Buying Cobalt Stocks on the Dip

Australia is one of many countries that maintains a list of “critical minerals,” defined as those vital to economic and national security. The reason is simple – minerals on the list are essential components of the manufacturing process of products without which the country maintaining the list would suffer both economic and national security consequences. Cobalt is one mineral on Australia’s approved Criterial Minerals List.

What is Cobalt and How is it Used?

Cobalt is a chemical element existing in the earth’s crust combined with other minerals like copper, copper, nickel, iron, zinc, silver, and others, although there are rare exceptions where cobalt is extracted as the primary mineral, not as byproducts of other minerals. Copper and nickel mining are the most prominent sources, with the cobalt extracted from the primary metal through reductive smelting.

Cobalt has been used for centuries to add blue pigment where needed and still is today in jewelry and glass, ceramic, and paint pigmentation. The primary use of cobalt is what was once the predominant lithium ion battery used in Electric Vehicles (EVs) – the NCM or lithium nickel/cobalt/manganese battery. Although still the preferred battery technology for longer distance use EVs, the new LFP – lithium ion phosphate battery – is now heavily in use for short distance EV transportation. Cobalt began its life in lithium ion batteries for consumer electronics applications, primarily cell phones. Cobalt is also used in jet engines, gas turbines, car exhaust systems, permanent magnets, and even human prosthetic implants.

An estimated 70% of the world’s cobalt supply comes out of the Democratic Republic of the Congo (DRC) mined by China Molybdenum. Mining practices there include child labor, making most Western economies scurry for alternative sources.

What Drives Cobalt Prices?

Cobalt is a commodity and like any commody the price of cobalt is driven by supply and demand. Long-time commodiy stock investors have seen the price volatility in commodity pricing that repeats itself again and again throughout history. Demand for the commodiy suddenly skyrockets with not enough supply to meet rising demand, sending the price of the commodity lurching forward. Producers ramp up supply leading to an oversupply condition should demand stabilise or decline, sending the price of the commodity into a downward spiral.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The hype over the adoption of EVs got ahead of itself and once analysts began to notice the slippage the massive ramp up in production out of the DRC created the dlassic oversupply condition and the subsequent collapse of the price of Cobalt.

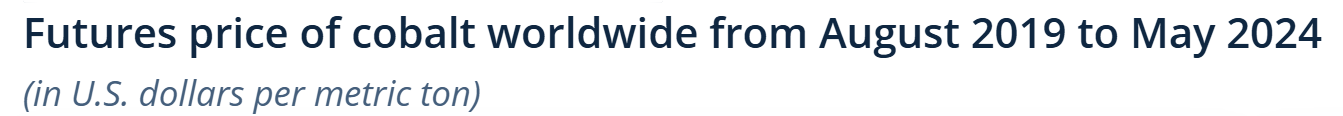

The graph from German database company Statista paints the gloomy picture for investors.

For the price of cobalt to rise again, the oversupply must be absorbed and EV demand needs to accelerate. No one questions the growth in the adoption of EVs and their extension into other forms of vehicular transportation, but it may take longer than originally anticipated.

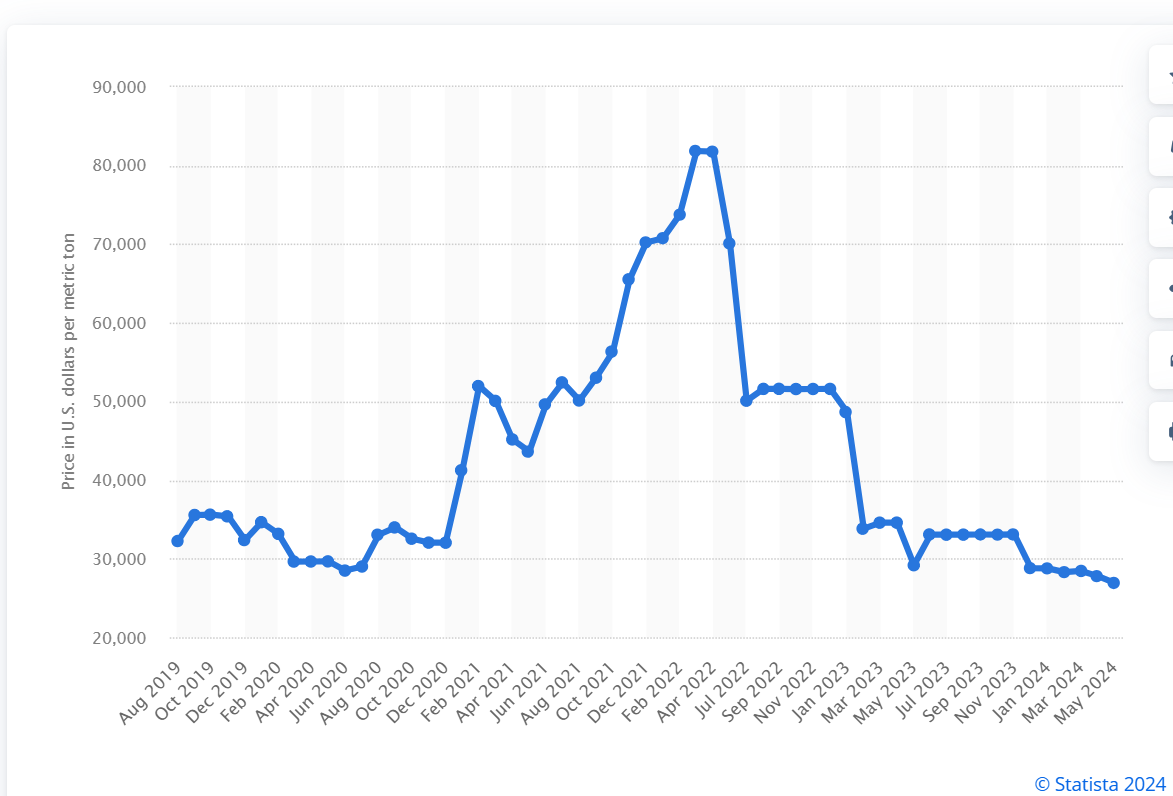

There are those who think the wait may not be that long. Global Intelligence operations at Standard & Poor see the supply and demand imbalance leveling off in FY 2026 with demand forecasted to outstrip supply in FY 2027.

From a 24 June article appearing in seekingalpha.com:

S&P Global expects cobalt demand to double by 2030.

Cobalt Stocks on the ASX

Right now the options for investors willing to take a risk on the resurrection of cobalt prices have choices limited to small cap companies in exploration and development stages of the mining life cycle, with one notable exception – IGO Limited (ASX IGO)

IGO Limited

IGO is a joint venture partner in the Tianqi Lithium Energy Australia at the Greenbushes lithium mine in Western Australia. The company also wholly owns two operating mines –the Forrestania nickel mine and the Nova nickel/copper/cobalt mine. In FY 2023 Nova produced 22,915 tonnes of nickel, 10,266 tonnes of copper, and 803 tonnes of cobalt. IGO also operates downstream processing facilities.

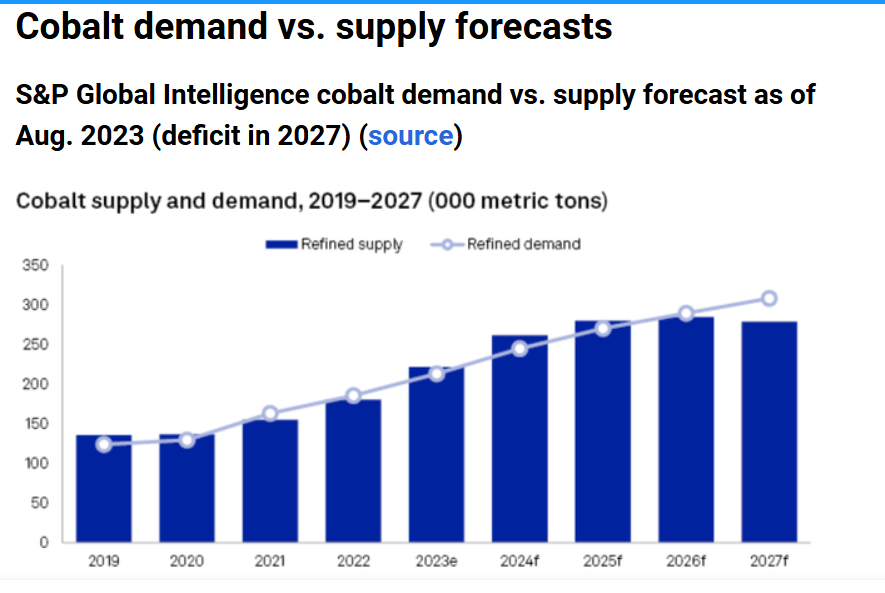

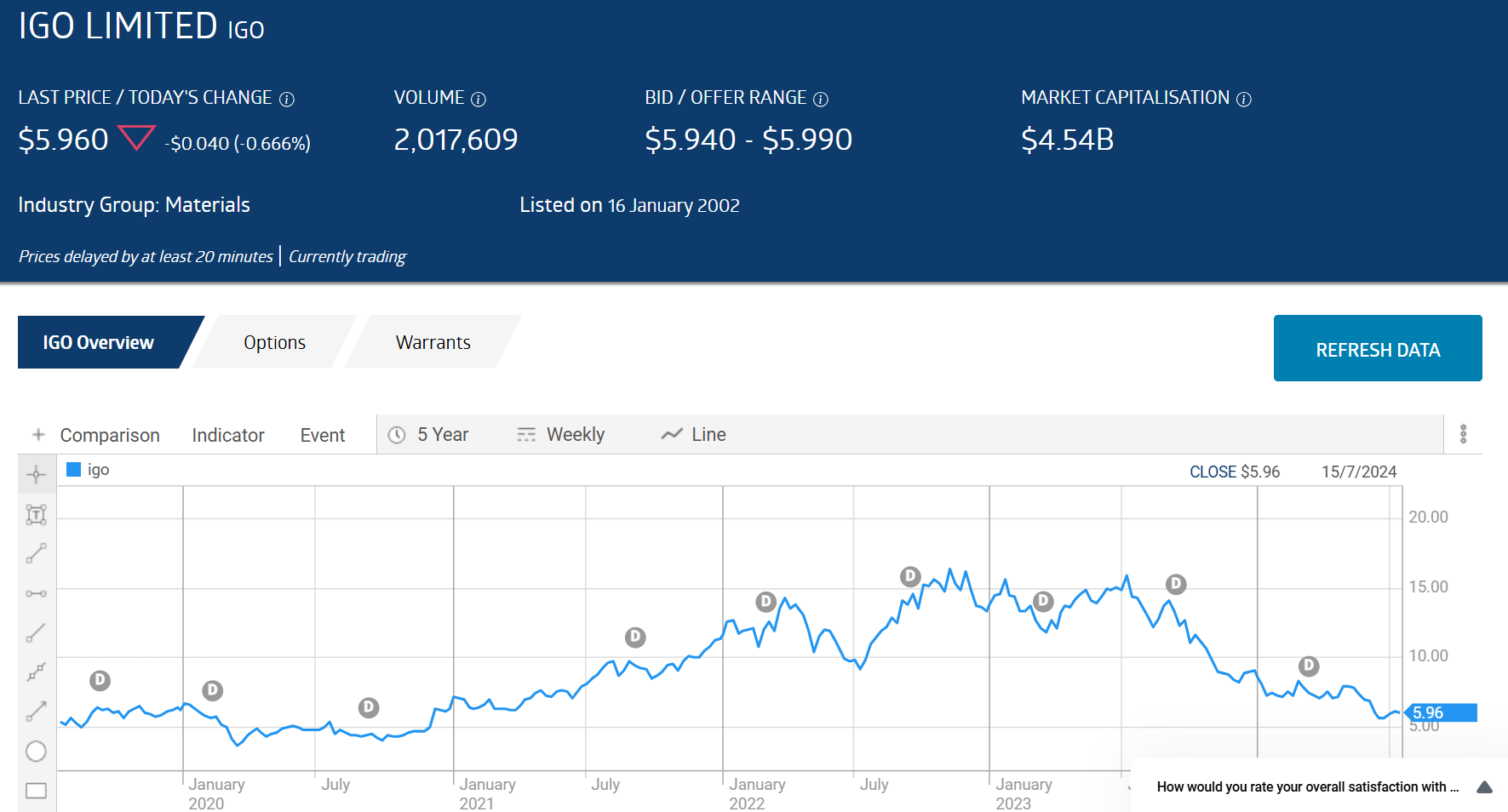

Forecasted cobalt production in FY 2024 is between 700 and 800 tonnes. The company has grown revenue and remained profitable in each of the last four fiscal years.

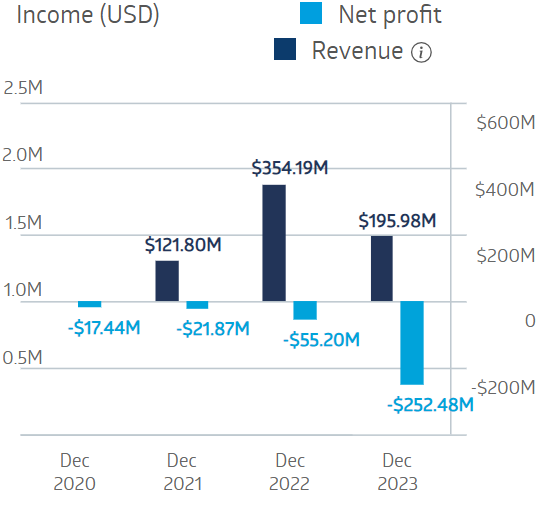

IGO Limited Financial Performance

Source: ASX

Half Year 2024 results reflected the declines in the prices of nickel and cobalt, with revenues down 19% and profit down 53%. Over five years the IGO share price rose 25.6% but year over year the price has dropped 60.3%, as of 18 July.

Source: ASX

There are four small cap ASX listed stocks with cobalt assets of note, with two enjoying rising stock prices and two with sinking stock prices.

Anson Resources (ASX: ASN) and Ardea Resources (ASX: ARL)

With a market cap of $200 million dollars as of 16 June, diversified battery minerals exploration and development company Anson Resources has managed to turn in a 258.7% rise in its share price over five years, despite the collapse of battery mineral commodity prices.

Source: ASX

Anson is a self-described “global critical minerals company.” The company’s flagship asset is the Paradox Lithium Project in the US state of Utah. The company has a Direct Lithium Extraction (DLE) technology for producing high-quality lithium carbonate for the EV battery market.

While it is its place in the lithium sector that appears to be attracting investor interest, the company also has a second lithium asset along with a uranium asset and the Hooley Well Cobalt-Nickel Laterite Project in Western Australia. A sampling drilling program at Hooley found “significant assay results.”

Cobalt production is not on the company’s radar at present, with Anson squarely focused on its lithium assets following the 1 May of 2024 agreement with LG Energy Solutions for battery-grade lithium carbonate.

Ardea Resources listed on the ASX in 2017 with the share price rising 33.3% over five years.

Source: ASX

Ardea Resources’ Kalgoorlie Nicke/Cobalt Project is “the largest nickel/cobalt resource in the developed world,” according to the company. The Australian government is designating small and microcap potential producers of minerals on the government’s Critical Minerals List with Major Project Status. On 18 March in 2022 Ardea earned MPS status, sending the stock price up about 40% in two days.

There are multiple prospective areas within the Kalgoorlie Nicke/Cobalt Project. Ardea has entered into a JV agreement with Sumitomo Metal Mining (SMM) and Mitsubishi Corporation (MC) to develop one of them – the Goongarrie Hub.

Initial drilling and a DFS (definitive feasibility study) are underway at Goongarrie, funded by Sumitomo and Mitsubishi, according to a 4 July announcement to the market. The company has exploration projects underway targeting nickel sulphide, rare earth elements, and lithium/caesium/tantalum.

The remaining two companies had close to “market darling” status at one time but investors have soured on them in the past year – Cobalt Blue (ASX: COB) and Jervois Global (ASX: JRV).

Cobalt Blue (ASX: COB)

The stock price is down 70.9% since listing in 2017 and down 32.9% over five years. Year over year paints an even bleaker picture – down 81.6% as of 17 July.

Source: ASX

Cobalt Blue Holdings is solely focused on the wholly owned Broken Hill Cobalt Project in New South Wales along with a processing facility to produce high grade, battery ready cobalt sulphate. The project is unique in that cobalt will be mined as the primary product. There are three distinct cobalt deposits within the project.

On 8 July Cobalt Blue announced the appointment of global engineering firm Tetra Tech to provide “detailed engineering work” for the refinery project, with project construction expected to be completed by the fourth quarter of FY 2025.

The company has a proven ‘re-mining” technology for extracting battery minerals from mine waste. Cobalt Blue is collaborating with Canada’s Hudbay Minerals at the Flin Flon Tailings Storage Facility in Manitoba, a western province in Canada.

Given the collapse in the price of Cobalt, the company placed the mining operations at Broken Hill “under strategic review.” The review’s focus is to scale back earlier plans to a “condensed, higher margin project.” In the eyes of management a smaller project is needed to acquire needed financing.

Jervois Global (ASX: JRV)

In July of 2021 Jervois announced the company was ready to proceed with the development and construction of its wholly owned Idaho Cobalt (ICO) Project in the western US state of Idaho. The cost of the project was estimated at $78.4 million dollars. The announcement launched JRV in an upward trajectory that peaked as the price of cobalt began to decline.

Source: ASX

On 28 March Jervois announced a halt in all construction activities on the project due to the falling price of cobalt.

In June, the company entered into a $15 million dollar agreement with the US Department of Defense to fund exploration drilling at the Idaho Cobalt Project to advance the company’s BFS (bankable feasibility study.) Jervois also announced a non-binding explorative memorandum with Global Tungsten & Powders, LLC (GTP) to explore GTP taking a minority stake in Jervois’ proposed US refinery.

Year over year JRV is down 68.2% but over the last month, the stock price has risen 42.8% as of 17 July.

Jervois is global in scope with the São Miguel Paulista Refinery in Brazil and another refinery in Finland. The company has drilling underway at another project, the Nico Young Nickel-Cobalt Project in New South Wales. The company generates revenue from its international refinery operations.

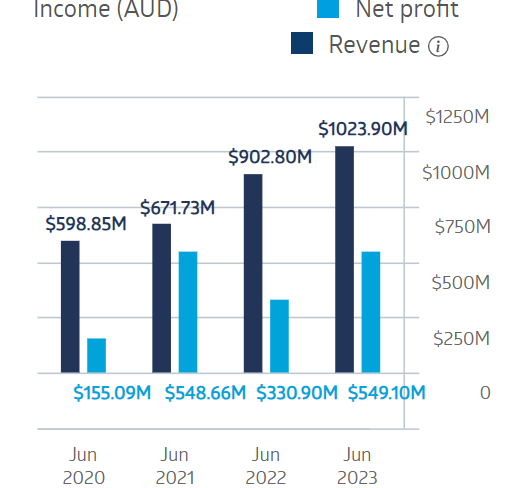

Jervois Global Financial Performance

Source: ASX

JRV stock has been in the Top Ten ASX Shorted Stock List since April of 2024.

Cobalt is a chemical element primarily used in lithium-ion batteries in consumer electronics and EV batteries along with other applications. The price of cobalt has cratered over the last year, driving the price of ASX listed mining companies in late stages of developing cobalt production and refining. ASX listed diversified miners with cobalt assets taking a back seat to lithium production have fared well.

The price of cobalt is expected to stabilize in FY 2026, with demand beginning to outstrip supply by FY 2027.