John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Suncorp Group (SUN)

Group net profit after tax fell 20.8 per cent to $388 million in the first half of fiscal year 2022. The result was impacted by natural hazard events and operational impacts from COVID-19. This diversified financial services company is strong, and we expect performance to improve in the second half. The recent share price fall provides a buying opportunity.

TPG Telecom (TPG)

The share price has fallen from $7.25 on October 4 to close at $5.80 on February 17. We expect TPG to benefit from increasing demand for global roaming services in response to international borders re-opening. TPG is capable of growing its fixed wireless business, which we expect will provide further upside to its shareholders.

HOLD RECOMMENDATIONS

Northern Star Resources (NST)

Northern Star is our preferred ASX listed gold company. It recently reported a net profit after tax of $261 million for the six months to December 31, 2021. The 43 per cent increase was driven by higher production and portfolio optimisation. The result exceeded expectations.

Newcrest Mining (NCM)

The company produced 436,000 ounces of gold and 26,000 tonnes of copper for the three months ending December 31, 2021. The company is on track to deliver group fiscal year 2022 guidance. Our hold rating reflects a possibility that the gold price may fall as inflationary fears ease.

SELL RECOMMENDATIONS

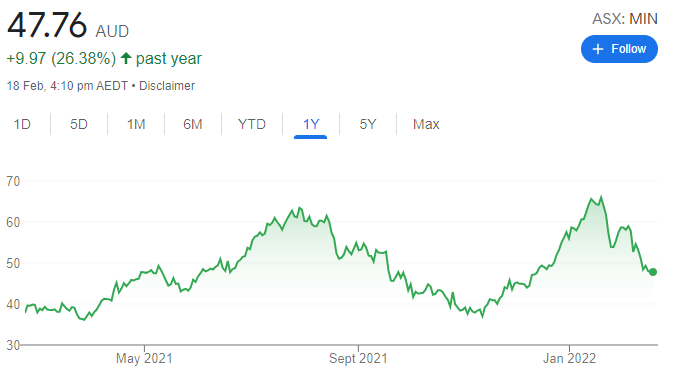

Mineral Resources (MIN)

First half 2022 results fell short of expectations. Revenue of $1.4 billion was down 12 per cent on the prior corresponding period. Underlying EBITDA of $156 million plunged 80 per cent. Statutory net profit after tax was $20 million, down 96 per cent. There’s a risk that iron ore prices could decline from recent highs.

Magellan Financial Group (MFG)

The global fund manager recently announced it had experienced unaudited net outflows of about $5.5 billion between January 1, 2022 and February 11. Net institutional outflows accounted for $5 billion of the total. We would need to see a sustained uptick in funds under management growth before upgrading our recommendation.

Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

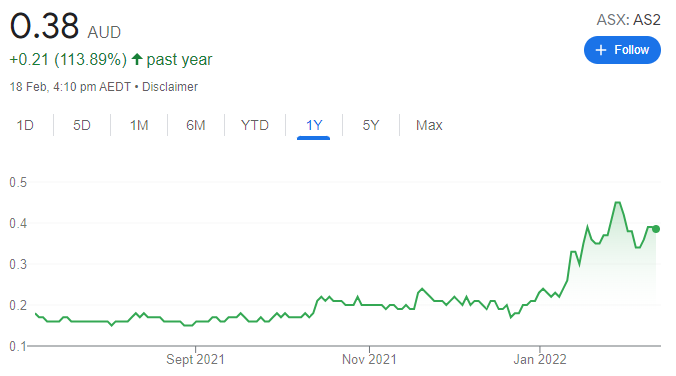

Askari Metals (AS2)

The company recently confirmed the presence of LCT-type pegmatites at the Barrow Creek Lithium Project, which is encouraging news. AS2 has previously been known as a gold explorer, but the lithium project offers potentially bright prospects. Lithium carbonate prices have soared in the past 12 months. The shares have been trending up since the start of 2022. Our firm is the number one shareholder in AS2.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

ReNu Energy (RNE)

The recent acquisition of Countrywide Renewable Hydrogen provides access to the growing green hydrogen industry through the Melbourne Hydrogen Hub, Hydrogen Tasmania and Hydrogen Portland. RNE is a leader in the green hydrogen space. In our view, the company’s technology will enable Australia to significantly cut greenhouse emissions in the future. We like the company’s outlook.

HOLD RECOMMENDATIONS

Lake Resources N.L. (LKE)

The company announced it intends to fast track lithium projects in Argentina. It has set a goal of annually producing 100,000 tonnes of high purity lithium chemical by 2030. It’s an ambitious target, in our view, where drilling and testing is still underway across its three lithium projects. A definitive feasibility study showed Lake’s flagship Kachi project would be able to produce 50,000 tonnes of lithium carbonate a year.

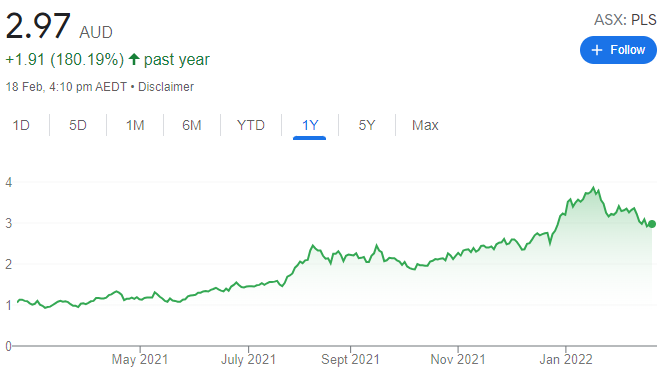

Pilbara Minerals (PLS)

In the December quarter, PLS produced 83,476 dry metric tonnes of spodumene concentrate, which was marginally lower than the revised guidance of between 85,000 tonnes and 95,000 tonnes. Average prices received in the December quarter were at the top end of prior guidance. Plant ramp-up initiatives amid extended shutdowns contributed to the production shortfalls. However, PLS offers potential given strong lithium market conditions.

SELL RECOMMENDATIONS

Kogan.com (KGN)

KGN operates in a highly competitive e-commerce industry involving giants, such as Amazon, ebay and Alibaba. Kogan faces industry challenges, such as low switching costs for consumers and low barriers to entry. Until global supply constraints ease, we’re not expecting a sustained improvement in financial metrics.

Myer Holdings (MYR)

The business is improving. Total sales for the five months to January 1, 2022 were up 12.3 per cent compared to the prior corresponding period. Group online sales grew 54.3 per cent. Sustaining performance remains a challenge during the pandemic and beyond given fierce competition and potentially higher interest rates.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

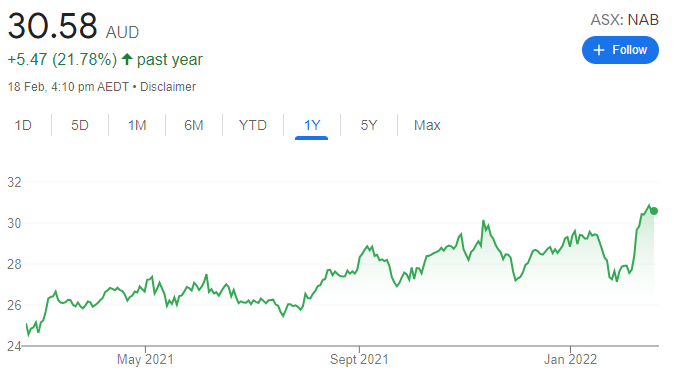

National Australia Bank (NAB)

First quarter 2022 results were ahead of expectations. Cash earnings grew 9.1 per cent on the prior corresponding period. Improving customer satisfaction and market share gains were solid achievements given the challenging operating environment. NAB had been losing market share in the past two years. Management is also optimistic about the outlook and is targeting flat expenses in the 2022 financial year.

Beach Energy (BPT)

This oil and gas explorer and producer posted a first half 2022 net profit after tax of $213 million, up 66 per cent on the prior corresponding period. A significantly improving crude oil price was a major tailwind. The outlook for the crude oil price is favourable. BPT is also making progress towards a production target of 28 million barrels of oil equivalent.

HOLD RECOMMENDATIONS

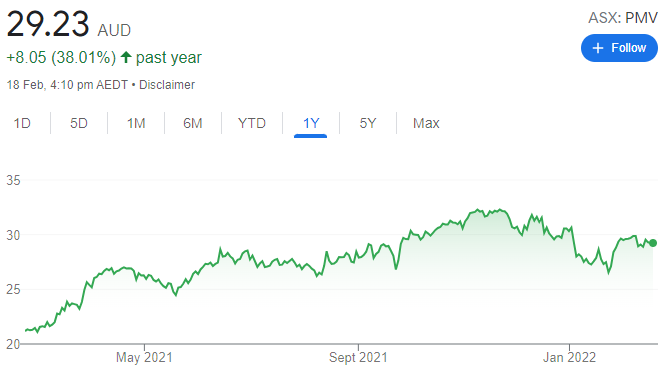

Premier Investments (PMV)

PMV owns retail brands Smiggle and Peter Alexander. PMV delivered a solid retail trading update at the end of January. The latest half year results are expected in late March, with earnings anticipated to grow 5 per cent year-on-year. Strong online sales should lead to improving margins. Tailwinds include increasing brand awareness and cost reductions from closing stores in high rental areas.

GrainCorp (GNC)

This integrated grain and edible oils business expects to almost double last year’s underlying profit. Impressive supply chain management, a second consecutive bumper crop and high demand for Australian grain and oil seeds are contributing to a positive outlook. We expect these factors, coupled with supply shortages and adverse weather in the northern hemisphere, to further help performance this financial year.

SELL RECOMMENDATIONS

Nanosonics (NAN)

This medical device manufacturer downgraded sales guidance for fiscal year 2022 after revising the North American sales model with GE Healthcare. Increasing sales opportunities may emerge from NAN taking on more control. However, in our view, there’s also an increasing risk to future earnings. The share price has fallen from $6.43 on January 4 to trade at $4.80 on February 17.

Kogan.com (KGN)

The share price of this online retailer has fallen from $16.43 on February 18, 2021 to trade at $6.12 on February 17, 2022. Underlying earnings (EBITDA) for the first half of fiscal year 2022 were below expectations. Operational costs impacted the result. We expect more pressure on the share price in response to potential supply chain interruptions and fluctuations in demand.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.