The COVID 19 Pandemic wreaked havoc in multiple ASX business sectors, among them retail. As companies closed their doors sending their employees home to work and brick and mortar stores shuttered their doors one by one, investing opportunities with internet only e-tailers and to a lesser extent with multi-channel retailers with a robust online sales platform to counter the revenues lost from brick and mortar stores. seemed obvious.

Two factors pushed the prospects for online sale beyond expectations. First, employees who came home to work found their living quarters lacking supplies needed for work – from furniture to electronic devices. So they shopped at the only places available to them – online.

The second was the massive cash infusions into the pockets of consumers around the developed world to keep them buying. And so they did, driving the share prices of top ASX online e-tailers like Temple and Webster (TPW) and Kogan.com (KGN).

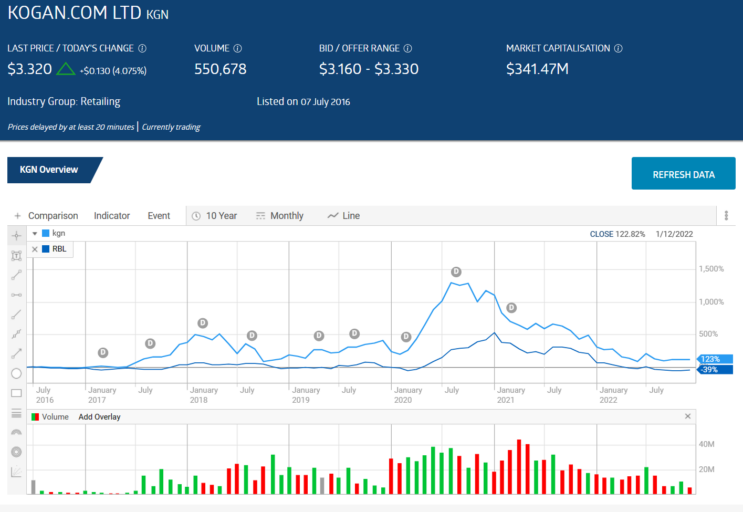

Already an ASX “market darling” shares of Kogan.com, once Australia’s largest ASX publicly traded online e-tailer, soared. Not far behind in terms of share price was online outlet for custom design products, Redbubble (RBL).

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

You can see both were riding high until speculation about a sooner-than-expected COVID 19 vaccine began to pop the bubble. While Redbubble has no inventory, relying instead on 3rd party manufacturers and shippers for the artist-supplied custom designs available on the Redbubble site, Kogan.com has multiple online sales platforms and sells products too numerous to mention.

Kogan management was sure the online shopping surge would continue, and why not? Online shopping in Australia was on fire, with the likes of US based eBay and Amazon joining multiple ASX listed companies with a substantial online presence, like JB Hi-Fi and Harvey Norman.

Kogan went on a buying spree, increasing inventory and product lines the company was sure would be needed as the online shopping surge seemed unstoppable. But it wasn’t.

Kogan management was not alone in underestimating the social needs of human beings. When the stores began to gradually reopen, shoppers returned, perhaps eager to mingle with others like them, tired and weary of being virtual prisoners in their homes.

By 2 November of 2022, an article appearing in dynamicbusiness.com cited the annual Retail Monitor Survey conducted by Monash University’s Australian Consumer and Retail Studies (ACRS) unit, which found Aussie shoppers were back in the stores at levels matching pre-pandemic shopping.

The study focused on apparel, household goods, and personal care items, as the products shoppers prefer to purchase in a brick and mortar outlet.

However, consumers prefer online shopping for sales and promotions along with more product availability. The research gives the edge to in-store buying for products that need the “touch before you buy” strategy.

The new ASX champion of online only sales is furniture and housewares, supplier Temple and Webster (TPW). Its business model is noteworthy in that consumers purchase products ranging from office and home furniture to home furnishings like lights, rugs, wall art and other décor items. The company maintains inventory only on its private label products – about 27%. Inventory responsibility for the remaining 73% of what Temple & Webster sells falls on the manufacturers in the company’s drop-shipping network, where customer orders are forwarded to the 3rd party manufacturers in the network to direct ship the products to the end customer.

Temple and Webster ‘s more than one million subscribing Australian customers have more than two hundred and forty thousand products from which to choose. The company is relatively new to the ASX, listing in 2015, following the acquisition of the operations of former rival – US based Wayfair Inc. – and Australian rival Milan Direct. In May of 2022 Temple & Webster expanded into the home improvement sector with the launch of the website thebuild.com.au.

Temple & Webster found itself with COVID 19 induced headwinds other than the excess inventory build up at Kogan. Lockdowns and in many cases self-isolation of workers left the global supply chain in a shambles.

Manufacturers who avoided lockdowns due to what they produced struggled to maintain a workforce healthy enough to produce product. Parts suppliers suffered the same fate, leading to parts shortages at still operating manufacturers.

Distributors of whatever manufactured goods were able to be produced were also suffering from lockdowns and labor shortages, as was every link in the supply chain, from land, sea, and air transportation to local warehousing and delivery.

The company claims its network of drop-ship partners mitigated the full impact of supply chain disruptions. Temple & Webster’s Full Year 2022 Financial Results Presentation pointed to the factories around the world with which it has relationships in the 1,000’s, along with more than 100 factories dedicated to the manufacture of the company’s private label products, and product pick-up points in the 100’s.

Despite the COVID headwinds the Temple & Webster reported respectable financial results, with revenues up 31% with 21% growth in active customers. Earnings before interest, taxes, depreciation, and amortisation (EBITDA) were down from $20.5 million dollars to $16.2 million. For tax purposes profit was reported before tax, down 31%.

Temple & Webster has major investment firms on both the bullish and bearish outlook for the company.

Goldman Sachs points to the growth of online furniture sales in the US and Australia’s lower penetration in that segment, leaving Temple & Webster with a substantial addressable market. Although Goldman acknowledges the challenges the company will face over the next few years, they expect solid revenue growth to return as soon as 2024, with rising online penetration and a consolidation in market share favoring the large players in the sector.

Macquarie takes the opposite view, focusing on the challenges facing the housing market.

Goldman also likes Redbubble for similar reasons – the continued move to online shopping and the first mover advantage for Redbubble in custom-inspired products. Redbubble has no inventory risk while Kogan’s is limited to its smaller branded product line.

Redbubble is a global marketplace bringing artists together with consumers looking for “one of a kind” items. An artist submits a design to Redbubble where consumers select their favorite design and a product on which the design will be imprinted. Products are close to unlimited, ranging from clothing to luggage to phone cases to gifts of any size and kind.

Artists open their own unique Redbubble Shop and upload their creations. Consumers pick the designs and the product and Redbubble steps in and handles the rest. Redbubble pays the artists and the product producers and keeps the rest.

Investors who tracked the earnings behind the rising share price during COVID 19 were aware the company was generating around 20% of their revenues from face masks.

Almost all of the custom products available to Redbubble customers are discretionary on the highest end of the scale. Should high inflation and high interest rates send the economy into a tail spin, a custom iPhone case may not be high on the shopping lists of most consumers. Redbubble may be at the most risk of any of these online only e-tailers in the short term.

Investors were dealt a crushing blow on 17 August when the company’s Full Year 2022 Financial Results were released to the market. NPAT (net profit after tax) summarises the disaster well. In FY 2021 Redbubble showed a net profit after tax of $31.7 million dollars. In FY 2022 net profit evaporated, with the company announcing a loss of $21.9 million dollars. Adding to investor angst was rising operating expenses.

There were positives, with a record number of artists – 809 thousand on Redbubble’s two platforms – a 19% increase over 2021. Revenue from recurring artists accounted for 68% of the company’s marketplace revenue, up from 60% in FY 2021. Forty six percent of revenues came from repeat customers versus 40% in FY 2021. Some brokerage houses are mildly positive on the stock as undervalued.

Like Temple & Webster, kogan.com has been a prime beneficiary of the shift out of brick and mortar stores onto online websites, selling everything from peanuts to pots and pans, and much, much, more.

While Temple & Webster’s market is targeted towards “everything home and office,” limited, kogan.com represents the polar opposite, selling – selling name brand merchandise in more categories than many consumers will ever need.

The company also offers a wide range of services to consumers, from mobile phone plans, to credit cards, to insurance and travel.

In mid-September of 2020 the kogan.com share price had climbed 180%, as investors rushed into the stock in the belief that the online shopping explosion fueled by COVID 19 would continue to grow to infinity.

As we now know, infinity lasted until stores began to reopen. Kogan.com would have taken a hit in any case, but the company’s decision to pile on the inventory turned a bad situation into a major calamity, forcing Kogan into discounting, sales, and markdowns.

Analysts and Kogan.com executives think the company can comeback. Insider buying is generally a positive sign for investors, as there may be many reasons for investors to sell some of their stock, there is only one reason to buy more – future growth. A Kogan insider recently bought 10,000 shares of the stock to add to existing holdings.

Investors appear to agree, as the share price has had some positive days over the last three months, despite a ghastly FY 2022 Financial Report, and a first quarter of 2023 update that did not bode well for the future.

The Q1 results report contained a string of declining sales categories, and declining active customers, topped off by a 103% drop in EBITDA. The debacle was described in the report introduction as “sales activity during the quarter was subdued. The positive news was the pace of the sell-off the company’s surplus inventory.

Management believes the mediocre Q1 performance will become a memory as kogan.com returns to growth once the inventory sell-off is complete. Investors agreed, as the share price got a small bump that day. For investors with risk tolerance the share price drop of these three once stellar e-tailers may be reason enough to take the plunge. The following table includes share price performance metrics for the three companies.

|

Company (CODE) |

Market Cap |

Share Price |

52 Week High Low |

Percentage Change Year to Date (YTD) Year over Year (YOY) |

|

Temple & Webster (TPW) |

$563.4M |

$4.52 |

$10.91 $2.96 |

-57.3% -57.9% |

|

Kogan.com (KGN) |

$341.4M |

$3.32 |

$9.08 $2.66 |

-59.16% -62.3% |

|

Redbubble (RBL) |

$185.7M |

$0.645 |

$3.39 $0.46 |

-80.2% -80.9.% |