Newcomers to share market investing quickly learn the need for a plan to guide investing decisions. The critical question facing investors is how to make an investment decision. How does one determine which stocks, or bonds, or commodities to buy?

In today’s market environment, many younger investors rely on social media investing groups for ideas of stocks worthy of purchase. Others adopt simple methods of spotting stocks based on investment philosophy. Growth investors might start the day checking the Market Movers list found on most financial websites for the day’s top gainers.

Such methods ignore the benefits of a planned approach, where investors identify stocks of interest and then monitor them for the best entry point.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What is a Watch List

As its name implies, a watch list is a recorded number of investment assets an investor watches for the best entry points for purchase. Watch lists can target virtually any class of investments, but stock watch lists are by far the most popular choice.

There are several reasons why stocks are ideally suited for watch lists.

First, stocks are by far the most targeted investment asset class. This popularity means stocks are “liquid” – demand for a stock means investors can enter and exit an investment quickly.

Second, popularity leads to massive coverage of stocks in the world of financial news. Outlets too numerous to mention bombard investors with daily doses of economic news and the impact on stocks generally and by sector. Much of the news reported has a catalytic impact on stock prices, with positive and negative earnings reports, new product announcements, and expansion into new market propelling stock price upward.

How to Create a Watch List

The actual creation of a watchlist is simple, but the prework is not. Investors need to have a sense of their investing goals and the kinds of stocks that interest them. Some investors are bargain hunters, while others are willing to pay more for stocks with high potential for future growth.

The digital world has pushed “yellow legal pad” watch lists into the dust bin of history. Wach lists are available on some financial websites, on trading platforms, and through dedicated software programs with stock screeners to build a watch list.

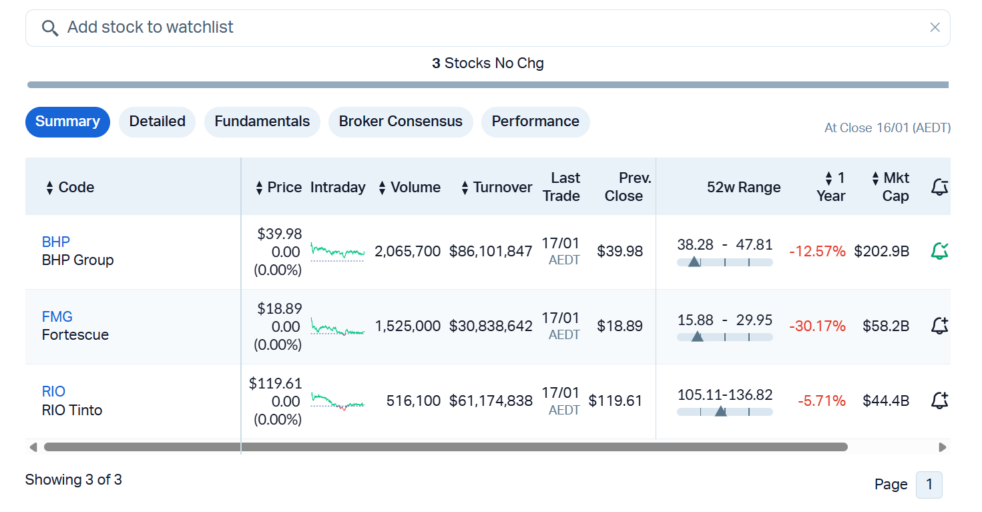

The following screen shot from marketindex.com.au provides a simple example.

Source: marketindex.com.au

Page 2 of the watchlist includes market announcements made on the ASX. The ASX website offers Free Sharemarket Services to registered investors, including watchlists. Both include Alert options, notifying investors when pre-defined criteria are met. Criteria range from 52 week highs to 52 week lows, multiple technical analysis indicators and valuation metrics like price to earnings, earnings growth, and book value ratios.

The best watchlist software allows customisation of the data points displayed. The best financial websites and trading platform software also offer pre-defined watchlists that often match investor interest. These lists are “curated” by experts with criteria similar or identical to that chosen by an average investor.

It is possible to create watchlists containing as many as 75 stocks or more, but market experts strongly recommend limiting watchlists to 20 to 25 stocks. Some investors choose to create multiple stock lists targeting different stocks of interest, but the caveat of creating mountains of data apply.

User defined watchlists and pre-defined watchlists serve the same purpose – monitoring and tracking performance to identify entry points.

Once created, investors closely monitor the watchlist for signals the stock has hit criteria defined by the investor. Once criteria deemed critical are met, the investor still needs to dig deeper into stock fundamentals not highlighted on the watchlist before making an investment decision.

Investors looking to broaden their investing horizon can set up watchlists for any asset that is tradeable – bonds, mutual funds, exchange traded funds, commodities, or currencies.

The mechanics of creating a watchlist begin by entering the ticker or trading code, but how do investors choose the stocks to build into their watchlists?

Selecting Stocks

While it is theoretically possible to create a watchlist from close monitoring of market news, that method leaves a major gap – what criteria should the watchlist be monitoring?

Common sense suggests stock screeners that sort through the maze of tradeable stocks in search of those that fit criteria deemed crucial by the investor are essential. In essence, the criteria dictate the stock selection.

With a high quality stock screener, investors can identify stocks that meet their investing preferences through parameters such as P/E, P/EG, and P/B ratios, along with price action indicators and technical indicators like the RSI (relative strength index.)

Some of the pre-defined screeners may provide much of what investors look for, but it is hard to match a dedicated, customisable stock screener.

Free stock screeners are rare in Australia. The better online trading platforms offer them. Serious investors might opt to pay for dedicated software.

The stock screener begins with broad strokes – like small cap medical device manufacturers – and moves into specifics. The digital world has made investing easier and more effective, but the starting point of what interests an individual investor remains in the minds of investors.

The Benefits of a Watch List

A well-constructed watch list is a major time saver for investors, affording the ability to monitor the performance of multiple stocks in a single list instead of searching for each individually.

In addition, researching the universe of publicly traded stocks is a daunting and time consuming task. A watchlist, once created, allows investors to focus on specific stocks that spark their interest and fit their investing goals.

Concentrated data points and alerts enable quick action once an investing opportunity pops up. Impulse trading is prevalent in much of the retail investing world, and watchlists can block impulsive trades.

A well-constructed watchlist isolates both fundamental and technical indicators, offering investors the best of both worlds.

Investors who wander around the world of financial websites absorbing article after article can reach the point of information overload. Restricting a watchlist to 20 to 25 sticks provide laser-like focus and avoid overload. Arguably the greatest mistake retail investors make with watchlists is including so many stocks focus is lost.

Rather than react to daily financial news or the latest rage on social media, investors can create watchlists to guide investment decisions. Stock screeners using criteria matching an individual investor’s goals and preferences identify stocks to enter into a watchlist, with a maximum of 202 to 25 stock advised by market experts.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy