Is it Time to Invest in Beaten Down ASX Listed Lithium Stocks?

In FY 2023 Australia exported 52% of the world’s supply of lithium. The many ASX lithium producers and explorer/developers were riding high as the hype over the coming massive adoption of electric vehicles drove lithium prices up. When the often inevitable cycle of commodity price movements reared its ugly head, those same companies experienced devastating drops in their share prices. Can they recover?

What is Lithium and What Is It Used For?

Lithium is a silvery-white alkaline based metal extracted from hard rock or pumped from the earth to evaporate in salt brine ponds. Australia holds the world’s largest resources of lithium from hard rock, along with the world’s largest lithium mine – the jointly owned Greenbushes Mine in Western Australia.

Lithium has medical and industrial applications, but its dominant use by far is in the kind of electric batteries used in consumer and commercial electronics, electric vehicles (EVs), and battery storage.

Lithium has a decided advantage over other battery metals and minerals that go into batteries. It is the least dense metal, giving it the highest electrochemical potential. While other metals used in the variety of currently available lithium-ion battery configurations like nickel, cobalt, and manganese have competition, lithium does not.

What Drives Lithium Prices?

The price of lithium and lithium mining stocks is following a pattern set by Australia’s dominant commodity – iron ore. When the Chinese embarked on what was arguably the largest construction boom in history, the price of the iron ore required for steel production skyrocketed, sending iron ore miners of all sizes scurrying about to ramp up production.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Commodity prices are determined by the delicate balance between demand for the commodity and its readily available supply. The massive increase in the production of iron ore led to a supply/demand imbalance as Chinese demand cooled.

In 2022 the price of lithium hit all-time highs as demand for EVs went up, particularly in China. Lithium miners followed the pattern, with existing miners producing more and smaller miners abandoning other commodities to cash in on the lithium boom. Then the Chinese economy faltered and demand fell.

Now we have existing miners cutting back on production and exploration and development companies shutting down plans until the price improves.

The good news for prospective investors is that the “wash, rinse, repeat” cycle will play out again.

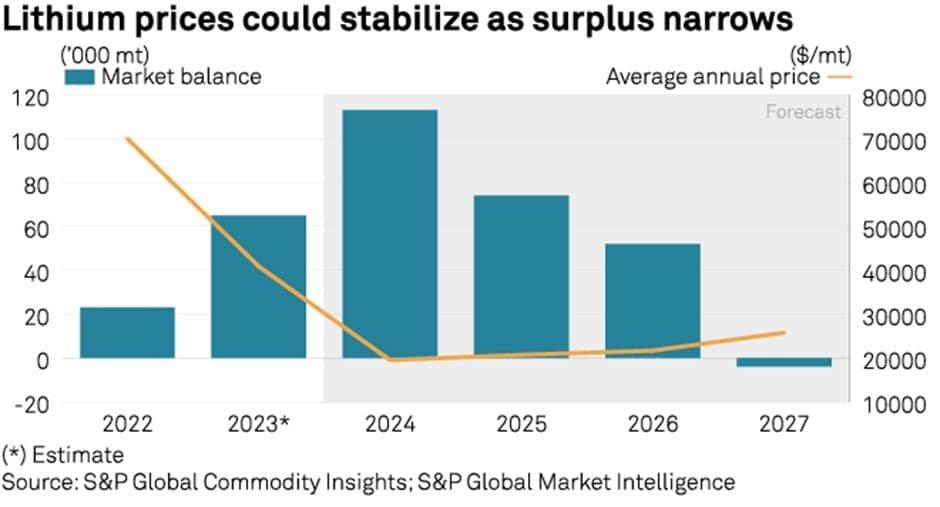

S&P Global intelligence sees the current supply cutbacks narrowing the imbalance between supply and demand, with balance restored and prices beginning to rise in 2027. The carnage wrought on ASXS lithium shares suggests long-term buying opportunities.

Lithium Stocks on the ASX

Given that Australia exports more lithium than any country in the world, it is no surprise there is a plethora of lithium miners on the ASX, both producers and explorers/developers.

The volatility of commodities like lithium adds risk to all investments in ASX listed lithium stocks, but there are three large cap producers worthy of interest along with two smaller miners bucking the downward price movement wreaking havoc throughout the lithium space.

Pilbara Minerals (ASX: PLS)

Pilbara is the sole owner of the Pilgangoora Lithium the “world’s largest independent hard-rock lithium operation,” according to the company. Pilbara is the largest pure play lithium miner on the ASX by market cap.

The Pilgangoora is a low cost, long life operation, with a resource base large enough for expansion to meet rising demand. The company has exploration assets in Western Australia and is aggressively pursuing entry into downstream lithium processing for direct delivery of battery-ready lithium. Pilbara has a joint venture (JV) agreement with South Korean steel manufacturer Posco to build a lithium hydroxide processing facility in South Korea.

The company has offtake agreements in place with Ganfeng Lithium and General Lithium. Pilbara’s goal is to diversify into an “integrated lithium raw materials and chemicals supplier.”

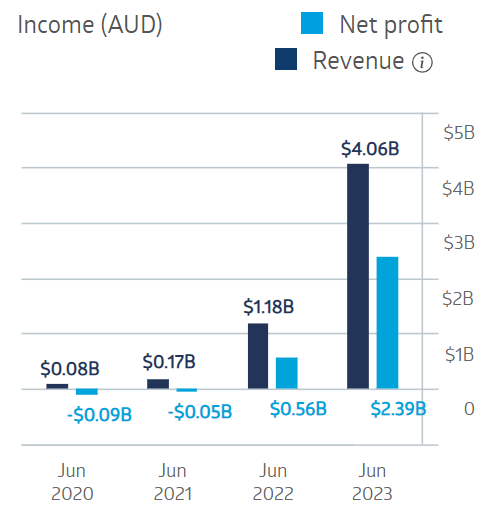

Despite softening lithium prices, the company continued its streak of rising revenues and profit into FY 2023.

Pilbara Minerals Financial Performance

Source: ASX

The bite came in the Half Year 2024 results, which saw revenues fall 65% and underlying profit after tax down 78%.

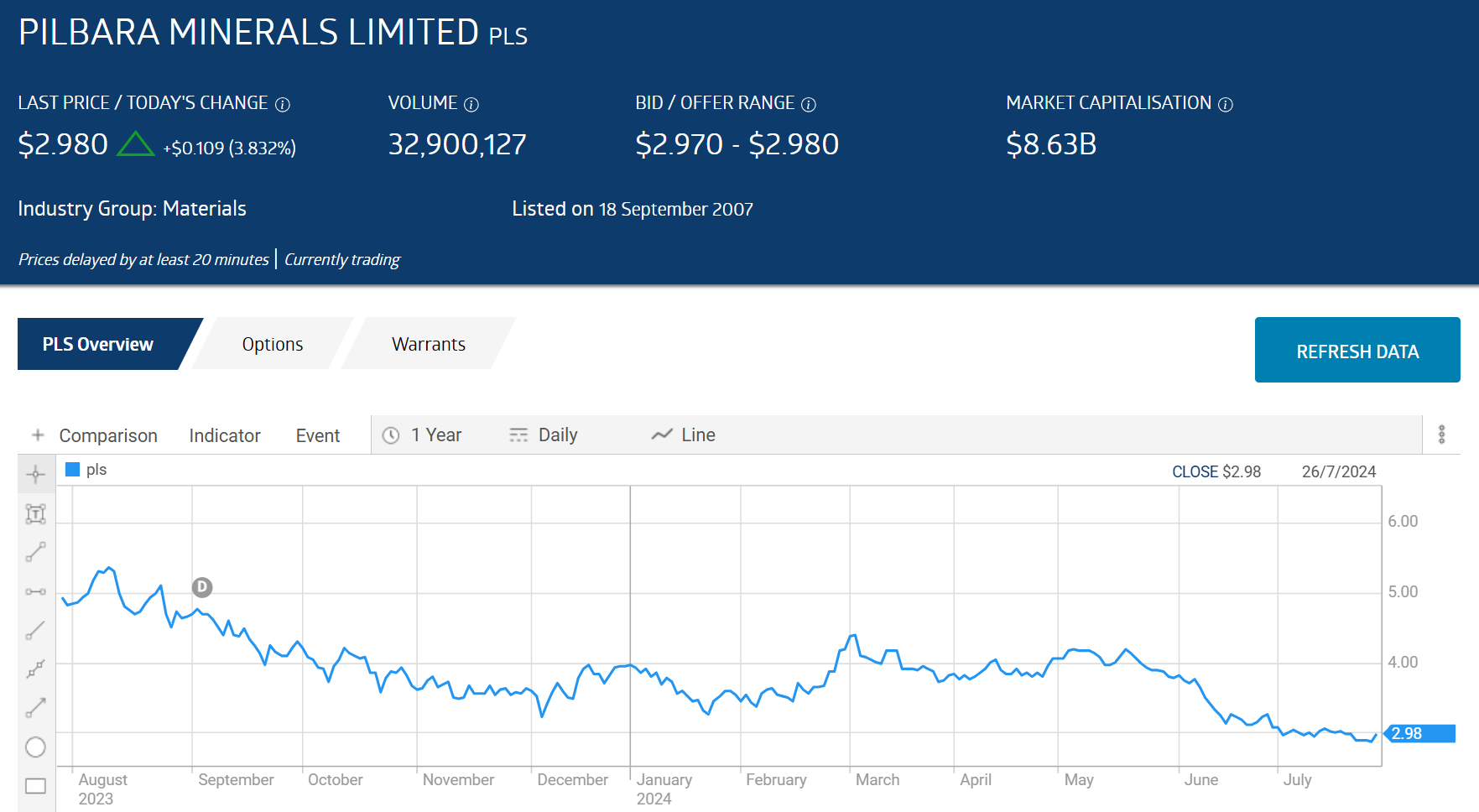

The Wall Street Journal has a HOLD rating on Pilbara shares, with 8 analysts at BUY, 7 at HOLD, and 5 at SELL. Pilbara is number six in the ASX Top Ten Shorted Stocks List.

Year over year the share price is down 38.3%. Over five years the share price rose 486.9%.

Source: ASX

Arcadium Lithium (ASX: LTM)

Arcadium Lithium began trading on the ASX in late December of 2023 following its second reincarnation in three years. In 2021 Australia’s hard rock lithium producer – Galaxy Resources – merged with lithium from brine producer Orocobre to create Allkem Limited,

In June mining giant Allkem merged with lithium chemicals giant US-based Livent to create a vertically integrated lithium chemicals producer. The new company’s end goal is the delivery of battery ready lithium, sourced from the company’s hard rock mining operations in Australia and its lithium from brine operations in South America.

Year to date the share price has joined the vast majority of ASX listed lithium stocks in a downward spiral, dropping 53.9%.

Source: ASX

The Wall Street Journal has a HOLD rating on Pilbara shares, with 8 analysts at BUY, 7 at HOLD, and 5 at SELL.

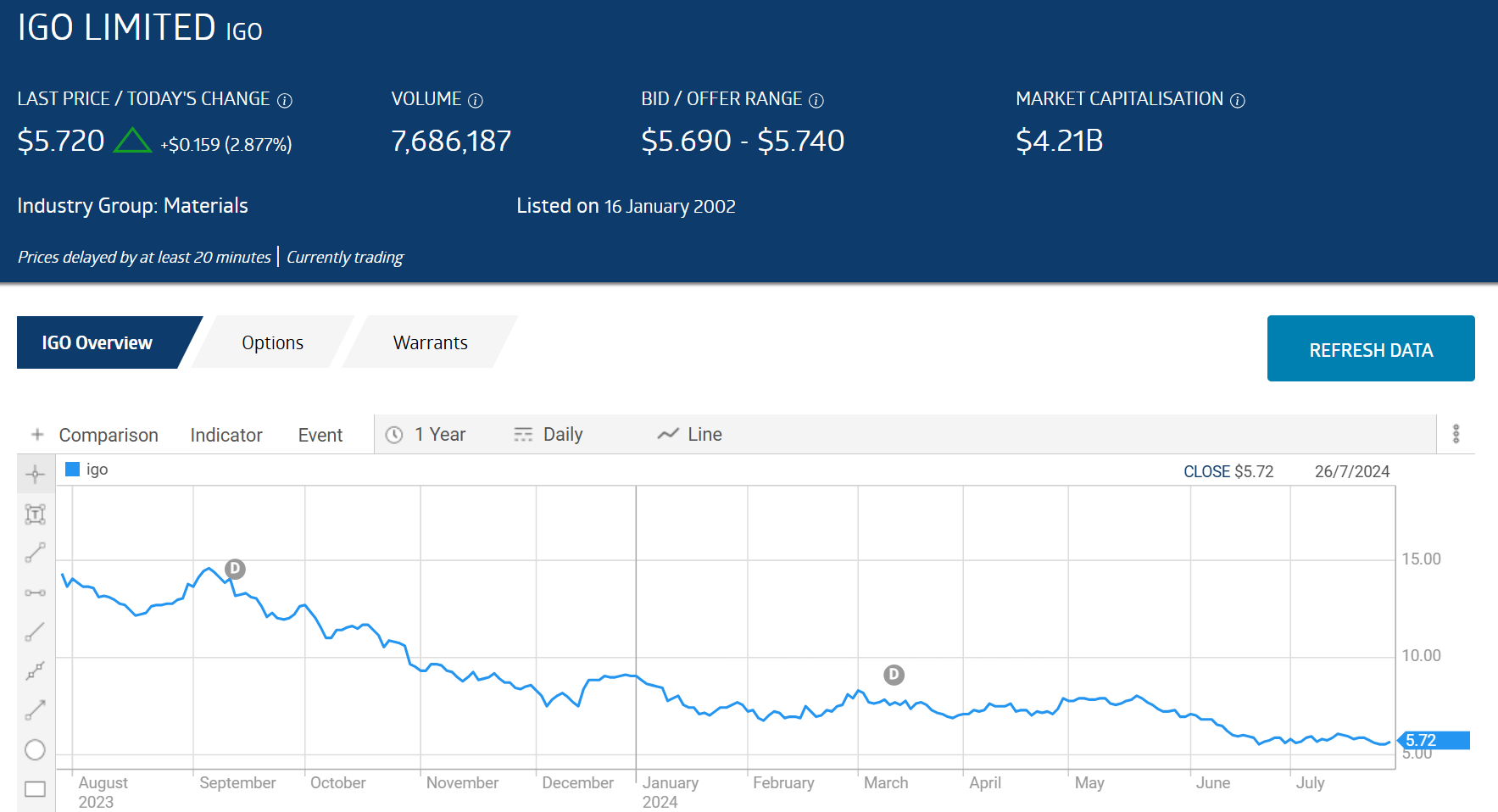

IGO Limited (IGO)

In late 2020 IGO shed its principal gold assets to move into critical battery minerals. IGO has a minority interest in what is said to be the world’s highest quality lithium from hard rock resource. JV partners include Tianqi Lithium Corporation and Albemarle. Greenbushes is the world’s highest-quality, low cost hard rock lithium resource. IGO also has a minority interest in the Kwinana lithium hydroxide refinery. Both Greenbushes and Kwinana are located in Western Australia.

IGO’s other critical battery mineral producing assets include the Nova nickel-copper-cobalt and the Forrestania nickel mines.

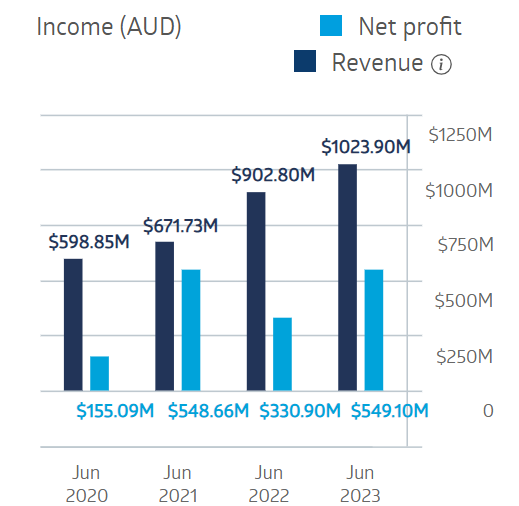

In FY 2023, IGO posted record EBITDA (earnings before interest taxes depreciation and amortisation) along with a 19% revenue increase and a 66% profit increase.

IGO Limited Financial Performance

Source: ASX

The collapse of the price of lithium caught up with IGO in the Half Year 2024 results, with revenues dropping 19% and profit declining 53%. The company announced a “marginal” reduction in production due to the lowering lithium price.” IGO has more than a dozen exploration projects, with two copper assets among them.

Year over year the IGO share price has fallen 59.8%. Over five years the share price rose 22.4%

Source: ASX

The Wall Street Journal has a HOLD rating on IGO, with 4 analysts at BUY, 3 at OVERWEIGHT, 6 at HOLD,1 at UNDERWEIGHT, and 3 at SELL.

Vulcan Energy Resources (ASX: VUL)

Along with micro-cap Prospect Resources, Vulcan Energy Resources is one of the few miners breaking the downward trend of most ASX listed lithium stocks.

Year to date the Vulcan share price rose 55.7%. Since listing in 2018 the share price has climbed more than 2,000%.

Source: ASX

Vulcan’s revolutionary approach to lithium extraction may be what is drawing such investor interest. The company claims it has the technology to “empower a net zero carbon future”

Vulcan plans to supply the European market with both lithium chemicals and renewable energy by tapping into geothermal brine containing lithium. Vulcan’s Zero Carbon Lithium Project is located in the upper Rhine valley in Germany.

Lithium will be extracted directly from geothermal wells and piped to a lithium extraction plant for the production of lithium chloride to be trucked to a lithium hydroxide processing plant.

The company has a geothermal processing plant in place where geothermal from the lithium extraction will be converted to energy and heat for sale to electricity grids.

On 11 April, the company announced the first production of lithium chloride.

On 3 June Vulcan announced strategic investments from institutional investors totaling $65 million dollars.

The Wall Street Journal is reporting 3 analysts with a BUY recommendation for Vulcan shares.

Prospect Resources (ASX: PSC)

Micro-cap Prospect Resources also has defied the trend, with a share price up 40.4% year to date.

Source: ASX

As recently as June of 2024 Africa-focused explorer Prospect Resources held a diversified portfolio of assets located in Zimbabwe, Zambia and Namibia.

Prospect plans to slow down spending at its Omaruru lithium project in Namibia and explore the possibility of selling Step Aside in Zimbabwe. Both measures will help the company focus on its newly acquired flagship asset – the Mumbezhi Copper/Cobalt Project in the copper belt in Zambia. The company’s rationale for the move is that copper has no competitive battery mineral as a substitute, and the price of lithium has fallen.

The Wall Street Journal is reporting 2 analysts with a BUY recommendation for Prospect shares.

As demand for the most critical metal needed for electric batteries – lithium – skyrocketed with the price following suit. Miners rushed to produce more to benefit from a lithium price that hit all-time highs in mid-2022. The resultant oversupply condition coupled with weakening EV demand in China cratered the price of both the commodity and the lithium miners. Some experts see the supply/demand imbalance correcting in 2027, leaving investors with long-term investing opportunities.