BHP Group Limited (ASX: BHP), the world’s largest mining company, finds itself at a critical juncture. Currently trading at $38.23, BHP’s share price has gained 11.9% off April’s low, yet remains 4.3% below where it began 2025. Now the question as to whether BHP can sustain recent momentum and definitively break through the $40 psychological barrier and achieve positive year-to-date (YTD) performance, looms for holders who have seen little to cheer since the end of 2023.

It will likely not be an easy path upwards, with recent reports indicating Chinese iron ore imports for May have slowed, due to seasonality. Recent analyst revisions have also been to the downside. However despite this, the BHP price has marched onwards, and with a substantial market capitalization of A$194 billion and a dividend yield of ~5%, BHP remains a cornerstone of the Australian market.

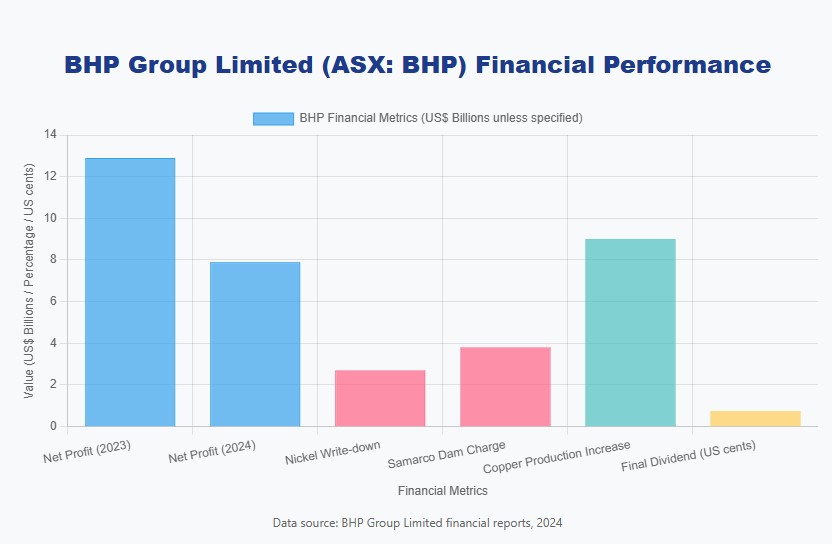

Growth concerns however are not unfounded, as evidenced by BHP’s 39% decline in full-year net profit to US$7.89 billion, despite record production volumes in its Western Australia Iron Ore operations and a 9% increase in copper production. This profit decline was largely attributed to one-off write-downs, including a US$2.7 billion write-down of Western Australian nickel assets and a US$3.8 billion charge related to the Samarco dam failure. The company also reduced its final dividend, reflecting a cautious approach amid anticipated market volatility driven by geopolitical tensions and economic headwinds.

Recent developments have further complicated the picture. A significant move was the joint acquisition of Filo Corp. with Lundin Mining Corporation, forming a copper-focused joint venture with the Filo del Sol (FDS) and Josemaria projects in Argentina and Chile, with a US$2.1 billion investment underscoring the firm’s strategic focus on copper, a metal vital for the burgeoning energy transition. This acquisition signals a long-term commitment to growth in a sector poised for significant demand, but this comes at a cost.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What The Bulls See

- Strategic focus on copper assets positions BHP for long-term growth in a key sector for the energy transition.

- Strong operational performance in iron ore and copper production demonstrates efficiency and resilience.

- Commitment to carbon reduction enhances BHP’s long-term sustainability and appeal to environmentally conscious investors.

- High dividend yield makes BHP attractive to income-seeking investors.

- Potential for commodity prices to rebound, boosting revenue and profitability.

The Bear View

- Exposure to volatile commodity markets makes BHP vulnerable to price fluctuations and economic downturns.

- Significant legal liabilities related to the Samarco dam failure could result in substantial financial losses.

- Analyst downgrades reflects concerns about rising operational costs and potential challenges in commodity markets.

- Premium valuation compared to fair value estimate suggests limited upside potential.

- Global economic uncertainties and geopolitical tensions could negatively impact demand for commodities.

Whilst there have been a couple of downgrades from analysts, including Bernstein in the past month, they have both been revised down to market perform, so not exactly bearish. This is evidenced by the average price target of $42.69. The view that BHP can perform alongside that of the broader market could yet prove attractive, particularly alongside a healthy dividend yield.

BHP’s ability to recapture $40 and achieve positive YTD performance hinges on a complex interplay of factors. The company’s strategic investments in copper, its operational efficiency, and its commitment to sustainability are all positive indicators. However, it faces significant challenges, including volatile commodity markets, falling Chinese demand for iron ore, as well as the costs associated with its carbon reduction initiatives

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy