Global inflation began its ominous rise early in 2021, initially fueled by massive infusions of fiscal and monetary stimulus measures to combat the rising tide of the COVID 19 Pandemic.

In short order, lockdowns and labor shortages in the global manufacturing sector ignited an equally ominous supply shortage.

By the dawn of 2022 inflation had become a major global concern, with suspicions of price gouging entering the picture.

The next component of what in hindsight appears to have been the gathering of a perfect storm for global economies reared its ugly head – the war between Russia and Ukraine.

As the fourth quarter of Fiscal Year 2022 drew to a close, the final nails were driven into the coffin – rising interest rates to combat inflation and the fear of a resulting recession.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

On 20 October, the yield on 10 Year US Treasury notes rose to their highest level since the onset of the Great Financial Crisis in 2008 – 4.29% – following a note from the president of the Philadelphia Federal Reserve Bank that the “disappointing progress” in the inflation battle would lead to rates well in excess of 4.0% by the end of 2022.

Other economic indicators of the day were negative as well, with housing starts and building permits declining. However, jobless claims of 214,00 were well below the expected 230,000, indicating the labor market in the US is not slowing down as expected.

The recession coverage in the financial press is increasingly bearish. On that same October day, the story investors read was that the Manufacturing Index from the Philadelphia Federal Reserve came in worse than expectations – negative 8.7 versus a forecasted decline of 5.0. Not all accounts of the Philadelphia Fed result pointed out the October index reading was lower than the September number of a decline of 9.9.

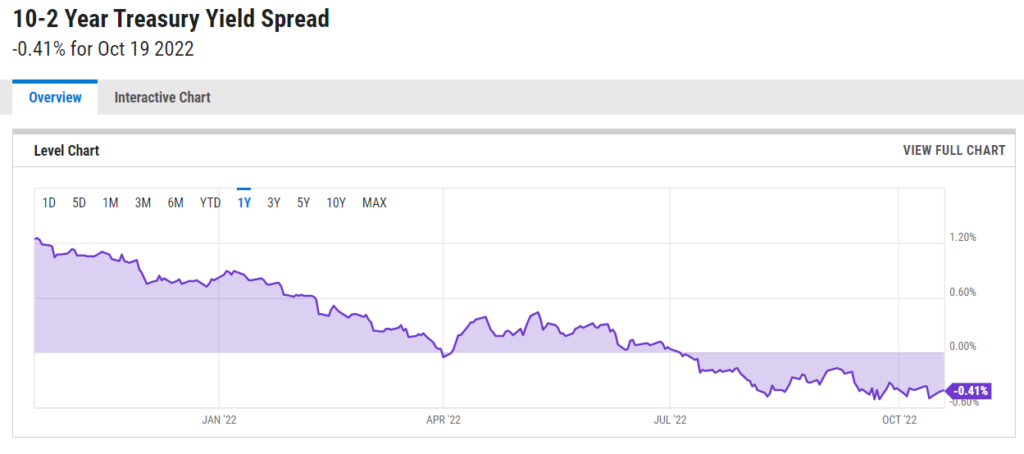

The same could be said of the investor angst over the inverted yield curve in US Treasury Notes. Investors are bombarded with news that the current yield on a short term 2 Year Treasury Note now exceeds the yield on the 10 Year Note, the opposite of what it should be.

After flattening gradually for the first half of the year, the yield curve inverted in July and despite the jump in the 10 Year Note, the curve remains inverted. Conventional wisdom tells investors an inverted yield curve can be an indicator of a recession looming on the horizon.

From the website ycharts.com:

Reading the fine print in the dire coverage of this phenomenon seems contradictory, including the pronouncement that as a recession indicator the spread is not anywhere approaching 90% predictive accuracy, while at the same time reading the spread has preceded every recession since the dawn of time.

Buried in the finest of fine print in a very few articles, an investor with an appetite for reading virtually everything available can find that many economists feel the spread between the 3 Month Treasury Note and the 10 Year Note is a better predictor. The St. Louis Federal Reserve Bank released a study of the predictive accuracy of the spread between the 3 Month and the 10 Year note.

First the study reminds investors at best it could be four quarters or more before a recession hits following a sustained inversion. With a substantial spread of -2.18 points, the inverted curve could reach an 86.5% probability of a recession coming in four quarters. With a minor positive spread of +0.41, the probabilistic accuracy drops to 15%. From ycharts.com we see that the current spread is +0.07.

This is not to downplay the severity of the economic situation in which we find ourselves, only to suggest there remain some positive lights. The bearish view of the curve is that regardless of current status, both curves have been flattening. The bullish view to date remains the US consumer, increasing spending by 2% year over year in Q2 of FY 2022.

In the past week in the US the influential head of the Chase Bank as well as the head of international investment bank Goldman Sachs warned of an impending recession, while the head of Bank of America sees the American consumer as “resilient” citing 10% growth in BofA’s debit and credit card spending through October. The following day American Express announced its credit accounts rose 20%.

The situation here in Australia seems healthier on the surface, but if the US slips into a major recession, the ASX will suffer.

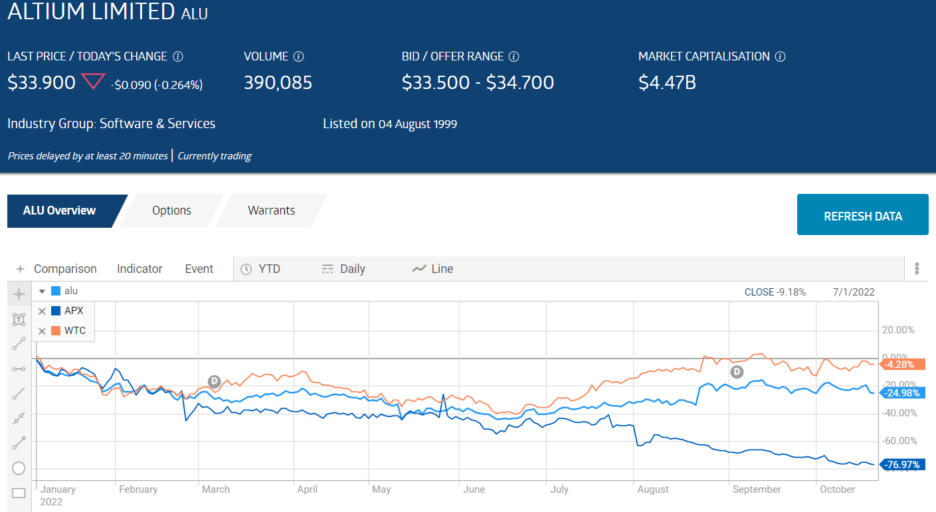

In both the US and here in Australia, technology stocks have borne an inordinate amount of pain – down 24% year to date in Australia and 32% in the US. Many analysts remain cautious about the tech sector, but analysts at Citi see a tech rebound in 2023.

The Technology sector has been one of the worst performers in 2022 around the world. Inflation means rising costs for businesses as well as consumers and many tech stocks remain cash poor, with investors drooling over potential future growth. Battling inflation means higher interest rates which can wreak havoc on borrowing costs for tech companies relying on debt to finance operations. In addition, tech stocks yet to show a profit have little if any pricing power, unlike many companies that can pass along rising operating costs to the consumer.

The ASX does not lack for high quality technology stocks, but two stand out because of their place in two major megatrends sweeping the world – digitalisation and artificial intelligence.

The companies are Altium Limited (ALU) and Appen Limited (APX). A third, Wisetech Global (WTC) is powering its logistics software platforms with AI (artificial intelligence.)

The website reference.com defines a megatrend as:

- A megatrend is a long-term change that affects governments, societies, and economies permanently over a long period of time.

From the ASX website we can see the share price declines each of the three have experienced year to date:

Of the three, Altium is a clear leader in future potential growth because of the core of the company’s business operations – printed circuit boards (PCBs).

Digitalisation of much of what we do began in the 1980’s with the advent of the personal computer and later the internet and the multiple applications that it spawned. In truth, digital technologies can trace their origins to the 1971 release of the first silicon chip from Intel.

Those early devices relied on printed circuit boards to route power to the processors. Prior to the advent of PCBs, connective wiring was loose and point to point, as in this antique television set. From the website how2electronics.com:

PCBs revolutionised that maze of loose wires, yet their impact and importance remain below the radar of many consumers, and more than a few investors.

Today, virtually all electronic devices – regardless of size or application – rely on printed circuit boards. PCBs are vital to the medical, automotive, maritime, aerospace, and industrial sectors. Consumer electronic devices from smartphones, to smartwatches, to remote control devices, to Internet connected appliances – all need PCBs. With the Internet of Things (IoT) broadening its scope, the market for PCBs will have another demand driver.

Altium was founded in 1985 and has grown to be a global leader in providing design software for the actual creators of PCBs across virtually all industrial classification sectors, from automotive and aerospace to healthcare, to industrial systems, to education, to consumer electronics, and to communications and entertainment.

The business model of providing the means for producing PCBs rather than producing products expands the scope of Altium’s footprint dramatically.

The company offers a variety of software platforms with Altium Designer serving as its flagship design platform. This platform allows designers to interface with any and all stakeholders in the end product via a cloud-based software addon, Altium 365.

CircuitStudio is an entry level and less expensive software package for designers. CircuitMaker is a free, open source platform allowing designers to create and market their own PCB designs.

Altium Enterprise Solutions (once called NEXUS) offers a complete electronic design package that coordinates workplace and resource management across all domains and disciplines of the enterprise.

Finally, Altium offers a search engine package called Octapart. The software package includes a comprehensive library of electronic parts data, with links to electronic distributors that carry the part. The search includes fully up-to-date status information on the desired part, with stock availability and lead time as well as pricing.

The company’s Full Year 2022 showed few lingering affects from the COVID 19 Pandemic, with revenues increasing 23% and net profit up 57%. Altium is a dividend payer with FY 2022 dividend payments up 18%. Altium has a variety of subscription levels with recurring revenue from subscriptions up 75%.

In a bold move, Altium management has committed the company to a goal of doubling its revenue to $500 million by 2026.

The company has a global footprint with impressive performance in the US and in Europe. US revenue is 55% of total revenue, while Europe accounts for 31% with Emerging Markets contributing 10% and the final 5% comes from the Asia Pacific region.

Altium maintains the view the “macro-environment is challenging,” but it continued its revenue and profit growth resumed. The company did warn investors of shortfalls from its SME customers (small to medium enterprises), withdrawing its guidance for the Full Year 2020. While revenue and some other targets were missed, the company did manage to turn in 10% revenue growth but profit after tax fell 42%.

Altium’s customers are some of the largest enterprises in the world who perhaps were better able to manage the Pandemic without cutting back on critical work for the future. The company’s market cap is $4.47 billion dollars and it last traded at $33.90. The 52 Week High is $45.30 and the low is $24.32.

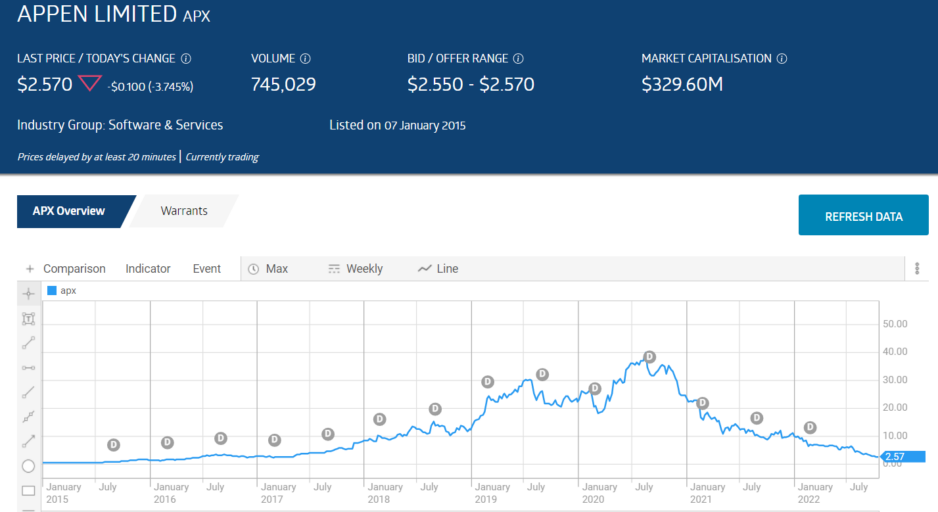

Appen experienced massive challenges due to the Pandemic, perhaps because of the nature of its business.

The company began as a language resources company providing language recognition software, expanding into speech synthesisers of applications from cars to a multitude of consumer electronic devices. The company now has put its Artificial Intelligence expertise gleaned from its language recognition software development at the forefront of its future growth. After abandoning the description of its operating divisions found on most financial websites of Relevance and Speech and Language, the company now includes the self-description “Powering the AI Life Cycle” as the header on its Financial Results and other market releases. Appen has morphed into a full blown AI company and has achieved “industry leader” status.

“Powering the AI Life Cycle” is an apt description as Appen works in whole or in part on guiding its customers through the developmental life cycle of an artificial intelligence or machine learning project. Machine learning is a form of artificial intelligence where “machines” receive data and “learn” pattern recognition.

Appen’s developmental process has four steps:

- Data Sourcing

- Data Preparation

- Model Training and Development

- Model Evaluation

The company listed on the ASX in 2015 and was already profitable from its speech and language operations. Once a market darling, the COVID 19 Pandemic crushed the company.

The company’s financial results have been abysmal , with the latest trading update coming on 5 October, warning of more poor results to come.

Appen eventually will have tailwinds at its back. A 2019 survey from US based research and consulting firm Gartner found that leading organizations anticipated doubling the number of AI Projects by the end of 2020. Obviously, the survey did not expect a global pandemic to intervene. The Appen market cap is $329 million dollars and it last traded at $2.57. The 52 Week High is $12.30 and the low is $2.55.

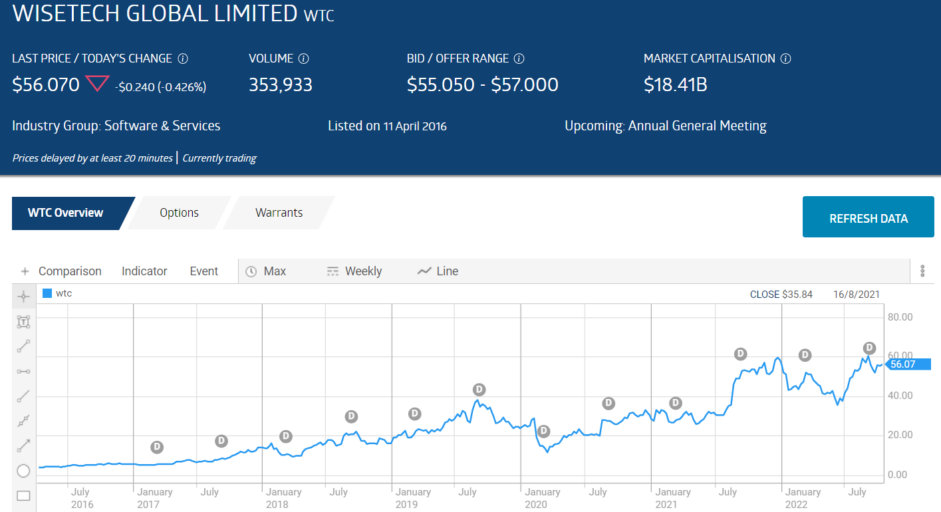

Wisetech Global is a global provider of software programs for supply chain management and logistics. The company’s flagship product is CargoWise. The product offers an end-to-end logistics solution suitable for both small businesses and giant multi-national companies as well.

Wisetech is another former market darling with the potential for a major comeback when the supply chain bottlenecks subside. The company listed on the ASX and is still up more than 1,000% since listing. The Wisetech market cap is $18 billion dollars and last traded at $56.07. The 52 Week High is $63.37 and the low is $34.10.