Jabin Hallihan, Auburn Capital

BUY RECOMMENDATIONS

BUY – Iluka Resources (ILU)

ILU is a global critical minerals company and a leading producer of zircon and high-grade titanium dioxide feedstocks. ILU is set to become a material supplier of separated rare earth oxides. Supported by a robust balance sheet and strategic expansion, ILU is resilient. In our view, ILU is trading at a significant discount to fair value.

BUY – Bank of Queensland (BOQ)

While reporting a fall in cash earnings after tax and total income in the first half of fiscal year 2024, the result was better than many investors expected. While challenges persist, including addressing softer net interest income and margins in the first half, we believe BOQ stands to benefit from anticipated interest rate cuts and loan re-pricing. Low unemployment and a robust housing market paint a brighter outlook. We retain an accumulate recommendation.

HOLD RECOMMENDATIONS

HOLD – South32 (S32)

Investors reacted positively to the diversified miner’s latest update. Aluminium production increased by 1 per cent for the fiscal year to date, as Hillside Aluminium achieved record production. South Africa Manganese delivered a production increase of 8 per cent. S32 also announced it would sell Illawarra Metallurgical Coal for up to $US1.65 billion, which will unlock capital and enable S32 to invest in other base metals projects.

HOLD – Challenger (CGF)

Challenger is an investment management firm. Group assets under management of $124 billion in the third quarter of fiscal year 2024 were up 6 per cent. The company generated strong lifetime annuity sales year-on-year. The company upgraded normalised net profit before tax guidance to the top end of the fiscal year 2024 range of between $555 million and $605 million.

SELL RECOMMENDATIONS

SELL – HUB24 (HUB)

HUB24 operates an investment and superannuation platform. The company reported total funds under administration of $100 billion at March 31, 2024, up 30 per cent on the prior corresponding period. Sustaining platform net inflows at existing levels will be a challenge in a competitive environment. In our view, the shares are trading at a premium and leave little or no room for error.

SELL – National Australia Bank (NAB)

The NAB’s share price has risen from $26.37 on June 30, 2023, to trade at $34.14 on April 24, 2024. In our view, the shares are fully priced and exposed to any softening in the economy. To mitigate risk, investors may want to consider trimming their portfolios. The first quarter 2024 update appeared to lack appealing catalysts to drive the share price higher in the short term. Please note that Bank of Queensland (BOQ) is recommended as a buy and a sell this week as sharemarket experts offer different views about the company’s outlook.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

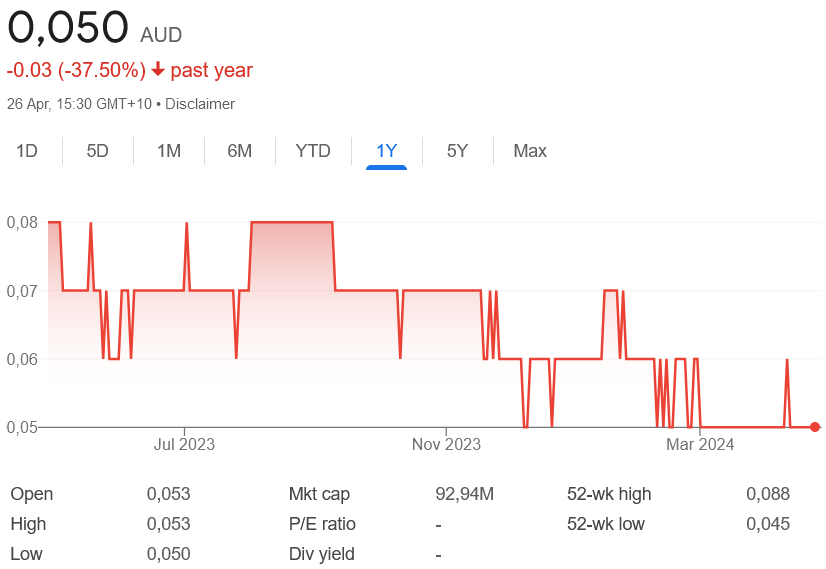

BUY – Hammer Metals (HMX)

The share price of this mineral explorer recently rallied after announcing it was selling a 70 per cent interest in three sub blocks at Mount Hope for up to $20 million. This frees up cash for Hammer to intensify drilling, with a view to increasing its Mount Isa regional copper resource. If the stock moves near 6 cents, buyer momentum could push HMX towards 10 cents. The shares were trading at 4.5 cents on April 24. Hammer is a speculative buy.

BUY – Cobre (CBE)

CBE is a resources exploration company with prospective projects in Botswana and Western Australia. The shares rose from 5.4 cents on March 28 to 8.2 cents on April 10. The shares were trading at 7.2 cents on April 24. Recent news the company was starting a diamond drilling program at its Okavango copper project in Botswana was a trigger behind the recent rally. In my view, an uptrend may emerge if the stock trades above 10 cents a share. CBE is a speculative buy.

HOLD RECOMMENDATIONS

HOLD – EQ Resources (EQR)

EQ Resources is a tungsten producer. It has mining activities in Australia and Spain. The company recently announced its Mt Carbine operation in north Queensland produced record tungsten concentrate in the third quarter of fiscal year 2024. Third quarter tungsten output at Mt Carbine was up 38 per cent on the prior quarter. According to our technical analysis, we expect the share price to move higher from here.

HOLD – Capricorn Metals (CMM)

The gold company recently announced a 26 per cent increase in the ore reserve estimate at the Mt Gibson Gold Project. The ore reserve grew to 1.83 million ounces at the Western Australian project. I expect this company to attract new buyers in response to a stronger gold price. The shares have risen from $4.25 on February 14 to trade at $5.05 on April 24.

SELL RECOMMENDATIONS

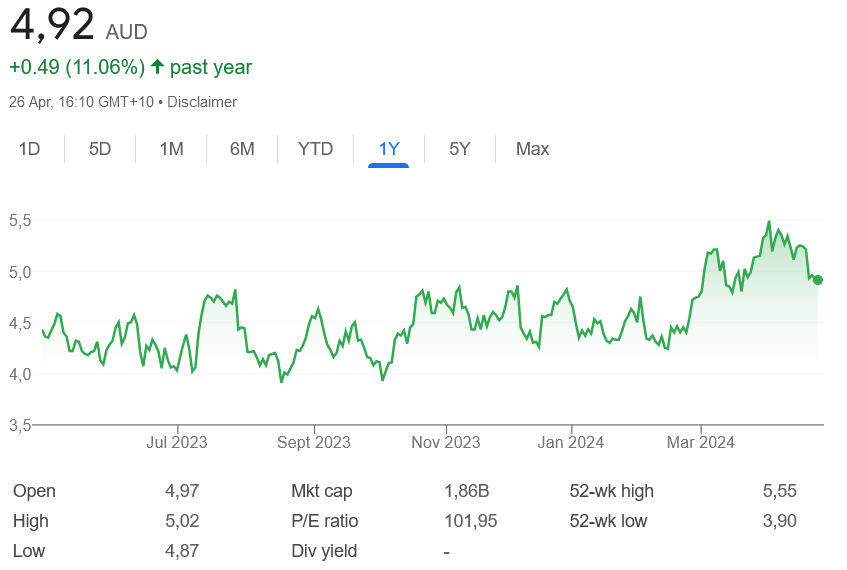

SELL – HUB24 (HUB)

This investment and superannuation platform operator posted a strong third quarter result in fiscal year 2024. The company delivered record platform net inflows of $3.5 billion, while total funds under administration reached $100 billion at March 31, 2024. The total number of advisers using the platform was up 17 per cent on the prior corresponding period. The share price has risen from $28 on April 26, 2023, to trade at $40.73 on April 24. In my view, the shares are expensive, so investors may want to consider taking a profit.

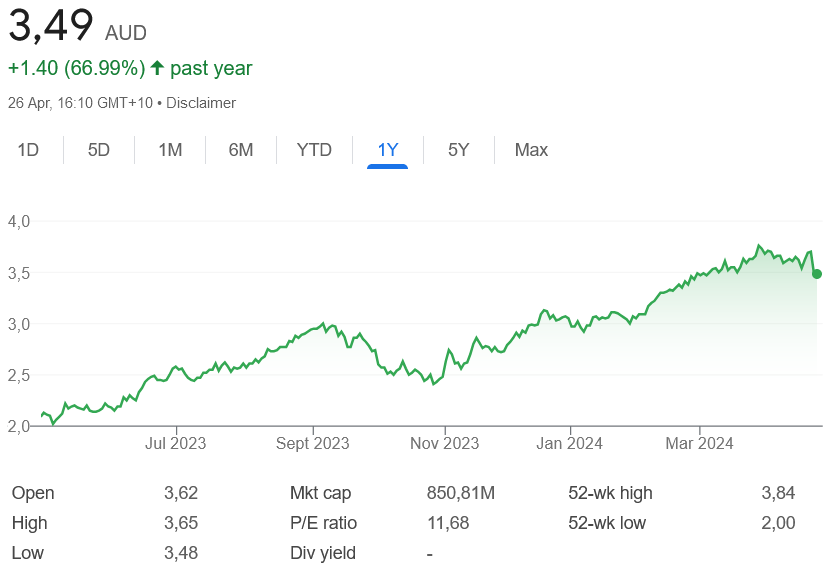

SELL – FleetPartners Group (FPR)

FPR provides vehicle leasing, fleet management, heavy commercial vehicles and salary packaging services. It operates in Australia and New Zealand. The shares have risen from $2.08 on April 26, 2023, to trade at $3.72 on April 24, 2024. In my view, the shares have risen too rapidly and are trading in extended territory. Investors may want to consider cashing in some gains.

Damien Nguyen, Morgans

BUY RECOMMENDATIONS

BUY – BHP Group (BHP)

This quality miner recently announced it was on target to meet copper, iron ore and energy coal production for the full year. Total copper production increased by 10 per cent for the nine months ending March 31, 2024. The average realised price was up 5 per cent. An effective strategy combined with competent and experienced management paints a bright outlook.

BUY – CSL (CSL)

The blood products group’s first half results in fiscal year 2024 were broadly in line with expectations. Total revenue of $US8.053 billion was up 12 per cent on the prior corresponding period. Reported net profit after tax of $US1.901 billion from ordinary activities was up 17 per cent. Unmet demand across all divisions provides confidence that management is likely to achieve double-digit earnings growth over the medium term. Our 12-month price target is $315.40. The shares were trading at $281.95 on April 24.

HOLD RECOMMENDATIONS

HOLD – Rio Tinto (RIO)

Production of bauxite, aluminium and mined copper in the first quarter of 2024 were up on the prior corresponding period. Pilbara iron ore production and shipments in the first quarter declined on the same period in 2023. However, the company retained full year guidance for its products. This mining giant appeals, particularly in uncertain times, given diverse operations and multiple revenue streams.

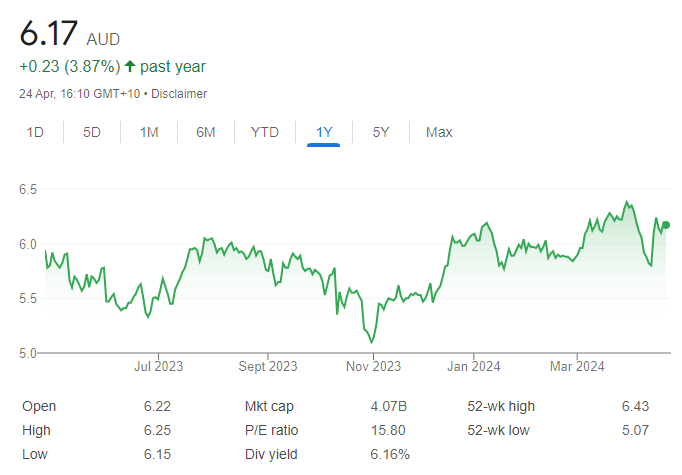

HOLD – National Australia Bank (NAB)

The bank reported December quarter lending balances rose by 1 per cent. The company generated growth in Australian home lending and small to medium enterprise business lending. Customer deposit balances grew across both business and private banking and personal banking. The shares have risen from $30.59 on January 3 to trade at $34.14 on April 24. Keep an eye on company updates.

SELL RECOMMENDATIONS

SELL – Orora (ORA)

ORA is a solid defensive business. However, this packaging giant recently reduced earnings guidance for fiscal year 2024. Revised group earnings before interest and tax, excluding the Saverglass acquisition, is forecast to range between $307 million and $317 million compared to $320.5 million in full year 2023. The company also reduced forecast EBITDA for the Saverglass acquisition. We remain cautious until the group can show an improvement in underlying performance.

SELL – Bank of Queensland (BOQ)

Cash earnings after tax of $172 million in the first half of fiscal year 2024 were down 33 per cent on the prior corresponding period. The fall was driven by a 13 per cent reduction in net interest income amid 6 per cent growth in operating expenses. The fully franked interim dividend was cut to 17 cents from last year’s 20 cents. In our view, the stock is trading at a premium in a fiercely competitive lending and deposits environment.

Related Articles:

- How to Start Day Trading in Australia

- Auto Trading Platforms in Australia

- The Best Forex Brokers in Australia

- The Best Australian Cryptocurrency Brokers

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.