Does the CANSLIM Investing Strategy Live Up to its Claims?

In the 1950’s, a young stock broker based in the US wondered if the high performing companies he followed shared any common attributes. In short, were the secrets of their success following the same path.

After years of research, William J. Oneill uncovered seven traits shared by the top stock market performing companies. Along the way, Oneill cemented his reputation as an investment guru, founding Investor’s Business Daily, with a print edition launched in 1984 adding a digital platform with both covering stock markets and international business, economics, and finance.

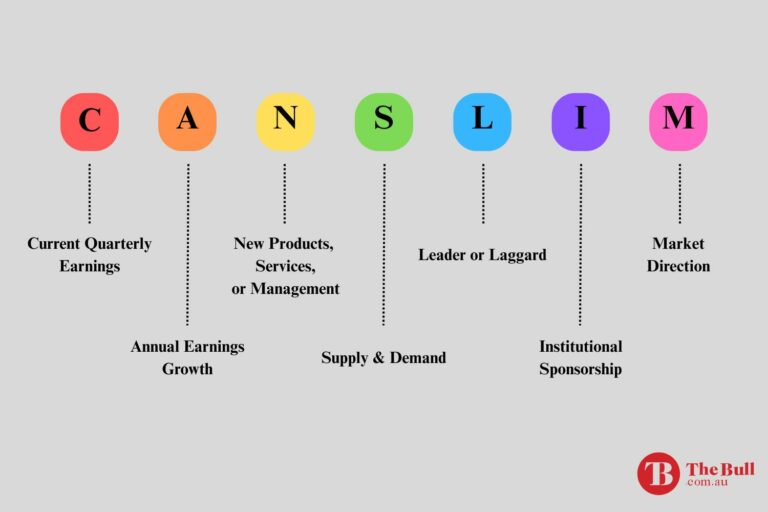

Oneill used an acronym for easy use for investors to search potential investments using the system he developed – CANSLIM.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What Is CANSLIM Investing?

Each of the letters in the acronym represent one of the critical attributes of successful companies identified in Oneill’s research.

C: Current Quarterly Earnings

In the US publicly traded companies are required to report earnings quarterly, not biannually as is the requirement here in Australia. At a minimum, investors using the CANSLIM system look for companies whose EPS (earnings per share) has increased 25% year over year. Higher growth rates are more desirable.

A: Annual Earnings Growth

For investors using the CANSLIM system annual earnings growth year over year is not the standard. What investors should be looking for is earnings growth at or better than 25% growth over a minimum of three years, with some investors opting for annual earnings growth over five years.

N: New Product, Services, or Management

Oneill found that extraordinarily successful companies are not satisfied with the status quo. “New” is the watchword for profitable companies looking to become more profitable. Innovation is their strategy that drives the watchword.

The ASX website lists all the announcements stocks trading on the ASX release to the market. Scanning the list of extraordinarily successful companies uncovers news of enhancement of existing products and the upcoming release of new products.

Successful companies bring in new management from time to time, with expertise in new product design and development or expertise in developing new markets for the products and services the company offers now and those coming in the future.

Investors checking the stock’s price action following announcements of “new” things happening more often than not see an upward spike in the stock price.

The CAN attributes are a precursor to the remaining attributes, attracting investors.

S: Supply and Demand

Stock prices go up and down based on the demand for the stock and the availability of shares for trading, regardless of company fundamentals.

Oneill found that companies with high trading volume and modest or low shares outstanding were good targets. High trading volume is indicative of institutional buying increasing demand for the stock. Add to that, companies that buy back their stock, reducing the available supply.

Buybacks tell investors the company has confidence in its stock with the expectation that scarcity of supply will lead to more demand for the stock.

L: Leader or Laggard

This double meaning attribute reflects Oneill’s firm belief investor should look for leaders in the market and avoid the laggards even if some analysts predict the laggards can emerge to become solid choices for investors.

What the system requires is companies that are the leaders in the business sector or geographic area in which they operate.

Proponents of CANSLIM investing system point to the system’s combining fundamental analysis, as seen in the research attributes of targeted stocks, with technical analysis. Oneill developed the Relative Price Strength Indicator (RPS). The indicator is proprietary and available on the Investor’s Business Daily website. The RPS rates all stocks in the company’s data base on price performance over the last year, with ratings from 1 to 99. CANSLIM investors look for stocks with a minimum RPS rating of 80.

I: Institutional Sponsorship

Investors using the CANSLIM investing system search for stocks being bought up by these institutions. Institutional investors include mutual and exchange traded funds, hedge funds, pension funds, banks, and insurance companies.

Tracking institutional in investing in Australia is more challenging than in the US where the Securities and Exchange Commission requires institutional investors to file 13f quarterly reports of their purchases.

In Australia, ASX announcements are a source and many of the better online trading platforms and financial websites post information on instructional investing. Yahoo finance Australia lists the percentage ownership of institutional investors in the Share Statistics section of the website.

Following institutional investing adds the services of the many trained analysts at those institutions to the research capability of retail investors.

M: Market Direction

Advocates of the CANSLIM investing system caution to shy away from bear markets as even the best of breed will move in the general direction of the market. Some analysts estimate that 75% of all stocks will follow the lead of the market.

CANSLIM Investing Advantages and Drawbacks

Perhaps the greatest advantage of CANSLIM is the simplicity of the path investors need to take to assess a stock. Retail investors are advised to do their “due diligence” in looking at company fundamentals. O’Neill narrowed the focus of investor’s due diligence to the seven attributes he found in high performing successful companies.

Another advantage is the elimination of emotion based investing. The system is ideal for newcomers to share market investing who are baffled by the broad advice on performing fundamental analysis. CANSLIM offers a precise system.

Time and temperament are arguably the system’s major disadvantage. The framework may be simple to follow, but only investors willing to invest the time required to research a stock for its attributes and the patience needed to stick with the system.

Beyond that, even CANSLIM proponents point out the system was designed to work in bull markets.

How to Invest with CANSLIM?

Stock screeners on trading platforms and some financial websites can be a starting point for finding stocks that qualify on most of the metrics in the CANSLIM system.

Beyond that, proponents advise setting a limit of 8% in losing stocks, and waiting for a stock to rise between 20% and 25% before taking any profits.

Finally, the caveat of staying out of bear markets if you are a CANSLIM investor is reinforced by Oneill’s estimate that three out of four stocks will not outperform in a bear market.

CANSLIM is an investing system offering investors a simple and easy to follow framework for identifying the best of breed stock investments. The system was developed by US stockbroker William J. Oneill who identified seven critical attributes common to successful companies.