- Atlas Pearls farms South Sea pearls, producing high-end jewelry.

- The company sells finished jewelry online and raw pearls to trade customers at auction.

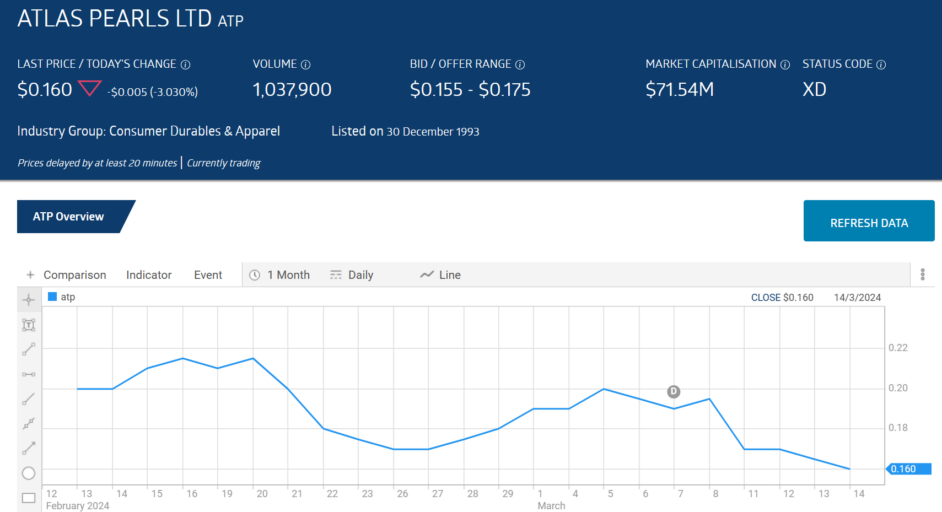

- Following the release of outstanding Half Year 2024 results the surging share price fell.

Atlas Pearls breaks conventional investing wisdom to stay clear of “one-trick-ponies.” The company has a sole source of revenue –South Sea pearls grown and harvested from seven farms sold at auction and processed into high-end jewelry sold online.

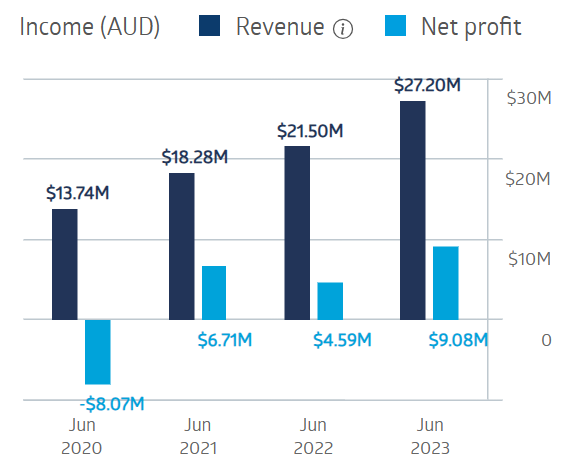

The company has an admirable track record of financial performance over the last four fiscal years, recovering quickly following a loss in the initial onset of the COVID 19 pandemic.

Atlas Pearls Financial Performance

Source: ASX

FY 2023 revenues rose 26% and net profit was up 98%. On 29 February, the company reported its Half Year 2024 Financial Results, exceeding the previous full year’s percentage gains by wide margins. Revenues were up 115% and net profit rose a staggering 452%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Reflecting the better-than-expected financial results, management declared a special dividend of $0.015 per share. The share price rose on the news, only to slide back to below pre-announcement levels within days.

Source: ASX

Year over year the share price is up 433.3%.

Atlas has bargain-basement valuation metrics with a price to earnings ratio (P/E) of 2.79 and a future oriented price to earnings growth ratio (P/EG) of 0.01. P/EGs under 1.0 are considered undervalued.

An analyst at Red Leaf Securities has a BUY recommendation on Atlas Pearls, citing the company’s “better than expected Half Year 2024 financial results and its declaration of a special dividend as a sign of financial strength and confidence in the business, leading to ATP offering potential upside.”

Atlas appears to be under the radar of the majority of the analyst community as sites like marketscreener.com and yahoo finance Australia show no analysts reporting recommendations on ATP.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Related Articles:

- Eight Top ASX Stocks for 2024

- 18 Share Tips: 11th March 2024

- Aussie Dollar Rallies Against USD Amid Uncertain Print

- Apple (NASDAQ:AAPL) Poised to Propel Forward in AI: Shares Up More Than 1% In US AM

- Copper Stocks Shine While ASX 200 Dips Amid Macquarie’s Bank Downgrades

- Australia and New Zealand Banking Group (ASX:ANZ) Displaying a High Yield and Potential for Growth