Is there Less Risk Investing in ASX Graphite Stocks?

Contemporary lithium-ion electric batteries have two main components – the cathode and the anode – that allow an electrical charge to pass from the positive cathode to the negative anode. While both are essential, the cathode has a greater effect on battery performance and accounts for 30% to 40% of the cost of a lithium battery cell, compared to 10% to 15% from the anode.

Anodes use carbon based graphite, silicon, or a combination of the two.

Cathodes have multiple metal/mineral combinations, with the array of alternative configurations coming from research efforts to improve battery efficiency and lower cost.

In effect, graphite is free from the many attempts to replace metals used in cathodes like cobalt, manganese, and nickel.

What is Graphite and What is it Used For?

Graphite is a carbon based mineral. In effect, its layered structure makes graphite a crystalline form of carbon. Graphite may be best know for its use in pencils, but the mineral has multiple other uses. Natural graphite has been used as a “refractory” – a substance that is resistant to heat. Graphite is also used in friction-reducing lubricants, as a substitute for asbestos in automotive brake linings, and in the manufacture of iron, steel, and glass.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Its most common use now is in the lithium batteries powering electronic devices and electric vehicles, although it has found its way into solar panels and energy storage systems.

What Drives the Price of Graphite

Like any commodity, the price is driven by the demand for the products that require the commodity for production. The graphite price received a boost from the hype over the coming revolutionary adoption of EVs (electric vehicles) in every corner of the world, sending internal combustion engine vehicles to the dustbin of history.

The revolution has stuttered as EV sales in China slowed, and the war in Ukraine sent a shock into the clean energy transition, dragging down the price of graphite, lithium, cobalt, and nickel, carrying most battery mineral stocks with it.

Commodity prices are governed by the laws of supply and demand. When demand exceeds supply, prices rise causing producers to rush more supply in the market. Slowing demand creates oversupply conditions, causing prices to drop.

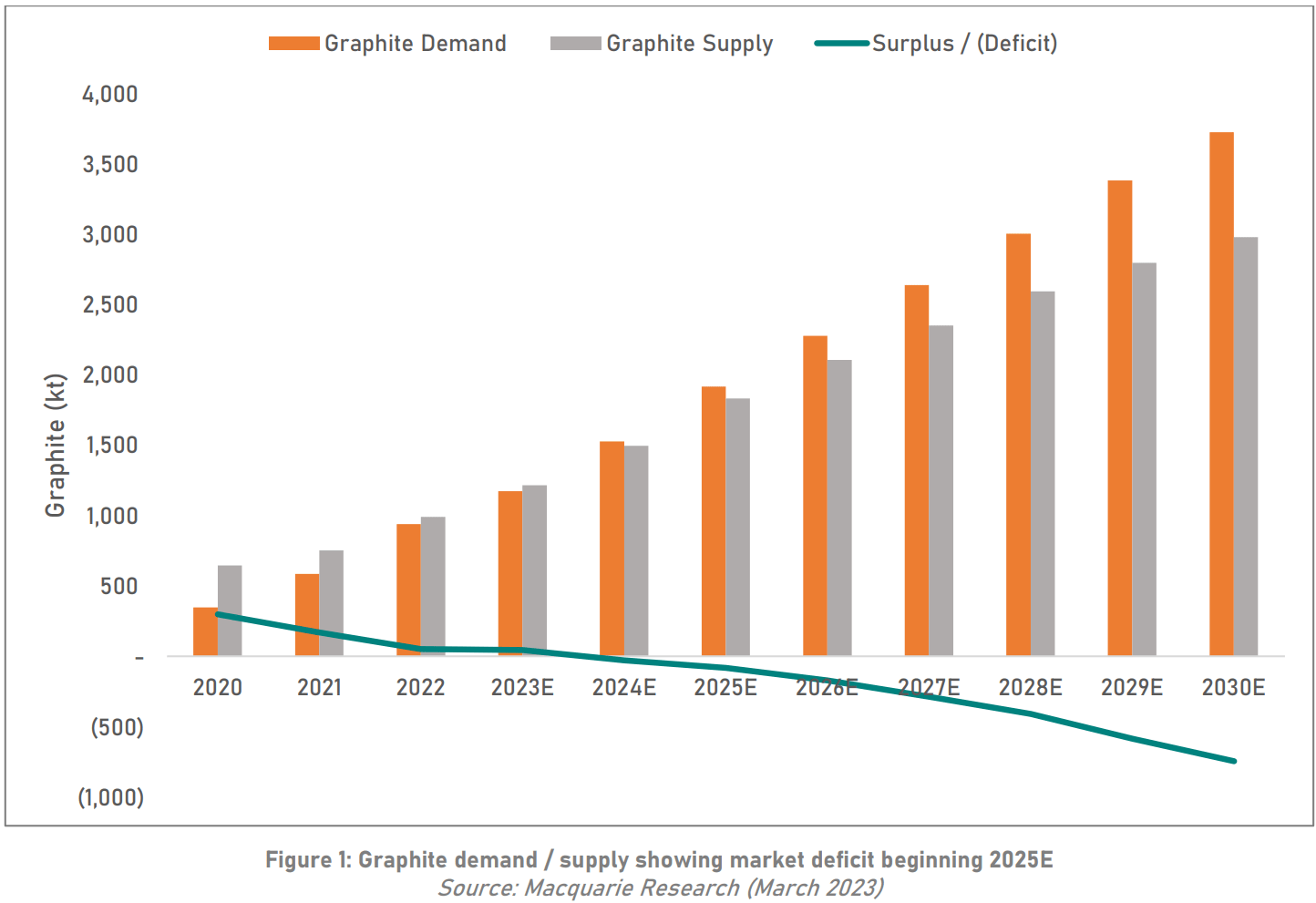

Macquarie Research sees the current oversupply depressing the price of graphite reversing beginning in FY 2025.

ASX Listed Graphite Stocks

In October of 2023 ASX listed graphite shares got a boost from the announcement China would restrict its graphite exports, with China dominating global production and processing of graphite.

Syrah Resources (ASX: SYR)

Syrah Resources has two assets driving the company’s ambition to “supply rapidly growing markets for natural graphite and active anode material products “ – the Balama Graphite Project in Mozambique, and the Vidalia Active Anode Material (AAM) Production Facility in the state of Louisiana in the US. The Bahama project is said to be one of the largest discovered graphite resources in the world, with a mine life estimated at fifty years.

The company will use its “balahama-graphite to batteries” process to turn mined graphite flakes into the spherical graphite used in lithium-ion batteries. Syrah marked its first high volume sale of graphite flakes in April of 2024 with an Indonesian company, preceded by the announcement of an offtake agreement with South Korea’s Posco.

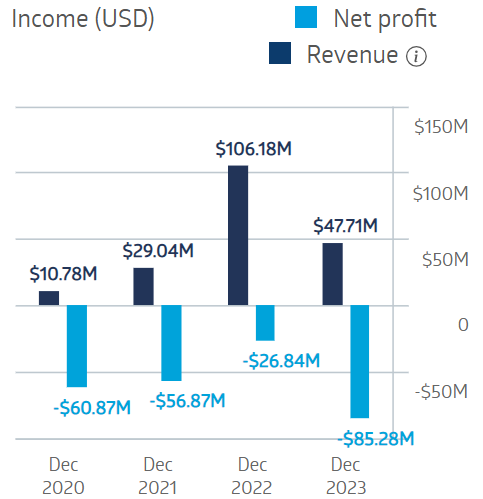

Graphite production at Balama had been delivering rising revenues until the price of graphite along with other battery metals and minerals began to collapse in mid-2022 and on into FY 2023. Operations at Vidalia have begun, lending credence to the company’s claim Vidalia is the first commercial scale facility operating outside of China.

Syrah Resources Financial Performance

Source: ASX

Despite the company’s progress and potential, Syrah Resources has been on the Top Ten Most Shorted ASX shares dating back to mid-2023. Shorts flocked to Syrah following the company’s announcement it would curtail graphite production in the face of falling graphite prices, exacerbating the company’s weakening balance sheet.

Over five years the stock price is down 64.7%. Year over year the stock has dropped 58.3%.

Source: ASX

The Wall Street Journal has an OVERWEIGHT rating on Syrah shares, with four analysts at BUY, one at Overweight, and one at HOLD.

Renascor Resources (ASX:RNU)

Renascor Resources (ASX:RNU) is developing the Siviour BAM (Battery Anode Material) Project in South Australia. Siviour will be vertically integrated, supplying graphite deposits to the processing facility to be turned into battery-ready purified spherical graphite, using flotation purification as opposed to acid based processing. The mineral reserves at Siviour are said to be the largest outside of Africa and the second largest reserve in the world.

Over five years the Renascor share price has risen 319% as of 23 July. The collapse of the price of graphite ignited a sell-off, leading to a fall of 54.8% year over year. The share price got a boost beginning in April from the announcement of a pending $185 million dollar government grant, now approved. Speculation abounds the company will receive additional government largesse from an explosion of budgetary commitments to further battery minerals production.

Source: ASX

Renascor has inked a 10 year non-binding memorandum of understanding with Posco for a production offtake agreement along with strategic cooperation and a potential equity investment. Renascor also has a similar agreement with Mitsubishi and one Japanese and two Chinese anode manufacturers.

The company has a DFS (definitive feasibility study) and a Battery Anode Material Study along with all permitting requirements in place.

The Wall Street Journal is reporting a single analyst with a BUY rating on Renascor shares.

Talga Group (ASX: TLG)

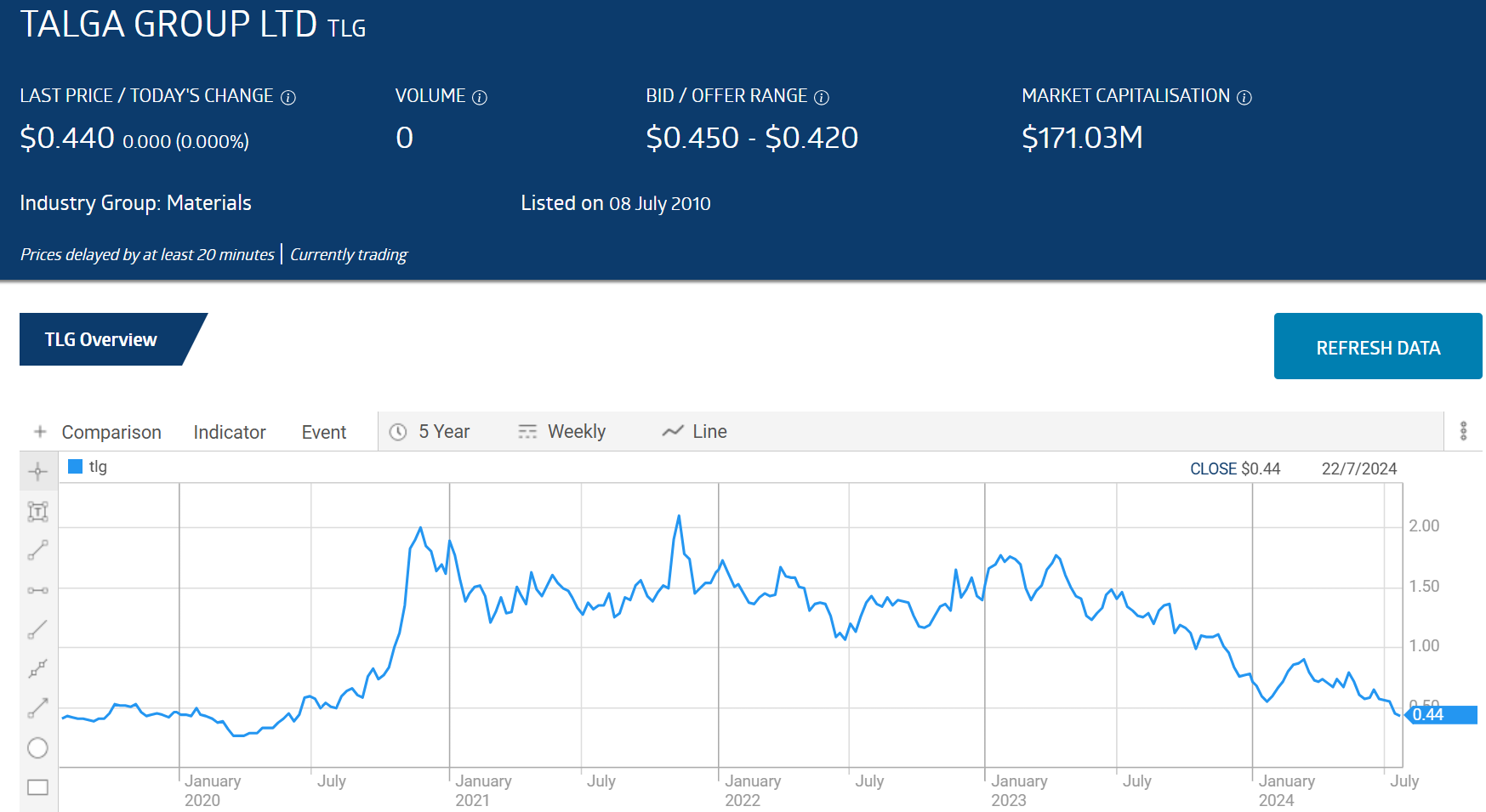

Talga Group (ASX: TLG) has three wholly owned graphite projects in Sweden – Vittangi, Jalkunen, and Raitajarvi. The company will operate as a “mine to battery” entity, with the Lulea Anode Refinery, with initial groundworks in process in preparation for construction. The Swedish location is intended to serve as a major provider of anodes and related anode materials to EV manufacturers in Europe. Talga has completed a FEED (front end engineering design) study for the refinery.

The company is exploring another asset in Sweden — the Aero Lithium Project. Talga has entered into an “Earn In” agreement with SQM, a Chilean lithium miner and producer that trades on the New York Stock Exchange (NYSE.)

Talga also has research and development facilities in Germany and the UK developing graphene additives.

Over five years TLG is down 9.2%. Year over year the share price has dropped 67.2%.

Source: ASX

The company generates a small amount of revenue, primarily from its UK graphene additive sales.

Metals Australia (ASX: MLS)

Metals Australia (ASX: MLS) is focusing its development efforts on critical mineral assets in Canada — the Lac Carheil Flake-Graphite Project and the Corvette River Lithium project, both in the province of Quebec. The Company is also advancing lithium exploration projects in Western Australia – the advanced Manindi Critical Minerals and Metals Project and the Warrambie Project.

Metals Australia has other metal exploration projects in development but the company has designated Lac Carheil as its flagship asset. The company has hired US-based graphite consulting firm Lonestar Technical Minerals for marketing and pricing strategy to be incorporated into the Metals Australia Lac Carheil pre-feasibility study (PFS). This follows multiple contracts to jump-start the project – a contract for the design of a Graphite Flake Concentrate Plant; a contract for metallurgical and laboratory testwork, a contract for the design of the PFS with Lycopodium of Canada, and a contract for drilling and full service support.

Over five years the share price has cratered 97.6% while year over year the price is down 40.6%.

Source: ASX

Graphite is one of many minerals designated as critical to Australia’s future economic success and national security. Most of the designated minerals and metals go into the clean energy transition, with lithium-ion batteries at the forefront, supporting electronic devices and electric vehicles.

Of the two major components of a lithium-ion battery, the cathode leads the anode in production efficiency and high cost. Anodes made of graphite account for between 10% and 15% of the cost of a lithium-ion cell. Cathodes account for 30% to 40% of the cost and are the subject of intense research looking for more efficient and cost-effective sources.

Graphite has multiple uses, but battery anodes rank first for the clean energy transition. The ASX has graphite miners with projects in development, with the majority being small and micro-caps. All have been devastated by the falling price of graphite which is expected to begin improving in 2025.