Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

JB Hi-Fi (JBH)

Interest rate increases can impact consumer spending, but we’re not expecting rises in Australia in the short term. We’re expecting JBH earnings to marginally weaken, but from a high base. The market has priced in a bigger sales fall than we anticipate. JBH has a strong track record of performance and we expect that will continue in the longer term. The share price of this consumer electronics giant was trading at $47.74 on January 20. The shares have traded higher than $50 in the past year.

Regis Resources (RRL)

We believe the stock is undervalued, as it hasn’t followed the gold price higher. Regis has the potential to ramp up production levels to offset potentially rising interest rates in the US. Relative to the other listed gold miners, Regis, in our view, is a more attractive buying opportunity. The shares were trading at $2.10 on January 20.

HOLD RECOMMENDATIONS

CSL (CSL)

The share price of this blood products group has fallen in response to a $6.3 billion institutional placement to fund the acquisition of pharmaceutical company Vifor Pharma, which specialises in renal disease and iron deficiency. The acquisition will push CSL’s gearing to a moderate level. The acquisition is a good move, as it will diversify CSL’s revenue streams moving forward.

Magellan Financial Group (MFG)

It was recently confirmed that St James’s Place (SJP) had terminated its mandate with Magellan. The SJP mandate represented about 12 per cent of group annual revenue at December 2021. The company experienced net outflows in the December quarter. The share price has been punished to the point that it’s possibly over-sold. Investors should consider their views on the company’s outlook. The stock may gradually recover.

SELL RECOMMENDATIONS

GUD Holdings (GUD)

This automotive and water products company recently completed the acquisition of AutoPacific Group. GUD generates significant revenue from combustion engine components. We believe the electric car revolution will present revenue challenges in the future. GUD shares have risen from $10.46 on December 20 to trade at $12.32 on January 20. Investors may want to consider locking in some gains.

Incitec Pivot (IPL)

This explosives and fertiliser company posted a strong full year result in fiscal year 2021. The company has benefited from increasing demand and lower gas prices. The company recently announced it had entered into an agreement to acquire an industrial explosives manufacturer. The share price has been rallying recently, which provides an opportunity for investors to consider taking some money off the table.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Qantas Airways (QAN)

Qantas has reduced its capacity expectations in response to rising COVID-19 cases and tighter international travel restrictions. Domestic capacity in the 2022 third quarter is expected to represent about 70 per cent of pre-COVID-19 levels. International capacity is expected to represent about 20 per cent of pre-COVID-19 levels. We remain positive about a domestic leisure-led recovery, a prevailing rational domestic market and strong loyalty earnings.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

TPG Telecom (TPG)

The company’s international brand attracts immigrants and travellers. Its competitive roaming offer for Australians travelling overseas is another positive. We expect subscriber growth and improving mobile pricing as international borders re-open. With the balance sheet rapidly deleveraging amid free cash flow yield forecasts of 7 per cent in calendar year 2023 and 8 per cent the following year, we see scope for higher capital returns.

HOLD RECOMMENDATIONS

Dexus (DXS)

The real estate group has sold four Sydney office assets that will realise $942 million. The proceeds will be initially used to repay debt and to fund its significant development pipeline. In fiscal year 2021, the office segment accounted for 81 per cent of the company’s net asset value (NAV), 5 percentage points less than in fiscal year 2020. We estimate the office segment will account for 78 per cent of NAV in December 2022 following settlement of all four transactions.

Growthpoint Properties Australia (GOZ)

GOZ upgraded funds from operations guidance by 2.7 per cent for fiscal year 2022. Revaluations in the December half lifted net tangible assets by 33 cents to $4.50. Its total portfolio value is about $5 billion. Positive valuations enable the company to use its material debt capacity to make acquisitions in 2022. We estimate it has $450 million of debt capacity before gearing hits the bottom end of its target range between 35 per cent and 45 per cent. We’re taking a more positive view on office valuations and retain our hold rating.

SELL RECOMMENDATIONS

Aurizon Holdings (AZJ)

The recent acquisition of One Rail Australia (ORA) for $2.35 billion provides entry to the Northern Territory and South Australian markets. However, the deal includes Aurizon selling ORA’s east coast rail operations, which, in our view, increases uncertainty, given the impact of possible negative thermal coal sentiment on any potential realised price.

Flight Centre Travel Group (FLT)

Historically, FLT has been one of the best retail travel groups in the world. But it’s up against a continuing pandemic. The share price has fallen from $24.43 on October 5 to trade at $17.56 on January 20. It faces navigating structural change in the travel agency revenue model in the Australian and New Zealand markets. In our view, the key challenge for the company is to continue reducing costs to protect group earnings.

Jean Claude Perrottet, Medallion Financial Group

BUY RECOMMENDATIONS

Credit Corp Group (CCP)

CCP purchases debt ledgers in Australia, New Zealand and the US. It also provides online consumer finance. CCP has generated consistent revenue growth in the past decade. CCP has lifted earnings and investment guidance for fiscal year 2022 following the recent acquisition of Radio Rentals. The acquisition could continue to provide significant upside moving forward.

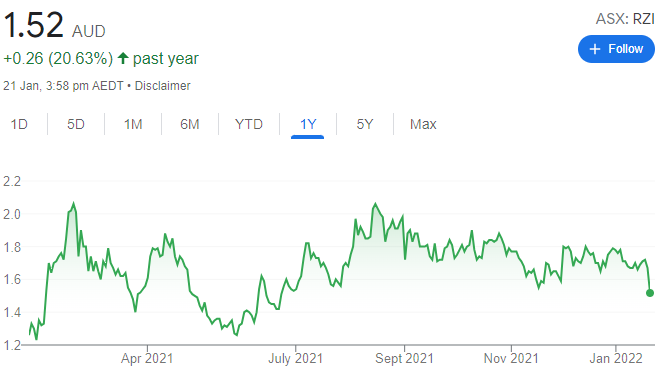

Raiz Invest (RZI)

This fast growing financial technology company provides an online micro-investment platform, which enables clients to invest into a diversified portfolio. In December, management confirmed an impressive 70.8 per cent increase in funds under management to $1 billion amid significantly increasing the number of clients. Positive metrics paint a bright outlook for the future.

HOLD RECOMMENDATIONS

Santos (STO)

The gas supplier’s balance sheet has improved in response to a low cost operating model. The company posted sales revenue of $US1.5 billion in the 2021 fourth quarter, a 34 per cent increase on the third quarter. It posted record annual sales revenue of $US4.7 billion. We expect STO to benefit from stronger LNG prices in response to recent high crude oil prices, which we expect will be sustained during 2022.

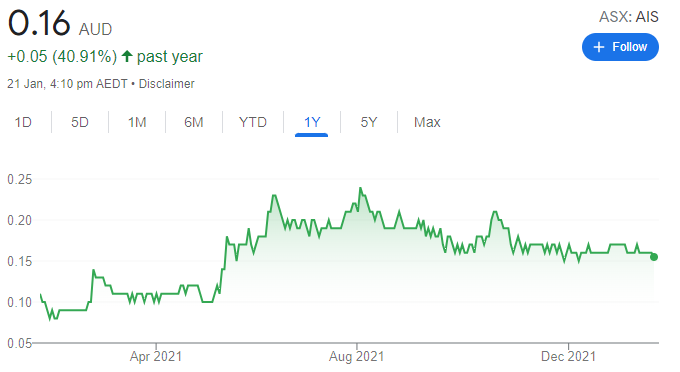

Aeris Resources (AIS)

AIS own the Tritton copper operations in New South Wales and the Cracow gold mine in Queensland. According to its fiscal year 2022 first quarter report, AIS has about $100 million in cash on its balance sheet and is debt free. We believe copper prices will rise in response to an increasing focus on renewables and electric vehicles.

SELL RECOMMENDATIONS

Mesoblast (MSB)

The company is developing allogeneic cellular medicines for treating inflammatory conditions. The share price has continued to struggle since Novartis Pharmaceuticals terminated its proposed deal to commercialise the biotech’s flagship product for treating respiratory illnesses. The shares have fallen from $1.70 on December 13 to close at $1.25 on January 20. We believe investors can do better elsewhere.

Redbubble (RBL)

RBL operates a global online market connecting independent artists with customers. A recent preliminary update revealed unaudited marketplace revenue of $288 million in the first half of fiscal year 2022 was down 18 per cent year-on-year. First half 2022 gross profit of $108 million fell 25 per cent year-on-year. Other stocks appeal more at this point.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.