Why Australians Should Invest in Indian Stocks

Aussie investors looking to “globalize” their investment portfolios have long looked to the most powerful economy in the world – the United States. Investors lured by the repeated claims that China would one day overtake the US to become the largest economy on the planet looked for opportunities to invest in dynamic and growing Chinese companies.

But what about India? The Indian economy is beginning to emerge from the shadows of their favored rivals.

Did you know for FY 2023-2024 India is forecasted to cement its place as the fastest growing economy in the world?

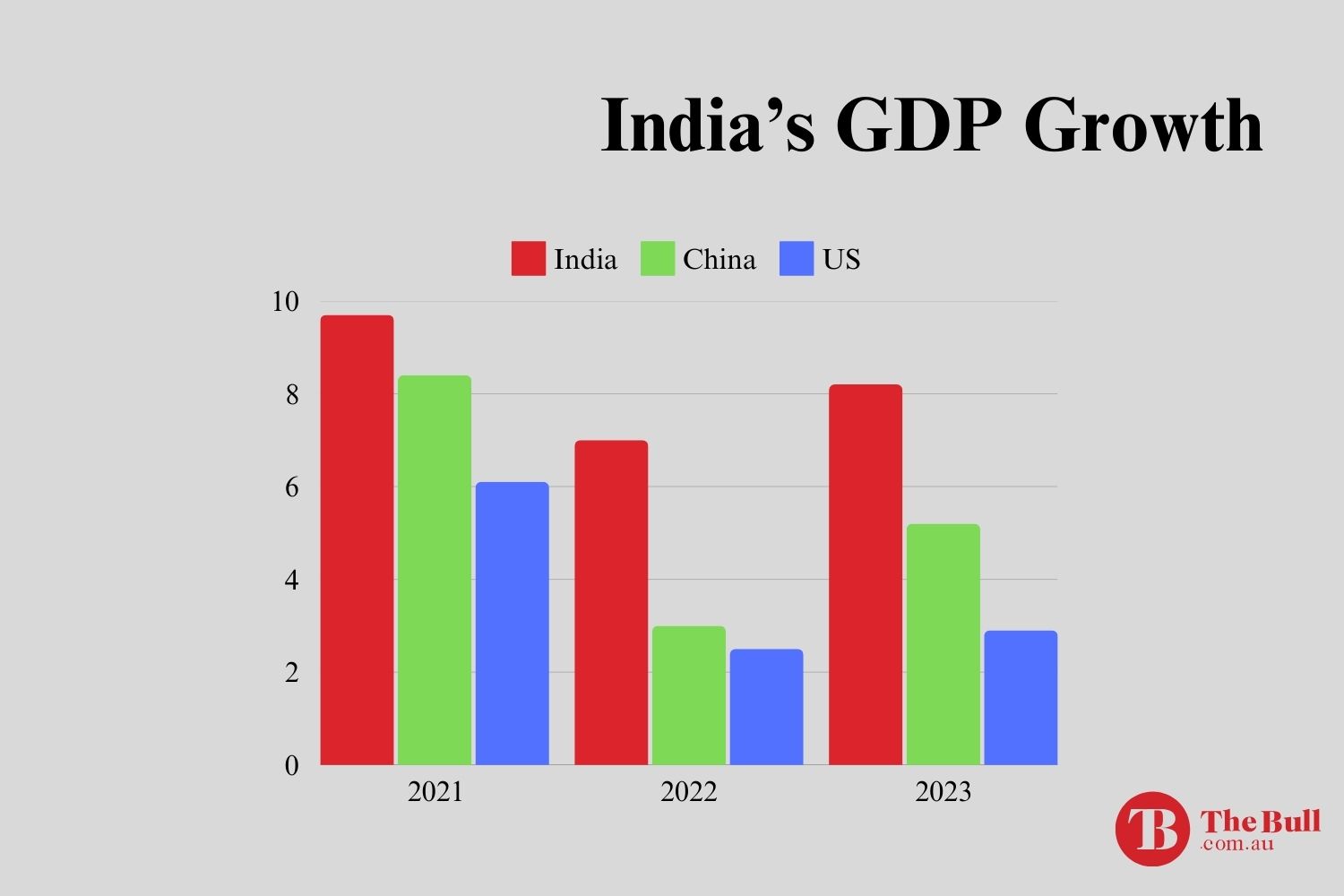

The State Bank of India is forecasting possible GDP (gross domestic product) growth of 8% for the Indian economy. The third quarter of 2024 already came in at 8.4% GDP growth, according to estimates from the Indian Ministry of Statistics. Global investment firm Blackrock shows India

already in the lead, posting this graph from the IMF (International Monetary Fund) in a whitepaper on its website:

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Forced to cite one reason for the dazzling future of the Indian economy, some experts and analysts would choose demographics.

Demographics in India – A Competitive Advantage

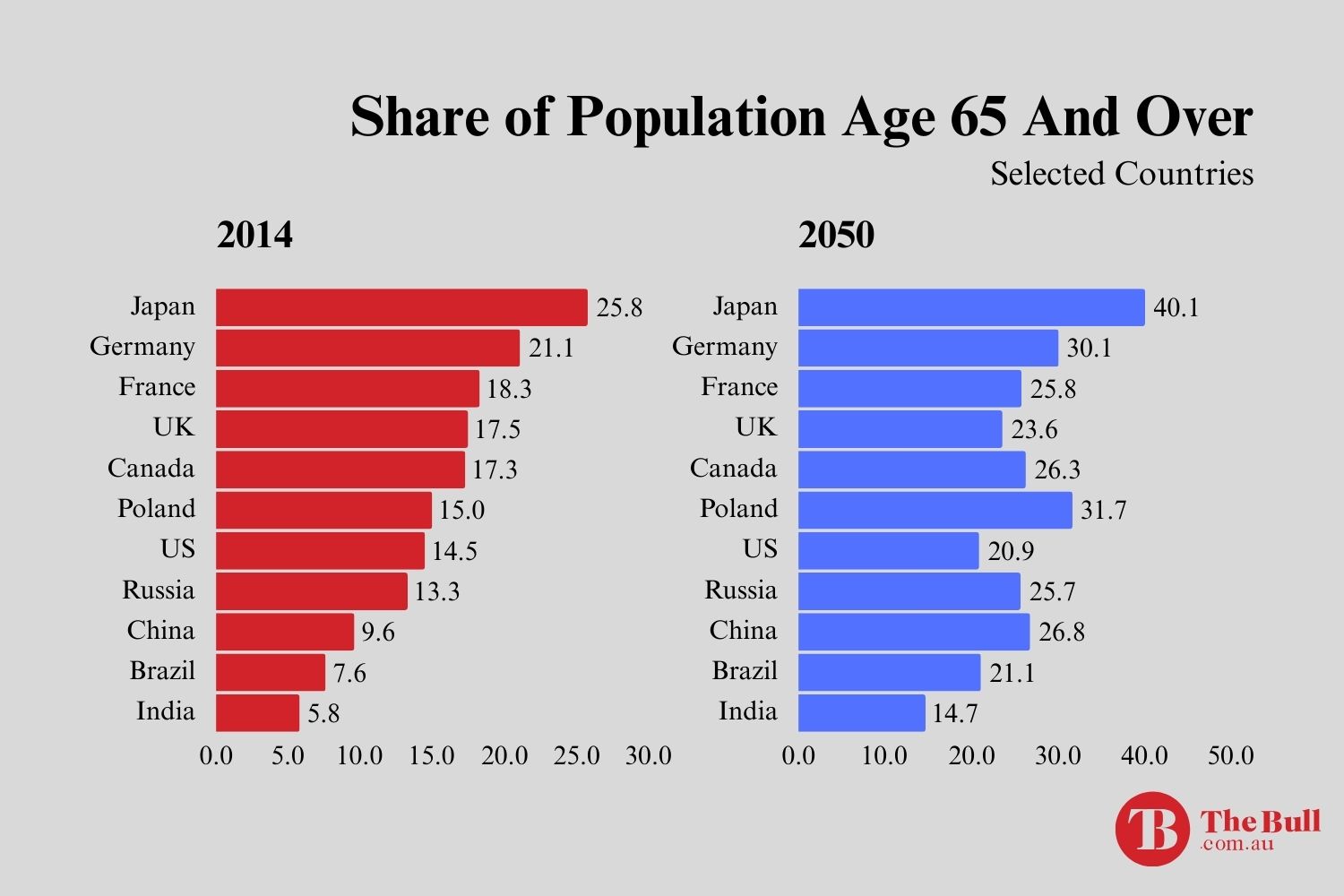

Ageing populations and diminishing birth rates are expected to become a major problem for the current world leading economies, including both the US and China, But not so in India. By 2050 China will have more than a quarter of its population over the age of 65. India will remain on the bottom of the list of leading world economies.

As the world’s leading economy, the US has a major advantage over China in battling the impact of ageing populations on its work force – immigration.

People all over the world are attracted to the US for its economic opportunities. Should that country ever get its immigration policies in order, immigrants can fill in the gaps in the work force left by an ageing population. But who wants to immigrate to China?

India does not have that problem. In 2023 India eclipsed China to become the most populous country on the planet. BlackRock has identified demographic divergence as a mega force driving global growth. A youthful population in India means a growing middle class, a larger work force, and growing productivity. As of 2023 about 65% of India’s population is under the age of 35, with about 50% under the age of 25.

India is also the largest democracy in the world, with presidential elections coming up later in 2024.The government of India introduced policies to encourage manufacturers to locate there, and it is working. Apple has stated its intention to reduce its reliance on Chinese manufacturers with about 7% of its iPhone 14s now being produced in India with an eye toward moving 25% of production there. Micron Technology is another of the many companies the World Bank suggests are planning to diversify beyond their “massive supply chain dependence” on China. Micron intends to build assembly and testing facilities in India.

India boasts a large population of STEM (Science, Technology, Engineering, and Mathematics) graduates, all fluent in the de-facto international language of business – English. Indian leaders are spreading around the world, with 25 of the CEOs of US S&P 500 companies coming from India. The government has made great strides in upgrading the countries physical and digital infrastructure. The Economist and other financial sources cite major improvements in the Indian financial system, with the country’s financial system now ranking seventh in total assets among global financial systems.

The Two Avenues for Australians to Invest in Indian Stocks

Most Australian investors have limited ways to buy Indian stocks. The most complex is buying stocks in individual companies listed on Indian stock exchanges. The simplest is to buy Indian ETFs listed on the ASX.

Indian ETFs on the ASX

Exchange traded funds are bought and sold like any other stock listed on the ASX, offering huge advantages to rank and file investors. Fortunately for Aussie retail investors, there are two quality ETFs listed on the ASX covering most of India’s top companies.

India Quality ETF (IIND) from BetaShares listed on the ASX in 2019, with the share price up 48.2% since listing.

Source: ASX 28 May 2024

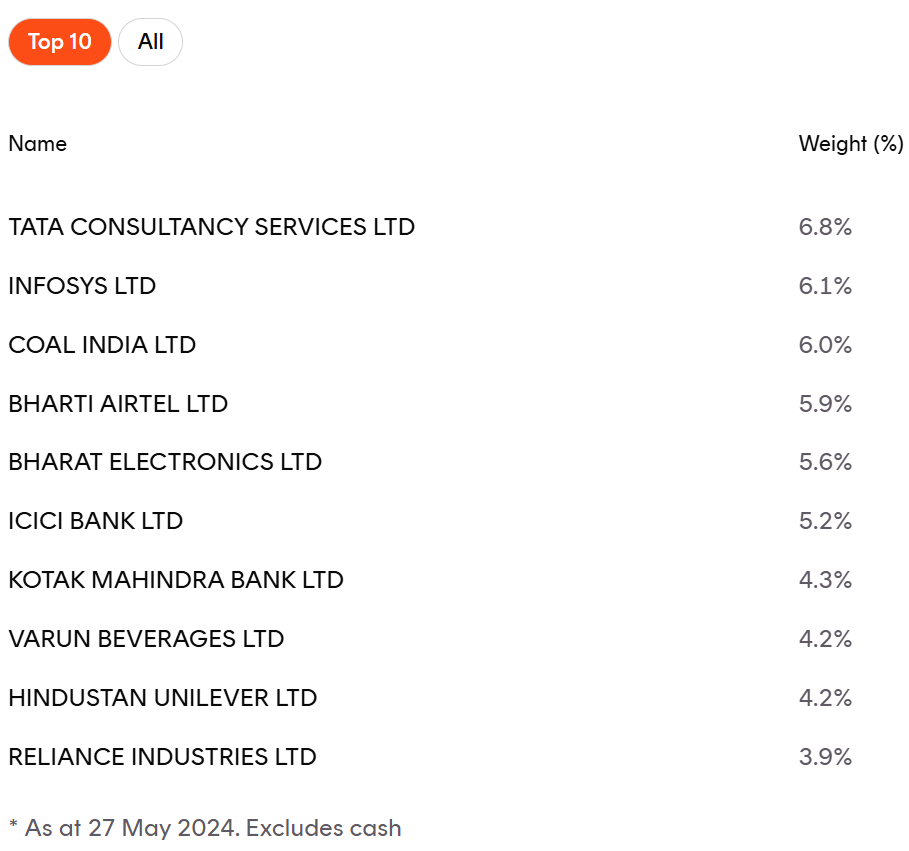

IIND tracks an index of thirty of the top companies in India selected by high profitability, high earnings stability, and low leverage. Although they may be unrecognizable to most Aussie investors, here are the top ten companies in the IIND portfolio, from the BetaShares website:

IIND is a passive fund simply tracking the performance of an index as opposed to an actively managed fund where professional managers try to outperform a benchmark by buying and selling according to market conditions.

Passive and active ETFs pay out distributions to shareholders based on performance with the fund passing off tax liability to the shareholder. The NAV, or net asset value of an ETF represents the total assets minus liabilities of companies in the fund portfolio divided by the number of shareholders. NAV rises and falls due to investor buying and fund distributions, but it is per share price performance and distributions that impact shareholder return.

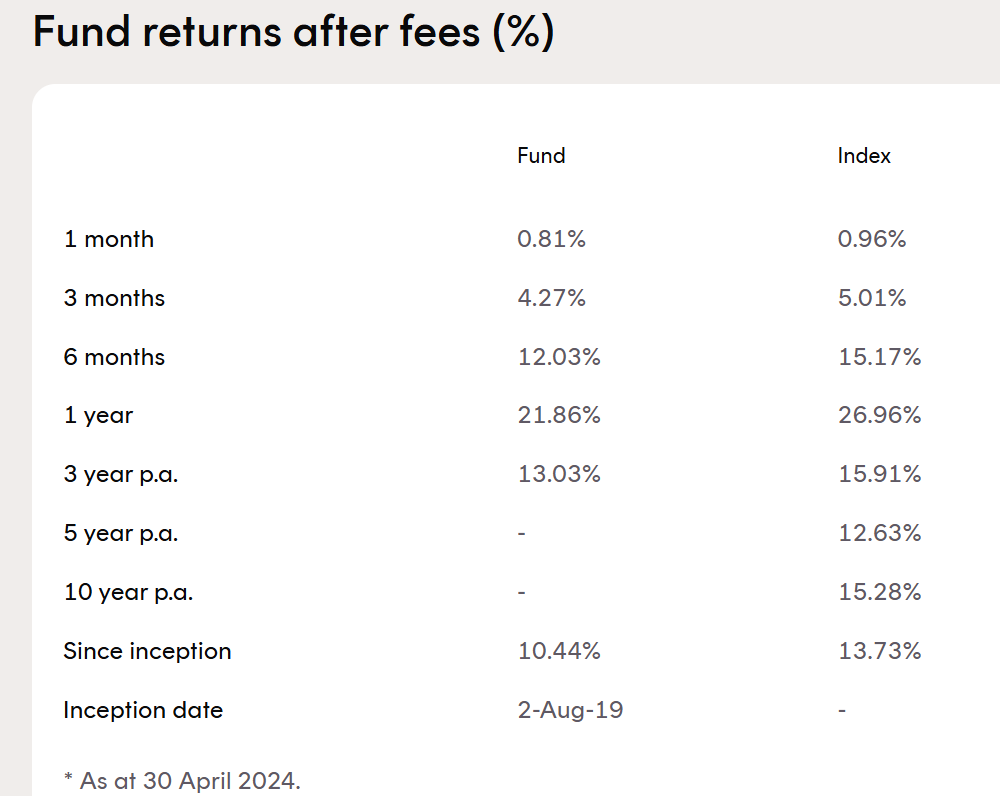

Shareholders return performance of passive ETFs like IIND can show an odd outcome, where the fund returns trail the index returns. This happens due to the complicated tax situation and the weighting of holdings within a passive ETF, allowing the financial performance of high-weighted funds to lower fund performance should the stock of highly weighted companies underperform.

Here then is the returns performance of IIND against the index over time. From the BetaShares website:

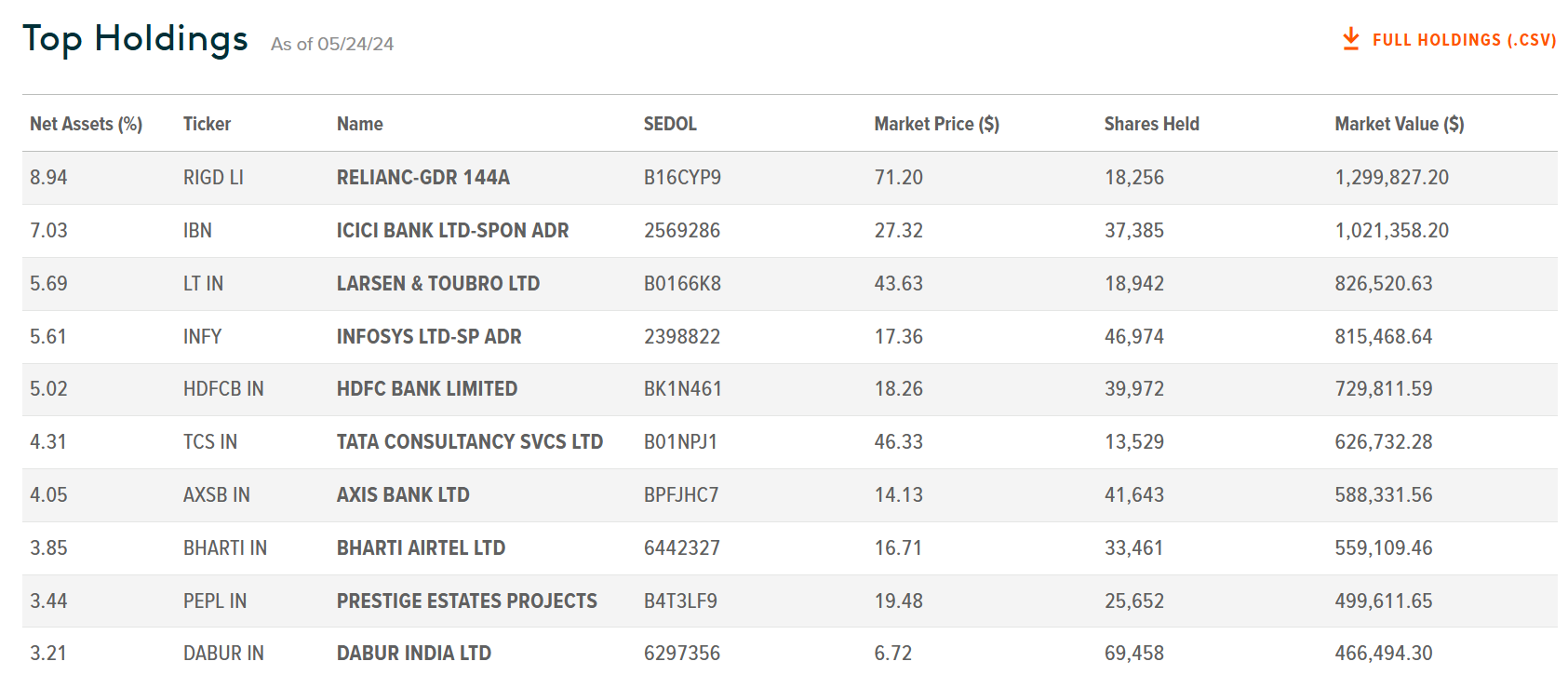

The Global X India Nifty 50 ETF (ASX: NDIA) tracks the performance of the Indian Stock Exchange Nifty 50 Index. For comparison purposes, here are the top ten holdings in the NDIA, from the Global X website:

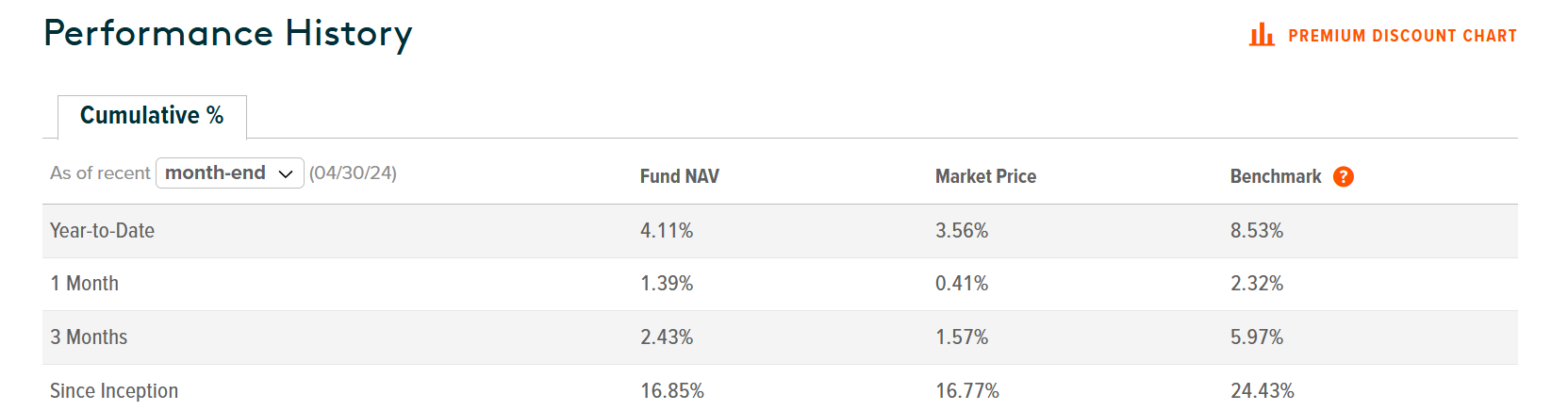

And here is the fund performance over time, also from the Global X website:

There are two important differences between the two, with the most important being IIND’s filtering of Indian stocks to sort out the highest quality against the standards of profitability, earnings, and leverage.

The second is the slight difference in expense ratios, with IIND charging 0.80% and NDIA 0.76%. These are the fees charged to investors based on a percentage of total assets.

The NDIA share price is up 52.4% since listing, outpacing IIND by a slim margin.

Source: ASX

Buying Individual Indian Stocks

Unlike US companies, there no Indian companies with dual listings on the ASX. Foreign investors can buy Indian stocks via the FPI (foreign portfolio investment.) Now the fourth largest stock exchange in the world, the Indian stock market is attracting more foreign investment. Individuals and funds opting to enter the market using FPI must be registered with India’s stock market regulating agency, the SEBI (Securities and Exchange Board of India.)

One of the SEBI requirements suggests most foreign investors are either funds or high net worth individuals – FPI investments cannot hold more than 10% in a company listed on the Indian Stock Exchange.

Aussie investors can make FPI investments via custodian banks that manage FPI transactions like Citi Bank and Deutsche Bank or through registered brokers like Jarvis Investments. Jarvis has an AI (artificial intelligence) platform and is registered with the SEBI.

India is emerging as a power player on the global economic stage. The country has already assumed the title of most populous country in the world. Currently ranked fifth among world economies, India already is the fastest growing economy on the planet, with some experts predicting India will supplant China as the second-largest economy in the world by 2075.

The country has a demographic advantage from its youthful population and has a government committed to boosting the country’s economy. Government initiatives have made major improvements in the country’s physical and digital infrastructure and is attracting foreign manufacturer like Apple and Micron to transfer manufacturing operations to India from China.

Australians can invest in the Indian economy through two ASX listed ETFs – BetaShares India Quality ETF or Global X India Nifty 50 or directly through the Indian Foreign Portfolio Investment scheme by registering with India’s SEBI.

Indian Stocks FAQs

Can I Invest in Indian Stocks From Australia?

Yes, Australians can invest in Indian stocks although the options are limited. Australian investors can buy two ASX-listed ETFS that include Indian shares – the BetaShares India Quality ETF and the Global X India Nifty Fifty. Foreign investors can purchase shares in individual Indian companies via the Indian Foreign Portfolio Investment scheme.

What is the Nifty 50?

The Nifty 50 is India’s stock market index, representing the float-weighted average of 50 of the largest Indian companies listed on the Indian stock exchange. India also has broad-based indices in the Nifty 100 and the Nifty 500 which represent the top 100 and 500 Indian companies respectively.

What are the 5 Biggest Indian Companies?

The 5 biggest Indian companies by market cap are Reliance Industries, HDFC Bank, Tata Consultancy Services, Bharti Airtel and ICICI Bank. Reliance Indistries is the biggest Indian company with a market cap of £168.06B. HDFC Bank is second biggest with a £139.27B market cap. Tata Consultancy Services is the third biggest at £110.68B, closely followed by Bharti Airtel at £95.55B and ICICI Bank at £90.90B.