Diversifying Beyond the ASX

The Australian Stock Exchange may be small in size compared to the world’s behemoths like the US S&P 500 and the UK’s FTSE 100, but our national stock market index has features attractive enough to lure stocks from around the world as a launching pad for an initial public offering (IPO).

The world leader in respiratory device manufacturing – San Franciso based ResMed Inc –– and fintech BNPL (buy now pay later) company Sezzle – both chose the ASX for their introduction to the investing community. However, the size of the ASX and its sparser mix of listed business sectors limits it as a hunting ground for retail investors seeking maximum diversification.

The ASX is heavy on the financial and resources sectors while both the US&P 500 and the FTSE 100 featuring a more diversified representation of business sectors. The world’s top technology companies weigh heavily in US indices, along with a solid assortment of health care and industrial companies.

While less diversified, the FTSE 100 has the advantage for bargain hunting investors, given the continued challenges the UK economy faces, with project growth in 2025 at between 1% and 1.5%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

How to Invest In UK Stocks

Portfolio diversification is a strategy for minimising investment risk universally recommended by most investing gurus. The idea is to spread investment assets into areas that may not move in the same direction in challenging times.

While the FTSE 100 is populated with companies with global and major European exposure, the smaller FTSE 250 focuses on smaller companies operating largely in the UK. Researching potential investment opportunities in foreign markets remains arguably the single biggest challenge facing the average retail investor looking to diversify internationally. Australians are bombarded with coverage of Australian companies from a vast array of resources. Accessing information about even the largest UK stocks may take more time and energy than many investors are willing to commit.

In the short term, this argues against investing in UK stocks, butt the potential bargains to be had can make sense for investors with long term horizons.

Investing in UK companies for Australians begins with finding a brokerage house or online trading platform that offers the best resources and fees, along with tax advice for Australian investors.

With a trading source in hand, Aussie investors have the same binary choice for equity investing as they do with domestic stocks:

- Individual stock picking, or

- Exchange traded funds (ETFs)

UK ETFs

While investing directly in a UK listed ETF is possible, currency exchange rates and tax implications make an ASX listed UK ETF a better choice for most investors. The sole UK ETF on the ASX is the BetaShares FT100 ETF (ASX: F100). It is an ideal choice for Aussies, offering exposure to some of the world’s largest companies inaccessible to Australian investors.

The F100 is an index fund, including all the top 100 companies trading in the UK. Here are the top ten with their current weighting in the index, according to the BetaShares website:

| ASTRAZENECA PLC | 8.3 |

| SHELL PLC | 7.6 |

| HSBC HOLDINGS PLC | 7.3 |

| UNILEVER PLC | 5.1 |

| RELX PLC | 3.6 |

| BP PLC | 3.4 |

| BRITISH AMERICAN TOBACCO PLC | 2.8 |

| LONDON STOCK EXCHANGE GROUP PL | 2.7 |

| GSK PLC | 2.7 |

| RIO TINTO PLC | 2.5 |

- AstraZeneca and GSK (Glaxo Smith Kline) are two of the largest pharmaceutical companies in the world.

- Shell and BP (British Petroleum) are two of the largest oil companies in the world.

- HSBC Holdings and the London Stock Exchange Group are two of the largest financial institutions in the world.

- RELX is a major international information and analytics company.

- British American Tobacco is the second largest tobacco company in the world.

- Unilever is the sixth largest FMCG (fast moving consumer goods) company in the world.

The BetaShares FTSE 100 ETF listed on the ASX in 2019. Year over year the fund has outperformed the ASX 200.

Source: ASX 14 February 2025

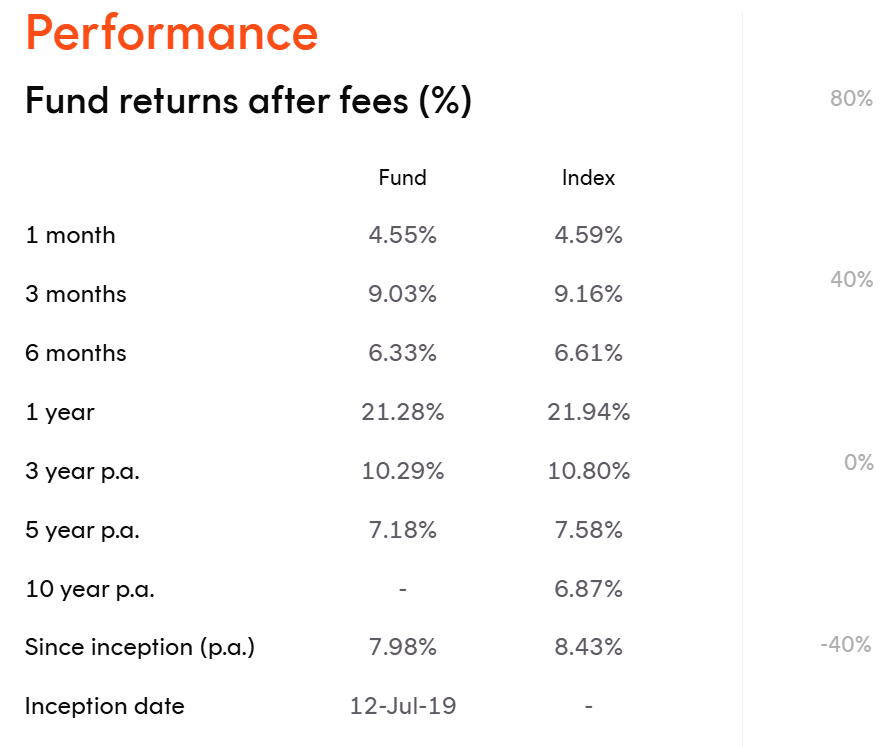

The following table from the BetaShares website tracks the fund’s return performance over time.

Source: BetaShares website

Best UK Stocks

Although lauded by investment professionals as a means of lowering investment risk, diversification has its downside. Along with lower risk comes lower reward. The core idea underlying diversification is holding high performance investment assets to counter the impact of low performing assets on the total holdings returns. What that means is high performers are pulled down by lower performers.

Stock picking can also aim for diversification by searching for “best of breed” assets from different sectors, geographic regions, or countries. The stability of financial stocks counter balances the volatility of technology or commodity stocks. The strategy works best with a long-term horizon, benefiting from cyclical movements in both business cycles and economic cycles.

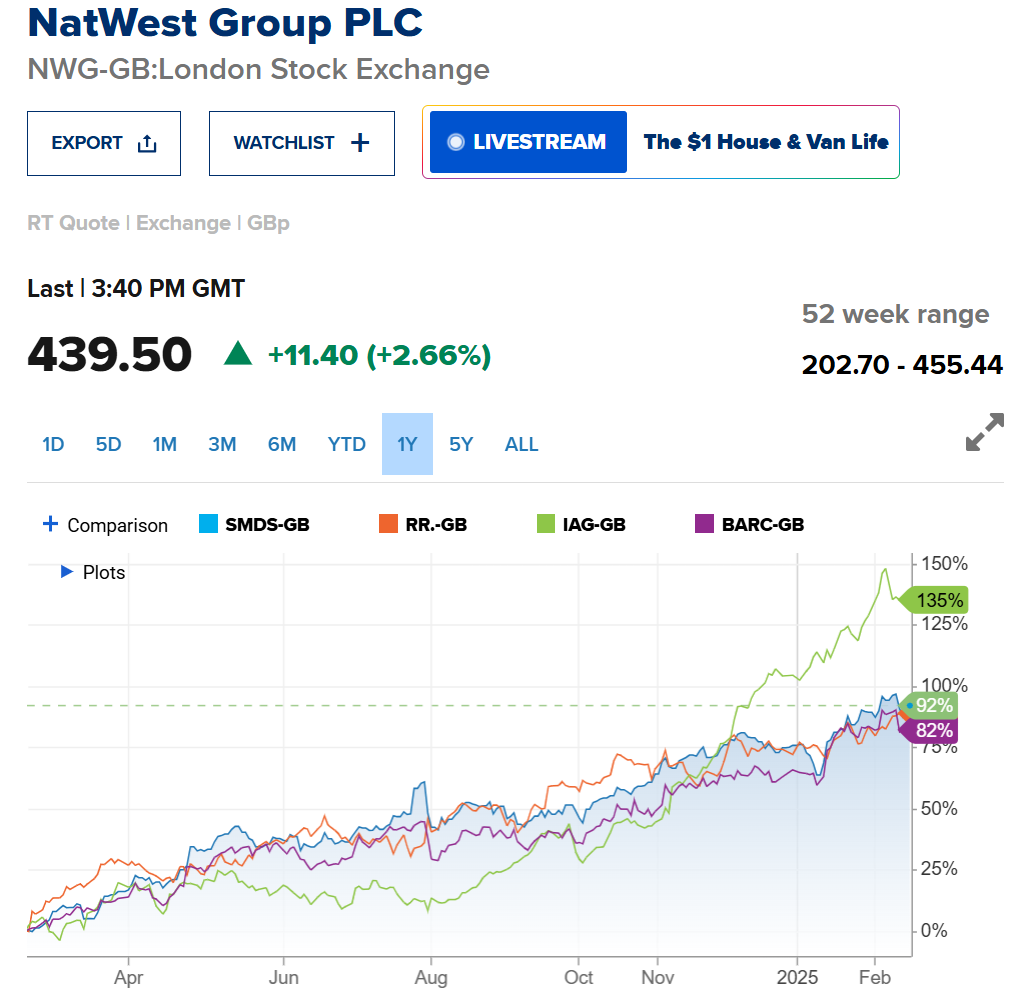

A “dream” portfolio of UK stocks would include the top five performers of 2024. From the website of US based financial and business news channel CNBC, here is a comparison of year over year share price appreciation of the top five FT100 performers to 17 February of 2025:

- NatWest

- Rolls Royce

- DS Smith

- IAG

- Barclays

Source: CNBC 17 February 2025

Barclays Bank and NatWest Group

Barclays Bank and NatWest Group rank in the top 50 of UK banks, with Barclays at the top of the heap and NatWest ranked fourteenth.

National Westminster Bank Public Limited Company began trading as NatWest Group in 2020, following its entry in 1968 from the merger of Westminster Bank and National Provincial Bank, later joining the Royal Bank of Scotland. The bank is one of Great Britain’s “Big Four” clearing banks.

While NatWest Group’s operations are limited to Great Britain, Barclays is international in scope, with two operating segments – Barclays UK and Barclays International.

Rolls Royce

Rolls Royce is an international company with operations in power systems, civil aerospace, and defence industries. Best known for its luxury cars and aerospace engines, the company is in the midst of a “strategic transformation.”

DS Smith

DS Smith is an international packaging and recycling company, merging with US based industry leader International Paper, effective in February of 2025. Now one of the world’s biggest paper, packaging, and recycling companies, the combined entity will continue its focus on US and EMEA (Europe, Middle East, and Africa) markets.

International Airlines Group (IAG)

International Airlines Group (IAG) owns major international air carriers British Airways and Iberia Airlines, along IAG Cargo. Despite a 2023 decline in cargo revenues, overall group operations just missed tripling operational income, rising to €3.5 billion from €1.27 billion.

Despite a sold reputation and many high quality companies, the ASX is limited in opportunities for diversification of holdings into some geographic reasons and business sectors. Portfolio diversification is a time-honored strategy for minimising investment risk by spreading assets across a variety of investments.

The FTS 100 includes some of the world’s largest companies not accessible to Australian investors. To diversify investors can either buy individual FT 100 companies from the London Stock Exchange, or invest domestically in the BetaShares FTSE 100 ETF (ASX: F100) that includes the top 100 companies in the UK.