Diversifying in the US Stock Market

The COVID 19 Pandemic accelerated a trend already in place – the arrival of a new class of investors, largely young. Those investors while educating themselves soon learned the value of building a portfolio of diversified holdings.

Diversification reduces investment risk by spreading investments across various assets with differing price movement under different market conditions. In challenging times, the financial stability of high dividend paying blue chip stocks could counter balance the low performing sectors like technology or consumer discretionary stocks.

The ASX offers solid stocks for investing opportunities, but our market is heavy on financial, resource, and commodity stocks, limiting opportunities for robust diversification.

US markets are huge in comparison, with a wealth of quality stocks in virtually every business sector. Aussie investors interested in building a well-diversified portfolio of holdings would do well to look to the US. About 40% of publicly owned companies trade on US markets.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

How to Invest in US Stocks

To tap into US markets, investors here in Australia can pick individual stocks directly through brokerage houses and online trading platforms that offer access to US stocks, or they can invest in a variety of US-based exchange traded funds (ETFs) trading directly on the ASX.

US ETFs on the ASX

When it comes to US ETFs on the ASX, Australian investors have multiple choices, beginning with those that track the performance of a US stock index, like the S&P 500, providing exposure to only the largest US companies.

Then there are specialty ETFs following a specific investing strategy or business sector, limited to US stocks but including mid-cap and small cap stocks.

Finally, there are ETFs with an international scope including 60% or more of US stocks.

For maximum exposure to large cap US stocks, ETFs tracking the S&P 500 provide more diversification than ETFs that track the technology heavy US NASDAQ index,

The S&P 500 ETFs listed on the ASX include:

- iShares Core S&P 500 ETF (ASX: IVV) from BlackRock asset and investment management company, and

- SPDR S&P 500 ETF Trust (ASX: SPY) from State Street Global Advisors

Both track all 500 of the stocks on the index, with virtually identical sector weightings, resulting in identical share price appreciation of both matching the index. Over five years, these two ETFs have dramatically outperformed the ASX 200 index, with the ETFs appreciating 88.7% versus 17.9% for the ASX 200, as of 19 February of 2025..

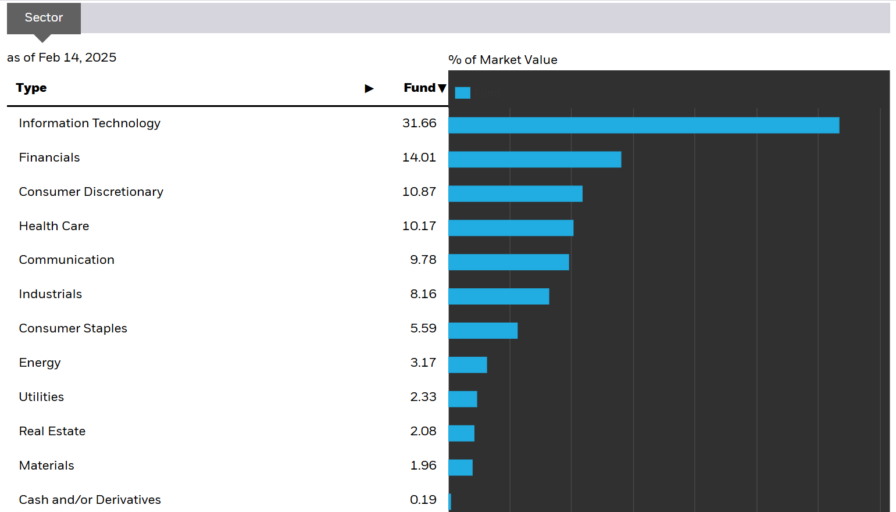

Here is the Sector Breakdown for the iShares S&P 500 ETF IVV:

Source: iShares Website

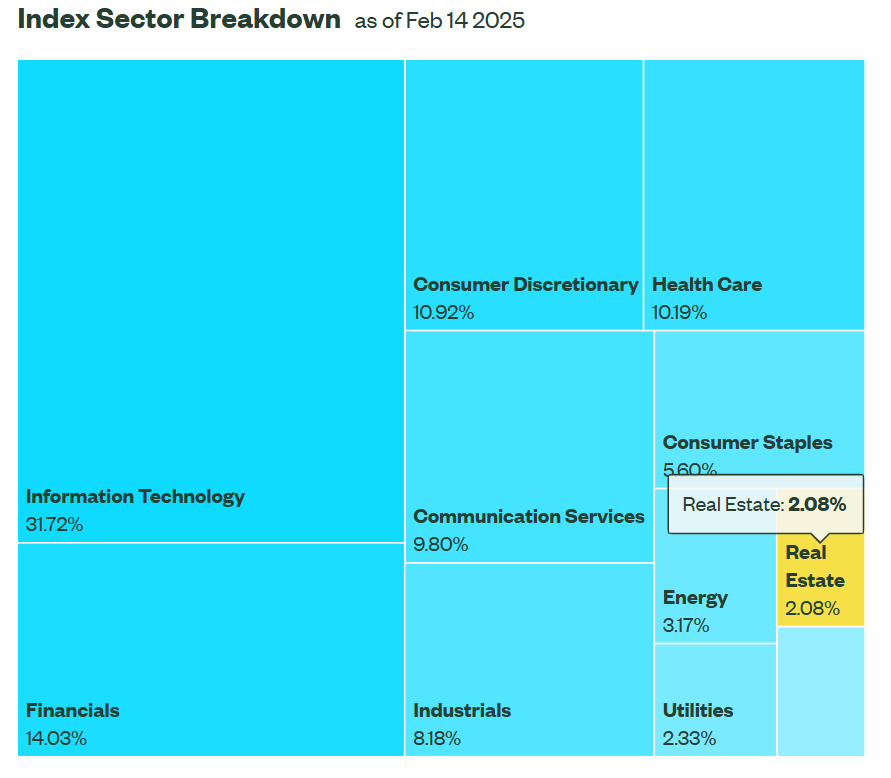

Now here is the virtually identical breakdown for the S SPDR S&P 500 ETF Trust SPY:

Source: SPDR Website

These two ETFs have an added benefit of distributions, with IVV posting total returns of more than 16% over five years and SPY returning over 15%.. iShares also offers a hedged version of the fund to mitigate currency fluctuations – the iShares S&P 500 (AUD Hedged) ETF (ASX: IHVV).

Vanguard offers an ETF with much broader exposure, covering blue chips to small caps –the Vanguard U.S. Total Market Shares Index ETF (ASX:VTS). This fund tracks the entirety of stocks listed on US exchanges – about 3,600 entries in the CRSP (Center for Research in Security Prices) US Total Market Index.

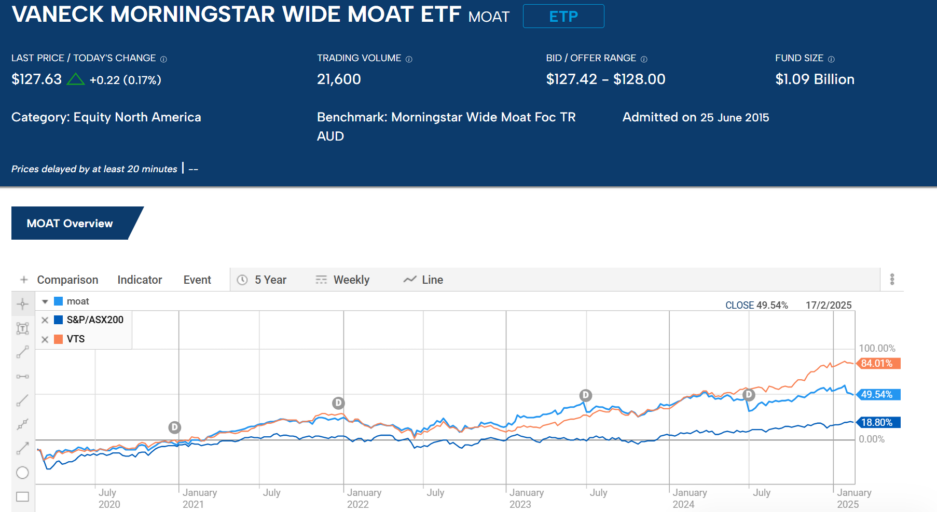

Aussie investors who favor lessons learned from legendary US investor Warren Buffe can look to the VanEck Morningstar Wide Moat ETF (ASX: MOAT). Buffet introduced the concept of a “moat” surrounding a company giving it a competitive advantage over other companies operating in the business sector. Global analyst firm Morningstar has a wide moat index, the basis for the ETF, comprised of only 51 stocks.

Over five years, the price of the broadly based VTS has outperformed the much narrower MOAT.

Source: ASX 17 February 2025

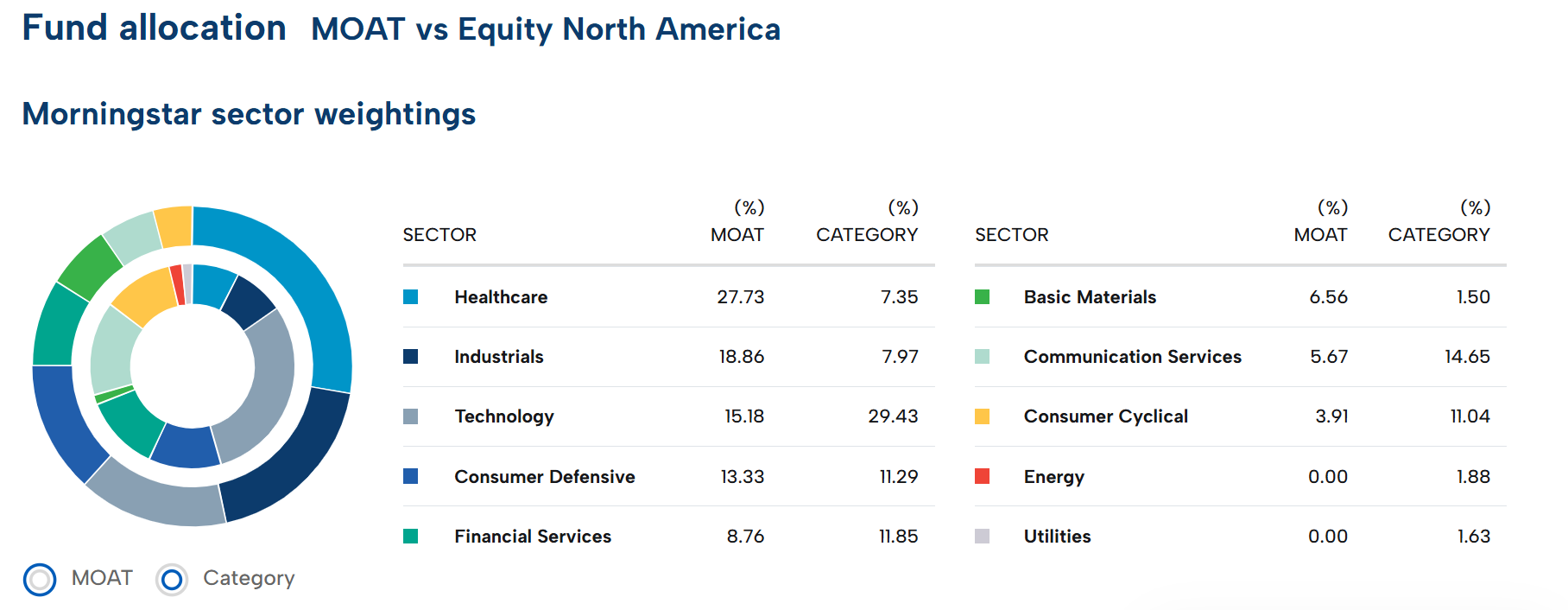

In sharp contrast to the top weighting of technology shares in both the IVV and the SPY, the MOAT portfolio’s top weighted sector is healthcare.

Source: ASX Website 17 February 2025

The Best US Stocks

Research is one of the greatest challenges facing investors looking to diversify by individual stock picking. That challenge is multiplied when leaving your home ground. Australian investors diversifying with ASX listed stocks have access to a wealth of information about potential choices. While coverage of US stocks is available, it requires more effort in finding sources and time to follow them.

There are multiple starting points to search for worthy candidates from US markets. Looking for the top performers is one of them.

Top performers generally come at top prices but investors with patience can wait to buy on the dip. Artificial intelligence (AI) stocks dominated in 2024,with Palantir Technologies (NASDAQ: PLTR) leading the way, up 340.5% and already hitting new highs in early 2025.

There were stocks from different business sectors providing some diversification. Here are five of the top performers from other sectors in the US from trading year 2024 :

- Vistra (NYSE: VST) Utilities

- Axon Enterprises (NASDAQ: AXON) Industrials

- Targa Resources (NYSE: TRGP) Energy

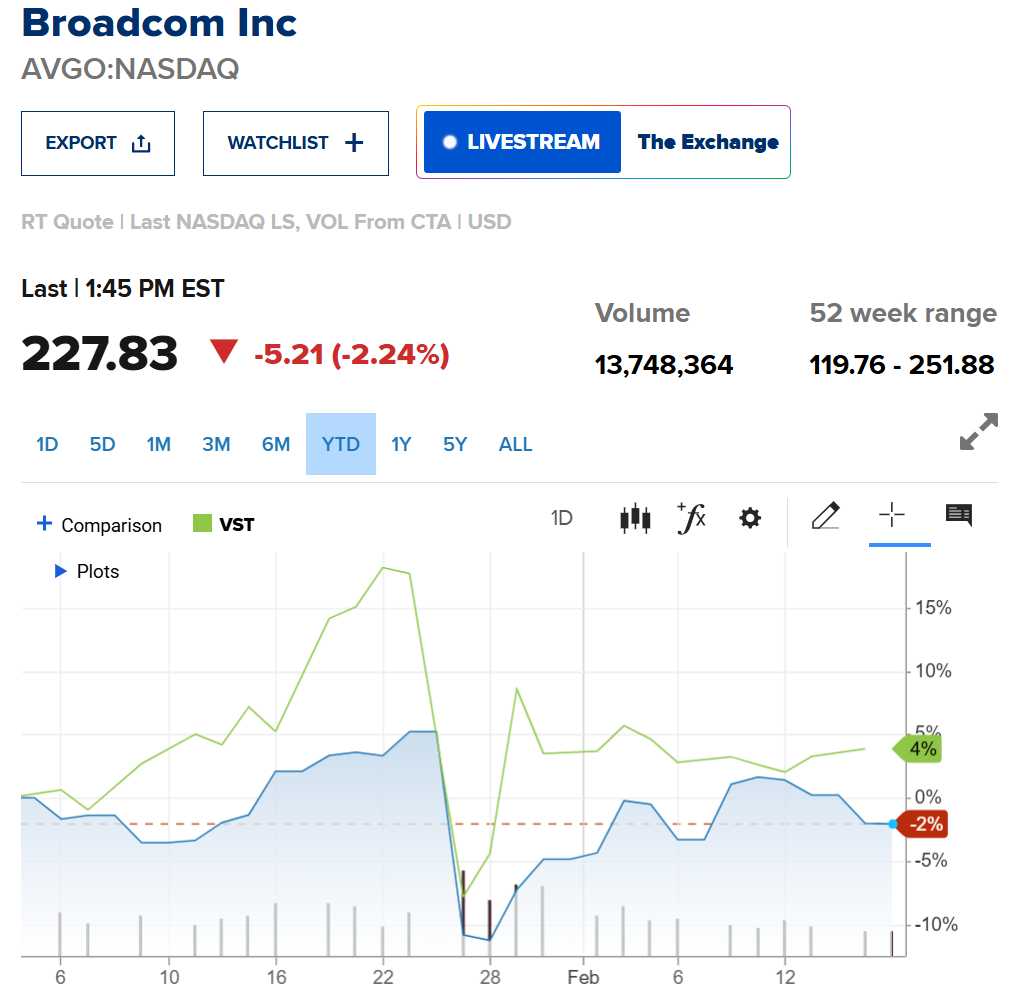

- Broadcom (NASDAQ: AVGO) Information Technology

- Walmart (NYSE: WMT) Consumer Defensive

Year to date, Vistra and Broadcom are off to a slow start, presenting potential buying opportunities for investors looking to buy on the dip.

Axon Enterprises and Walmart are off to a hot start in 2025, with both hitting new 52 week highs since the beginning of the trading year 2025, providing opportunities for investors who follow the “buy high sell higher” investing strategy.

Source: CNBC 18 February 2025

Source: CNBC 19 February 2025

Broadcom is a global technology firm with two operating segments – semiconductor solutions and infrastructure software. The semiconductor segment is home to Broadcom’s intellectual property licensed product lines

Vistra is a retail and electrical power generating company, with six business segments – Retail, East, West, Texas, Sunset, and Asset Closure.

Walmart is an international brand but has no presence in Australia. Axon Enterprises provides law enforcement with technology solutions, including body and in-car cameras and the company’s best known product line – TASER energy devices.

Opportunities to build a diversified portfolio of stocks from the ASX 200 are limited. The ASX 200 lacks the range of business sectors found in US markets, which are the largest in the world.

Online trading platforms and brokerage houses give Australians access to US markets in two ways – buying individual stocks or exchange traded funds (ETFs).

Available ETFs include index funds that track US indices like the S&P 500 and specialty ETFs that track business sectors, investing strategies, or geographic regions. For exposure to every stock trading in the US there is the Vanguard U.S. Total Market Shares Index ETF (ASX:VTS). To track the top 500 US companies on the S&P 500, there are two choices – the iShares Core S&P 500 ETF (ASX: IVV) and the SPDR S&P 500 ETF Trust (ASX: SPY).