Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

BUY – IGO Limited (IGO)

IGO is a nickel and lithium miner. The shares fell from $16.12 on July 14 to $12.33 on August 17. It has since found buyer support to trade at $13.775 on August 31. Momentum indicators have also triggered a buy signal. Fears about weaker Chinese growth have negatively impacted the resources sector. But we believe IGO and other resource stocks have been oversold and provide a buying opportunity.

BUY – Amcor PLC (AMC)

The share price of this global packaging giant has been trending lower since the start of the year. The shares fell from $15.30 on August 1 to $14.17 on August 17. The shares were trading at $15.09 on August 31. From a charting perspective, we believe the share price has probably bottomed out and is likely to move higher from here.

HOLD RECOMMENDATIONS

HOLD – Charter Hall Group (CHC)

CHC is a fully integrated property investment and funds management group. The shares have risen from $10.29 on August 16 to trade at $10.85 on August 31. In our view, the company delivered better than expected fiscal year 2023 results. Property funds under management grew $6.2 billion to $71.9 billion. We expect the share price to continue its recovery.

HOLD – Fortescue Metals Group (FMG)

Despite the negativity around the Chinese economy, iron ore prices have started to rebound in the past few weeks. This indicates that shrewd investors are already positioning for a recovery. The shares have fallen from $23.73 on July 26 to trade at $21.50 on August 31. We expect the share price to improve in line with a recovering iron ore price.

SELL RECOMMENDATIONS

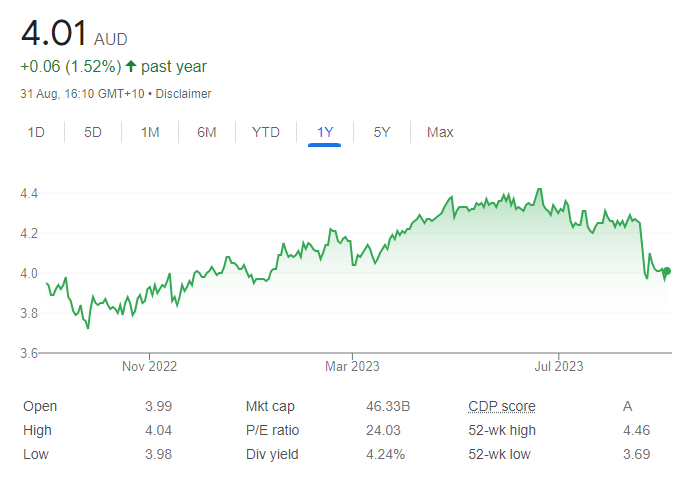

SELL – Telstra Group (TLS)

Most analysts are optimistic about the telecommunications giant, but the price action is telling another story. Despite Telstra’s recent full year earnings meeting analyst expectations, the share price has been sold off on heavy volume. This implies the upside was already priced into the share price. The shares have fallen from $4.31 on July 27 to trade at $4.02 on August 31.

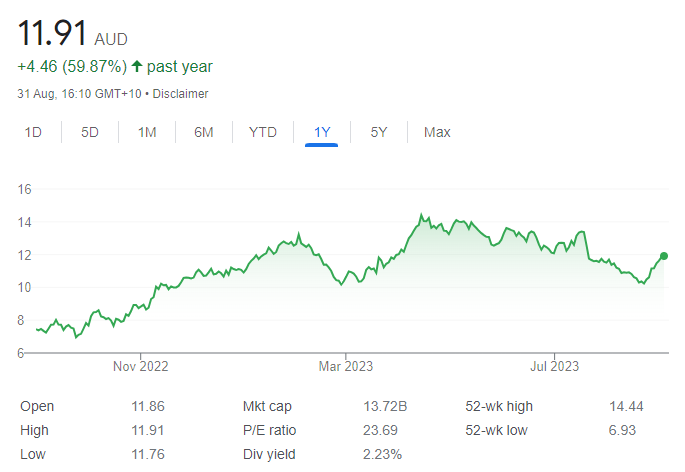

SELL – QBE Insurance Group (QBE)

The insurance industry remains fiercely competitive. In our view, the market is over estimating the ability of insurers to pass on further price increases without consequences. Higher premiums can lead to struggling policyholders opting out of renewing their insurance. Investment income is also expected to peak without further interest rate increases. The shares have risen from $12.77 on January 10 to trade at $14.96 on August 31. Investors may want to consider cashing in some gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

BUY – ResMed Inc. (RMD)

The medical device maker reported revenue of $4.2 billion in full year 2023, up 18 per cent on the prior corresponding period. Income from operations increased 13 per cent to $1.131 billion. However, the gross margin contracted by 80 basis points to 55.8 per cent. Moving forward, we expect margins to recover, as supply chain issues subside. In our view, share price weakness provides a buying opportunity.

BUY – Charter Hall Long WALE REIT (CLW)

CLW is an Australian real estate investment trust. In financial year 2023, CLW reported a 10.6 per cent increase in net property income compared to the prior corresponding period. However, operating earnings per security and distribution per security were both down by 8.2 per cent. We expect CLW to sell assets to reduce gearing. We believe the downside is more than priced in, and recent share price weakness provides a buying opportunity.

HOLD RECOMMENDATIONS

HOLD – Northern Star Resources (NST)

The gold producer posted revenue of $4.131 billion in fiscal year 2023, up 9 per cent on the prior corresponding period. Record cash earnings of $1.223 billion were up 16 per cent. Gold sold totalled 1.563 million ounces and was within guidance. There could be tailwinds for the gold price outlook as US interest rates appear close to a peak. However, upside depends on cost improvements and gold prices, so on our conservative assumptions, NST appears to be fair value.

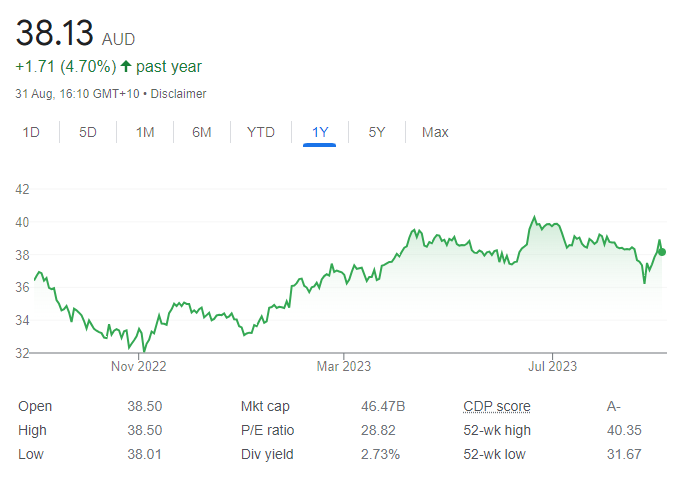

HOLD – Woolworths Group (WOW)

The supermarket group reported a strong full year result in fiscal year 2023. Group earnings before interest and tax of $3.116 billion was up 15.8 per cent on the prior corresponding period. The final dividend of 58 cents a share was up 9.4 per cent. Moving forward, we expect rising transport, wages and energy costs to remain a challenge. The share price has already rallied, so we rate the company as fair value.

SELL RECOMMENDATIONS

SELL – Washington H Soul Pattinson & Company (SOL)

SOL invests in a diverse portfolio of assets across a range of industries. It invests in resources, building materials, telecommunications, retail, property and more. SOL is a solid company. However, we expect downward pressure on coal prices. The share price has risen from $27.12 on January 3 to trade at $32.82 on August 31. Investors may want to consider cashing in some gains on share price strength.

SELL – Costa Group Holdings (CGC)

CGC is a big horticultural company. It grows, packs, markets and distributes fresh fruit and vegetables. Half year total revenue to July 2, 2023 was up on the prior corresponding period, but statutory profit was down. On May 31, Paine Schwartz Partners (PSP) lodged a confidential, non-binding indicative proposal to acquire the remaining shares in CGC that it didn’t already own for $3.50 cash. At August 31, it remains uncertain if a transaction with PSP will proceed and at what price. CGC shares were trading at $2.875 on August 31.

Nathan Lodge, Securities Vault

BUY RECOMMENDATIONS

BUY – Iceni Gold (ICL)

This Perth based gold explorer focuses on the 14 Mile Well project area in the Laverton Greenstone Belt. The company recently announced that a 2-ounce gold nugget had been recovered on the surface at the Claypan target. ICL has reported some encouraging results in the past 12 months. The shares are tightly held by investors. The stock was priced at 8.6 cents on August 31.

BUY – Siren Gold (SNG)

This New Zealand gold explorer has six key projects. The company has an 1100 square kilometre tenement package in the Reefton and Lyell goldfields and the Sams Creek porphyry dyke. The company recently announced its global resource had increased to 1.3 million ounces of gold equivalent. The outlook is appearing brighter for this speculative stock.

HOLD RECOMMENDATIONS

HOLD – CurveBeam AI (CVB)

CVB develops, makes and sells medical imaging CT scanners, coupled with artificial intelligence software clinical solutions, to support medical practitioners managing musculoskeletal conditions. Funds from the recent initial public offering (IPO) will go towards accelerating sales growth and investing in new product development. The stock offers a value opportunity, in my view.

HOLD – NeuroScientific Biopharmaceuticals (NSB)

The company is developing peptide based pharmaceutical products that target several neurodegenerative conditions with high unmet medical demand. The company’s product EmtinB is initially targeting Alzheimer’s disease and glaucoma. Future success depends on the performance of clinical trials, leaving it a speculative stock. I expect trading volume levels to recover.

SELL RECOMMENDATIONS

SELL – ENRG Elements (EEL)

The company is focusing on the exploration and development of its uranium, lithium and copper projects, commodities considered essential for a clean energy future. The company’s uranium and lithium projects are located in the Agadez region in the Republic of Niger. The recent uprising in Niger leaves a volatile political situation. The company recently confirmed its personnel remain safe and that its operations remain unaffected. Given the political situation, we prefer other stocks.

SELL – Critical Minerals Group (CMG)

The company is building a position in the vanadium market. Its flagship is the Lindfield project. The company’s objective is to develop and produce mineral deposits that will enhance the global energy transition. The shares have risen from 15 cents on March 3 to close at 25 cents on August 31. The share price can be volatile, so investors may want to consider cashing in some gains.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.