- Microsoft and Google report disappointing quarterly earnings after closing Tuesday.

- Australian inflation comes in hotter than the estimates suggested.

- With Chinese stocks struggling, inflation on a tear, and the Aussie dollar in the doldrums, will US company earnings provide a life raft to the markets?

The week in data

After delaying publishing to make room for the quinquennial party congress, Chinese economic data was relatively positive. Annualised GDP figures beat estimates at 3.9%, and retail sales are down to 2.5% growth, but that is to be expected under lockdown.

Markets, particularly foreign investors, growing weary of the restrictive COVID policies, turned a blind eye to the data and listened more intently to the words of Chairman Xi Jinping. The US listing of Chinese stocks and the Hong Kong market bearing the brunt of their ire at a seemingly change in tack toward security over markets.

Behind the curtain of the S&P PMI data published on Monday, a window into European manufacturing and services paints a picture of decline. A survey of many business executives in October suggests an economic contraction in the weeks and months ahead. The EU S&P Global Composite PMI missed the consensus with a reading of 47.1.

Readings of Australian inflation show no signs of a decline in prices. The third quarter of this calendar year reflected a 1.8% jump in the consumer price index.

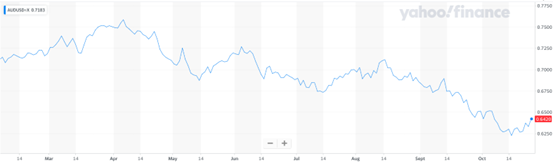

Aussie dollar and inflation

A stronger Aussie dollar can help reduce the cost of imports and dampen inflation. Unfortunately, the Australian dollar has taken a bit of a beating recently.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

An iron ore price slipping below 100 USD/MT has done little to shore up the balance of payments, and the Australian dollar has fallen back below 65c on the US Dollar, down 10% over the last two months.

Earnings bailout

With the lid still not on inflation, and our biggest trading partner China suffering some heavy blows in market trading, there was a chance that US earnings could lift us out of the doldrums.

Tech giants Microsoft NASDAQ:MSFT (MSFT) and Alphabet NASDAQ:GOOG (GOOG) reported quarterly earnings after trading hours on Tuesday. GOOG sales missed due to an underperforming YouTube; MSFT fell short of forecasts.

The NASDAQ retreated 2% in after-hours trading, which indicates more selling. GOOG retreated over 6% in after-hours, and MSFT fell back by a similar magnitude.

Impact on markets

To a degree, the USD cash trade has unwound over the last few days, with money having cycled back into investment. The dollar index DXY is down from the highs of 114 to 110. Last night’s data prints and earnings news has investors fretting that the worst is not yet in the past.

The 2-year versus 10-year US treasury yield spread dipped further into the negative as money returned to the longer-duration safe havens rather than residing in the volatile near-term securities.

Outlook

The uncertainty is likely to persist as more companies take the slowdown as an opportunity to clean house, write off or liquidate underperforming assets, and evaluate employment levels.

With debt and equity still showing signs of stress, Aussie stocks will likely experience a bumpy few weeks and months.