John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Auckland International Airport (AIA)

A positive for AIA is the New Zealand Government bringing forward its plans to re-open the country’s borders to international travellers. The return of international travel may encourage AIA management to resume dividends. If the company starts paying dividends, AIA is likely to attract interest from global funds seeking yield from quality infrastructure assets.

Mad Paws Holdings (MPA)

We’re impressed with this pet services provider after an on-site review of the company’s operations. The pet chemist business is potentially the most lucrative segment of the company’s operations, as it’s able to sell pet pharmaceutical products at an attractive premium to repeat customers. There’s plenty of room for growth for the pet chemist business, as it uses the Mad Paws platform to sell their products.

HOLD RECOMMENDATIONS

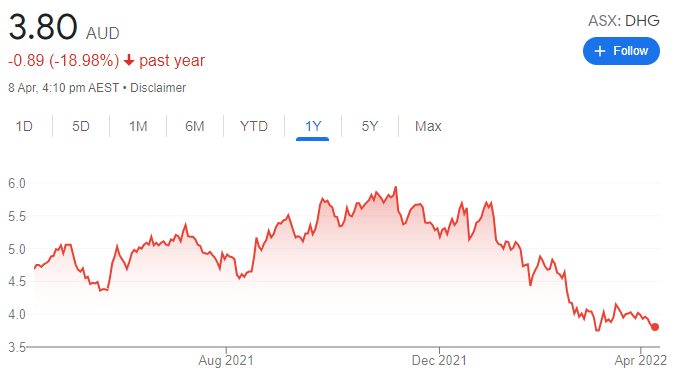

Domain Holdings Australia (DHG)

This digital real estate listings company is raising $180 million after entering into a binding agreement to acquire real estate campaign management platform Realbase. The retail entitlement offer is due to close in on April 28. Investors should examine the offer and take personal circumstances into account before investing. Longer term, Domain offers value. But we want to see how the company performs after the acquisition before moving from a hold recommendation to a buy.

Fortescue Metals Group (FMG)

The share price of this iron ore producer has performed strongly recently in response to rising iron ore prices and the company’s ability to manage costs and production. The risks for shareholders are weakening iron ore prices and the company’s hydrogen energy investments. In our view, it’s best to hold and see how these risks play out.

SELL RECOMMENDATIONS

Sayona Mining (SYA)

The share price of this lithium explorer has soared amid recent testing results confirming the quality of its spodumene product. Moving forward, the risk is to the downside, in our view, as there’s little room for error if the next round of company announcements misses high market expectations.

Woodside Petroleum (WPL)

Our sell recommendation isn’t a reflection of the company, but rather a possible fall in crude oil prices. We expect supply side pressures to ease if a solution is found to the war in Ukraine. WPL has performed strongly, so investors may want to consider locking in some profits.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

Auteco Minerals (AUT)

AUT owns and operates the Pickle Crow gold project in Ontario, Canada. The project has an existing resource of 2.23 million ounces at 7.8 grams a tonne gold. The asset is in a tier 1 location with a long history of high-grade gold production. AUT recently raised $20 million of equity, which has substantially de-risked the company leading into an extensive drilling program in 2022.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Great Boulder Resources (GBR)

This gold explorer is developing the Side Well project in the Murchison region of Western Australia. The company has demonstrated several high-grade gold results at its Mulga Bill prospect. The prospect is big and offers scale. Recent metallurgical testing highlighted an overall gold recovery of 99.7 per cent.

HOLD RECOMMENDATIONS

Woodside Petroleum (WPL)

Woodside is one of Australia’s biggest oil and gas producers. The share price has enjoyed a substantial rise since the beginning of the 2022 calendar year. Woodside has been one of the primary beneficiaries of a rising crude oil price in response to the war in Ukraine. Talks of an easing military presence in the Ukraine may dampen oil and gas spot prices.

The a2 Milk Company (A2M)

This infant formula company has been one of the more disappointing stories in the past year, as a result of investor concerns about sustainable demand from its major buyer China. Profit margins have been squeezed due to the pandemic. The worst of COVID-19 related issues may be behind A2M, but we can’t see enough confidence yet to consider it a buy.

SELL RECOMMENDATIONS

Qantas Airways (QAN)

The airline has been severely impacted by COVID-19. We expect relatively high crude oil prices to pressure margins, particularly in relation to international travel. In our view, the uptake for airline travel will be slower than most people anticipate. Investors may want to consider selling if they have made a short term profit.

Rio Tinto (RIO)

Rio Tinto is one of the world’s biggest mining companies, specialising in producing iron ore. The iron ore spot price has risen significantly in response to supply-side issues flowing from the war in Ukraine. The share price has risen from $90.97 on November 1 to close at $118.74 on April 7. The stock went ex-dividend several weeks ago, so it may be prudent for investors to consider locking in a profit.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

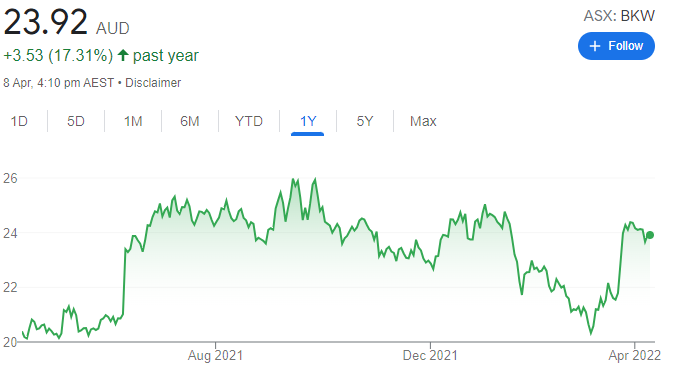

Brickworks (BKW)

BKW reported first half 2022 underlying net profit after tax of $330 million, up 269 per cent on the prior corresponding period. The company declared an interim dividend of 22 cents, up a cent on a year ago. All divisions posted strong earnings growth, except Building Products North America. In the medium term, we expect company earnings to continue growing on the back of a strong pipeline of work from housing activity in Australia and improving non-residential construction activity in the US.

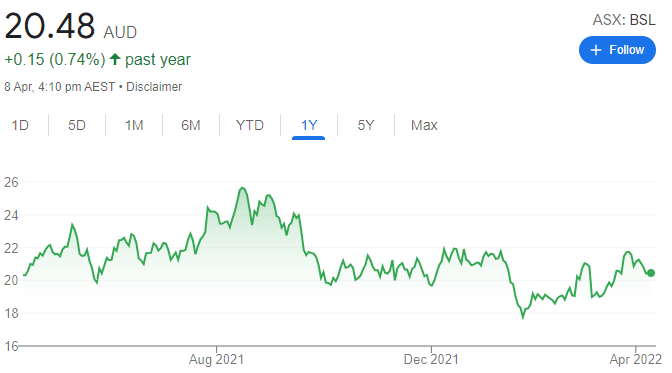

BlueScope Steel (BSL)

Steel prices in Europe and the US have moved higher. Despite declining from recent highs, spot spreads are still generating an attractive 18 per cent free cash flow yield for BlueScope from fiscal year 2023 and beyond. This highlights that BlueScope remains a high generator of free cash flow despite strong cost inflation.

HOLD RECOMMENDATIONS

Boral (BLD)

Lower sales volumes as a result of east coast floods should be more than offset by flood recovery work. This building products supplier is a likely beneficiary of Federal Government infrastructure spending moving forward. However, we have moderated our top line fiscal year 2023 and 2024 forecasts in response to work delays.

McPherson’s (MCP)

This health and beauty products supplier has announced a key strategic alliance with Chemist Warehouse. According to our analysis, the agreement is expected to be earnings per share accretive in fiscal year 2023. The alliance will expand the company’s portfolio of brands at Chemist Warehouse, while also recognising McPherson’s as a preferred supplier.

SELL RECOMMENDATIONS

Mineral Resources (MIN)

This mining services company focuses on the iron ore and hard rock lithium sectors in Western Australia. We expect the iron ore price to decline into the second half of calendar year 2022, which is likely to weigh on group free cash flow, in our view. MIN continues to trade above our valuation. We remain impressed with management’s track record of value creation, but would examine becoming more positive at a lower trading level.

Carsales.com (CAR)

The share price has fallen from $24.19 on January 7 to trade at $20.40 on April 7. At this point, we can’t identify a catalyst that will generate strong earnings tailwinds enjoyed by other online classified operators. We also perceive higher execution risk compared to other online classified operators. Despite the valuation moderating since the start of calendar year 2022, we remain cautious.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.