Free Knigthsbridge Trading Academy worth $2750 with Axitrader

Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

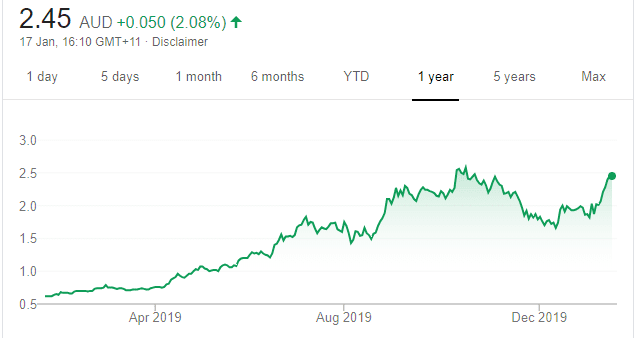

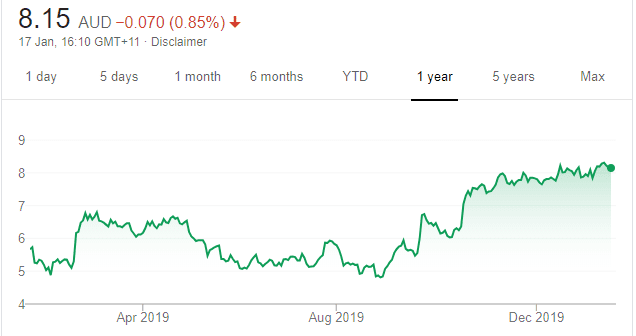

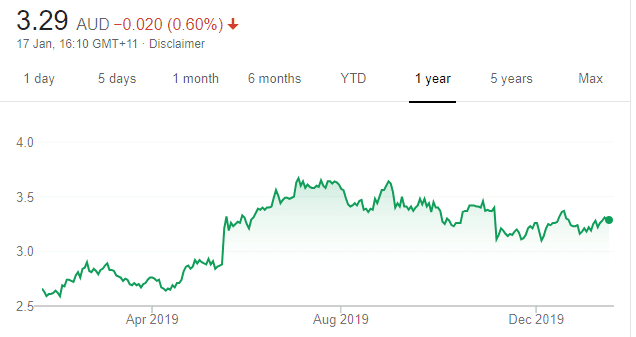

PolyNovo (PNV)

Chart: Share price over the year

An Australian biotechnology company that designs, develops and makes dermal regeneration solutions. Its key patented product is NovoSorb, which is sold in Australia, New Zealand and the US. The product has been approved in the UK and the European Union. PNV recently announced monthly sales exceeded more than $2 million for the first time in December 2019. It was only in May 2019 that monthly sales reached $1 million for the first time. Sales momentum paints a bright outlook.

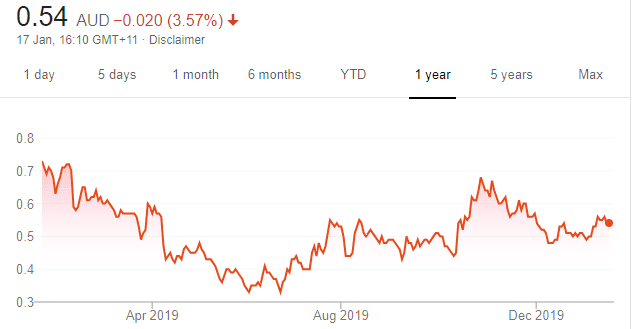

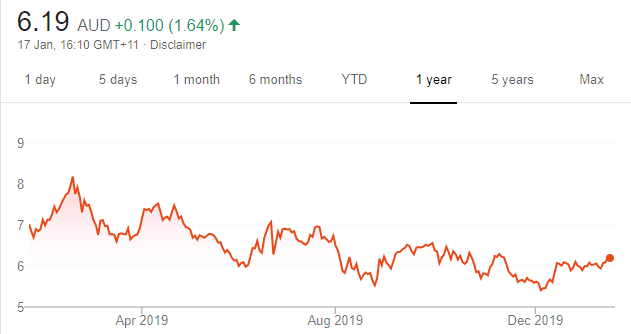

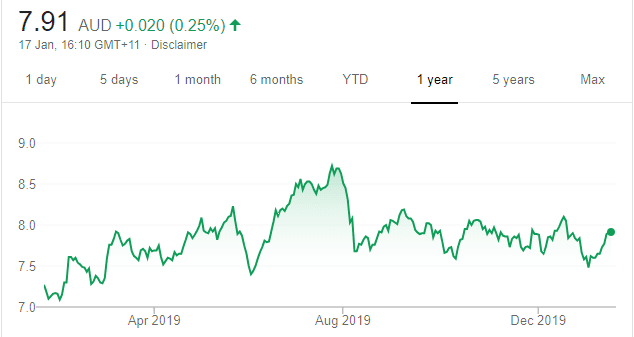

Praemium (PPS)

Chart: Share price over the year

A technology business focused on the financial services sector. It offers investment management, portfolio administration and reporting services. It reached a milestone $20 billion in funds under administration late last year. Recent quarterly guidance showed strong growth in international markets. The company is well off its all time highs due to margin pressure, in our view. But at these prices, the business seems attractive.

HOLD RECOMMENDATIONS

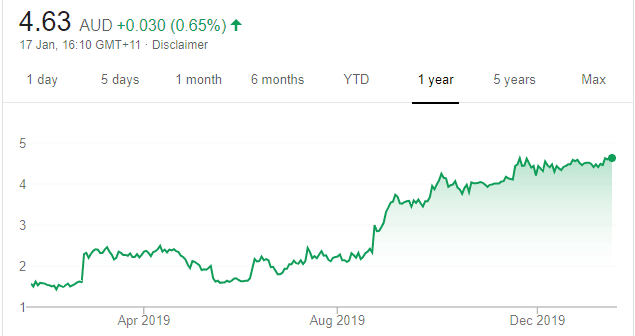

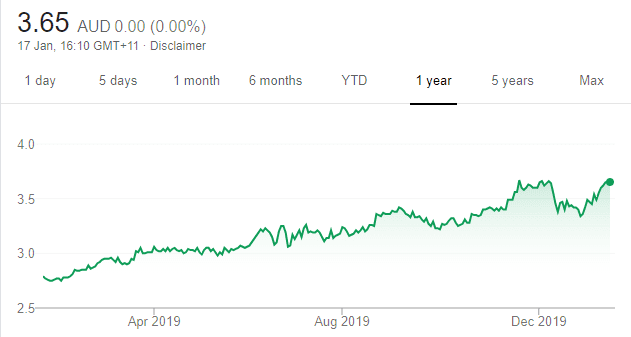

BWX Limited (BWX)

Chart: Share price over the year

Develops, makes and distributes natural body, hair and skin care products. Its main markets are in Australia, the US and South East Asia. Changes to the senior management team followed a failed private equity takeover of BWX in 2018. Since then, BWX has provided better than expected guidance. The share price has been a strong performer and the company remains a hold for now.

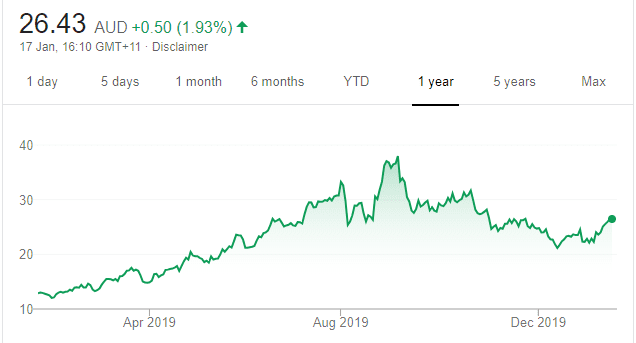

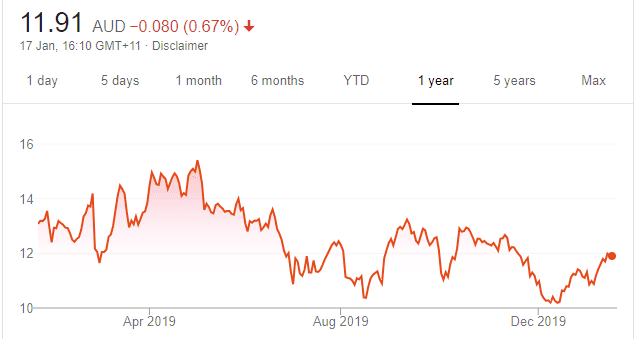

Pro Medicus (PME)

Chart: Share price over the year

Provides information, communication and visualisation technology services to the radiology sector. Services arm radiologists and clinicians with advanced capabilities for viewing 2D, 3D and 4D medical images. The share price hit a high above $38 in September last year following a strong full year result. The price has since been has been slashed, most likely due to slowing momentum in the higher price/earnings ratio space. However, the company’s results were impressive in the past two years. The shares were trading at $25.91 on January 16.

SELL RECOMMENDATIONS

JB Hi-Fi (JBH)

Chart: Share price over the year

Shares in the consumer electronics giant have risen from about $20 a year ago to trade at $41.54 on January 16. We believe the share price has risen on more favourable expectations, improving consumer confidence and a recovery in the housing market. Recently trading on a higher price/earnings ratio of almost 20, we believe most of the short term uplift in sales has been factored into the share price. Consider taking some profits.

IOOF Holdings (IFL)

Top Australian Brokers

- IG - Extensive product array and user-friendly platforms - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

- Quadcode Markets - multi-asset CFD broker - Read our review

Chart: Share price over the year

IOOF is diversified financial services provider, operating in wholesale and retail funds management. Following earnings downgrades in 2018/19, the share price has rebounded strongly since mid last year. We believe today’s share price is difficult to justify on long term revenue and profit growth forecasts. The shares were trading at $8.25 on January 16.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Sandfire Resources (SFR)

Chart: Share price over the year

The share price action for this Australian copper producer suggests it should start to rally from here. We also believe the copper price should rise as global growth recovers. From a charting perspective, we can see potential for SFR to increase towards $8. The shares were trading at $6.065 on January 16.

Aristocrat Leisure (ALL)

Chart: Share price over the year

This gaming machine company has consistently generated strong earnings growth year-on-year. Its share price profile is stable and it appears this uptrend should continue. We view any marginal dips in the share price as a buying opportunity. The shares were trading at $36.68 on January 16.

HOLD RECOMMENDATIONS

Galaxy Resources (GXY)

Chart: Share price over the year

Several lithium stocks appear to be gaining favour with investors. The share price of lithium supplier Orocobre has performed strongly since early December. Recently, lithium stock Galaxy has been moving higher. Its share price has risen from 92.5 cents on December 31 to trade at $1.182 on January 16. We expect buying momentum to drive GXY higher from here.

FlexiGroup (FXL)

Chart: Share price over the year

Swift share price moves higher before easing back on lower volumes was a familiar pattern in 2019. Between October and December was a period of consolidation. It appears consolidation is finishing given a strong start to 2020. Shares in this diversified financial services firm have risen from $1.84 on December 31 to trade at $2.18 on January 16. We expect it to go higher from here.

SELL RECOMMENDATIONS

QBE Insurance (QBE)

Chart: Share price over the year

The insurer’s share price has underperformed the broader sharemarket since the GFC. It’s been range trading between $10 and $14 in the past few years. The shares were trading at $13.735 on January 16. Given uncertainty surrounding the final number of bushfire claims and how much they total, it might be best to consider an exit.

Centuria Industrial REIT (CIP)

Chart: Share price over the year

CIP is a pure play industrial real estate investment trust. The share price looks extended on the chart and, in our view, is trading at a substantial premium to net tangible assets. We believe rising bond yields will negatively impact the share prices of REITs. Investors could consider taking some profits. The shares were trading at $3.645 on January 16.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

HUB24 (HUB)

Chart: Share price over the year

Operates an investment and superannuation platform. The business is growing rapidly and EBITDA margins continue to expand given strong operating leverage. We see substantial valuation upside. The shares were trading at $11.79 on January 16.

Lendlease Corporation (LLC)

Chart: Share price over the year

LLC is an international property and infrastructure group. The outlook is bright following a series of major project wins. LLC is trading well below our valuation, assuming an orderly wind-down of its engineering business following an agreement to sell it. We believe Lendlease offers a sound capital position, and its gearing should stabilise at the mid-to upper point of its target range of between 10 per cent and 20 per cent. We believe the Barangaroo South project is also a catalyst for Lendlease to trade at a higher multiple.

HOLD RECOMMENDATIONS

APA Group (APA)

Chart: Share price over the year

Owns and operates Australia’s biggest natural gas infrastructure business and other energy infrastructure assets, such as gas storage and wind farms. With the stock trading marginally above our target, we retain a hold recommendation. The shares were trading at $11.59 on January 16.

Insurance Australia Group (IAG)

Chart: Share price over the year

Bushfire claims will hurt the bottom line, but re-insurance will cushion the impact. The stock has good defensive earnings characteristics, in our view. But IAG is trading above our price target, so we retain a hold recommendation. The shares were trading at $7.90 on January 16.

SELL RECOMMENDATIONS

Alumina (AWC)

Chart: Share price over the year

Earnings were down in the first half of 2019 and we believe this will continue to weigh on the stock. Alumina prices need to rise for us to feel more confident about the company’s outlook. A lower price entry that provides attractive upside to our net present value would also be positive. Until we see an improving outlook, we retain a sell recommendation. The shares were trading at $2.285 on January 16.

Medibank Private (MPL)

Chart: Share price over the year

The private health insurance industry remains under pressure. The young are continuing to question the value of holding private health insurance. We’re questioning whether Medibank can retain margins in an increasingly competitive and shrinking industry. In the background is political pressure on private health insurance companies to keep premium increases to a minimum going forward. In our view, better growth options exist elsewhere.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.