The optimistic view that inflation in the US is peaking took a hit on 13 October with the release of a bullet-laden September CPI (consumer prices inflation) report. The bullets – a 0.4% increase over August and year over year inflation at 8.2% -support the counter-argument view held by many that the interest rate hikes are not working, at least not yet. A growing number of experts fear the US Federal Reserve Bank will drive the country into a recession with more rate hikes.

One of the key members of the Fed indicated a rate hikes would reach a high of 4.5% interest, followed by an assessment period to gauge impact on a longer term. The current rate there is 3.0% -3.25%.

As questions were asked when the dust settled, some market experts chimed in with the opinion the latest report supports the view inflation has peaked. The September numbers – +8.2% – were almost identical to the August numbers – +8.3%- with only a difference of .001.

As the US markets opened for business, the most watched index on the planet – the Dow Jones Industrial Average (DJIA) – fell close to six hundred points. In a classic example of market participants “shooting first and asking questions later.” By the lunch hour in New York, all three US indices dramatically reversed the trend, with the DOW making a full three hundred sixty degree turnaround, moving up 600 points. The DOW and the S&P 500 indices closed with increases in excess of 2.5%. Even the embattled NASDAQ closed up 2.3%.

Our economy dodged the GFC (Great Financial Crisis) without plunging into recession, as did most other economies in developed nations. The RBA appears ready to begin easing increases to the cash rate and the economy appears recession-resistant at the moment.

Top Australian Brokers

- City Index - Aussie shares from $5 - Read our review

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

So why do Aussie investors appear worried? One of the many things newcomers to share market investing learn in the proverbial blink of an eye is the ASX follows US markets. This happens with regularity, with not enough attention paid to the actual economic situation here in Australia.

The day after the historic market surge in the US, the ASX followed suit. The Friday Evening Market Report from CommSec appearing on thebull.com.au highlighted the reaction. The ASX 200 rose 116.2 points (1.75%) with eight sectors and 83 per cent of stocks in the ASX 200 ending the day with rising prices.

The dramatic volatility last week was extreme but is likely to continue although perhaps not as severe. There are still some financial experts offering ways to invest in the midst of the storm rather than seeking shelter in going to cash or fixed income investments.

Most base their appeal on time. In markets with high volatility and uncertainty, worthy investments fall, regardless of potential. Quality tech stocks have been crushed regardless of what king of ”tech” they produce. Over time, most recover as did many ASX stocks following the GFC.

In better times many investors see opportunities in stocks working in “megatrend” sectors. Global asset management and investment advisory firm BlackRock has this to say about megatrends:

- Megatrends powerful, transformative forces that could change the global economy, business, and society – have been changing the way we live for centuries. Think electricity, automobile, the Internet.

One of the megatrends with investing potential for investors that appears to have fallen under the radar is cybersecurity.

The recent hacking at Optus served as a reminder hacking is not going away. The average cost of a single hacking incident for businesses with fewer than 100,000 records breached is USD$200,000, according to a survey from Hiscox Business Insurance company with data provided by CNBC. The average cost of ransomware data breaches with records in excess of 100,000 data points breached has reached $USD$4.4 million, according to the latest global survey from IBM Security. The global total cost of cybercrime of all types is expected to reach $10.5 trillion dollars by 2025, according to the latest version of the “2022 Cybersecurity Almanac” ‘from Cisco/Cybersecurity Ventures

Remote working dramatically accelerating as a result of the COPVID 19 Pandemic is adding to the complexity of dealing with future data breaches. The pandemic is credited by experts for driving the total cost of cyber crime around the world to $6 trillion dollars in 2021.

Australian investors who see “megatrend” potential in cybersecurity stocks have less than a dozen small-cap choices on the ASX. There is a cybersecurity ETF (exchange traded fund) called HACK that offers lower risk than investing in individual stocks.

There are thirty seven big cap stocks in the HACK portfolio, all with market caps in the billions. All but one are categorized as information technology stocks and one under the GISC classification of industrials. Thirty six are based in the US with one in India.

Investors with high risk tolerance and an oversized appetite for stocks making big gains are aware of the downside of all ETFs that outweigh the risks of individual stock picking.

In short, the average returns of the fund counter-balance high performers against low performers. The following five year price movement chart controls for the recent tech sell-off and the pandemic. Two pure play cybersecurity stocks in the portfolio – CrowdStrike (CRWD) and Fortinet (FTNT) are compared against the ETF of which they are part and the US index in which CRWD and FTNT trade – the Nasdaq. From the US financial website cnbc.com:

The individually traded stocks and the NASDAQ index all outperformed the ETF.

From the ASX website here is the five year share price performance of HACK against two of the top cybersecurity stocks on the ASX – Tesserent Limited (TNT) and Prophecy International Limited (POV):

This chart shows an advantage of an ETF. Over time, the fund has increased slowly but steadily, never approaching the highs achieved by the individual stocks, but in a severe downturn, the returns are comparable.

ETFs have a major advantage over traditional mutual funds newcomers to share market investing may not realise. ETFs can be bought and sold in a matter of minutes, just like individual stocks.

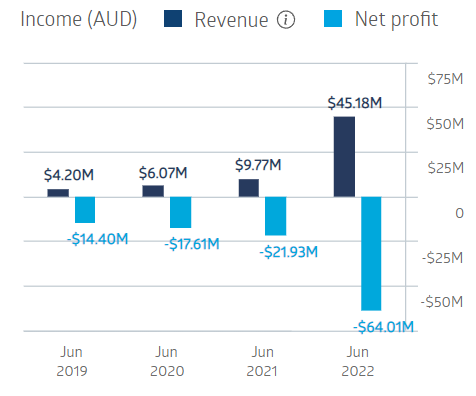

Tesserent is the largest business focused cybersecurity stock on the ASX by market cap – $137 million dollars. The largest is Family Zone (FZ0) at $242 million dollars. In truth, the company has nothing to do with the kinds of cybersecurity needs of organisations in commercial and governmental sectors. Family Zone offers software allowing parents to control and monitor internet access of their children. Over five years the share price has dropped 69%, now trading at $0.28 per share, down from a 52 week high of $0.72 per share. Year over year the share price is down 60%. The company has grown revenue in each of the last three fiscal years while posting big losses. From the ASX website the following graph tracks the company’s revenue and net profit over the last three years:

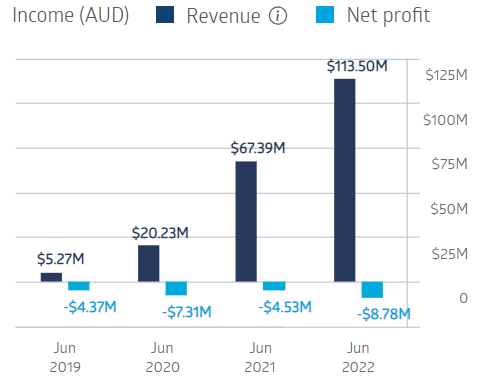

Tesserent last traded at $0.105 per share, close to the 52 week low of $0.10. The 52 week high stock price of$0.245. Year over year the price is down 58%. The company is generating revenue but is not yet profitable. From the ASX website:

The profit figures include yearly one-off charges, such as acquisition costs and debt refinancing. In 2022 the company’s normalised profit – eliminating substantial debt refinancing and other one-time costs – rose 38%.

Unlike other cybersecurity companies, Tesserent does not have a pre-designed software platform that may or may not be tailored to a customer’s needs. Tesserent’s approach is called Cyber 360, working from the beginning – listening to a customer – to the completion of the circle – risk monitoring.

The Cyber 360 strategic approach begins with first identifying security threats, and then assessing their potential impact of the threat risk.

Corrective action is then taken and protection measures for future threats put in place.

The cycle repeats with identifying and responding to new threats and other security incidents.

Tesserent operates in Australia and New Zealand, serving more than twelve hundred organisations in government, manufacturing, insurance, finance, legal, logistics, utilities, health, and education. The company is the top cyber security provider on the ASX.

Prophecy has a market cap of $57 million dollars and last traded at $0.785 per share, slightly higher than the stock’s 52 week low of $0.74 but more than 50% below the 52 week high of $1.72. Year over year the share price is down 17.37%.

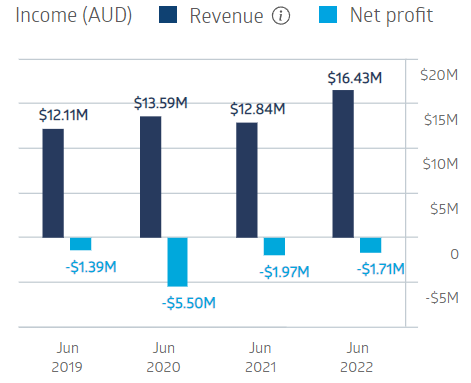

Like all ASX stocks in this sector, Prophecy is generating revenue, but is not profitable. From the ASX website:

In the early years of the twenty first century, Prophecy began to expand its traditional focus since the late 1980’s on accounting software to cyber security. In conjunction with Australian military and defence personnel, Prophecy created its first offering – Snare.

Snare is the company’s flagship project but Prophecy also offers eMite – a software analytics program for improving an organisation’s customer contact centres.

Many call centres consist of an uncoordinated maze of contact points based on product line, or geography. The cloud-bases eMite platform brings disparate data from multiple points into an integrated whole, capable of undergoing analysis.

The company has repeated announcements of contract signings. In October 0f 2021 the share price reached a 52 week high on the news of a deal with Humana, a major healthcare insurer in the lucrative US market.

A little more than a month prior to the Optus hack, Prophecy signed a five year MSA (master supply agreement) with Optus for services and software from both Snare and eMite for Optus, Optus subsidiaries, and Optus customers.

Both eMite and Snare are SaaS (software as a service) subscription based products with multiple contact points. Snare Servers provide centralised data control and Snare Agents examine all company-identified IT events at their source.

The company has offices in Sydney, Adelaide, Manila, the UK, and the US serving 4,200 client sites with Prophecy big data analytics and cybersecurity software.