The fascination with the glitter of gold dates back thousands of years. The ancient Egyptian, Greek and Roman civilisations highly prized the metal. Gold was used as a medium of financial exchange in the ancient world, with the first recorded use of gold coins as currency being around 630 BCE in the kingdom of Lydia in Western Turkey.

Gold has long been abandoned as a payment method. However, contrary to some believing gold no longer has any intrinsic value in today’s economies, it remains in demand for use in the manufacture of jewellery, electronics and aerospace components.

In the modern world, gold is seen as an investment vehicle. Many market experts advise investors that gold should form a part of a well-balanced portfolio.

Gold is a popular asset to trade in Australia, and there are multiple ways to invest in the metal.

Why Invest in Gold?

Investors tend to buy gold during recessions, global economic catastrophes, inflation, and a fall in the value of the US dollar – the de facto global reserve currency – against other currencies and at times of geopolitical uncertainty. That is because gold is regarded as a safe haven; it can always be exchanged for goods by its owner and is unaffected by falling currency values.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

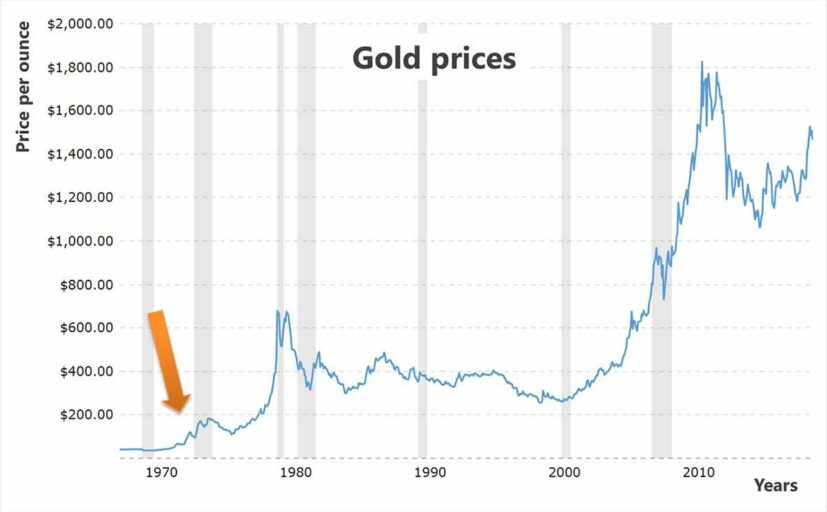

The dramatic shift in the price of gold since 2000 is often explained as a reaction to the fall of the US dollar in 1998. The twenty-first century began with the dot.com bubble in the technology sector and the rise of global terrorism, possibly contributing to a massive bull run in gold.

Price of Gold – 1998 to June 2023

Source: Macrotrends.net 01/06/2023

In February 2022, gold was trading at around $2,000 USD when inflation fears began to ramp up. The question must be asked – why did the price of gold fall while inflation was rising?

Complex factors can influence the price of gold, the main one being rising interest rates. The US Federal Reserve Bank began raising rates to combat inflation, making fixed-interest investments more attractive than non-interest-paying gold. The price of gold is rising once again in 2023.

How to Trade Gold

Investors have multiple choices for how to trade gold in Australia.

First, investors can own physical gold in the form of sovereigns, collectible gold coins, or gold bullion.

Gold coins can be bought directly through gold dealers and some online sites, including eBay and pawnshops. The gold content may be less than in gold bullion bars, and the cost will be higher than with bullion.

Gold bullion can generally be bought from the same sources. The US Mint maintains a list of reputable gold dealers. Storage is an issue, with many dealers offering storage and insurance for your investment for additional costs.

You can also gain exposure to physical gold from ETFs (exchange-traded funds) that track the price of gold. Gold ETFs in Australia include ETF Securities GOLD ETF (ASX: GOLD), with physical gold stored at the JP Morgan Chase vaults in London. Perth Mint Gold (ASX: PMGOLD) backs investments in the fund with gold stored in the Perth Mint.

Investing in the miners that extract gold is another option. Australia has no lack of gold miners, giving investors a choice to invest in individual mining stocks or ETFs containing a basket of mining stocks.

Although not for novice traders due to the risk and exhaustive research requirements, futures and options trading are additional ways to trade gold. Options trading is preferred for most investors since the options contract can be bought or sold, eliminating the requirement for physical possession of the gold at the end of the contract as with futures. Futures and options contracts are derivative investments, allowing investors to achieve higher returns for fewer investment dollars.

Gold trading hours vary by the chosen investment. The Sydney market for spot gold is open from 9:00 AM to 3:00 PM, local time. However, gold is traded in markets worldwide, enabling Aussie investors to trade gold virtually 24 hours a day, five days a week.

What Factors Affect the Price of Gold?

The continual use of the term “safe haven” to describe gold trading can be misleading without considering the complex and often interwoven factors that affect its price. Taken at face value, a simplistic belief in gold as a “safe haven” may have surprised investors watching the price of gold drop while global inflation rose.

Higher interest rates steer investors away from gold towards bonds, high dividend-paying stocks, and bank term deposits.

Gold acts like other commodities – the underlying reality is that gold prices rise and fall based on supply and demand. The numerous factors cited affecting the price should more appropriately be categorised as impacting the supply and demand balance.

One factor differentiating gold from virtually all other commodities is that gold lasts forever once mined from the earth. It is not consumed, thus creating more demand.

Central banks played a role in the explosion in gold prices beginning around the turn of the century. With gold no longer needed to support a sovereign country’s currency, central banks could sell off some of their gold bullion, subject to limitations, thereby adding supply to the market. An ascending series of financial troubles culminated with the GFC central banks buying gold, cutting into the supply, and forcing up prices as demand from investors, coupled with central bank buying, sent the price of gold skyrocketing.

Choosing a Broker

The choice of a broker to trade gold depends on the investment vehicle chosen. Dealers in pure gold recommend finding a trustworthy, reputable dealer. The extensive advertising campaigns to buy gold in traditional and social media should be treated with extreme caution.

Today many full-service brokerage houses have online trading sites offering stocks, funds, options, and futures contracts.

Online-only trading sites vary in the investment vehicles offered. The top sites typically offer stock and ETF trades, Forex, Contracts for Difference (CFDs), Cryptocurrencies, and commodities. The bull.com features reviews for eight of the top sites in Australia.

Gold Trading Strategies

There are a variety of trading strategies for trading gold, most dependent on the gold investment vehicle chosen. Two critical strategic steps common to all gold investments are understanding some of the market psychology behind the price action of gold as well as the history of gold price movements.

Market psychology is all about sentiment. Virtually all investments rely more on perception than reality. For the past three years, market sentiment has bounced back and forth, driven between beliefs in the best and worst-case scenarios of contemporary events, beginning with the COVID-19 pandemic and its aftermath. More recently, interest rate hikes by the Central Banks across the world are causing problems and could potentially create a global recession.

For each of these, bewildered investors can find supporting arguments for both best and worst-case scenarios, but market movements are the ultimate guide to market sentiment. Investors at all levels act on their perceptions. Sector or market downturns are driven by the belief that things could improve, worsen, or remain the same.

Investing in gold miners and ETFs can follow fundamental and/or technical analysis strategies, studying the historical and estimated future performance from an ETF or stock’s price movement history and/or the investment’s financial condition. In addition, economic and business conditions in the sector in which the company operates have an effect, as well as country and global economies.

Fundamental analysis of ETFs is challenging, but some knowledge of the top ten holdings in an ETF is often sufficient.

Looking back on the price movements of gold since 1971 can lead an investor to correlate price movements with economic conditions at the time. In 1971 the US led the world off the gold standard. In 1974 the US enacted a law allowing the sale of gold to private parties for the first time in 40 years. Within ten years, the price of gold rose 385% before a bout of inflation in the early 1980s cooled off the first-ever bull run in gold.

Summary

No longer used as a direct form of payment for goods and services, gold’s use in the modern world is in jewellery manufacturing and as an investment and security vehicle.

Australian investors have multiple options for trading gold. Physical gold coins can be purchased from online dealers and auction sites. Owning gold bullion is also possible, with dealers offering storage options.

A more practical choice is investing in the stocks of gold mining companies or ETFs that track the price of gold or a select basket of gold miners.

Studying the history of gold trading can influence the holding time of an investment. The gold price bounced twice in the 1980s before going essentially flat for much of the 1990s. From the stable price movement of the early 90s, it took ten years to ignite the most significant gold bull run in history.

Some investors rush to invest in gold as economic trouble approaches, while others heed the advice to diversify an investment portfolio with gold at any time. Gold trading alternatives for investors range from physical gold coins or bullion to ETFs. Holding gold bullion is also possible, as are options and futures contracts and more traditional investing in gold miner stocks and ETFs.

Hard and soft factors impact the price of gold. The critical soft factor is market sentiment. Retail and institutional investors act based on their perceptions of what may happen, often ignoring reality. A Central Bank buying gold reserves, global catastrophes, inflation, economic downturns, and recessions all impact the value of gold.