The ASX healthcare sector offers Aussie investors opportunities covering both ends of stock market investing – the safety of established companies offering high-demand medical treatments and the seductive qualities of speculative startups researching revolutionary therapies.

The mature Australian health stocks offer investors a low-risk opportunity for long-term gains due to their defensive qualities and the size and penetration of the total addressable market for what they offer.

At the opposite pole lie the high-risk, high-reward companies often treading unchartered waters. These are the stocks that get investors’ blood pumping at the prospect of “ten bagger’ returns popularised by the legendary US investor Peter Lynch.

The established and the speculative companies have powerful demographic tailwinds that bode well for their future performance. All over the world, the population is ageing as the former largest generation the world has ever seen – the baby boomers – continue to retire. Perhaps of greater significance is the dramatic increase in human life span, as reports of seniors older than one hundred years have become common.

The total addressable market for whatever treatment a company offers, or plans to offer, is a critical factor often overlooked by investors. An established company operating in a saturated market is less desirable than one operating in an expanding market.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

This consideration is especially relevant for speculative stocks, companies working on treatments affecting a small percentage of the population.

Speculative biotech and life sciences stocks can reward investors with rapidly rising stock prices as positive news on what the company is doing continues to dominate financial websites. The crown jewel announcements are positive news on a series of clinical trials leading to approval for market distribution. However, if the trial news is moderately positive or negative, the share price gains can evaporate in a heartbeat.

Some market experts suggest investors lean toward risk aversion, not risk tolerance. If you are asking yourself, what are the best ASX health stocks to buy? The answer for most investors would appear to be the established players in the sector, especially given the uncertain economic conditions in 2023 carrying over into 2024.

Here are five of the best healthcare stocks to buy.

- CSL Limited (CSL)

- Cochlear Limited (ASX: COH)

- ResMed Inc. (ASX: RMD)

- Sonic Healthcare (ASX: SHL)

- Pro Medicus Limited (ASX: PME)

CSL Limited (CSL)

CSL offers two vital medical products – blood plasma and vaccines. The global market for blood plasma is expected to grow at a compound annual growth rate (CAGR) of 10.3% through 2030. The global market for vaccines in 2021 was $USD 61.04 billion dollars, with forecasted growth to 2028 to reach USD$ 125.4 billion dollars, a CAGR of 10.3%.

The company has two business segments – CSL Behring and Seqirus. CSL Behring provides blood plasma treatments, while Seqirus is one of the world’s largest providers of influenza vaccines. CSL invests heavily in the research and development (R&D) of medical treatments to support the company’s future growth.

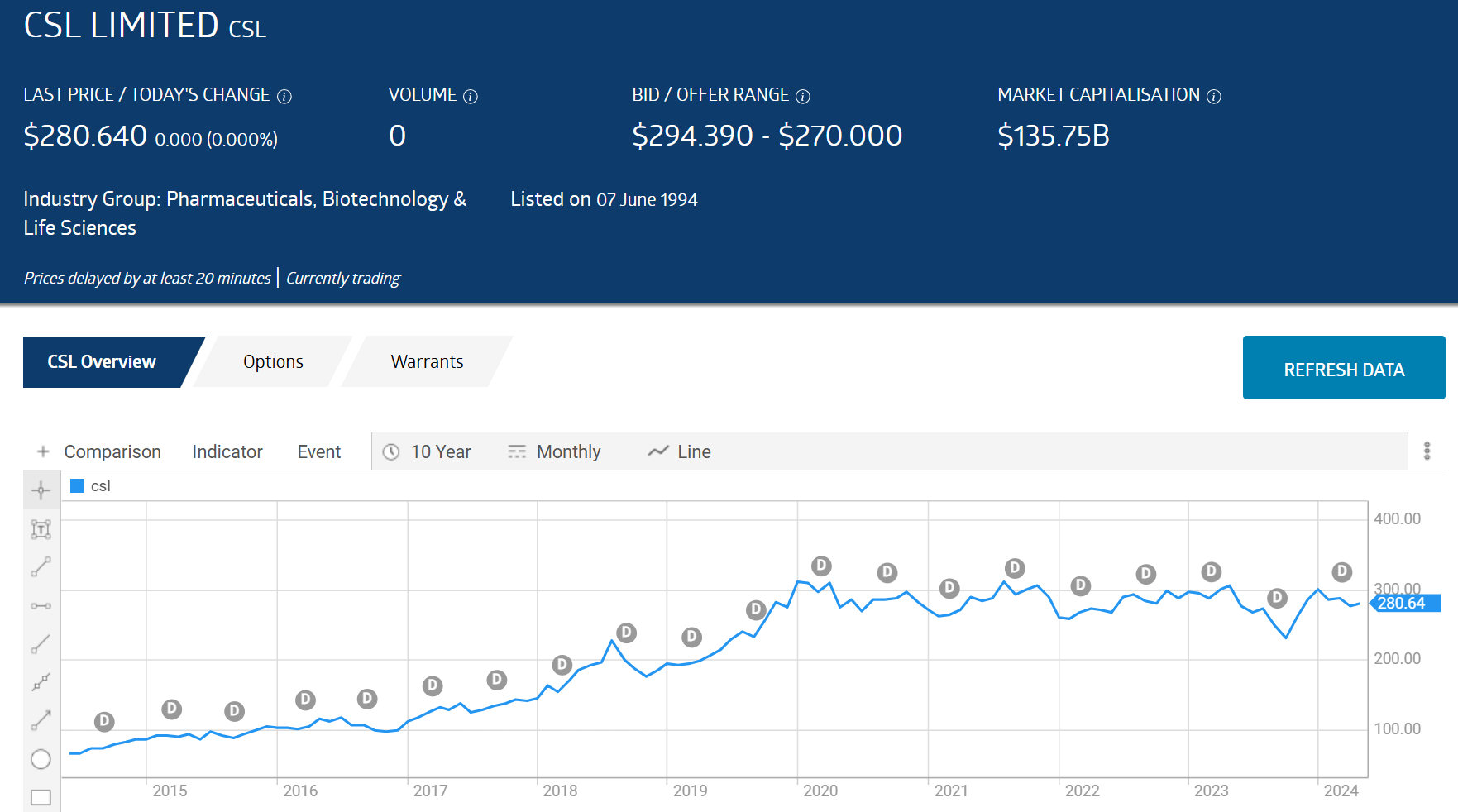

Over a little more than a decade, the CSL share price has risen more than 327%, from $66.52 per share on 6 January 2013 to $280.64 as of 27 May of 2024.

Source: ASX Website

CSL is a prolific dividend payer, with dividend payments going back to FY 2014. CSL actually increased dividend payments during the Covid pandemic while their business was suffering – from $1.99 in FY 2020 to $2.21 in FY 2021 to $2.26 in FY 2022 and $2.41 in FY 2023.

The company’s five-year average P/E (price-to-earnings ratio) is 40.79, while the five-year average price-to-forward earnings ratio is 37.33 – with both ratios characteristic of growth stocks. The forward P/E uses forecasted earnings over the coming twelve months in its calculation.

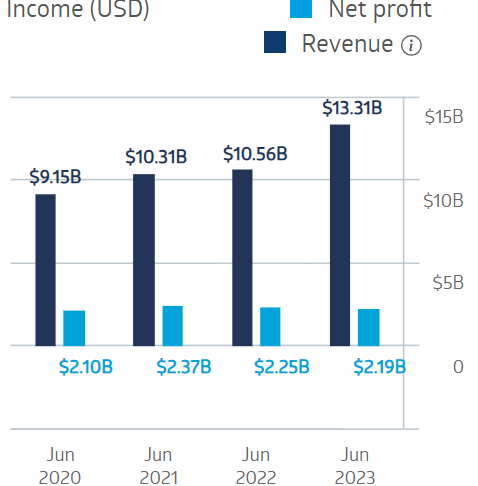

The COVID-19 pandemic posed challenges to CSL, hindering its plasma collection procedures. Despite that, the company saw increasing revenues and profit stability over the last four fiscal years.

CSL Financial Performance

Source: ASX 27 May 2024

Half Year 2024 results were solid, with revenues rising 11% and net profit up 17%.

The Wall Street Journal has an analyst consensus rating of OVERWEIGHT on CSL shares, with six analysts at BUY, three at OVERWEIGHT, and three at HOLD.

Cochlear Limited (ASX: COH)

Cochlear Ltd provides cochlear implants, bone-anchored hearing aids, and a variety of sound processors associated with both. While cochlear hearing implants are traditionally associated with paediatric use, the company also focuses on the senior citizen market, consistent with the global trend toward older population demographics.

Cochlear controls 60% of the global market, with 80% of the company’s revenues coming from developed countries, opening the door to emerging markets as a growth opportunity. Cochlear products are upgradeable, and the company’s R&D operation consistently upgrades its existing line alongside developing new products.

The global cochlear implant market was $USD1.6 billion dollars in FY 2022, up dramatically from the prior year’s $USD$452 million when the pandemic curtailed non-emergency medical procedures. A global CAGR of 8.41% is expected between 2023 and 2030, with 9.2% expected in the US. The World Health Organisation estimates more than five million people worldwide will experience hearing loss by 2050.

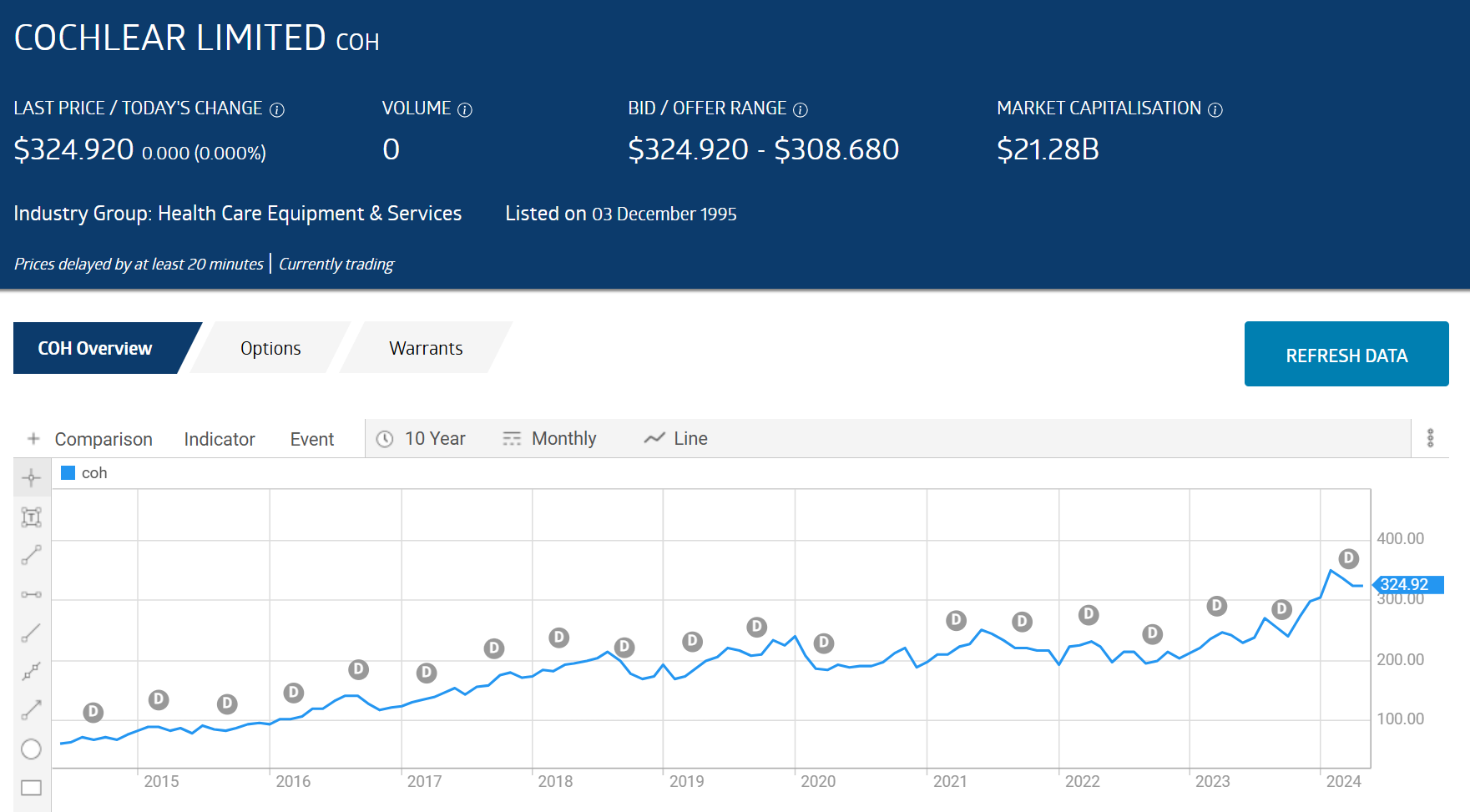

Over a little more than a decade, Cochlear’s share price has risen from $61.78 on 1 January 2013 to $324.92 as of 27 May 2024, an increase of around 425%.

Source: ASX 27 May 2024

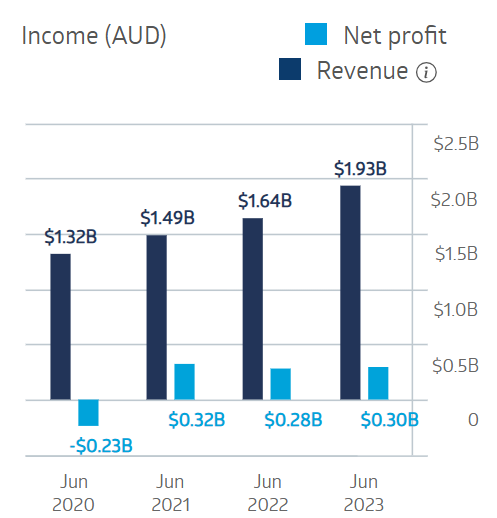

Year over year the share price is up 32.6%. . The company’s financial performance took an early hit from Covid, posting a loss in FY 2020, but returned to profit and revenue growth in FY 2021.

Cochlear Financial Performance

Source: ASX 27 May of 2024

Half Year 2024 results saw revenues up 25% and underlying net profit up 35%. The company increased its interim dividend payment by 29%.

The Wall Street Journal is reporting an UNDERWEIGHT rating for COH shares, with 2 analysts at OVERWEIGHT, eight at HOLD, 2 at UNDERWEIGHT, and a surprising six at SELL.

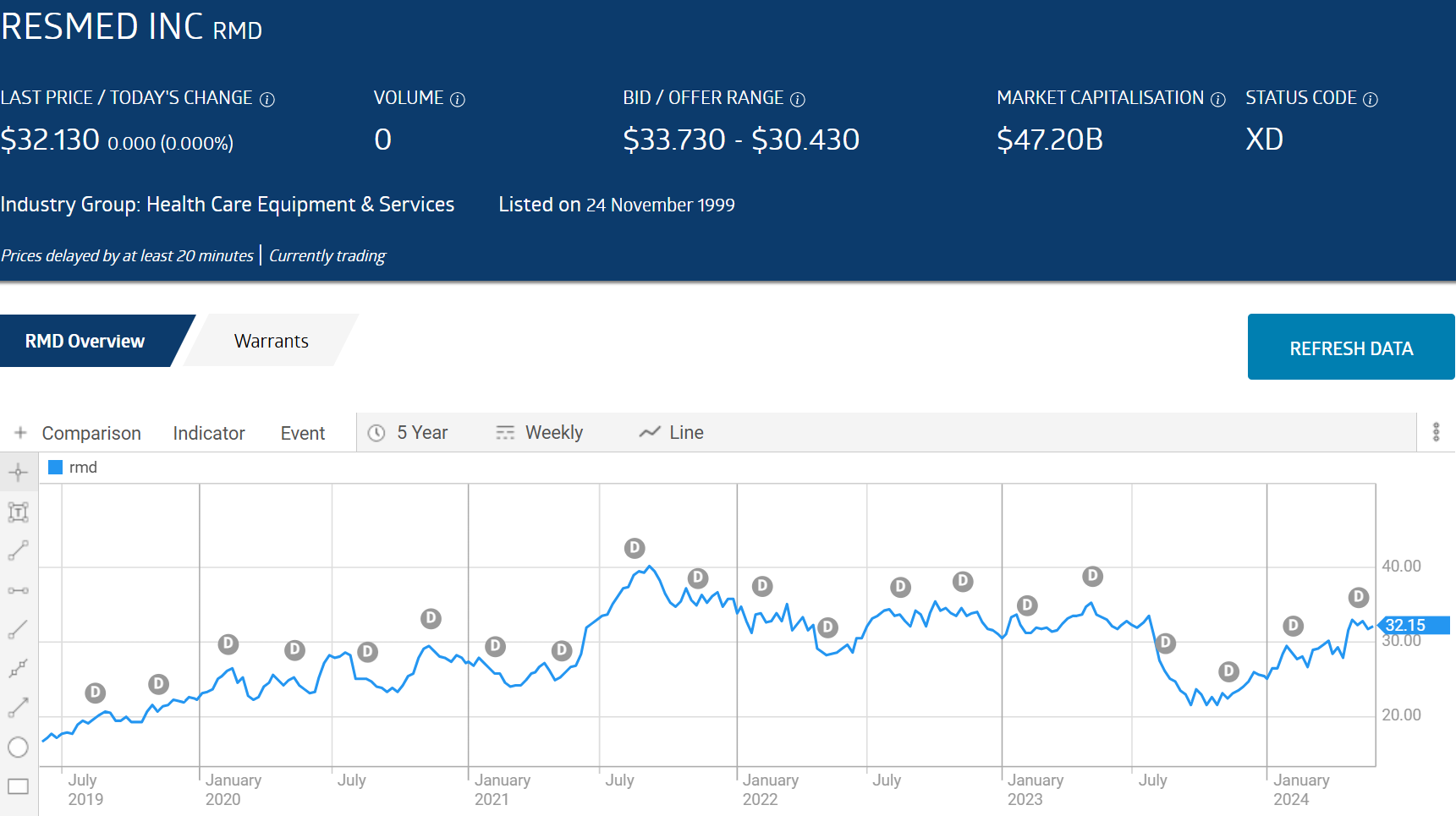

ResMed Inc. (ASX: RMD)

ResMed is a US-based company that began trading on the ASX in 1999. The company has been in the business of sleep technology for 30 years, beginning with the CPAP (Continuous Positive Airway Pressure) machine – a device to help people breathe and sleep better.

The company has grown to become a global leader in respiratory and sleep therapy, offering multiple CPAP models to fit a range of customer preferences, along with the associated equipment and supplies.

The market for sleep apnea devices has twin tailwinds signaling a robust future – ageing and obesity. Both impact breathing, with sleep apnea undetected in a large segment of the US population. In 2022 the sleep apnea market was valued at USD7.5 billion dollars. Forecasted growth is at 7.5% CAGR, with the market value to reach USD$16.5 billion by 2032.

In addition to product growth, ResMed now offers a suite of software products to respiratory health professionals on a Software as a Service (SaaS) model. Year over year, the share price is down 3.5%. Over five years the share price has risen 119%.

Source: ASX 27 May 2024

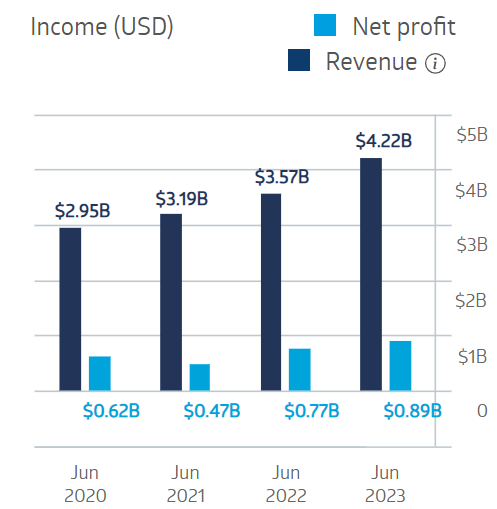

ResMed grew revenues in each of the last four years, and by FY 2022, net profit had exceeded the pre-pandemic level.

ResMed Financial Performance

Source: ASX 27 May 2024

Based in the US ResMed reports financial results quarterly. The company’s 3rd Quarter of 2024 results were released on 25 April, with revenues up 12% and net income up 9%.

The Wall Street Journal has an analyst consensus OVERWEIGHT rating on RMD shares with twelve analysts at BUY, four at OVERWEIGHT, and six at HOLD.

Sonic Healthcare (ASX: SHL)

Sonic operates in two healthcare sectors – pathology and diagnostic imaging. Both are growing in demand. The company gets 85% of its revenue from pathology and ranks in the top three in all markets it serves –Australia, Germany, Switzerland, the UK, and the US. The company also operates primary care medical centres across Australia.

Global growth for pathology services has a CAGR of 3.2% to 2030. In 2022 market size was USD $217.53 billion, while diagnostic imaging has a CAGR of 4.3%, expected to grow from USD $31.9 billion in 2023 to USD $45.8 billion in 2030.

Sonic Healthcare has a respectable ten-year share price performance appreciation, up 41.2% along the way, with continuous dividend payments. Year over year the share price has dropped 29.3%.

Source: ASX 27 May 2024

Although Sonic faced the same COVID challenges as many healthcare providers – elimination of non-life-threatening procedures, the company’s pathology division actually benefited from CovidWhile Sonic’s diagnostic imaging business did suffer, the company managed to continue its revenue growth, with profit dipping slightly in FY 2020. Profit in FY 2022 was more than two and a half times the pre-pandemic level, but both revenues and profit slipped in FY 2023 as the massive drops in Covid generated revenue caught up with the company.

Sonic Healthcare Financial Performance

Source: ASX 27 May 2024

Half Year 2024 results brought bad news, with revenues up 5% but net profit dropping 47%, with management attributing the loss to the transition from declining Covid revenues to normal business. The company did increase its dividend by 2.4%.

A 20 May earnings update to the market deepened the gloom, with management reducing prior revenue and earnings forecast for the full year 2024.

The analyst community has responded with downgrades and target price cuts. The Wall Street Journal has a HOLD rating on Sonic shares, with five analysts at BUY, one at OVERWEIGHT, six at HOLD, two at UNDERWEIGHT, and two at SELL.

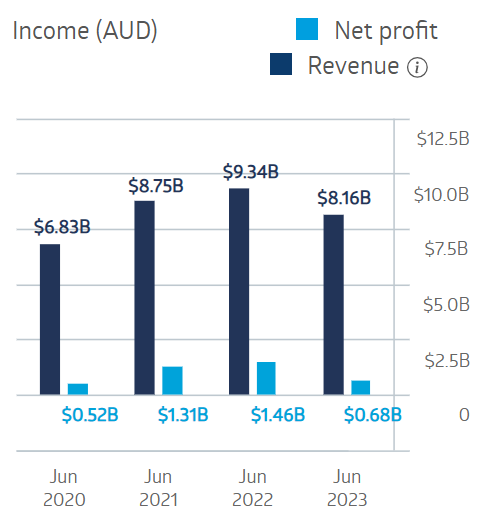

Pro Medicus Limited (ASX: PME)

Pro Medicus serves the professional radiology and clinician sector globally with three interrelated software offerings. The company provides radiographic imaging systems (RIS), and Pro Medicus offers picture archiving platforms and a communications platform.

Pro Medicus also offers management and control systems for business operations. The company’s Visage products allow 2-D, 3-D, and 4-D imaging with full archiving and easy retrieval capabilities for physicians and clinicians using Pro Medicus systems.

The global market for radiographic imaging systems has a projected CAGR of 7.9%, reaching USD $3.2 billion by 2032. That does not reflect the competitive advantage the company has by coupling its RIS platform with PAC ( picture archiving and communications).

Year over year, the stock price is up 89.1%, but over the five-year period that included the outbreak and the new strains of Covid, the share price rose 454%.

Source: ASX 27 May 2024

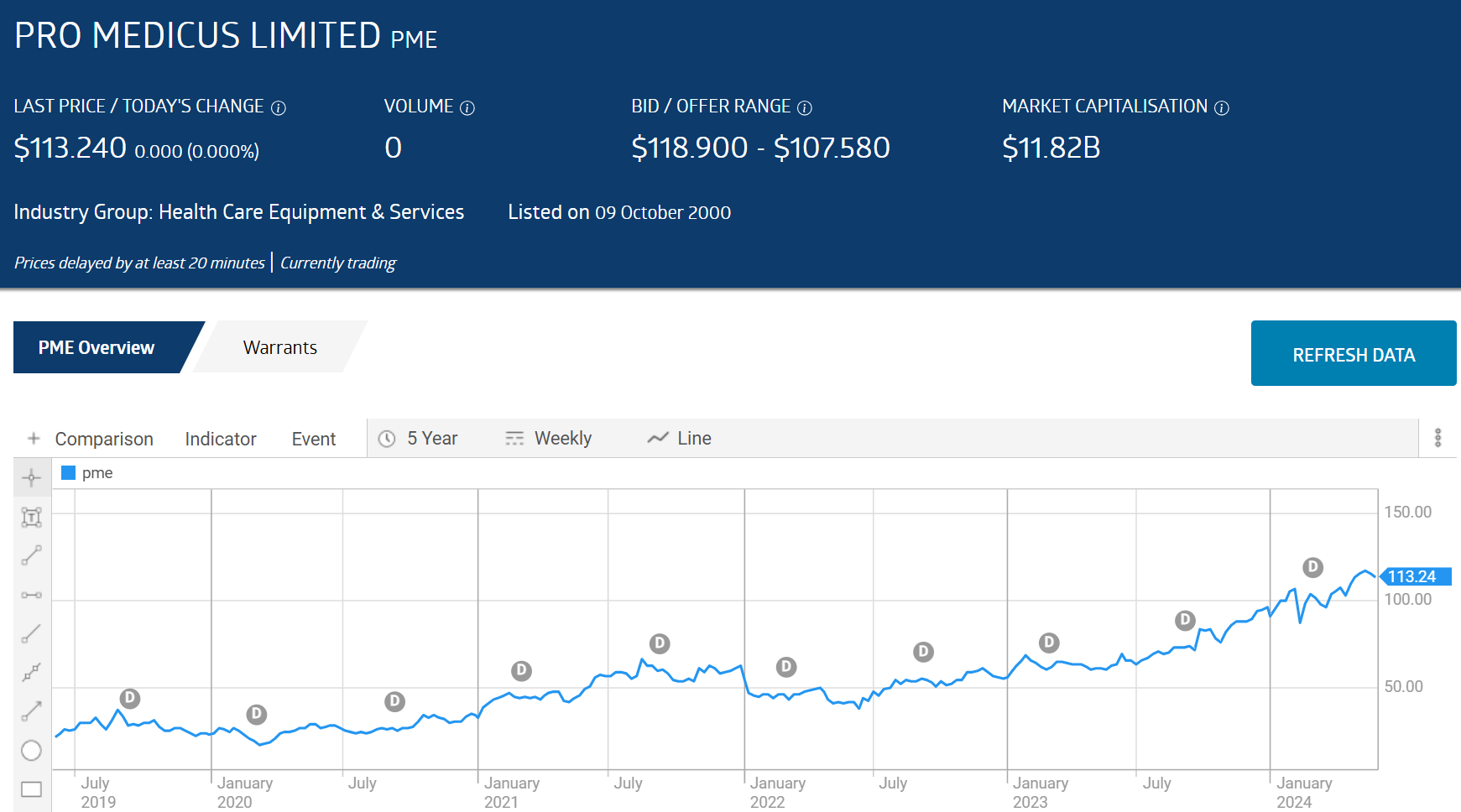

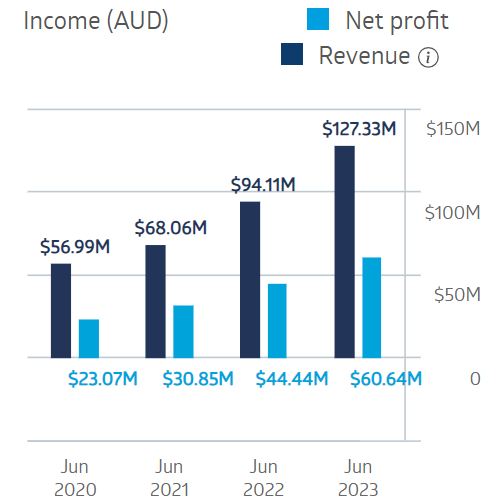

Pro Medicus has the distinction of being one of very few stocks that managed to grow both revenue and profit in each of the last four fiscal years, despite Covid.

Pro Medicus Financial Performance

Source: ASX 27 May 2024

Half Year 2024 results continued the outstanding financial performance, with revenues up 30.3% and net profit up 33.3%.

The Wall Street Journal has an analyst consensus OVERWEIGHT rating on PME shares, with four of the analysts reporting at BUY, one at OVERWEIGHT, and two at HOLD.

The global healthcare sector is set to benefit from two long-term tailwinds – people in the developed world are living longer and require more medical care into old age.

Picking the best ASX healthcare stocks to buy is challenging, given the number of solidly established stocks and promising startups. For the risk-averse, market potential is a critical factor in selecting the best. A large company operating in a market that has reached or is approaching saturation is not as desirable an investment as a business in a sector expected to grow.