Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Integral Diagnostics (IDX)

IDX provides medical imaging services across Australia and New Zealand. The company’s hub and spoke model generates efficiencies. The diagnostics sector has long-term appealing trends given an ageing population and patients returning for medical examinations and treatments.

AIC Mines (A1M)

AIC Mines is a new copper producer after acquiring the Eloise mine. It has the capacity to produce between 45,000 and 50,000 tonnes of copper and gold concentrate a year. Current mine life is about eight years. AIC continues to improve near-mine ore deposits, adding more value to the Eloise acquisition.

HOLD RECOMMENDATIONS

QBE Insurance Group (QBE)

QBE has the capacity to navigate a turbulent claims environment. Revenue for the half year to June 30, 2022 rose 26 per cent to $US11.538 billion on premium increases. Net profit fell 66 per cent to $US151 million. We expect investment income to improve, following an increase in running yield from 0.68 per cent to 2.49 per cent.

Orora (ORA)

To offset inflation, rising input costs and margin pressure, this packaging giant raised prices on numerous occasions in North America to support revenue growth. Orora’s higher prices hardly impacted sales volumes, which is a sign of pricing power and resilient consumer demand.

SELL RECOMMENDATIONS

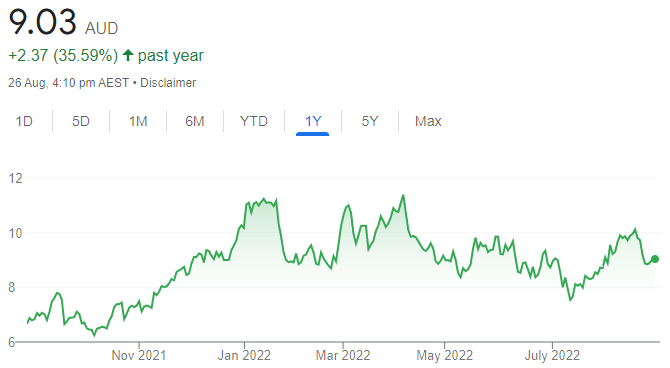

Lynas Rare Earths (LYC)

The share price of this rare earths producer has benefited from rising prices. Lynas produced 15,263 tonnes of rare earth oxide in fiscal year 2022, down 7 per cent on 2021. Cash costs jumped by 35 per cent to $341 million. Pressure on margins is increasing, as rare earth prices ease and inflationary forces persist.

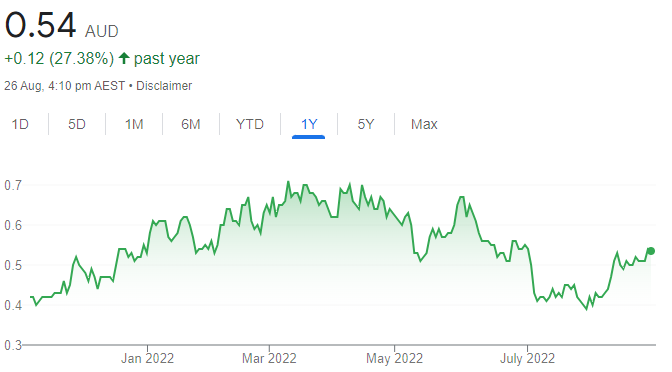

Australian Pacific Coal (AQC)

The company has received a non-binding indicative proposal from M Resources to acquire 100 per cent of AQC shares via an off-market takeover bid. The company is considering the proposal released to the market on August 25. Investors reacted positively to the news, with the share price closing at 36.5 cents on August 25. Investors may want to consider cashing in some gains.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

Rio Tinto (RIO)

Some investors may have been disappointed with the conservative interim dividend of $US2.67 a share. But the global miner has a top core business with excess cash on its balance sheet. We see greater investor returns at the full year result. In our view, recent share price weakness presents a buying opportunity.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Seek (SEK)

This employment and education company delivered better than expected revenue and earnings growth in fiscal year 2022. However, Seek’s share price has recently retreated. The company operates a dominant job advertising site, and we expect it to benefit in an exceptionally tight employment market. A value opportunity exists at these price levels.

HOLD RECOMMENDATIONS

Xero (XRO)

We like the outlook for this accounting software provider. But the recent update was marginally more cautious than we had hoped. Delays in new customer wins have prompted an adjustment to Xero’s UK sales strategy. It may restrain a significant share price recovery until investors see evidence of execution success.

Inghams Group (ING)

Australia’s largest listed poultry producer posted a disappointing full year result in fiscal year 2022, in our view. The company experienced a significant increase in feed and fuel costs. We expect poultry prices and company operations to recover, creating potential for more encouraging news. The stock was recently trading below our fair value, so we suggest holding for now.

SELL RECOMMENDATIONS

Endeavour Group (EDV)

Australia’s dominant liquor retailer and hotel operator offers defensive qualities. Group sales of $11.6 billion in fiscal year 2022 were flat year-on-year. Group earnings before interest and tax of $924 million represented a 2.8 per cent increase on the prior corresponding period. In our view, liquor sales and margins may be impacted by price increases as households tighten budgets. The company is trading above our valuation.

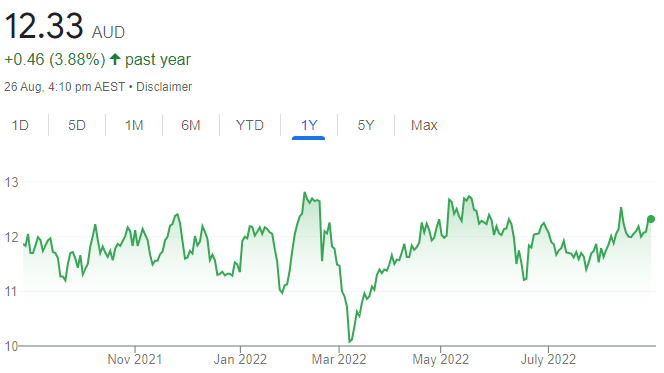

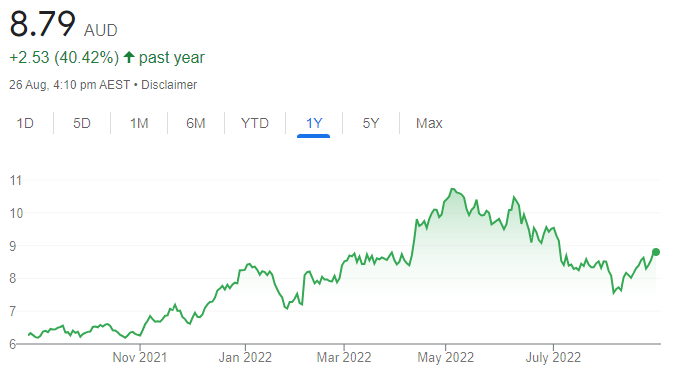

Computershare (CPU)

This share registry and corporate services giant has been a strong performer in the past 12 months. The company benefits from higher interest rates, as revealed in recent results. But other business units have underperformed our expectations, so we see more attractive value elsewhere in the sector.

Layton Membrey, Marcus Today

BUY RECOMMENDATIONS

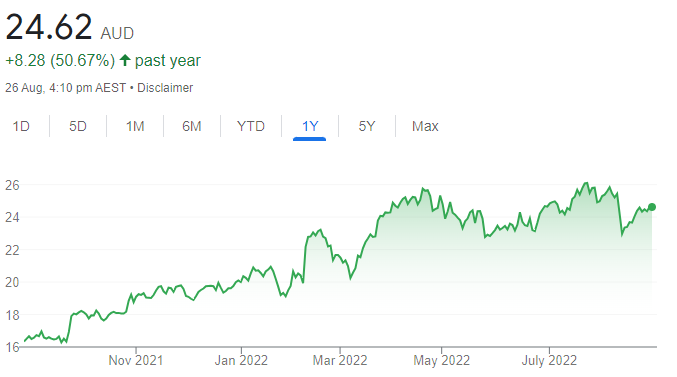

BHP Group (BHP)

The global miner reported a strong 2022 full year result. The outlook is positive. BHP has a strong balance sheet and cash position to chase growth. BHP’s non-binding takeover proposal for OZ Minerals (OZL) at $25 a share was rejected by the OZL board. But the proposal shows BHP has the firepower for suitable acquisitions. Keep an eye on BHP’s news flow.

GrainCorp (GNC)

This diversified Australian agribusiness recently upgraded earnings guidance for the full year ending September 30, 2022. It expects underlying net profit after tax to range between $365 million and $400 million. It was previously forecasting NPAT to range between $310 million and $370 million. GNC is expecting another east coast Australian crop to be above average in fiscal year 2022/23.

HOLD RECOMMENDATIONS

Transurban Group (TCL)

The toll road operator was sold off following its full year result. But we expect a better performance in the shorter term as tolls are linked to inflation. Traffic numbers should continue to rebound from the COVID-19 slump. We believe the company is positioned to grow in the medium to long term.

Credit Corp Group (CCP)

Shares were heavily oversold on full year results, despite the company lifting net profit after tax by 9 per cent and its dividend by 3 per cent. Weaker guidance was behind the price fall, in our view. However, CCP is one of the few companies that’s likely to perform well in an economy under pressure. It has a history of under-promising and over-delivering.

SELL RECOMMENDATIONS

Redbubble (RBL)

RBL operates a global online market connecting independent artists with customers. In our view, the company was sold down on disappointing full year results. The shares have fallen from $1.495 on August 16 to close at 84 cents on August 25. Tighter discretionary spending paints a challenging outlook.

Kogan.com (KGN)

The online retailer posted a $35.5 million statutory loss in fiscal year 2022. This compares with a $3.5 million profit the prior year. Revenue fell 8 per cent on the prior year to $718.5 million. The shares have fallen from $4.70 on July 28 to close at $3.53 on August 25. The higher interest rate environment is challenging for shoppers at this point in the cycle.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.