Dylan Evans, Catapult Wealth

BUY RECOMMENDATIONS

BUY – Charter Hall Long WALE REIT (CLW)

CLW is a diversified real estate investment trust. A key attraction is a quality property portfolio with an occupancy rate of 99 per cent. An average lease expiry of 10.8 years provides long term income security. Office exposure is only 18 per cent in an environment of more people working from home. CLW has struggled in the past two years in response to rising bond yields. But the stock is appealing at these levels. The dividend yield was recently above 8 per cent. Also, any asset sales to lower debt would be positive for the stock.

BUY – Transurban (TCL)

TCL is one of the biggest toll road operators in the world. It has roads in Melbourne, Sydney, Brisbane and the US. TCL was disrupted by the pandemic, but acquired assets that paint a brighter outlook. WestConnex, Australia’s largest tunnel road infrastructure project, was completed in Sydney in November 2023. TCL should benefit in the next few years from increasing traffic volumes, inflation-linked tolls and the completion of the West Gate Tunnel project in Melbourne.

HOLD RECOMMENDATIONS

HOLD – National Storage REIT (NSR)

NSR is one the biggest self-storage providers in Australia and New Zealand, with more than 235 centres. The business has been solid. Underlying earnings of $76 million in the first half of fiscal year 2024 grew by 6 per cent. We expect earnings growth to continue as low gearing leaves NSR in a good position to make acquisitions. NSR is also a potential takeover target, with a history of previous bids suggesting global and domestic acquirers are most interested in NSR’s assets.

HOLD – Super Retail Group (SUL)

SUL is the holding company for retail brands, including Supercheap Auto, Rebel, BCF and Macpac. There’s a lot we like about this stock. Its underlying brands are strong. Company profitability and earnings quality are good, and the firm has no debt. We can’t recommend SUL as a buy due to the risk of slower consumer spending from cost of living increases and higher interest rates. Possible workplace litigation between the company and several employees has no bearing on our hold recommendation.

SELL RECOMMENDATIONS

SELL – Sims (SGM)

SGM is a global leader in metals recycling, with operations in Australia, the UK, US and New Zealand. Metal prices and energy costs are highly volatile. The business can be capital intensive and is exposed to operating at relatively low margins. Statutory net profit after tax of $65.8 million in the first half of fiscal year 2024 was down 34.9 per cent on the prior corresponding period. Corporate costs were also higher. The shares have fallen from $14.51 on February 19 to trade at $11.72 on May 2.

SELL – Medibank Private (MPL)

Group revenue from external customers of $4.024 billion in the first half of fiscal year 2024 was up 3.3 per cent on the prior corresponding period. Group operating profit of $319.4 million was up 4.2 per cent. Across the industry, our concern is rising premiums may price existing customers out of private health insurance and deter others from joining funds. The share price has fallen from $3.91 on March 13 to trade at $3.45 on May 2.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

BUY – FireFly Metals (FFM)

FireFly is a copper explorer and developer. The company’s Green Bay Copper-Gold project is in Newfoundland, Canada. Exploration has revealed high grade copper mineralisation at depth. Copper demand is expected to increase as part of the transition to a cleaner energy future during the next decade. FireFly offers good exposure to a rising copper price.

BUY – Qoria (QOR)

Qoria is a technology company providing digital solutions to keep children safe on the internet. The business is growing users and revenue. The company expects to be cash flow positive in calendar year 2024 and EBITDA positive in fiscal year 2025. The company recently rejected a takeover bid at 40 cents a share on the grounds it undervalued the company. K1 Investment Management, a US based private investment firm, lodged the unsolicited, conditional and non-binding indicative proposal. QOR may receive a higher bid or attract another potential acquirer.

HOLD RECOMMENDATIONS

HOLD – BHP Group (BHP)

BHP is the conservative path for exposure to the copper price. The company generates almost a third of its revenue from copper. BHP recently launched a $60 billion takeover offer for Anglo American, a London listed miner, with South American copper mines. Anglo American has rejected BHP’s offer. Iron ore is still the dominant driver of BHP’s revenue and earnings. The iron ore price was recently trading above $US100 a tonne.

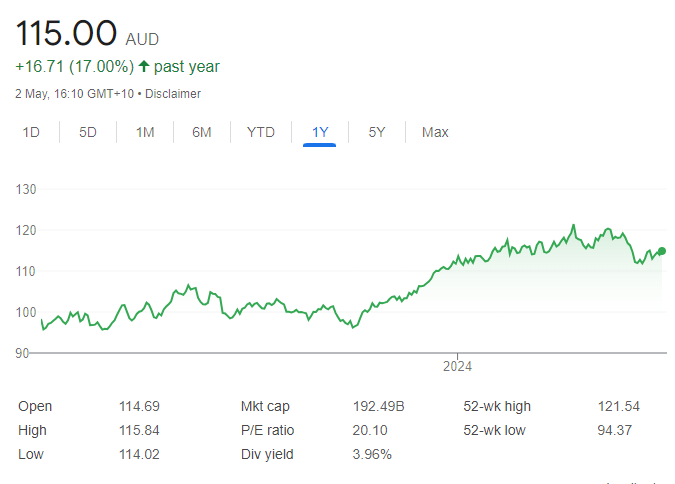

HOLD – Commonwealth Bank of Australia (CBA)

The share price of Australia’s biggest bank is off its highs above $120 in early March. But the price has risen from $96.87 on November 1 to trade at $114.195 on May 2. Cash net profit after tax of $5.019 billion in the first half of fiscal year 2024 was down 3 per cent on the prior corresponding period. Yet the fully franked interim dividend of $2.15 a share was up 2 per cent. Investors can hold for a reliable and appealing dividend and potential capital growth.

SELL RECOMMENDATIONS

SELL – Navigator Global Investments (NGI)

NGI is a diversified alternative asset management company. It partners with management teams operating institutional businesses across the globe. Statutory EBITDA of $US1.5 million in the first half of fiscal year 2024 was down from $US24.2 million in the prior corresponding period. The share price has risen from $1.17 on January 3 to trade at $1.805 on May 2. The stock is yet to recover from its pre-pandemic highs. Investors may want to consider cashing in some gains.

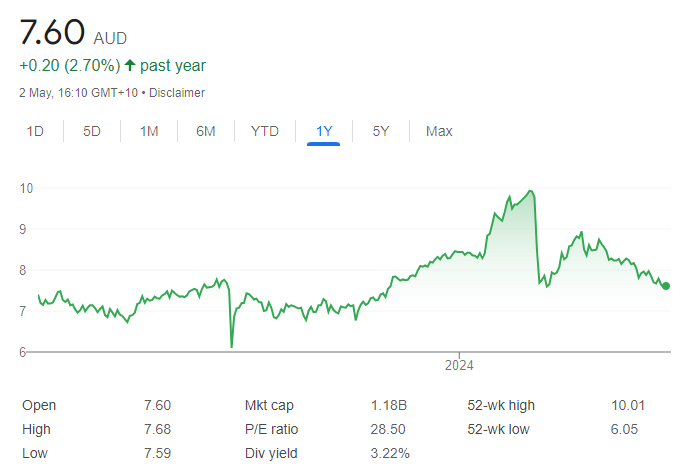

SELL – Challenger (CGF)

Challenger is an investment management firm. Challenger benefits from increasing investor interest in a higher interest rate environment, with the business able to offer higher annuity rates. However, a possibly lower interest rate environment provides more investment competition for annuities. Some economists are predicting interest rates may start falling before the end of 2024, or in early 2025. Challenger’s share price can be volatile. Investors may want to consider reducing holdings.

Elio D’Amato, Stockopedia

BUY RECOMMENDATIONS

BUY – South32 (S32)

Australian manganese operations were temporarily suspended in March 2024 after a cyclone. However, South Africa Manganese delivered record production, with the company recently announcing an 8 per cent increase for the fiscal year to date. Aluminium production increased by 1 per cent. South32 (S32) also announced it would sell Illawarra Metallurgical Coal for up to $US1.65 billion, which will realise significant value. Investment for the zinc-lead-silver Taylor deposit in the US has been approved, which is positive for the company’s outlook.

BUY – Data#3 (DTL)

DTL provides information technology services and solutions. As an outsourcing business, DTL is at the forefront of successfully integrating new emerging technologies, such as artificial intelligence, into businesses. This enhances value by ultimately improving margins. The company delivered growing revenue and net profit after tax in the first half of fiscal year 2024 compared to the prior corresponding period. Since February, the share price has drifted lower and was trading at an attractive entry level on May 2.

HOLD RECOMMENDATIONS

HOLD – NextDC (NXT)

The data centre operator recently completed a capital raising. Proceeds will go towards accelerating the development and fit out of its digital infrastructure platform in its core Sydney and Melbourne markets to meet increasing customer demand. Artificial intelligence should drive strong demand for data capacity in the future. In our view, the recent share price run has been excessive in the short term, but not in the long term as online processing needs grow.

HOLD – GQG Partners Inc. (GQG)

We continue to like the long term outlook for this fund manager. Growing net funds under management is the primary driver of returns for a funds management business. GQG lifted total funds under management from $US137.5 billion on February 29 to $US143.4 billion on March 31. It reported net flows during the quarter of $US4.6 billion. The share price has performed strongly since November, so investors can expect short term volatility in this tightly held stock.

SELL RECOMMENDATIONS

SELL – Insignia Financial (IFL)

This financial services company reported a statutory loss of $49.9 million for the six months ending December 31, 2023. This compares with a $45.1 million profit in the prior corresponding period. Higher transformation and separation costs contributed to the recent loss. For the six months ending December 31, 2023, net revenue of $695.7 million was up 0.6 per cent. The share price has fallen from $3.10 on May 15, 2023, to trade at $2.445 on May 2, 2024. Other stocks offer better growth prospects, in our view.

SELL – Queensland Pacific Metals (QPM)

The company’s core focus has switched to growing and developing its gas and energy assets. It will limit further expenditure on its Townsville Energy Chemicals Hub (TECH) project in response to challenging nickel and battery market conditions. We prefer bigger and more established energy companies at this stage of the cycle.

Related Articles:

- CFD Brokers in Australia

- Stock Trading in Australia

- The best automated trading platforms

- The Best ASX Stocks for Day Trading

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.