Uranium Powered Nuclear Reactors Are Back in the Energy Mix

The Fukushima nuclear reactor disaster in 2011 crushed the future of nuclear energy. Governments cancelled plans to build new reactors and looked to phasing out existing nuclear energy reactors. Miners shuttered uranium mines around the world, putting them into “care and maintenance’ status.

Fukushima brought back memories of the near-catastrophic consequences of the Chernobyl nuclear reactor meltdown in April of 1986.

More than a decade later nuclear energy is back in the mix of power sources, pushed there by an energy crisis arising from the war in Ukraine. In addition, governments who had committed to ambitious reductions in fossil fuel powered electricity generators began to question the feasibility of meeting those goals without nuclear energy.

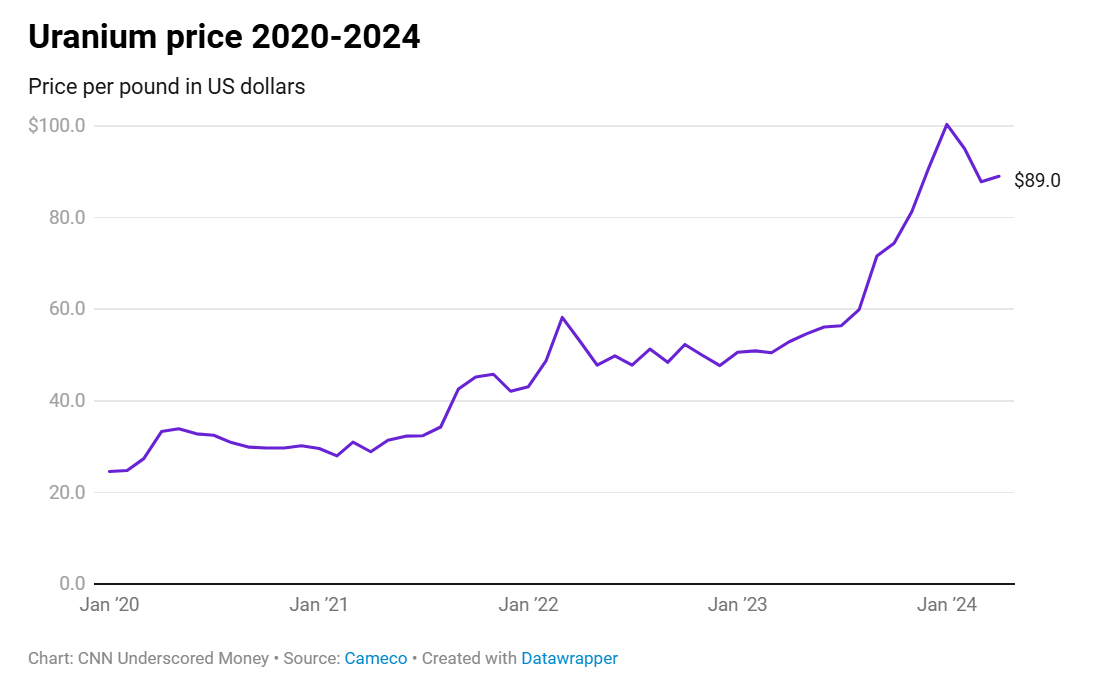

Uranium mines are reopening and the price of uranium is at decade highs.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What is Uranium and What Is It Used For?

Uranium is a chemical element typically found in rock formations. While uranium is used in some medical treatments and industrial hydrogen production and heat applications, its primary use is as a fuel, powering nuclear energy producing reactors and a variety of military applications.

Uranium is mined both from open pit and underground mines. The extracted ore must be processed to separate the uranium from the ore.

According to commodity.com/energy/uranium, 47% of the world’s uranium comes from open pit and underground mining while 48% comes from a more environmentally friendly method – in situ mining. In-situ mining involves injecting oxygen infused water into uranium bearing sites, which dissolves the uranium from the rock to be pumped to the surface for further processing.

What Drives Uranium Prices?

Like any commodity, the price of uranium follows the laws of supply and demand. When demand for the commodity exceeds available supply, the price will rise. So, what then drives demand?

First and foremost is the direct demand for the commodity, coupled with availability of supply and existing inventories of supply. Macroeconomic factors play a role as well. New technologies can play a role as well, with the attraction of newer, smaller, modular nuclear reactors.

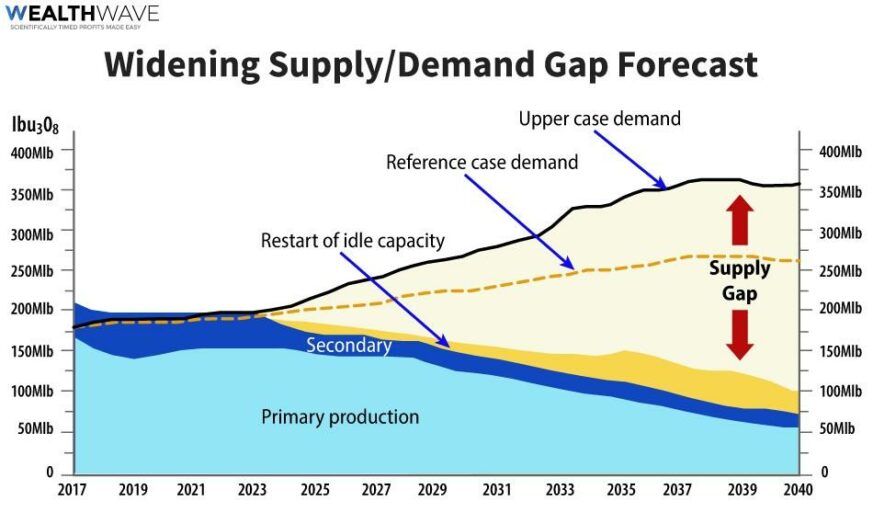

Imbalances drive prices up where supply is insufficient to meet demand and drive prices down when supply exceeds demand. There are experts predicting significand demand/supply imbalances in the near future.

Source: World Nuclear Association/Deep Yellow

Uranium Stocks on the ASX

Australia ranks fourth in a list of the world’s top producing countries, led by Kazakhstan producing about 43% of total global supply of uranium. Second is Namibia at 12% followed by Canada at 10% and Australia at 9%.

BHP Group (ASX: BHP)

The ASX boasts a significant existing uranium producer and several development stage and early producing miners. For risk averse investors, BHP’s massive Olympic Dam mining complex in South Australia produced 3,406 tonnes of uranium in FY 2023, a year over year increase of 43%. BHP now accounts for 7% of global uranium production. Yet uranium revenues rank low in BHP operations, dominated by iron ore and copper. Experts tell us the untapped uranium reserves at Olympic put BHP in a strong position to expand its place in the global uranium supply. The Australian government claims Olympic Dam holds “26% of the world’s low-cost uranium resources and is the world’s largest uranium deposit”. The company is already the largest uranium producer in Australia. However, the Australian government appears cool towards including nuclear energy in the mix here, pushing other renewable energy sources.

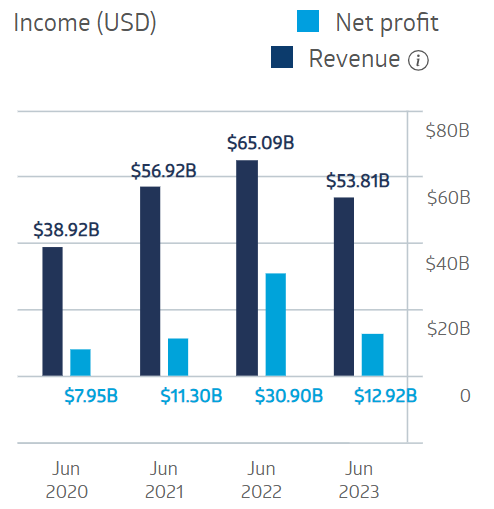

The global slump in commodity prices in FY 2023 interrupted BHP’s string of three consecutive fiscal years of rising revenues and profits.

BHP Group Financial Performance

Source: ASX

The Half Year 2024 results saw revenues fall 16% and net profit after tax down 32%.

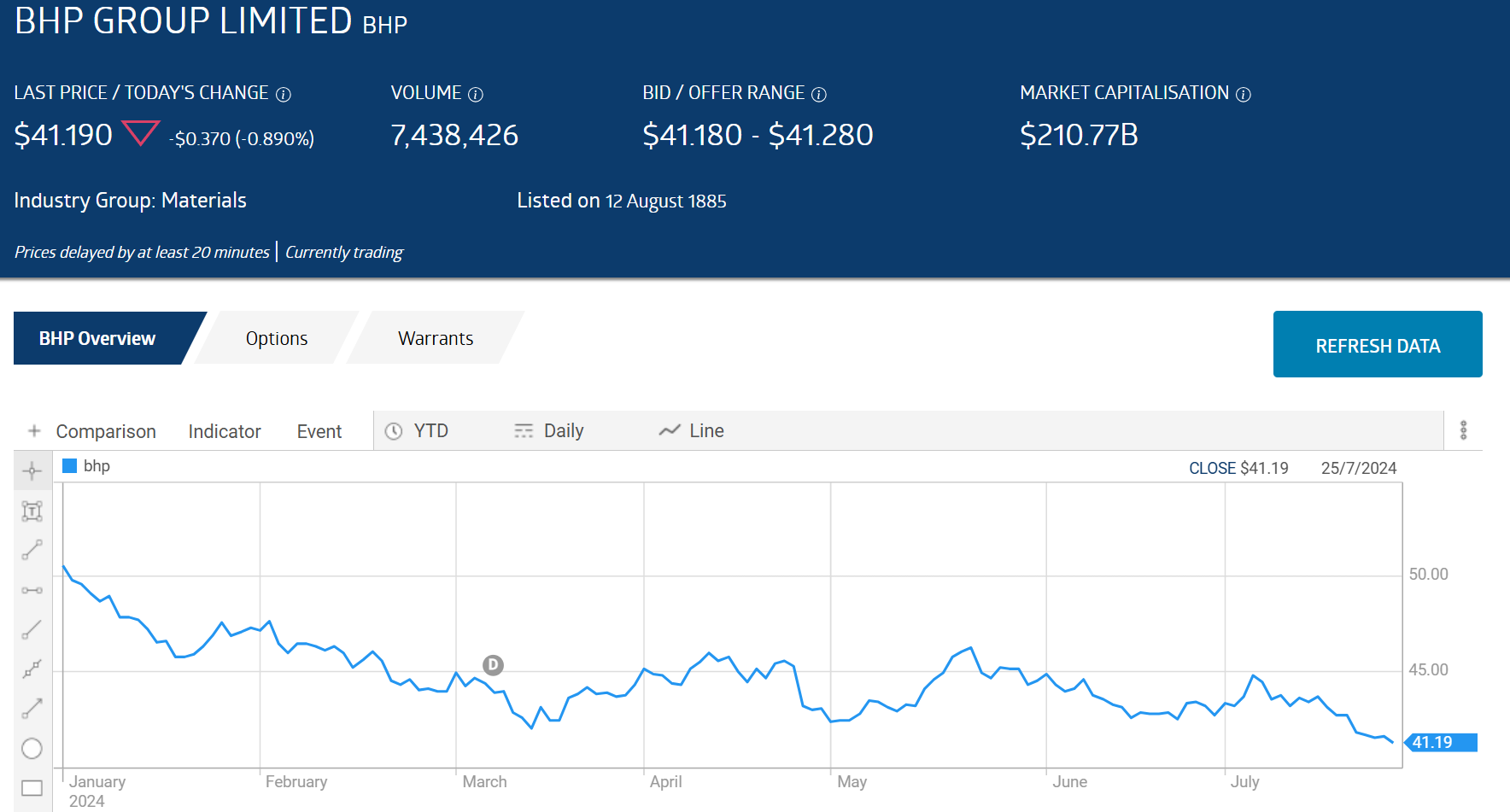

With a Price to Earnings (P/E) ratio of 12.75 against an index average P/E of 20.16 and a P/EG ratio of 0.50, BHP could be considered a “bargain stock.” The Price to Earnings Growth ratio uses forecasted future growth in earnings as opposed to historical earnings in the traditional P/E ratio.

BHP’s share price performance year to date – down 18% — suggests a possible buying opportunity.

Source: ASX

The Wall Street Journal has an OVERWEIGHT rating on BHP shares, with 7 analysts at BUY and 17 at HOLD.

Marketscreener.com has an OUTPERFORM rating on BHP, with 4 analysts at BUY, 2 at OUTPERFORM, and 14 at HOLD.

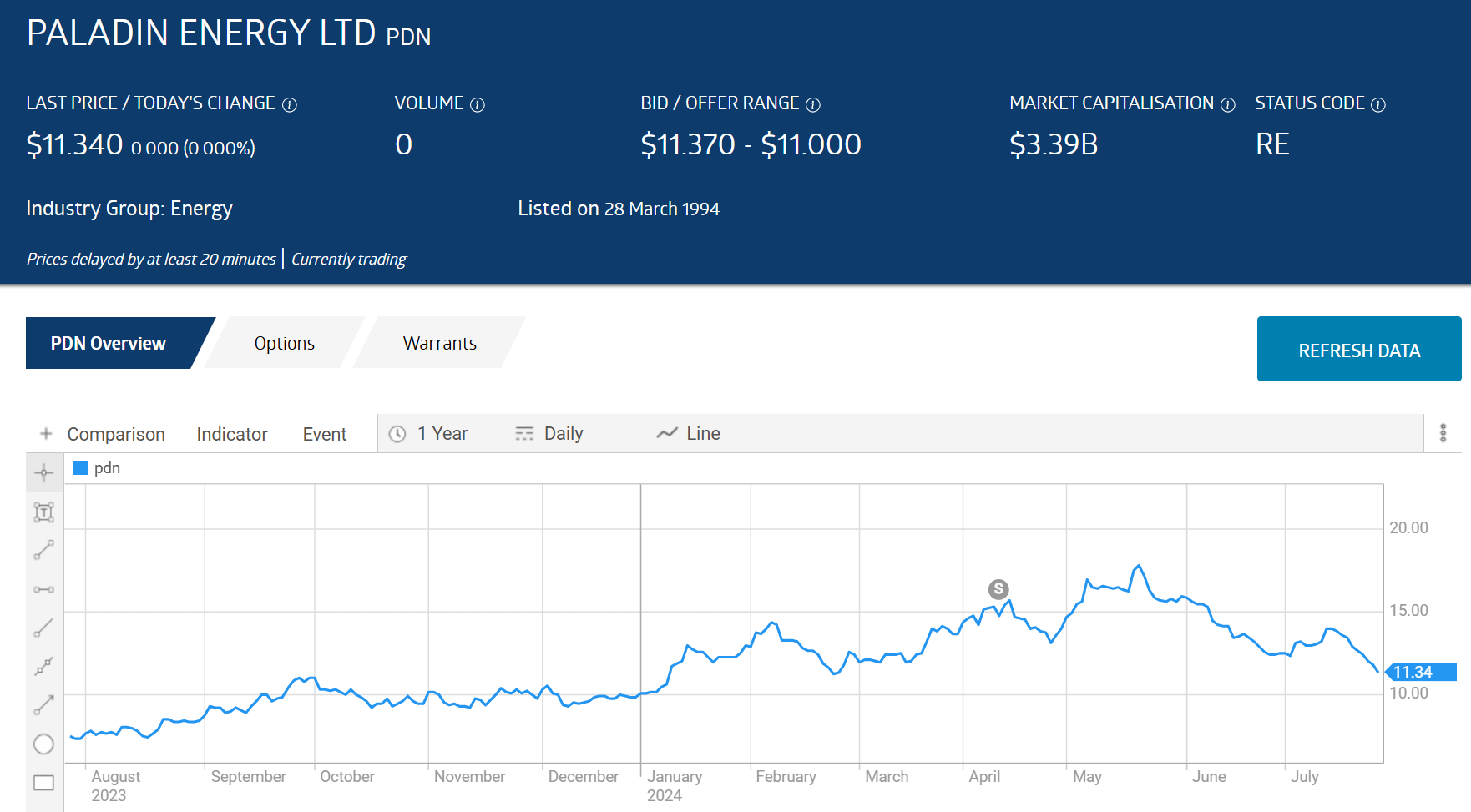

Paladin Energy (ASX:PDN)

Paladin’s flagship asset is its 75% ownership in the Langer Heinrich Mine in Namibia, Africa, with the Namibian government holding 25%. The company made the decision to take the mine out of care and maintenance status. Langer Heinrich is considered a “world class” tier one long-life operation. On 30 March, commercial production began at the mine.

On 24 June Paladin acquired TSE listed (Toronto Stock Exchange) Fusion Uranium Corporation, a uranium explorer. Paladin has a uranium exploration asset in Canada.

Year over year the Paladin share price is up about 48%, and down about 14% over the last three months.

Source: ASX

Marketscreener.com has a BUY rating on Paladin shares, with 7 analysts at BUY and 1 at OUTPERFORM.

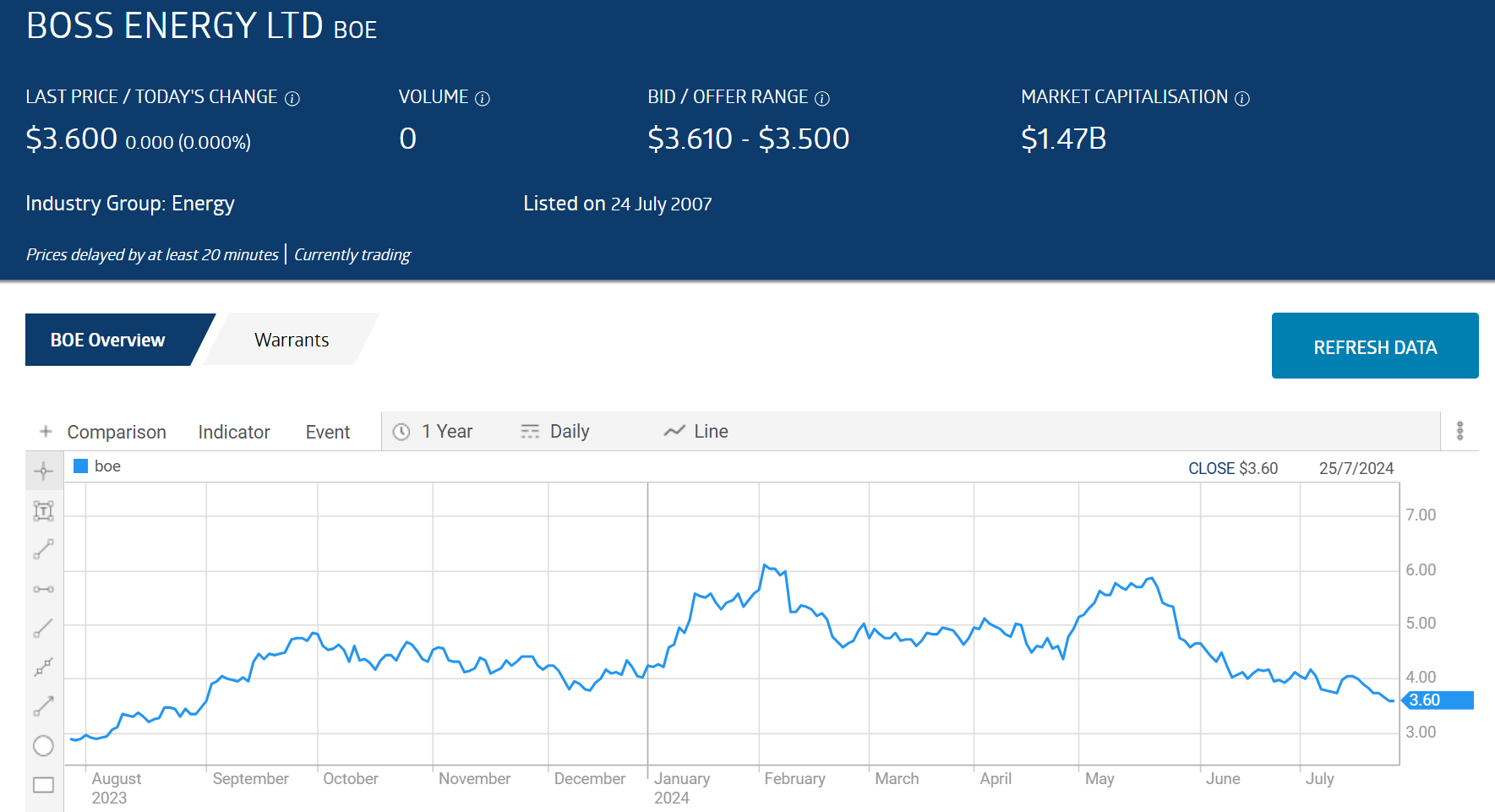

Boss Energy (ASX: BOE)

Boss Energy is another mining company bringing a shuttered uranium mine back to life – the Honeymoon Uranium Project in South Australia.

On 4 July, the company announced its first shipment of uranium trioxide to European nuclear utilities. Honeymoon produced 57,364 pounds of uranium by 30 June of 2024, with construction in the project continuing. By FY 2026 the company expects Honeymoon to produce 1.63 million pounds.

Boss holds a 30% interest in the Alta Mesa Project, an in-situ uranium operation in the US state of Texas, now in production. The majority owner is Nasdaq listed enCore Energy Corporation.

Boss is also developing the Gould Dam satellite deposit, intended to ramp up production at Honeymoon.

Year over year the Boss Energy share price is up 23.2%, with the share price dropping in tandem with a uranium price drop beginning in late May. Over five years the share price is up more than 8,000%, rising from penny stock status trading around $0.05 per share to $3.60, as of 25 July of 2024.

Bargain hunters should take note – the stock price has dropped 21.9% over the past month.

Source: ASX

The Wall Street Journal has an OVERWEIGHT rating on Boss shares, with 4 analysts at BUY and 3 at HOLD.

Marketscreener.com has an OUTPERFORM rating on BOE, with 3 analysts at BUY, 1 at OUTPERFORM, and 3 at HOLD.

Deep Yellow Limited (ASX: DYL)

In FY 2023 Deep Yellow was the best performing energy share on the ASX. The company is somewhat unique in that it is developing two large scale simultaneously – the flagship Tumas Uranium project in Namibia and the Mulga Rock Uranium Project in Western Australia.

Deep Yellow made the bold claim at an investor conference that the production capacity of its assets would make the company the largest pure play uranium producer on the ASX, producing more than 7 million pounds of uranium per year.

The DFS (definitive feasibility study) for Tumas revealed a mine life up to 30 years, and production of 3.6 million pounds of U308. Deep Yellow has named Ausenco Services as its preferred EPCM (engineering, procurement, construction, and management) contractor for the Tumas project. Deep Yellow has a 20 year mining license for the project.

There are two targeted mining operations within the Mulga Rock Project – Alligator River and Omahola Basement. The DFS for Mulga Rock is under revision to “improve project economics.” Deep Yellow expects production to commence at Tumas in 2026 and 2028 at Mulga Rock.

Year over year the Deep Yellow share price is up 67.3%. Over five years the share price is up 260.9%. Over the last month, the price has dropped15.3%.

The Wall Street Journal has an OVERWEIGHT rating on Deep Yellow shares, with 2 analysts at BUY and 1 at HOLD.

Marketscreener.com has a BUY rating on DYL, with 3 analysts at BUY, 1 and 1 at HOLD.

Lotus Resources ( ASX: LOT)

Lotus acquired the shuttered Kayelekera uranium mine in Malawi from Paladin Energy. Lotus owns 85% of the project with Malawi government controlling 15%.

In 2022 Lotus completed a DFS to restart the mine. The company has both a mining license and environmental permits in place, with project planning in the final phase.

Lotus has another asset – the Letlhakane Uranium Project in Botswana, Africa. Letlhakane is one of the largest undeveloped uranium projects, according to the company. Drilling is underway at Letlhakane.

Year over Year the Lotus Resources share price is up 41%. Over five years the share price is up 689.3%. Over the past three months the share price dropped 32.1%.

Source: ASX

The Wall Street Journal has a BUY rating on Lotus shares, with 3 analysts at BUY.

Marketscreener.com has a BUY rating on LOT, with 4 analysts at BUY.

Bannerman Resources (ASX: BMN)

Bannerman Energy is another company touting its flagship Etango Project in of Namibia as “world class” based on mineral resource endowment of 207 million pounds of U3O8 based on previously completed DFS in 2012 and 2015. The project is licensed and fully permitted.

Bannerman now has both FEED (front end engineering design) and CBE (cost base estimates)

studies in place, as well as a scoping study completed in February of 2024. A final investment decision (FID) on the project is expected later in 2024. Production could begin in mid-2027.

Year over year the Bannerman Resources share price is up 71.1%. Over five years the share price rose 506.6%. The Bannerman share price is down 25.4% over the last three months.

Source: ASX

The Wall Street Journal has an OVERWEIGHT rating on Bannerman shares, with 3 analysts at BUY.

Marketscreener.com has a BUY rating on BMN, with a single analyst at BUY.

ASX listed uranium miners are bringing mines shuttered following the Fukushima nuclear disaster back into production. Demand for nuclear energy is rising, following the energy crisis resulting from the war in Ukraine, coupled with governments realizing ambitious clean energy goals could not be met without nuclear energy.

Some experts speculate that the recent downturn in uranium prices could reflect market concerns that the rush of uranium miners reopening shuttered mines could lead to a supply/demand imbalance.