- Chicken, turkey, and stockfeed producer and distributor Inghams Group’s share price hit a 52 week high on 6 February.

- The company reported blockbuster Half Year 2024 financial results on 15 February.

- A cautionary outlook may have been responsible for a collapsing share price, down double digits in the past month.

Inghams listed on the ASX in 2016, taking its shareholders on a wild ride, with dips worthy of a roller coaster, yet managing a 14..2% increase since it began trading.

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

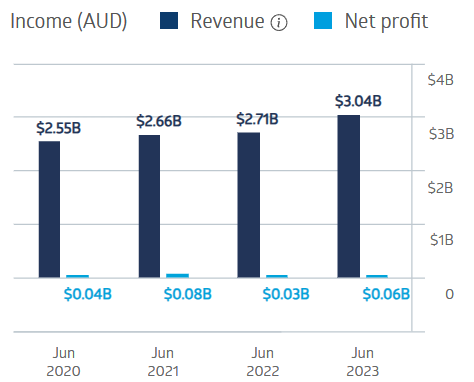

The company’s steady financial performance over the last four fiscal years broke free with a doubling of net profit between FY 2022 and FY 2023. The share price jumped on the news.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Half Year 2024 financial results showed an 8.7% revenue increase and stunning rises in net profit after tax – up 268.6%, and underlying net profit after tax – up 134.2%.

Inghams Group Financial Performance

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Investors ignored the positive performance, driving down the share price 16.4% over the last month following a cautious outlook for the full year.

Inghams Group began paying dividends in FY2018, maintaining dividends during the COVID 19 pandemic. The FY 2023 payment was $0.24 per share. Inghams dividend payments have a five year average dividend yield of 3.73%.

An analyst at Marcus Today has a SELL recommendation on Inghams Group shares, citing “rising costs and net debt reported in the Half Year 2024 results along with challenging market conditions with ongoing inflationary pressures and a continuing shift towards in-home dining.”

Marketscreener.com has an analyst consensus BUY rating on Inghams, with eight of twelve analysts reporting at BUY, one at OUTPERFORM, two at HOLD, and one at UNDERPERFORM.

Yahoo finance Australia also has an analyst consensus BUY rating on ING shares, with one of eight analysts reporting at STRONG BUY, five at BUY, and two at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy