In 1848 thousands upon thousands of US residents swarmed to the state of California to seek fame and fortune once gold was discovered at Sutter’s Mill in the foothills of the Sierra Nevada mountains.

Few of those adventurers arrived in California with enough “grub” to first pursue a claim and then mine it, with “grub” extending from food to all supplies needed for the sure-to come discovery.

So hopeful prospectors went looking for those with the money and the willingness to take a risk on little more than the promise of the gold discovery and the miner seeking help. In exchange for the “grub” the miners offered to the would be benefactors a “stake” in whatever they discovered.

The grubstaking business model extended beyond the mining sector in the early years of the 20th century and remains to this day in many forms. Venture capital firms and companies offering a stake in the company’s profits via capital raises.

Although still in use, the term is not the favorite of market experts and analysts in describing the process of a larger company taking a stake – buying shares – in a smaller company with an eye towards the future. Grubstaking evokes images not consistent with contemporary mining practices nor the role of mining in global economies.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Grubstaking in mining reappeared in at least one financial website to describe the BHP Xplor program, announced in August of 2022. Australian financial website smallcaps.com.au on 19 January of 2023 touted the announcement of the first beneficiaries of the Xplor program – seven companies, with three ASX listed and four privately held companies. The selected seven for 2023 came from a pool of applying companies.

In its initial announcement of the Xplor Program, BHP stated its intent to support the efforts of miners of minerals critical to the energy transition in the early stages of exploration and development. The initial focus is on copper and nickel miners. Unlike the grubstaking efforts of old and most venture capital arrangements of the present, the Xplor Program goes beyond the initial cash contribution of $500,000, without taking an equity stake in the company.

Xplor also offers a host of support services, from access to technical experts in geology, mining, and operations, to training, legal, HR, and land services. In the final and arguably most significant differentiation between Xplor and historical grubstaking assistance, selected companies have access to the entire BHP ecosystem of vendors and suppliers.

The market reaction to the news and the final selection was miniscule, with little coverage in the financial news of the initial announcement of the program and even less on the company selection announcement. Investor reaction was modest at best.

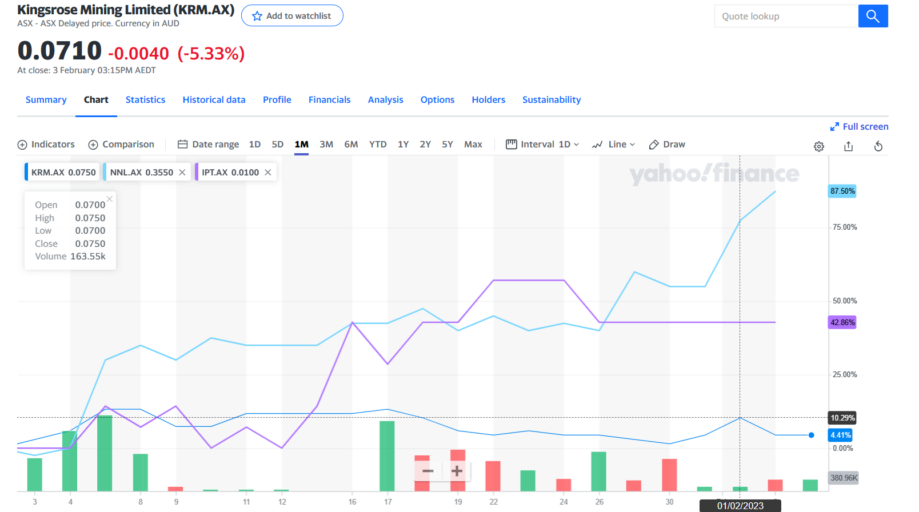

The three ASX listed companies were Kingsrose Mining (KRM) – up 2.6% on the news – newly listed Nordic Nickel (NNL) – up 7.5% – and penny stock Impact Minerals (IPT)– up 25%.

Of the three, only Nordic Nickel has managed to maintain upward momentum. From the yahoo finance Australia website:

Nordic Nickel is based in Perth with nickel sulphide assets in Finland’s Arctic Region of Central Lapland, known as the Central Lapland Greenstone Belt (CLGB). The Finnish, Norwegian, and Swedish miners operating in that Arctic region have historically been a major source of minerals to meet the needs of European countries, with resource estimates suggesting there is more to come. The Russian areas bordering the Scandinavian countries are also sources of nickel and PGM mines. PGM stands for Platinum Group Metals – iridium, osmium, palladium, platinum, rhodium, and ruthenium.

Nordic has two projects in the area – Pulju and Maaninkijori 3 – with the flagship Pulju Project targeted as the major recipient of the funding and support from the BHP Xplor Program. Pulju has a historical drilling base, dating back to the early days of Finnish steel mining company Outokumpu. Drilling in the 1980’s and 1990’s was limited to open mine exploration. Nordic gained access to the database in 2021 and sees significant opportunities for deeper drilling which commenced in early January of 2023. Nordic is confident in uncovering significant nickel deposits based on the proximity of Pulju to Anglo American’s Sakatti mine, a multi mineral source containing nickel, copper, and cobalt, along with platinum, palladium, gold and silver.

The Finnish government is one of the few around the world to introduce a National Battery Strategy. Nordic has employed the services of one of Finland’s leading drilling companies – Kati Drilling – and geological consulting firms – Magnus Minerals.

Nordic has exploration rights over 425 kilometres within the CLGB. The company expects drilling to continue throughout 2023. The company also expects geophysical exploration to develop drilling targets at Maaninkijori 3 starting in April of 2023 Nordic Nickel listed on the ASX on 31 May of 2022 with the share pricing rising 28.7% since its first day of trading. The company continues to make application for additional exploration permits within the Pulju Project.

Kingsrose Mining is one of many gold miners to shift focus to concentrate on battery minerals. As 2022 drew to a close, Kingsrose was finalising the details of the sale of its remaining gold asset – the Way Linggo Gold mine in Indonesia. The sale frees the company to focus exclusively on its two Scandinavian mine acquisitions dating back to 10 November of 2021 – the Penikat Project in central Finland and the Porsanger Project in Northern Norway. Both are in close proximity to the Nordic Nickel Project, benefitting from Anglo American operations as well. Both projects are considered highly prospective for PGE, nickel, and copper.

The Porsanger Project was drilled in the 1990’s in a Norwegian Government sponsored copper exploration program. The drilling found palladium, copper, and nickel mineralisation, but no further exploration was done. Kingsrose is currently applying for drilling permits at the two points in the project where the 1990’s drilling teased at larger mineralisation deposits.

Penikat also has historical drilling results that suggest the project could rank near projects in Russia and South Africa for the mineralisation of the world’s highest grade Platinum Group Element (PGE) elements palladium, platinum, rhodium, iridium, as well as copper and nickel.

Kingsrose is applying for exploration and drilling permits and expects to commence drilling in Q4 of 2023 and into q1 of 2024.

On 18 January the company announced entering into an agreement with Scandinavian Resources Holding Company and Toronto Stock Exchange listed Global Energy Metals Corporation for a staged investment in the Rana Nickel/Copper/Cobalt Project in Norway.

In 2002, the nickel /copper/cobalt producing Bruvann Mine was shuttered and since then little exploration or drilling using modern mining technology was done until a 2019 3D computer geological model pinpointed 6 new targets with nickel bearing rocks. The three entities are forming a joint venture for first developing and ultimately operating the project.

BHP was impressed enough with Impact Minerals to ignore the company’s status as a penny stock. The following table includes market cap and share price movement for the three companies.

|

Company (CODE) |

Market Cap |

Share Price |

52 Week High Low |

Share Price Movement Year over Year |

|

Kingsrose Mining (KRM) |

$56.4M |

$0.071 |

$0.088 $0.047 |

+1.4% |

|

Nordic Nickel (NNL) |

$40.9M |

$0.375 |

$0.39 $0.18 |

+29.3% |

|

Impact Minerals (IPT) |

$24.8M |

$0.01 |

$0.011 $0.006 |

+5.0% |

The latest Quarterly Activities Report for Impact Minerals released on 30 January lists the status of the company’s portfolio of six projects, while the website lists four active, with the Broken Hill Nickel/Copper/PGM Project taking prime position.

The company lays claim to a new geodynamic framework for the Broken Hill area created from a “significant amount of in-house research, based on analysing alkaline magmatic rocks within the project. Impact is now working with a retired University of Queensland, using the geodynamic framework to identify drilling targets. One of the standards BHP is looking for in the Xplor Program is innovation.

Impact and diversified ASX listed miner IGO Limited (IG0) have formed a JV to further targeted drilling at Broken Hill.

Impact has tenement applications in progress at one of its other projects with sampling programmes underway at another and a variety of exploration efforts in different stages at the company’s remaining active projects.

A scatter gun approach such as Impact appears to have chosen to follow requires substantial allocations of capital. As of the most recent quarter, the company has $3.85 million dollars total cash on hand and no debt.

For investors with an eye towards potential IPO’s in the future, here are the four privately held companies selected for the initial Xplor six month program:

- Tutume Metals – copper/nickel explorer in Botswana, South Africa;

- Red Ox Copper exploring for copper in Australia;

- Asian Battery Metals exploring for critical metals in the Asia Pacific region;

- Bronzite Exploration, a Canadian early-stage explorer working with a Carleton University Professor in Ottawa.