What Happened to Optus

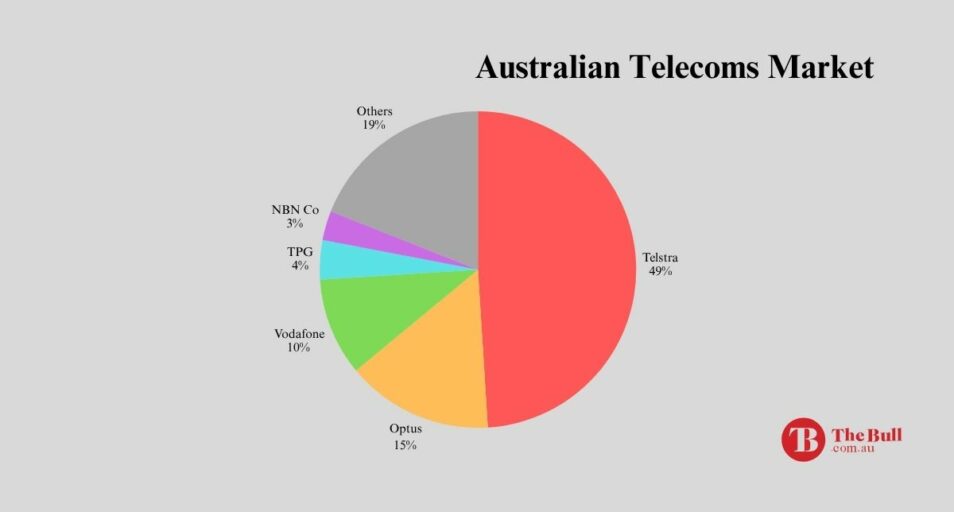

Newcomers to investing in companies on the Australian Stock Exchange who might begin searching for the best of the best Australian telecommunication companies will find graphs like this one, showing our top telcos by market share:

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Their search will grind to a halt when they look for shares of Australia’s second largest telco – Optus – on the online trading platform of their choice. It won’t be there. The graph is not restricted to ASX listed companies.

Optus is owned by SingTel, (the Singapore Telecommunciations Company) a conglomerate with subsidiaries boasting the island nation’s principal fixed line telco provider and one of the top four mobile providers.

Optus shares had been trading on the ASX since SingTel bought the company in 2001 for $17 billion dollars under the code SGD. In 2015 SingTel decided to pull the plug on Optus shares, formally requesting the approval of the ASX to delist the company. SingTel claims the decision was made due to “low trading volume, liquidity and market demand” – all of which imply Aussie investors preferred to invest in other telcos listed on the ASX.

SingTel continues to trade on the Singapore Stock Exchange and Optus remains in business in Australia as a subsidiary of SingTel. Optus shares do not trade independently on the SGX.

History of Optus

In 1981 the Australian Government established a military and civilian satellite communications system called AUSSAT Pty, launching the first satellite in 1985. AUSSAT satellites also transmitted television signals to Australia’s many remote locations.

AUSSAT was a money loser and the federal government was looking to degulate the telecommunications industry. In 1991 the government sold its AUSSAT satellites and a telecommincations license to Optus Communications, a consortium of UK and US telcos, insurance and investment companies, and logistics companies.

In 2022 the company was rocked by a major hack of its customers, followed by another catastrophe in 2023 when an outage struck the company’s fixed and mobile internet services nationwide.

The 13 hour outage hit approximately 10 million customers and 400,000 business and government users. According to abc.net.au news.

Optus Alternatives for ASX Investors

Optus shares may not be available but the ASX has other high-quality listed telecommunications companies from which Aussie investors can select an investment for the future. Here are 5 of the top ASX listed telcommunications companies.

Telstra Group (ASX: TLS)

Telstra is arguably the kind of company legendary US investor Peter Lynch had in mind when he coined the adage – big companies don’t make big moves.”

Telstra can trace its origins back to 1901 when Australian telecommunications were under the watchful eye of the federal government. The company name is an abbreviaton of Telecom Australia, with Telstra adopting that name in 1993. Telstra listed on the ASX in 1997.

Prior to the onset of the National Broadband Network (NBN) the company owned our fixed line telephone network, with control gradually moving to the NBN over a tumultuous period. Optus has been a major competitor of Telstra since the 1990’s.

In the eyes of many investors and analysts alike, Telstra is seen as one of the country’s premier dividend stocks, as evidenced by its dividend paying history. The company has not missed an interim or a final dividend payment since it began paying dividends in 1998, the year following its listing.

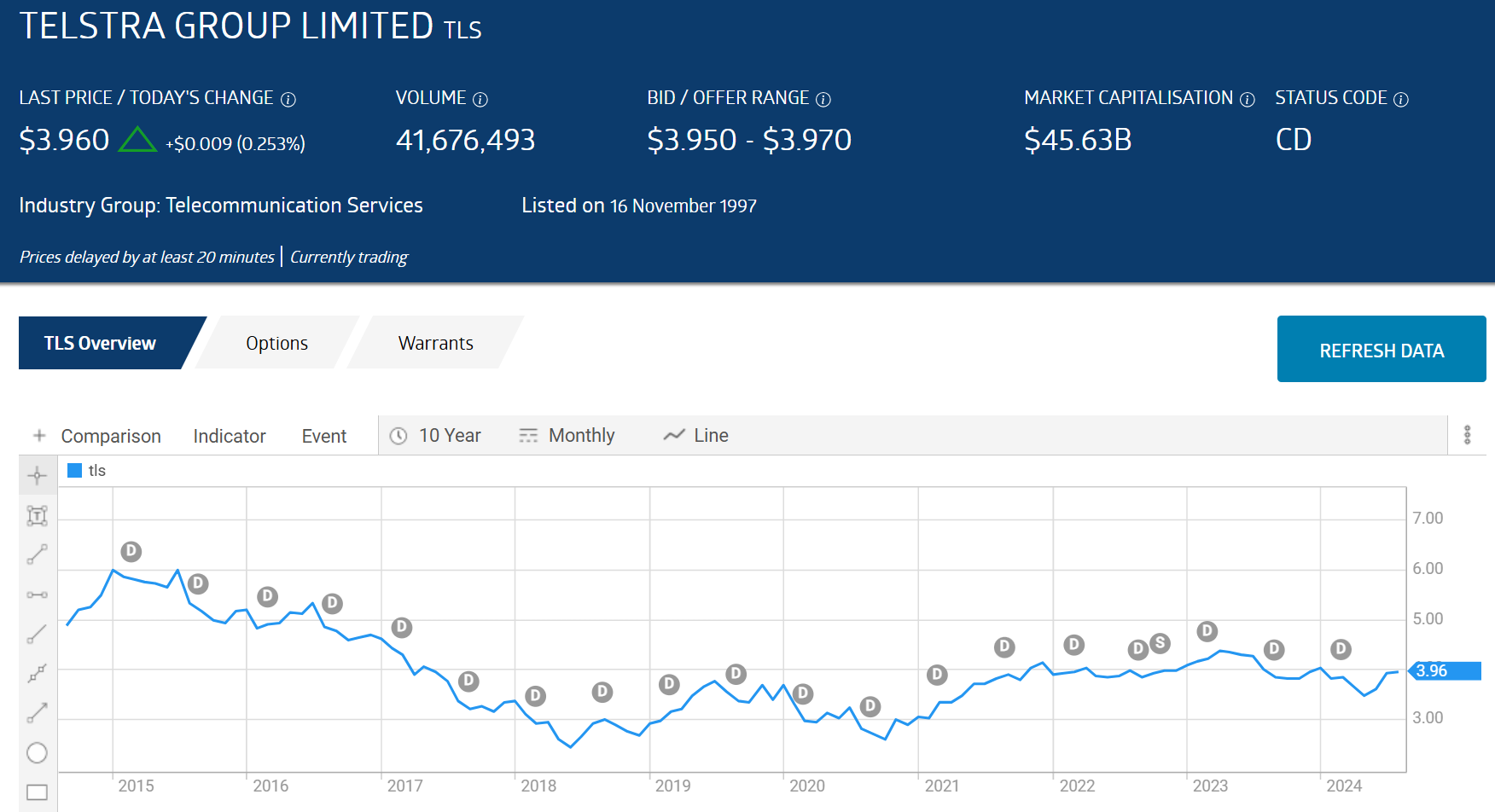

A ten year share price movement chart depicts the company’s history of consistent dividend payments and scant share price appreciation.

Source: ASX

Year to date the share price is flat, while year over year the price is down 7%, and down only 0.75% over five years, all as of 16 August of 2024.

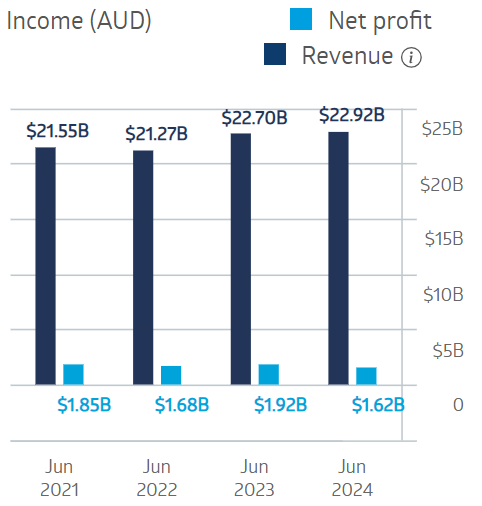

The company’s financial performance over the last four four fiscal years also reflects its stability.

Telstra Group Financial Performance

Source: ASX

The FY 2024 results were released on 15 August and the share price rose from $3.87 per share to $3.99, despite missing expected earnings per share(EPS) and revenue. Apparently, investors were pleased with the slow and steady growth represented by the 3.4% increase in revenues and a 7.5% increase in underlying net profit. One-offs from the company’s cost control restructuring drove down reported profit by 12.8%. Dividends increased by 5.9%.

Source: ASX

The Wall Street Journal has an OVERWEIGHT rating on Telstra shares, with 10 analysts reporting at BUY, 4 at OVERWEIGHT, 2 at HOLD, and 1 at SELL.

Marketcreener.com has an OUTPERFORM recommendation on Telstra shares, with 8 analysts at BUY, 4 at OUTPERFORM, 3 at HOLD, and 1 at SELL.

Investors interested in telecommunications stocks attracting investor attention have two choices to consider – Superloop Limited and Tuas Limited. Both have shown impressive share price appreciation, typical of high growth stocks.

Superloop Limited (ASX: SLC)

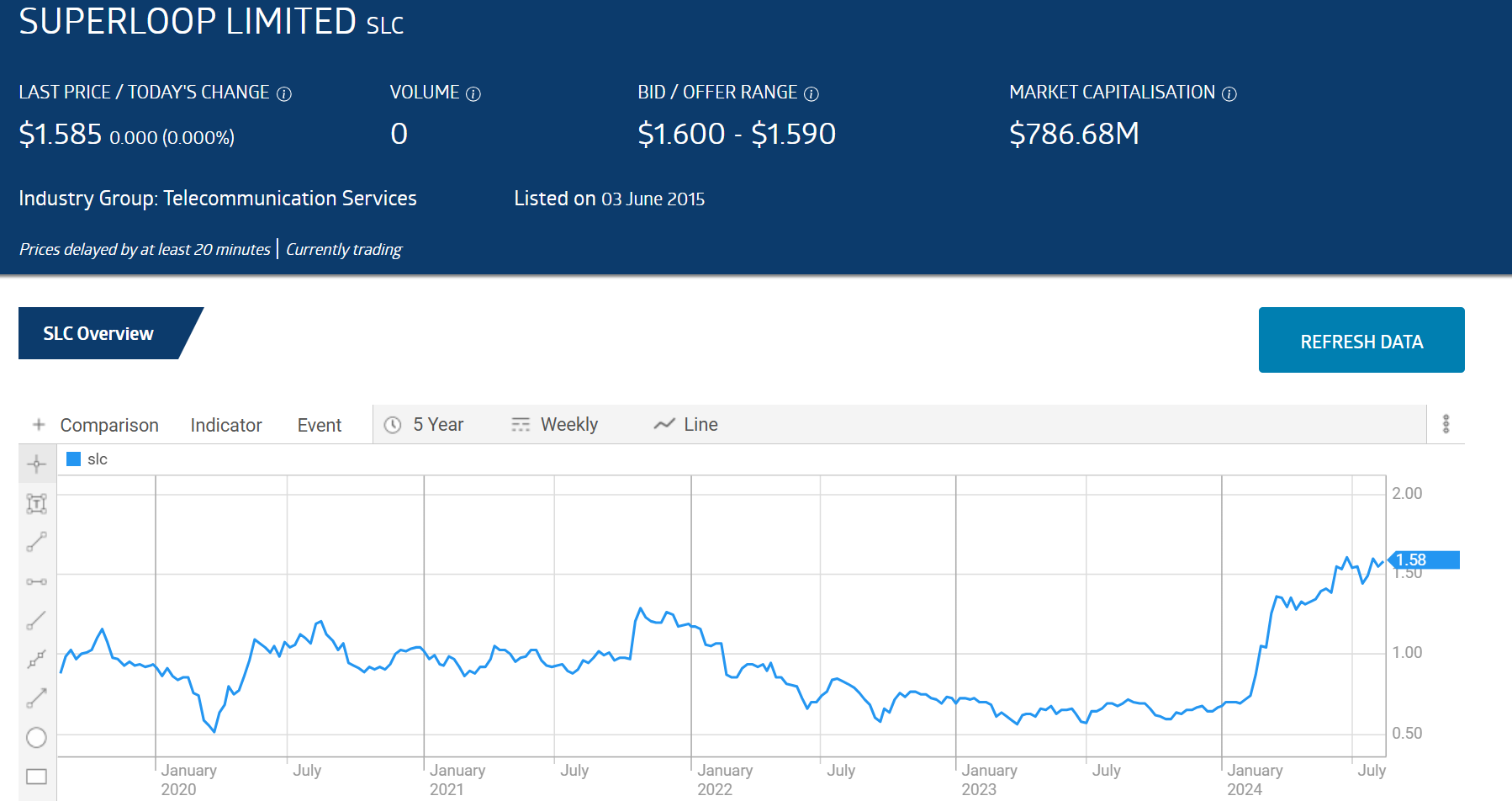

The company listed on the ASX in 2015 and has yet to turn a profit although revenues are increasing. The share price over the last five years is up 68.5%, catching fire in 2024, up 136.5% year to date as of 16 August.

Source: ASX

What may be exciting investors is the company’s business model – providing fiber optic telecommunications infrastructure to the consumer, business, and wholesale markets. The catalyst in 2024 was the release of the company’s Half Year 2024 results. Revenues continued the pattern or increases but the surprise was the reversal from a Half Year 2023 loss of $8.3 million dollars to a profit of $1.2 million in the Half Year 2024.

That momentum persisted, with the share price now trading at multi-year highs. The catalyst for the latest move was a 2 July trading update announcing a record-setting addition of more than 34,000 customers to its consumer segment and the wholesale internet services contract with Origin Energy Retail “going live” with Origin offering Superloop’s white label service to Origin internet customers, formerly on Aussie Broadband (ASX: ABB) service. Superloop also upgraded its Full Year 2024 guidance.

In February of 2024 Superloop rejected a takeover offer from Aussie Broadband, resulting in an ongoing legal battle. Superloop also has a wholesale contract with AGL Energy, signed in November of 2023.

Yahoo finance has a BUY recommendation on SLC, with 1 analyst at STRONG BUY, and 3 analysts at BUY.

Marketcreener.com has a BUY recommendation on Superloop shares, with 3 analysts at BUY and 2 at OUTPERFORM.

TUAS Limited (ASX: TUA)

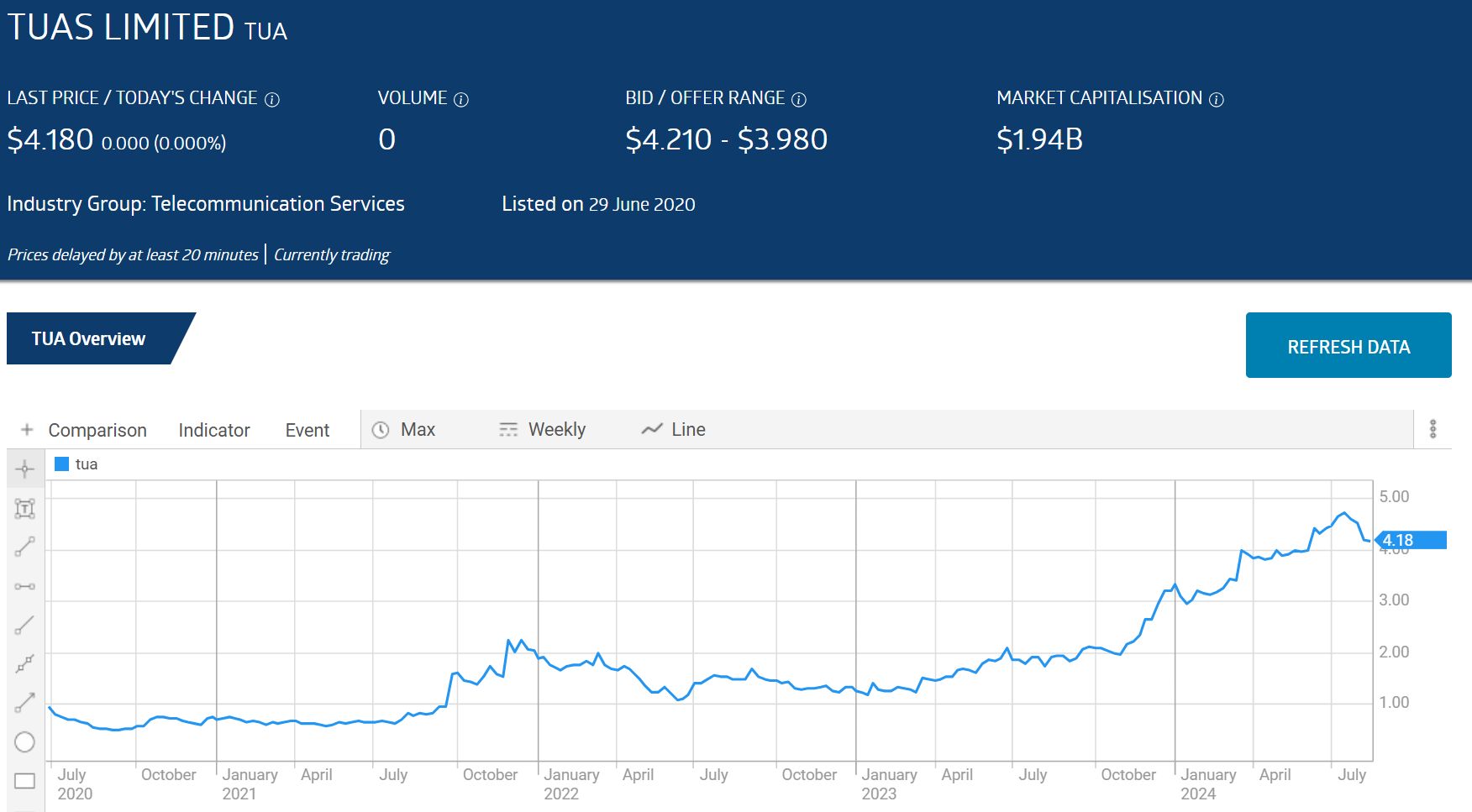

Tuas listed on the ASX in 2020, focusing its telecommunication operations on Singapore. Like Superloop, Tuas remains unprofitable with rising revenues and an exploding stock price, fueled by its growth in the Singapore mobile telephone market.

Since listing on 6 June of 2006, the share price has risen 753%.

Source: ASX

Year over year the share price is up 118.8% but has been sliding of late – up only 3.47% over the last three months and falling into negative territory over the last month – down 11.8%.

Given the company’s stunning revenue growth from $5.09 million dollars in FY 2020 to $86.09 million in FY 2023, Tuas may qualify as a bargain hunter’s stock.

Half Year 2024 Results released on 20 March continued the meteoric revenue increases, up 38% over the Half Year 2023 while reducing its posted loss in half – from $7.5 million to $3.5 million.

The company grew subscriber growth from 691,000 in the Half Year 2023 to 969,000 in the Half Year 2024, with the company expecting growth to continue in the second half of FY 2024.

The Wall Street Journal is reporting 1 analyst with a BUY rating on Tuas.

Tuas is led by founder David Teoh, who also founded the second largest telco on the ASX by market cap —TPG Telecom (ASX: TPG).

The Wall Street Journal is reporting 1 analyst with a BUY recommendation on Tuas shares.

Marketcreener.com has a BUY recommendation on Tuas shares, with 1 analyst at BUY and 1

at OUTPERFORM.

Investors finding Optus as the nation’s second largest telecommunications provider may be surprised to learn the company does not trade on the ASX. Optus was formed in 1991 and was acquired by SingTel in 2001, trading on the ASX as SGD. In 2015 SingTel delisted from the ASX but continues to trade in Singapore.

Investors can now choose between the top telco on the ASX – Telstra – and two newer entries with potential for high growth futures – Superloop (ASX: SLC) and Tuas (ASX: TUA.) Telstra is the time tested stable company with a reputation as a sure and steady dividend payers. Both Superloop and Tuas have seen spectacular share price appreciation.