The Minister of Resources for the Australian government maintains a list of minerals considered essential to our modern technologies, economies and national security, where Australia has geological potential for the minerals which are in demand from our strategic international partners.

Along with the well-known commodities like cobalt, lithium, graphite, manganese, and nickel critical for their use in EVs (electric vehicles) and other clean energy applications, a group of seventeen elements known as “rare earths” make the list. Similar lists exist in the governments of the US, the UK, the EU, India, Japan, and the Republic of Korea.

Paradoxically, rare earths are not rare in the earth’s crust but do present mining challenges, the most important being finding quantities large enough to warrant the economics of extraction and processing. These elements are essential for many high-tech consumer and industrial devices and many other applications in the defense industry.

Of the seventeen elements, the most critical are neodymium, praseodymium, dysprosium and terbium, know collectively as the “magnet earths” due to their use in the magnetic components needed in the drive trains of both hybrid and electric vehicles and wind turbines.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Are Rare Earths Stocks a Good Investment?

There are a number of reasons REEs make good investments, with demand growth being by far the most important. From the website of ASX listed rare earth explorer Arafura, Resources (ASX: ARU) shows the demand growth to 2032 for the “magnet earths” as well as their applications:

While the volatility associated with rare earth mining stocks may be attractive to high-risk tolerant investors looking for profits in price swings, risk-averse investors need patience and a long-term outlook.

The other side of the growing demand argument for investing in rare earth stocks is the limited supply.

Rare earth stocks do not appear to attract investor enthusiasm similar to the more popular minerals on the critical lists like lithium, nickel, and graphite where miners of these commodities typically have higher average trading volumes than their rare earth counterparts.

The Best ASX Rare Earths Stocks

It would be hard to argue that Lynas Rare Earths (ASX: LYC) is not the best ASX rare earth stock for most investors. The company is already producing and has earned the position of largest rare earths miner outside of China, with Lynas providing 20% of the world’s supply at the close of FY 2021.

Lynas not only mines rare earths at its Western Australia Mt. Weld mine, but the company also refines raw rare earths at its existing processing facilities in Kalgoorlie, Western Australia and an advance materials plant in Malaysia. The company is constructing another rare earth processing facility in the US in the state of Texas, under contract with the US government’s Department of Defense (DOD.) Lynas is also expanding operations at Mt. Weld.

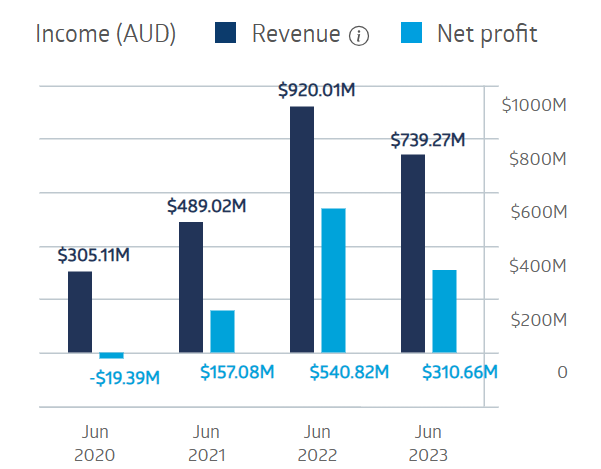

Lynas’s financials showed a loss in the first year of the COVID pandemic, recovering and then slipping in FY 2023.

Lynas Rare Earths Financial Performance

Source: ASX

Half Year 2024 financial results reflected the company’s stated intent of a “transition year” as Lynas invested $347 million dollars in expansion projects. Revenues for the Half Year fell 37% while net profit fell 74%.

Over five years the share price is up 200.2% while year over year the share price has fallen 7.8% as of 6 April of 2024.

Source: ASX

Marketscreener.com has an OVERWEIGHT rating on Lynas shares, with nine of the fifteen analysts reporting at BUY, one at OVERWEIGHT, one at HOLD, two at UNDERPERFORM, and two at SELL.

The Wall Street Journal has an OVERWEIGHT rating on Lynas shares, with nine of the fifteen analysts reporting at BUY, one at OVERWEIGHT, one at HOLD, one at UNDERWEIGHT, and three at SELL.

Iluka Resources (ASX: ILU)

Iluka’s share price performance illustrates the volatile nature of REE stocks. Over five years the share price is up 335.2%; year over year the share price is down 33.6%; but year to date the shar price is up 10.7%, as of 26 April of 2024.

Source: ASX

In early January of 2024 ILU stock hit a 52-week low. Days later global investment banking firm Goldman Sachs came out with a note highlighting Iluka stock as undervalued, maintaining ILU on its Asia-Pacific Conviction Buy List with a price target of $7.70 per share. On 14 February Goldman raised the price target to AUD$9.80 per share.

The company mines, processes, and sells products made up of critical mineral sands zircon, titanium-dioxide, rutile, synthetic rutile and others in addition to exploring for rare earth elements.

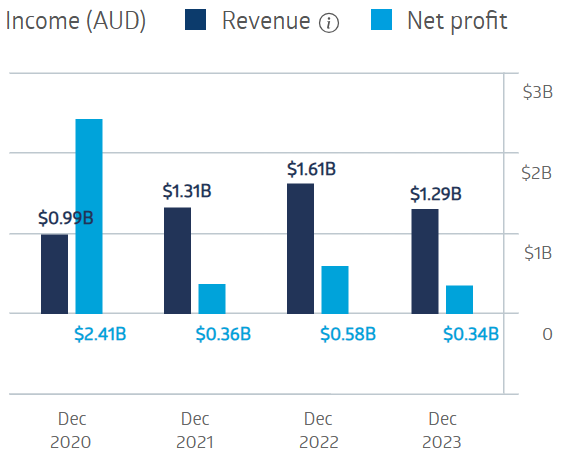

The company generates revenue and profit with a dip in the challenging conditions of FY 2023.

Iluka Resources Financial Performance

Source: ASX

The company has four assets spread across Australia in Western Australia, South Australia, and New South Wales. Rare earths produced by Iluka are by-products of mineral sands. The company is building the first integrated refinery for processing rare earths in Australia at its Eneabba operations in Western Australia.

The Australian Government has established a Critical Minerals Strategy to support critical mineral mining companies. Iluka has been awarded a $1.25 billion-dollar non-recourse loan for the development of the Eneabba refinery.

The Balranald deposit in South Australia has an approved final investment decision in place and is under development.

The Wimmera deposit in New South Wales is in the exploration and testing stage, with prospective resources of both mineral sands and rare earth elements.

The company’s Jacinth-Ambrosia operation in South Australia is the largest zircon mine in the world.

Marketscreener.com has an analyst consensus OUTPERFORM rating on Iluka shares, with two of the nine analysts reporting at BUY, 3 at OUTPERFORM, five at HOLD, and one at UNDERPERFORM,

The Wall Street Journal has an analyst consensus rating of OUVERWEIGHT, with 3 of the 11 analysts reporting at BUY, 2 at OUVERWEIGHT, 5 at HOLD, and 1 at UNDERWEIGHT.

Arafura Rare Earths (ASX: ARU) is the sole owner of the rare earths Nolans Project, the company’s flagship asset. Arafura’s Aileron-Reynolds project is in exploration status, undergoing a variety of geophysical surveys. Both projects are in the Northern Territory.

According to Arafura management, the Nolans Project has the potential to provide between 5% and 10% of the world’s supply of rare earths magnet elements over the 35 years of the life of the mine.

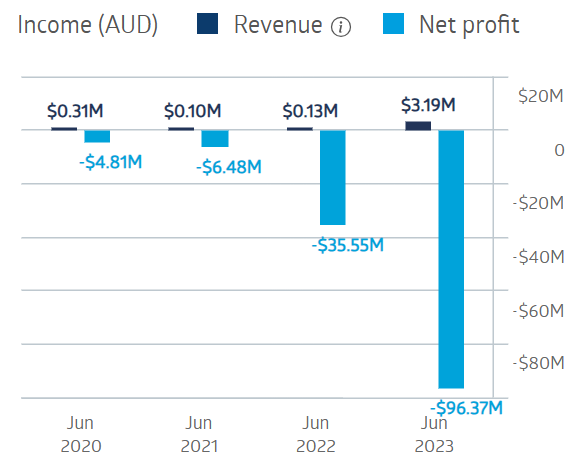

This is a high-risk investment as the company is generating minimal revenue and posting staggering losses.

Arafura Rare Earths (ASX: ARU)

Source: ASX

In a recent investor conference presentation Arafura management proclaimed that Nolan was shovel ready and ready to begin construction, with the footnote that “ the commencement of construction is subject to finalisation and financial close of debt facilities and receipt of equity funding sufficient to proceed to construction.” The company has entered into some offtake agreements.

Over five years the share price is up 248.1% as of 26 April of 2024. Year over year he price has fallen 58,8%, with the share price getting a big boost following the 13 March announcement of the conditional approval of USD$533-million-dollar debt finance package from the Commonwealth Government of the Northern Territory.

Source: ASX

There are other rare earth exploration and development companies with promising projects in earlier phases of development. For investors who believe in “following the money trail” Australian Strategic Materials (ASX: ASM) may be more than worthy of a look.

The company’s asset is the construction ready Dubbo Rare Earth Project in New South Wales. On 26 March, the company announced to the market “growing North American support builds momentum for funding the Dubbo Project.”

Canada’s official export credit agency Export Development of Canada issued a Letter of Interest for a $400 million dollar debt financing package for the Dubbo Project.

The company previously received conditional financial support of up to AUD$200 million dollars from Export Finance Australia and USD$600 million dollars in support from the Export-Import Bank of the United States.

The company is relatively new to the ASX, listing in 2020 with the share price falling 19.5% since listing.

Source: ASX

Rare earths are minerals considered critical for their numerous applications in consumer electronics, industrial processes, and magnetic materials vital to ‘green technologies” of electric vehicles (EVs), wind turbines, solar panels, and more.

Comparing average trading volumes of ASX industry leader Lynas Rare Earths to popular lithium miners suggests Lynas and other rare earth stocks trail the more popular critical minerals in investor interest.

Robust demand is an additional reason for investing in rare earth companies. Between 2022 and 2032 experts predict 8% CAGR (compound annual growth rate), with growth in all segments in which rare earths are used.

Beyond the top three ASX listed companies involved in rare earth production/development/exploration, there are many smaller miners working in the space.