Members of that bold and confident group of investors labeled as “stock-pickers” have multiple choices for hunting for targets.

While investors with high risk aversion seek the relative safety of fixed choice or exchange traded/mutual funds investing, those willing to accept the risks know the potential benefits of picking their own stocks far outweigh the averaged gains of fund investing.

Share markets truly are target rich environments, regardless of investing philosophy, Broadly speaking, retail investors can be divided into two camps – those who believe the strong performing stocks get stronger – growth investors – and those who believe some bargain stocks on sale have upside potential – value investors.

Both investor groups can turn to sources backed by market experts, key among them are analyst picks and lists of shorted stocks.

Online financial websites are littered with lists of favored stocks from selected analysts, many from well known firms. These sites also cover analyst upgrades and downgrades of stocks, with the respective investing groups gravitating to the stocks in line with their philosophy.

Top Australian Brokers

- City Index - Aussie shares from $5 - Read our review

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Top 30 Short Lists like the one appearing on thebull.com.au attract bargain hunters who believe short sellers – purported to be “the smartest people in the room” – can be wrong, especially when stocks on the list have positive growth forecasts.

Stock screeners appeal to both groups, with the ability to isolate stocks with low price to earnings ratios P/E) and price to book ratios (P/B) ratios with the “seek the strong” group screening for opposite metrics.

Of the many potential sources, there are two that have the backing of market sentiment – 52 Week Highs and 52 Week Lows. A stock hitting that high or low water mark virtually always does so following news injected into the market. It might be positive or negative earnings, a pending acquisition, a capital raise, or positive news on the sector in which the stock operates. Investors vote by buying or selling the stock.

During the last trading week of the first quarter (Q1) six stocks that seem ideally suited for growth investors looking for strong performers posted 52 Week Highs. Five are lithium miners, with two generating revenue and profits –Allkem Limited (AKE) and IGO Limited (IGO) and featuring high P/Es and triple digit two year earnings growth forecasts. The remaining three – Lake Resources (LKE), Core Lithium (CXO), and AVZ Resources (AVZ) – are still in the exploration stage. The sixth is agricultural stock Nufarm Limited (NUF).

Even the most skeptical of skeptics on the timing of the Electric Vehicle (EV) revolution have to be falling to the wayside. A few days ago, the CEO of the world’s largest EV manufacturer –Elon Musk of US based Tesla – was in the news heralding the opening of Gigafactory Berlin on 22 March to produce batteries, assorted parts, and Model Y EVs. Earlier in the month Volkswagen announced it was building a new manufacturing facility for the exclusive production of its newest flagship EV model – the Trinity – scheduled for launch in 2026.

Major car manufacturers are phasing out ICE (internal combustion engine) cars – Jaguar/ Land Rover by 2025; Volvo by 2030; Mazda by 2030; Ford by 2030; Nissan by 2030; General Motors by 2035; Mercedes Benz by 2039; and Honda by 2040.

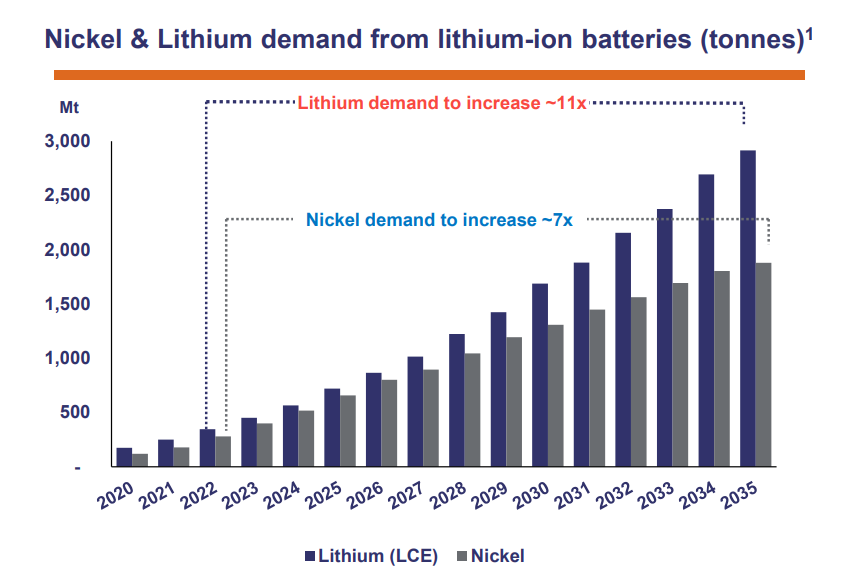

Demand for a primary metal in the construction of the Li ion (lithium ion) batteries to power EVs – lithium – is skyrocketing, as is another battery metal – nickel. Worldwide demand in 2020 was approximately 350,000 tons, with industry estimates now forecasting lithium demand to increase as much as six times the 2020 level by 2030. The following graph is from a recent investor presentation from IGO Limited:

Allkem Limited (AKE) is a recent listing on the ASX stemming from the merger of two major ASX lithium mining companies – Galaxy Resources and Orocobre. Allkem now produces raw lithium from both of the major global sources of supply – hard rock, as mined by Galaxy, and evaporation from salt brines as mined by Orocobre.

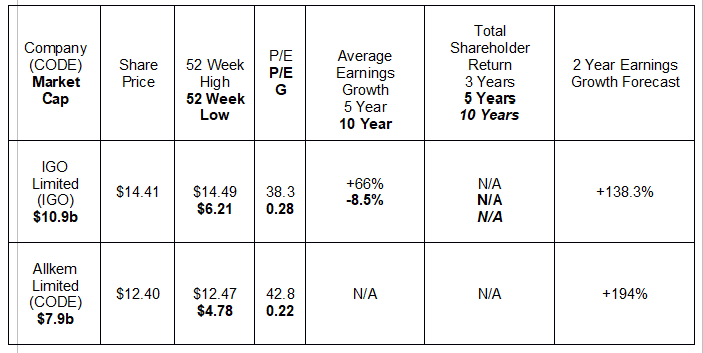

The following table includes current share price information and historical performance metrics for AKE and IGO.

The average P/E for the mining sector is 13.5 with the average P/EG (growth forecasts included in the earnings denominator) standing at 0.40. A P/EG under 1.0 indicates a stock is undervalued, suggesting that despite the high P/E the stock prices of both companies may have more room to go. The outsized earnings growth forecasts suggest this as well.

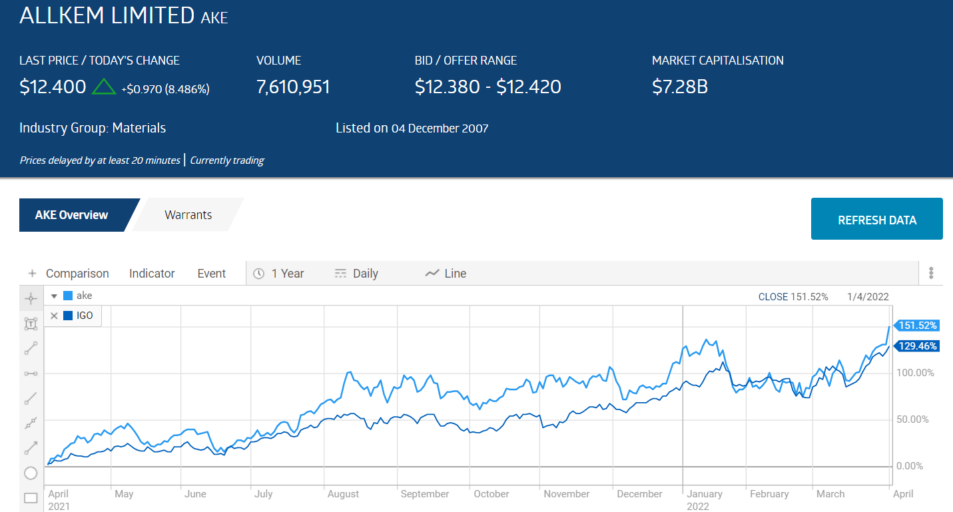

The following share price movement from the ASX website shows high investor enthusiasm for these two companies.

Cobalt is another ingredient needed for the manufacture of lithium-ion batteries, and IGO mines all three – Lithium, Nickel, and Cobalt. The company states its purpose as “discovering, developing, and delivering p[products critical to a clean energy future.”

Going into the close of the trading year 2021, IGO owned and operated the Nova nickel-copper-cobalt operation in Western Australia. In addition, the company held a 51% JV (joint venture) interest in the Greenbushes Lithium mine, with a majority interest held by the Tianqi Lithium Corporation of China. IGO wholly owns the Kwinana processing plant where battery grade lithium hydroxide is produced.

IGO showed the market the company was serious about shifting its focus to “clean energy metals” when it sold its JV interest in the successful Tropicana Gold Mine in April of 2021. In mid-December of 2021, the company again reaffirmed its focus with the announcement of its intent to acquire Western Areas (WSR), a nickel miner with two wholly owned nickel mines within the company’s Forrestania Nickel Operation.

Western Areas posted an earnings per share and an NPAT loss in FY 2021, but earnings are forecasted to rebound about 132% over the next two fiscal years. On 13 March IGO announced the proposed acquisition of Western Areas is subject to a short delay, as Western Areas reevaluates the proposal in light of the recent explosive rise in the price of nickel in world markets. The WSA share price also hit a 52 Week High in the trading week.

IGO also holds a 70% JV interest in the Fraser Range Project near Nova, with a recent drilling result showing positive results for graphite deposits, another metal needed for battery production.

While IGO’s revenues declined 28% In FY 2021, net profit after tax (NPAT) rose 253%. The pattern continued in IGO’s FY 2022 Half Year Results, with revenues falling 18% from the Half Year 2021 Results while NPAT rose 67%.

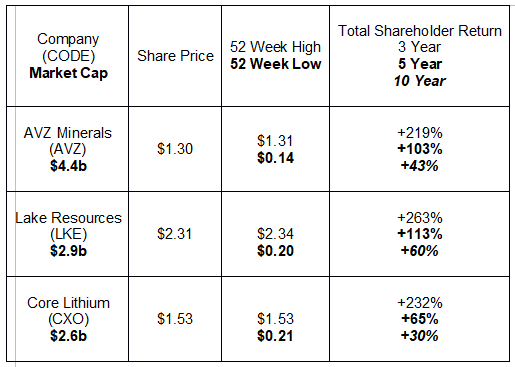

The price movement chart below shows investor enthusiasm for the three lithium miners still in exploration stages exceeds the robust support of the two producing mining companies by a wide margin.

All three of these companies have been on the ASX for at least ten years. While they have no P/E or P/EG ratios with no profits or earnings to report, investor fervor for these companies is not a phenomenon of recent vintage.

The following table includes year over year prices and total shareholder returns over 3, 5, and 10 years. Since the companies have never paid dividends – included with price appreciation in calculating shareholder return – the shareholder returns are based solely on share price movement.

AVZ Minerals holds interest in two development projects in the DRC (Democratic Republic of Congo) – a 75% interest in the Manono Project and a 100% interest in the Manono Extension Project. The company claims Manono could hold one of the largest lithium pegmatite deposits in the world.

In 2020 AVZ released a highly positive DFS (definitive feasibility study) and recently announced successful drilling results in the Roche Dure section of the Project. The company has completed multiple share placements.

On 14 January, the company was admitted to the OTCQX Best Market, the highest level in Over the Counter (OTC) trading exchanges. On 5 March, AVZ was admitted to the ASX 200.

Lake Resources has lithium from brine assets in the Lithium Triangle region in South America. The company has four projects in development in Argentina, with a recent announcement of an offtake agreement from its Kachi flagship project with Japan’s Hanwa Co. The non-binding MOU (memorandum of understanding) calls for delivery of between 15,000 and 25,000 TPA (tonnes per annum) over a ten year period.

Hanwa is interested in a long-term relationship with Lake, entertaining the possibility of financial support in bringing the project to production. Lake has a “compelling” PFS (pre-feasibility study) in place. On 2 March, the company received a modular demonstration processing facility from its US based technical partner, Lilac Solutions.

Lake claims the ion exchange processing technology costs less, saves water, and improves production capability.

Core Lithium is developing the Finniss Lithium Project, located in the Northern Territory near Darwin. Finnis is the company’s flagship project, with other assets in earlier stages of development. Core Lithium completed a DFS and a scoping study on Finnis in 2021, pointing to potential production averaging 173,000ktpa of high-quality lithium concentrate. A 31 March release of additional positive drilling results was welcomed by investors. The share price is resilient enough to withstand the negative news of the resignation of the CEO for personal reasons. The stock price stumbled but within four days hit its all-time high.

Finnis was granted Major Project Status (MPS) by the Federal Government in recognition of the “strategic significance” of the project.

Agriculture has been identified as a megatrend for some time, given growth in both overall populations and rising middle classes. The rising demand for food is at risk given both the dwindling supply of suitable farming land and the soil deterioration of existing farmland. Drought and flooding from climate change could be another risk.

Nufarm manufactures herbicides, insecticides, and fungicides for crop protection as well as seed treatment products.

In FY 2021 the company reported a 19% increase in revenue; reversed an FYT 2020 loss of $73 million dollars with a net profit of $61 million, and resumed dividend payments, suspended in FY 2018. A strong start to FY 2022 announced at an investor presentation led one major broker to increase the company’s price target.

Revenues for the first quarter were up 36% with company management expressing confidence for the full year performance.

The company is “high tech” in the field of developing sustainable practices in agriculture with its range of novel solutions, from biologicals to bio stimulants, and mechanical and electric processes.

A Nufarm subsidiary – Nuseed – makes a biological feedstock called Carinata Oil. On 1 February, the company announced a strategic partnership with BP North America with a market development and offtake agreement for Carinata. BP will use Carinata Oil to produce renewable biofuels.

Nufarm may be a beneficiary of the soft commodity boom, now rising even higher due to the situation in Ukraine and Russia. The company has a two year earnings growth forecast of +41.7% and a dividend growth forecast of +85.7%.