Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

Mineral Resources (MIN)

MIN has been sold down along with several other iron ore competitors. However, MIN is one of the world’s top five lithium producers. In the near term, it will re-start operations at the Wodgina Lithium mine in the Pilbara region of Western Australia. The Wodgina hard rock lithium deposit is one of the biggest in the world. MIN should benefit if lithium prices remain high.

Aroa Biosurgery (ARX)

The company makes and sells medical products to improve healing of wounds and soft tissue reconstruction. ARX guided to sales of between $NZ34 million and $NZ37 million in the current financial year, which is between 58 per cent and 71 per cent higher than the prior corresponding period. Continuing sales growth and high margin products paint a bright outlook.

HOLD RECOMMENDATIONS

Newcrest Mining (NCM)

NCM is the biggest gold company on the ASX. It recently guided to significantly lowering costs during the next decade. The company has a pipeline of new growth projects. In our view, NCM can be part of any balanced portfolio. Investors should benefit from any increase in gold prices.

GrainCorp (GNC)

The agribusiness delivered a strong fiscal year 2021 result, posting underlying EBITDA of $331 million. The current winter crop is likely to be huge. The outlook is bright, so we expect the share price to benefit from continuing momentum. The shares have risen from $5.16 on June 30 to finish at $7.04 on November 18.

SELL RECOMMENDATIONS

Splitit Payments (SPT)

The company operates in the crowded buy now, pay later space. Shoppers can use their credit cards to pay in installments. However competition in the buy now, pay later space is fierce. The share price has fallen from 41 cents on October 29 to close at 30.5 cents on November 18. We prefer others.

AGL Energy (AGL)

The share price continues to drift, falling from $11.88 on January 5 to close at $5.19 on November 18. Electricity prices have fallen and competition in the power sector is fierce. We expect renewable energy providers to increasingly disrupt the sector. In our view, other companies appeal more for their outlook.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

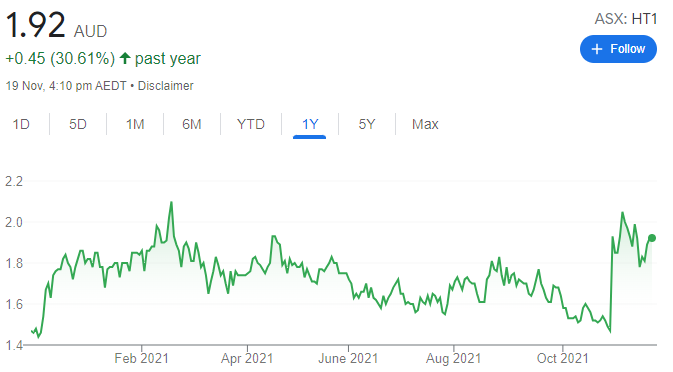

HT&E Limited (HT1)

The media company recently announced a binding agreement to acquire Grant Broadcasters for $307.5 million. Grant Broadcasters is a family owned regional radio operator. HT&E owns the Australian Radio Network. The deal is a material one and creates a radio network of significant scale across Australia.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Core Lithium (CXO)

The company is developing the Finniss lithium project in the Northern Territory. The project is fully funded and first production of lithium concentrate is scheduled for the fourth quarter of fiscal year 2022. The project is relatively close to port and other necessary infrastructure. About 80 per cent of initial output is covered under four year off-take agreements. We like the company’s outlook.

HOLD RECOMMENDATIONS

Ramsay Health Care (RHC)

Unaudited total revenue for the first quarter of fiscal year 2022 was $3.2 billion, a 1.3 per cent increase on the prior corresponding period. Unaudited earnings before interest and tax of $197.4 million represented a 27.8 per cent fall on the prior corresponding period. COVID-19 impacted elective surgery in Australia. We have moved from a buy to a hold recommendation for this private hospital operator.

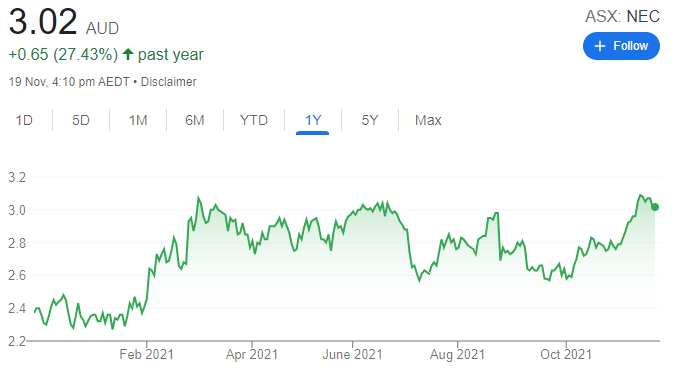

Nine Entertainment Co. Holdings (NEC)

The media giant posted group revenue of $2.331 billion in fiscal year 2021, an 8 per cent increase on the prior corresponding period. Group EBITDA of $564.7 million was up 43 per cent. The shares were priced at $2.58 on October 1. The shares were trading at $3.06 on November 18.

SELL RECOMMENDATIONS

Western Areas (WSA)

WSA supplies high-grade nickel concentrates to smelter and refinery operators. The long life Odysseus mine is a key growth project. The main change to our valuation is a premium applied to reflect potential corporate activity, which lifts our price target to $2.90. However, material downside to our valuation is also implied if a transaction doesn’t eventuate.

Xero (XRO)

A key focus of this cloud based accounting software company is subscriber and revenue growth and it delivered on both in the first half of fiscal year 2022. Operating revenue of $NZ505.7 million was up 23 per cent on the prior corresponding period. Total subscribers increased by 23 per cent to 3 million. But, in our view, the company’s valuation remains above a level that we consider a balanced risk/reward equation.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Pacgold (PGO)

The Queensland explorer has reported encouraging results from recent drilling at the Alice River Gold Project, including 26 metres at 3.6 grams a tonne of gold and 3 metres at 21 grams a tonne of gold. The new target zone extends more than 800 metres south from the open pit and it hasn’t been previously drilled. Results from another 19 holes are yet to be reported to the market. In our view, PGO has growth potential, but it remains a speculative proposition.

Nyrada Inc. (NYR)

NYR is a pre-clinical stage drug development company, specialising in novel molecule drugs to treat cardiovascular and neurological diseases. The company recently reported encouraging results from its cholesterol-lowering program. Pilot work is progressing with its brain injury program. The company says it anticipates starting the first-in-human phase 1 study in the second half of calendar year 2022. Share price weakness provides a buying opportunity. However, the stock is highly speculative and more suited to investors with an appetite for risk.

HOLD RECOMMENDATIONS

Eagle Mountain Mining (EM2)

EM2 has reported further high grade assay results along the Western Talon at Oracle Ridge in the US state of Arizona. Results include 5.8 metres at 2.72 per cent copper and 29.59 grams a tonne of silver. These results provide encouragement that the JORC resource at Oracle Ridge can be expanded once all results are incorporated. Three drilling rigs are active on the project. Expect constant news flow. EM2 should be considered a speculative growth opportunity.

Alta Zinc (AZI)

The company released an improved mineral resource estimate for its Gorno zinc-lead project in Italy. The indicated resource category has risen to 72.6 per cent of the total resource. The revised mineral resource estimate is encouraging, and will enable further studies to de-risk the mining plan. AZI also offers speculative upside from several Italian exploration projects with a focus on copper and cobalt.

SELL RECOMMENDATIONS

Pilbara Minerals (PLS)

PLS has announced a strong activities report for the September quarter. It produced a record 85,759 dry metric tonnes of spodumene concentrate, up 11 per cent on the June quarter. The PLS share price has been strong, rising from $1.87 on October 6 to trade at $2.42 on November 18. Share price strength provides an opportunity to consider taking a profit.

Computershare (CPU)

CPU recently announced it had completed acquiring the assets of Wells Fargo Corporate Trust Services, a US based provider of trust and agency services to government and corporate clients. CPU’s share price has risen from $13.19 on March 1 to trade at $19.71 on November 18. Global equity markets have generated strong returns. Investors may want to consider taking some profits.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.