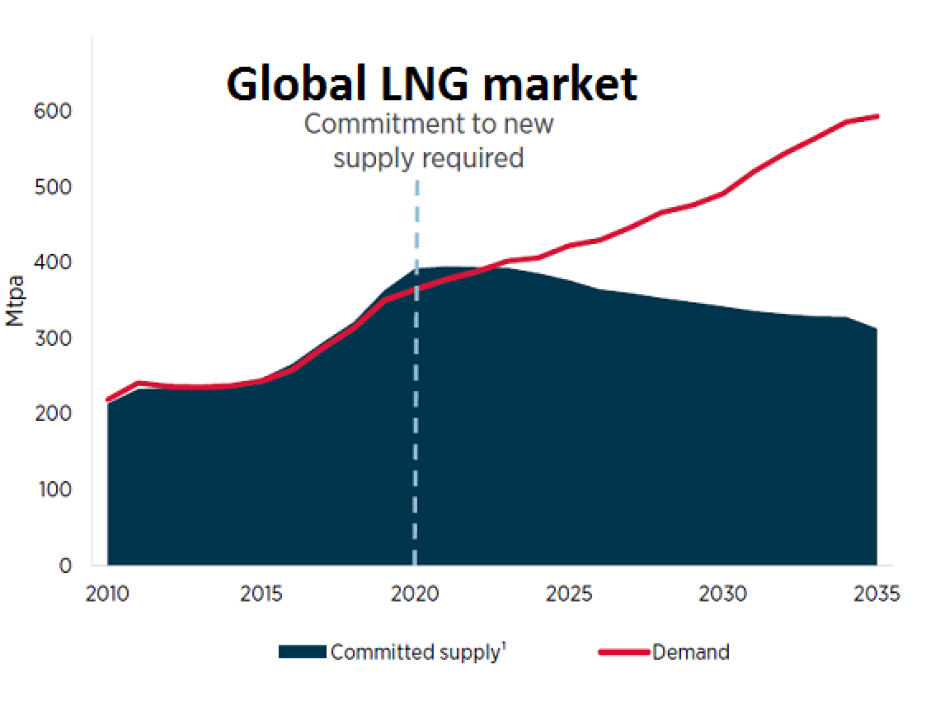

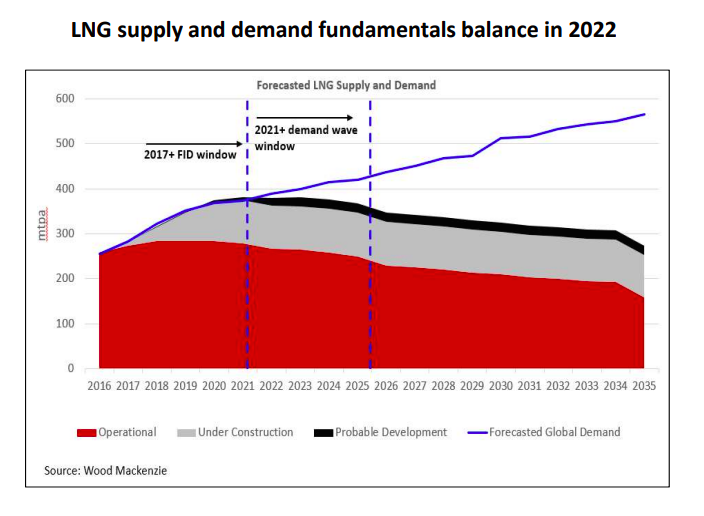

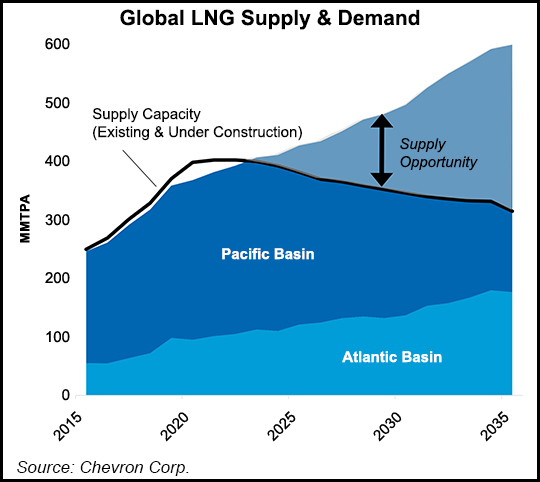

Once the darling of investors anticipating the “golden age of gas”, LNG stocks fell out of favor, first as the production delays and massive cost overruns of major LNG projects came into focus; and second as supply coming online exceeded demand, driving down the price.

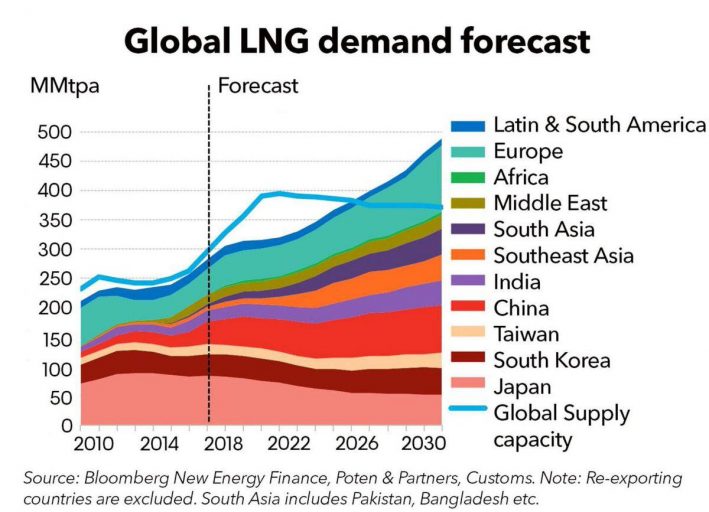

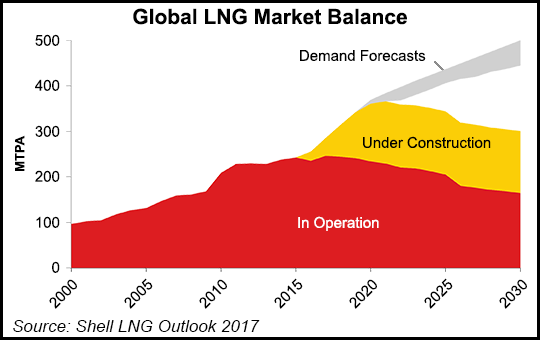

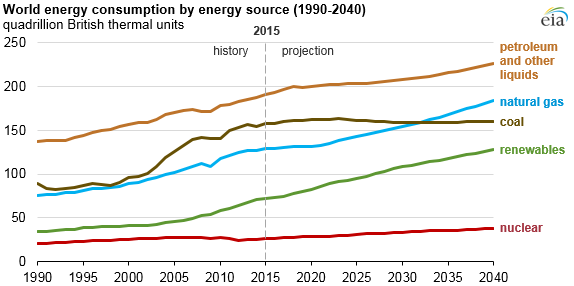

Multiple sources in the world of market analysis see the situation as stabilising, with demand outstripping supply in a little more than a decade. The following five graphs support the argument the optimistic outlook for LNG represents a consensus view.

The first graph is from abc.net.au. The others include their source.

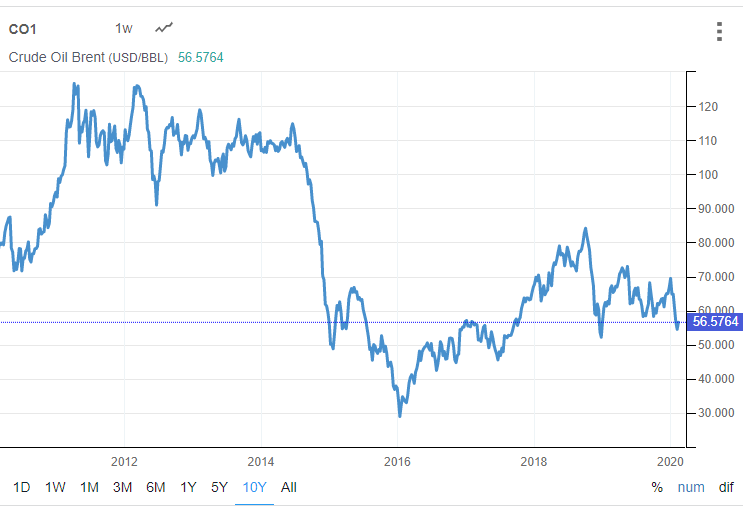

It would be foolhardy for any investor to take the plunge with any of the big three producers based on LNG outlook alone. These companies are also oil producers and the price of oil over the past decade has been highly volatile, with the coronavirus the latest catalyst for falling prices.

The ten-year price movement paints a fuller picture.

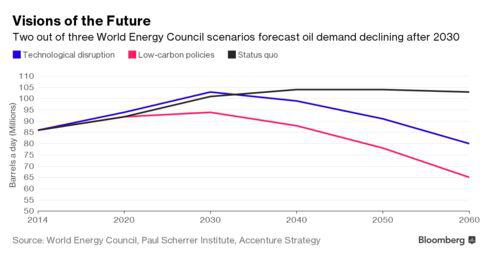

Despite the naysayers predicting the fall of oil once mass adoption of EVs (electric vehicles) takes place, the demand for oil is expected to continue to grow until 2030 according to one source and until 2040 according to a different source.

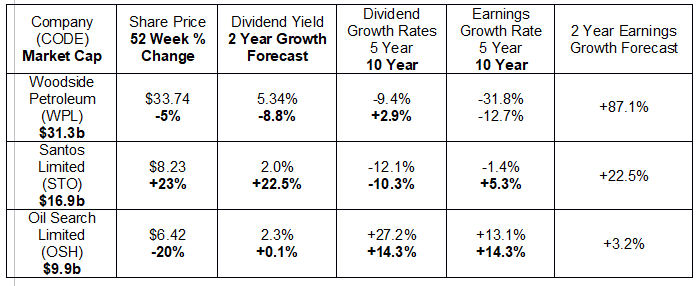

Despite the debate over demand for oil and the volatility of the oil price, two of the top three oil producers on the ASX have double digit 2-year earnings growth forecasts. The third has impressive historical dividend and earnings growth rates. The following table includes price and performance metrics.

Woodside justifiably claims the title of “pioneer in the LNG industry in Australia. The company has an impressive array of operating producers, assets in development, and exploration assets.

The crown jewel is Woodside’s earliest successful endeavor – the NorthWest Shelf in Western Australia. The company’s Australian assets are clustered in this area, including the oil and gas and LNG production from the NorthWest Shelf; LNG production from Woodside’s wholly owned Pluto LNG operation; the Chevron joint LNG venture at Wheatstone; and a NorthWest Shelf joint venture including the Enfield oil assets.

Woodside is developing the Burrup Hub, a proposed LNG processing facility serving the company’s existing and under development LNG operations in the Northwest Shelf. These include the Browse project and a floating LNG platform called Scarborough. The company also has an LNG project under development in Canada and oil and gas development assets in Senegal, Myanmar, and Timor Leste.

The company’s Full Year 2019 Financial Results disappointed investors with asset write downs and cyclone interruptions crushing net profit with a reported USD$382 million, down from FY 2018’s $1,467 million.

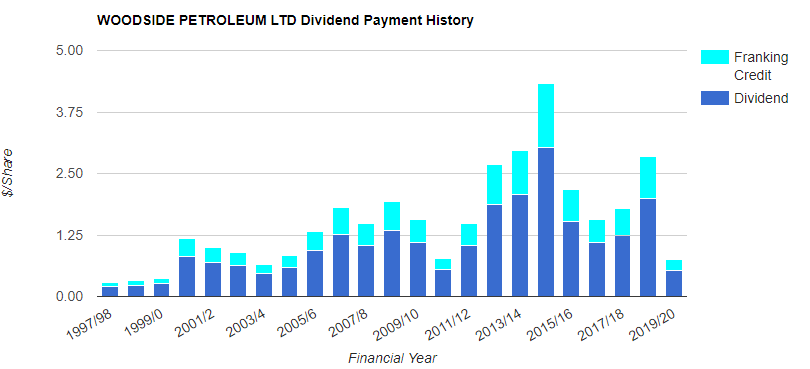

However, continuing the company’s practice since inception of paying fully franked dividends without interruption, Woodside investors received a dividend payment of USD$0.91 per share. Given the weak dollar, Aussie investors pocketed AUD$1.35 per share.

Woodside has routinely matched its dividend payments to performance, lowering its average over time. However, the dividends paid have been substantial, as shown in the following graph from sharedividends.com.au.

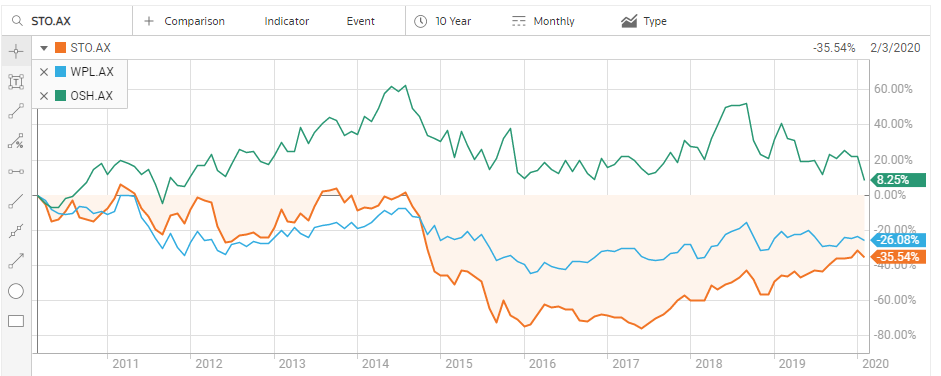

The second decade of the 21st Century has not been kind to the major ASX oil stocks, with only Oil Search Limited managing to eke out a modest share price gain.

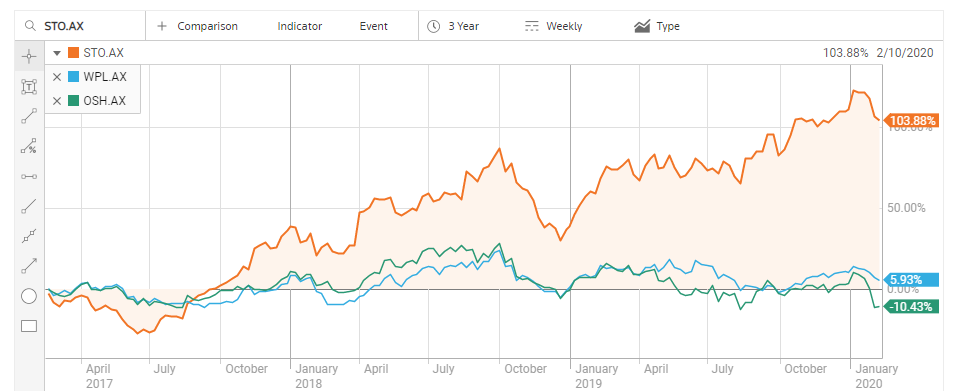

Santos Limited fell the furthest as the price of oil collapsed in late 2014 but over the last three years, Santos has come roaring back to claim the mantle of top performing ASX oil and gas stock over that period.

In late December of 2016 the company announced a turnaround strategy, shedding some assets to reduce debt and focus on five core assets:

- Cooper Basin – producing gas, ethane, crude oil and gas liquids

- Gladstone Liquefied Natural Gas (GLNG) – operator and majority joint venture holder with Malaysian and South Korean oil and gas companies Petronas and Kogas

- PNG – a minority interest in the Papua New Guinea LNG operation

- Northern Australia – in October of 2019 Santos bought out partner Conoco Philips in the Darwin LNG operation

- Western Australia Gas -.gas and oil operations in the Carnarvon Basin and the recently acquired assets of Quadrant Energy.

The turnaround strategy began to reward investors in FY 2017 when the company grew revenue from $3,584 million to $3,983 million and reduced its loss from $1,446 million to $461 million. In FY 2018 revenues increased substantially to $5,185 million and Santos returned to profitability with a net profit of $892 million.

Oil Search Limited is a Papua New Guinea oil and gas producer founded in 1929. The company now operates all of the producing oil fields in Papua New Guinea.

In 2014 the PNG LNG project, operated by Exxon Mobil with Oil Search holding a 29.7% interest, began shipping. Oil Search has interests in two additional gas fields in Papua New Guinea, once expecting the development of three additional LNG operating facilities from those fields.

The company serves as an example to investors of sovereign risk, even in countries like Papua New Guinea with a history of cooperation. Expansion of PNG LNG is halted with majority owner Exxon Mobil unwilling to negotiate on the country’s terms according to PNG officials in a November 2019 statement. Oil Search is also a minority owner (23%) of another LNG project in Papua New Guinea operated by France’s Total. That project successfully negotiated with the PNG government but as of 2 February of 2020 talks with Exxon Mobil collapsed.

Expansion in the LNG operations in Papua New Guinea were not the company’s only growth plans. In February of 2018 the company acquired a portfolio of oil producing assets in the North Slope oil patch in the US state of Alaska. One of the largest onshore oil discoveries of the last three decades in the US, the Nanushuk Field, is one of the key assets in the acquisition.

Over five- and ten-years Oil Search has outperformed in both dividend and earnings growth. Investors worried about the death of the internal combustion engine (ICE) fueling the demand for oil should consider the average holding period of long-term investors – five years.