Billionaire Mining Guru Tim Goyder Reaching for the Stars

Most Australian investors recognize the names Andrew Forrest and Gina Rineheart, but Tim Goyder?

In November of 2021, an enthusiastic investor with forty years’ experience in the mining sector began to emerge from the shadows. His name is Tim Goyder and unlike more traditional mining magnates, Goyder began making his fortune on the promise of two fledging junior miners –Liontown Resources (ASX: LTR) and Chalice Mining (ASX: CHN) – out of his portfolio of junior miners. Now in 2024 Goyder has added more hidden gems to his stable, while his first finds – Liontown and Chalice – remain in the mix.

A native of Western Australia, Goyder began his love affair with mining in the small town where he grew up with an early background in farming. He believes in “having a lot of tickets in the lottery,” which explains his pointing out to interviewers for every mining magnate you read about that has made it big, there are dozens upon dozens who barely get by. In his own words:

“I’ve been in this trade since I was 20 years old but I think that you’ve got to have perseverance, you’ve got to have energy and you’ve got to be able to get up after being knocked down 15 times.”

Goyder floated both of his prized startups in 2006 – Chalice in March and Liontown in December.

Fast forward to 2023 when Liontown’s flagship Kathleen Valley lithium asset drew the attention of global lithium giant US-based lithium chemical company Albemarle, an existing minority shareholder. Albemarle offered to acquire the entire company at a 69% premium to the 30 day weighted average of the Liontown Share price. The Liontown board, chaired by Tim Goyder, turned it down.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Goyder holds close to 14% of Liontown shares and is the majority shareholder at Chalice, with close to 9%.

Which Companies Does Tim Goyder Own?

Goyder’s crown jewels are Chalice and Liontown – both are now in the ASX 200 Index — , but he also has interest in uranium and rare earths explorer DevEx Resources and natural gas explorer Strike Energy. with a recent entry into Battery Minerals, now WMT (Waratah Minerals).

Goyder is enthusiastically in favor of the Australian government expanding its support of battery minerals mining to include downstream processing plants and even the manufacture of batteries. In his words:

“Why not? Why not reach for the stars?”

Liontown Resources (LTR)

Liontown began construction at Kathleen Valley in 2022, with first production anticipated in mid-2024. Successful drilling has confirmed the project will be a Tier 1, world class, long-life producing mine.

Liontown has established a long-term funding partnership to develop Kathleen Valley, beginning with a $250 million dollar investment from LG Energy Solutions, along with a 10 year offtake agreement. In addition, the LG/Liontown strategic partnership is assessing the feasibility of building a lithium refinery at the Kathleen Valley Project. LG Energy Solutions is a South Korean Battery manufacturer.

On 15 June, the company announced a short-term, ten month binding offtake agreement with Beijing Sinomine International Trade Co. for the purchase of up to 100,000 DMT (dry metric tonnes).

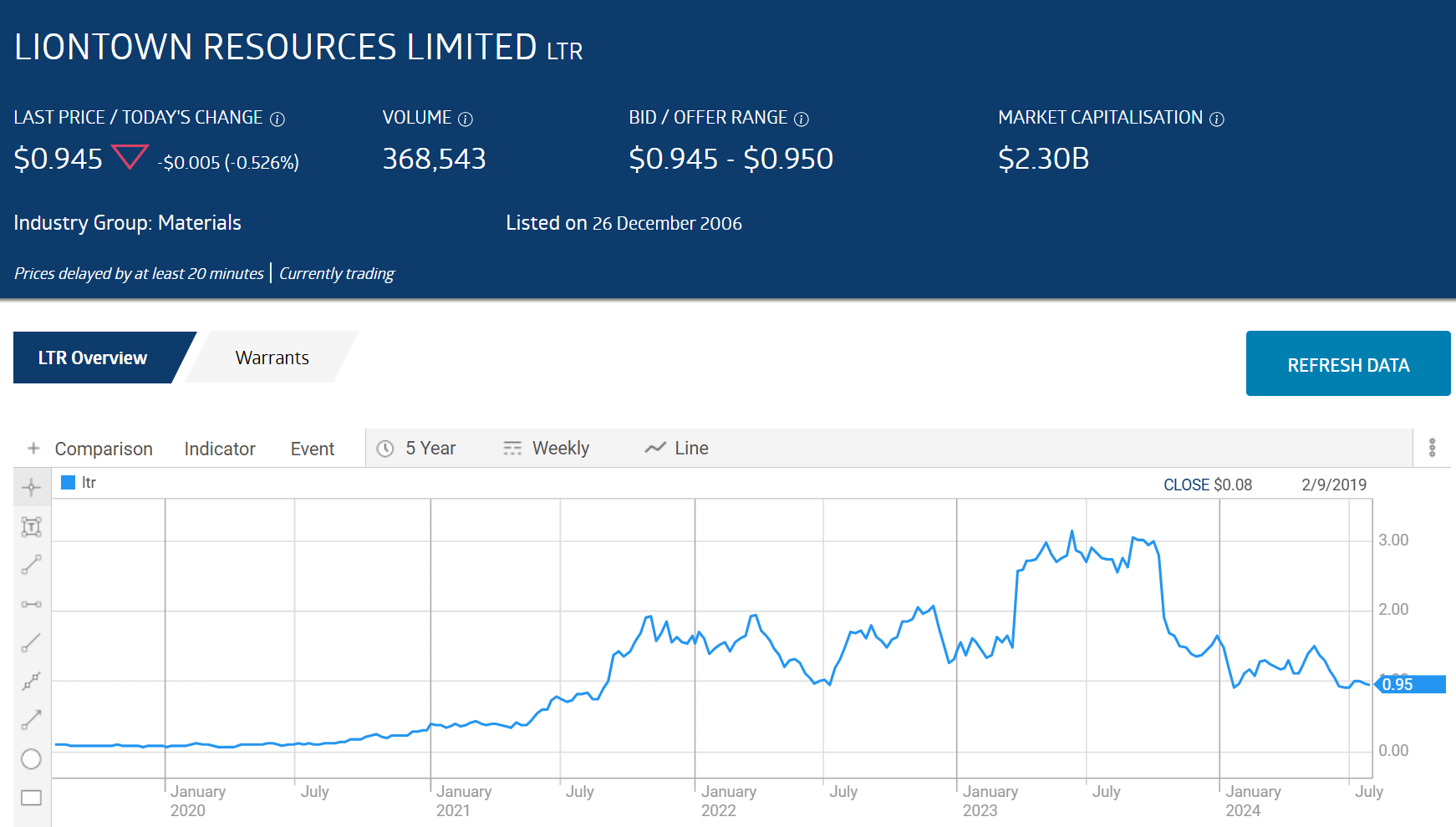

Over five years Liontown share price is up 850%, but has dropped 65.4%, year over year. Albemarle’s strong interest in the company screams “buying opportunity” for risk tolerant investors. The share price followed the price of lithium down in response to an oversupply condition, with many experts believing it will correct by 2027.

Source: ASX

The Wall Street Journal has a HOLD rating on Liontown shares, with 2 analysts at BUY, 1 at OVERWEIGHT, 1 at HOLD, and 1 at UNDERWEIGHT.

Chalice Mining (ASX: CHN)

Chalice Mining’s flagship asset is its wholly owned Gonneville PGE-Nickel-Copper-Cobalt Project in Western Australia.

On 3 July, the company announced a strategic Memorandum of Understanding (MOU) with Japan’s Mitsubishi Corporation for collaboration on technical, financing, marketing, and offtake aspects while the pre-feasibility study (PFS) is in progress.

Gonneville will be a world class asset – reportedly the largest palladium/nickel/copper/cobalt project in the Western World but Chalice is still in the pre-feasibility stage of development, pushing commencement of production years ago.

Chalice Mining is on the ASX Top Ten Shorted Stocks list.

The Wall Street Journal has an OVERWEIGHT rating on Chalice Mining shares, with 4 analysts at BUY, 1 at OVERWEIGHT, 8 at HOLD, 2 at UNDERWEIGHT, and 1 at SELL.

DevEx Resources

Tim Goyder is the majority shareholder of the company at 17% and the Chairperson of the Board. In early April of 2024 he added 2 million shares to his holdings.

DevEx is focusing on the Nedbalek Uranium Project, located within the Alligator Rivers Uranium Province in the Northern Territory. The Nedbalek has a history of production and the DevEx drilling campaign there is ongoing. The company has two additional exploration assets – the Murphy West Uranium Project in the Northern Territory and the Kennedy REE (rare earth elements) Project in Queensland.

Over five years the DevEX Resources share price is up 273.1%. Year over year the share price is down 26.4%, as of intraday 30 July.

Source: ASX

Strike Energy (ASX:STX)

Goyder served as Chairperson of Strike Energy for six years, ending in 2018.

Strike has a portfolio of natural gas assets in the Perth Basin, with final investment decisions (FID) underway for the West Erregulla Gas Field and the South Erregulla Power Project.

Strike has begun production at its Walyerling Project, transitioning from exploration to production. The company has additional gas assets in the Perth Basin in exploration status, along with a geothermal asset.

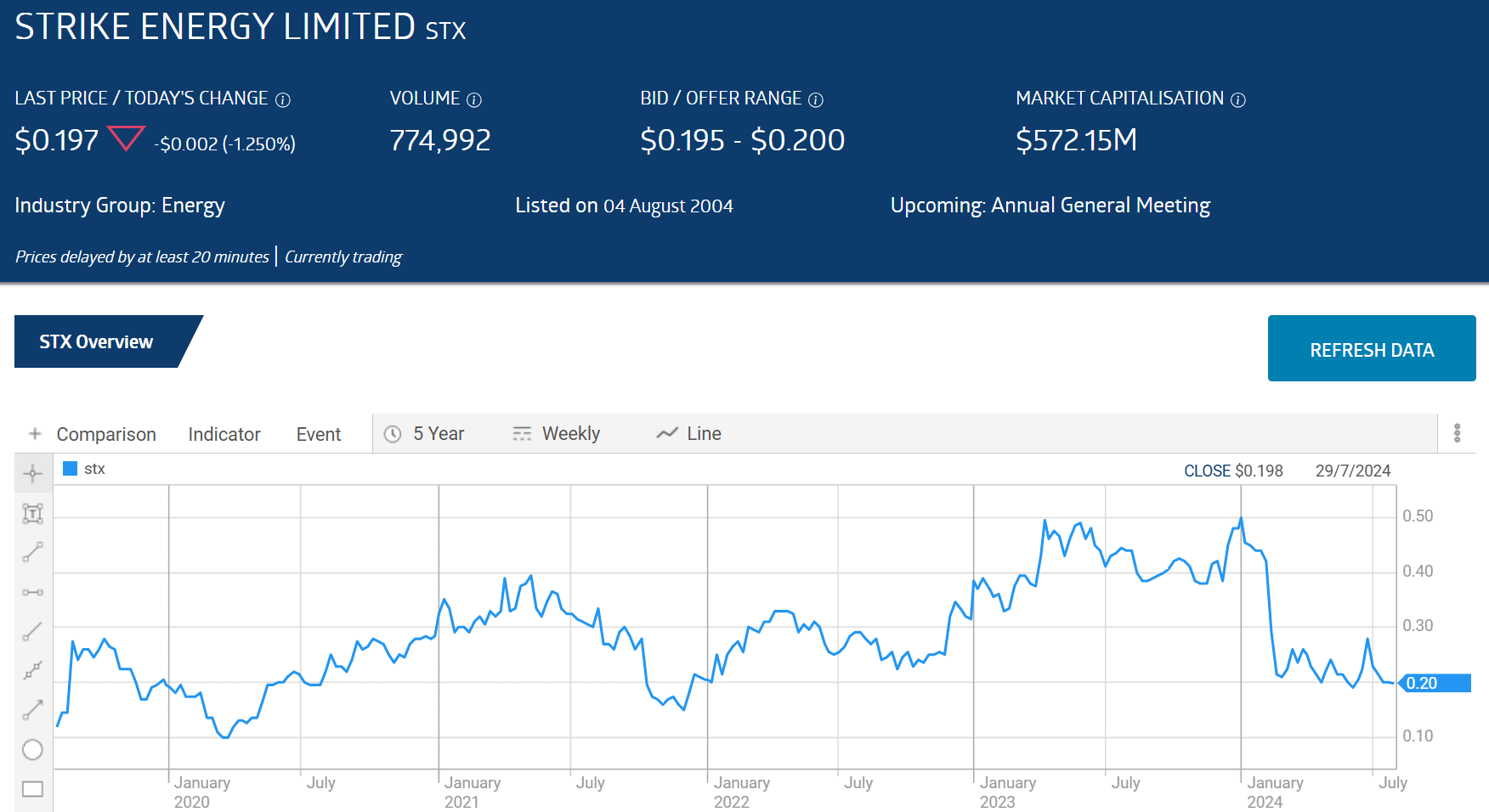

Over five years the Strike Energy share price is up 219.1%. Year over year the share price is down 55.6%, as of intraday 30 July.

Source: ASX

The Wall Street Journal has an OVERWEIGHT rating on Strike shares, with 3 analysts at BUY, 3 at OVERWEIGHT, and 2 at HOLD.

Battery Minerals (ASX: BAT) now Waratah Mining (ASX: WTM)

Tim Goyder owns a 7.26% interest in Waratah Mining, with a December of 2023 investment along with Stuart Tonkin of ASX listed gold miner Northern Star Resources (ASX: NST).

Waratah has three assets in development – the Stavely-Stawell Gold/Copper Project and the Azura Copper Project, both in Western Australia. Its latest asset is the Spur Gold/Copper Project, acquired in December of 2023.

The Spur acquisition and the name change reflects the company’s strategy of focusing on developing both its copper and gold resources. Speculation is that the copper focus prompted the investment from Tim Goyder and Stuart Tonkin.

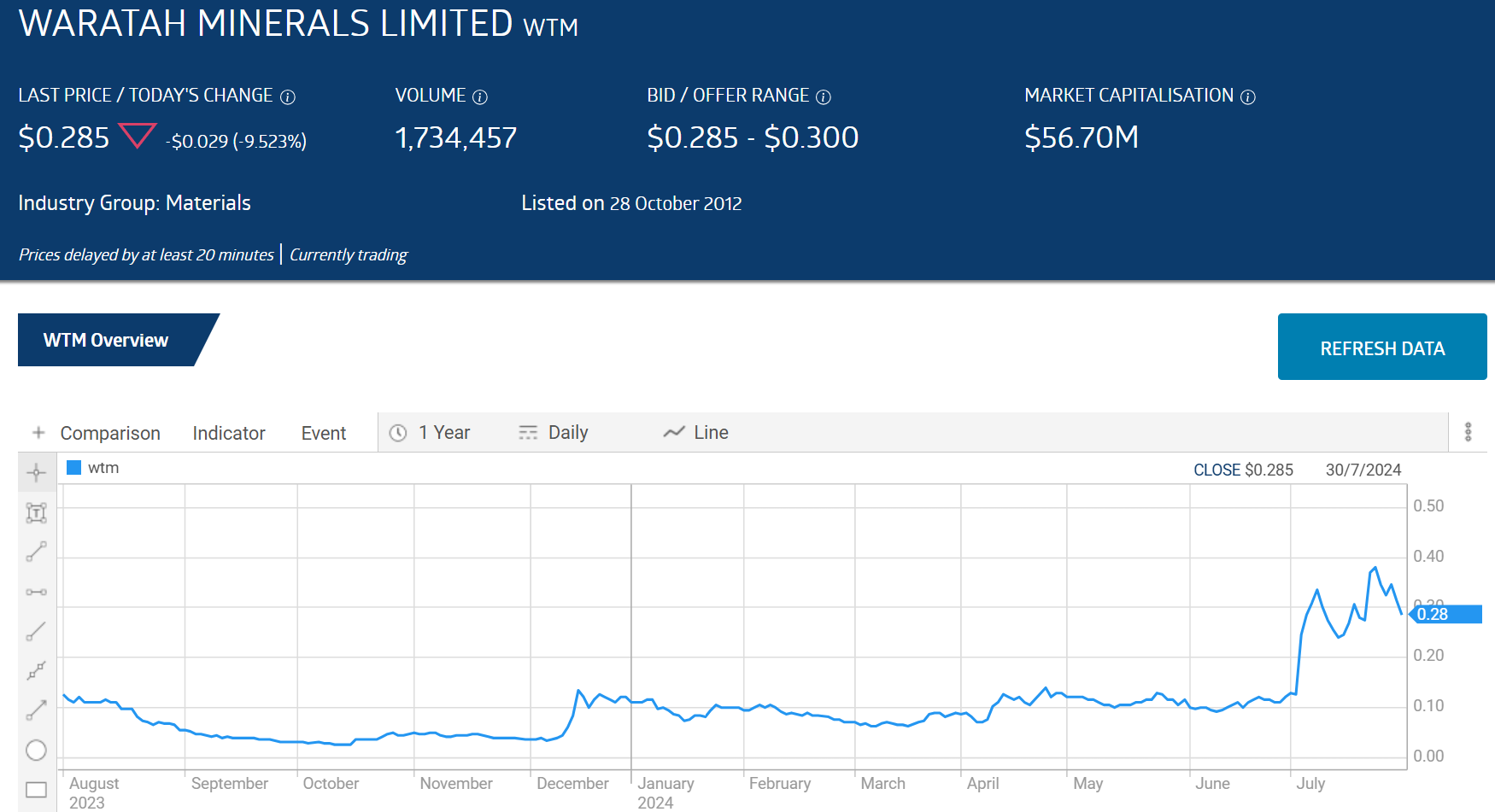

Year over year the Waratah share price is up 119.2%, as of 30 July.

Source: ASX

The Wall Street Journal is reporting a single analyst with a HOLD recommendation on Waratah shares.

Tim Goyder’s long history of involvement in the mining industry has vaulted him into billionaire status. He is joining the ranks of well-known Australian mining gurus Gina Rinehart and Andrew Forest.

Goyder has an eye for junior miners in early exploration and development stages. His most notable holdings are Liontown Resources and Chalice Mining. He also has interests in uranium and rare earth element miner DevEx Resources, natural gas developer/producer Stike Energy, and copper/gold miner Waratah Mining, formerly Battery Minerals.