John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Spenda (SPX)

Spenda supplies industries with a broad range of business-to-business payment services. In December 2022, the company announced its platform would be rolled out to the Carpet Court franchise network. It also announced it had entered into a new two-year payment facilitator agreement with Fiserv. We expect these agreements to be positive for the company’s future financial performance. We anticipate further agreements and upside for Spenda.

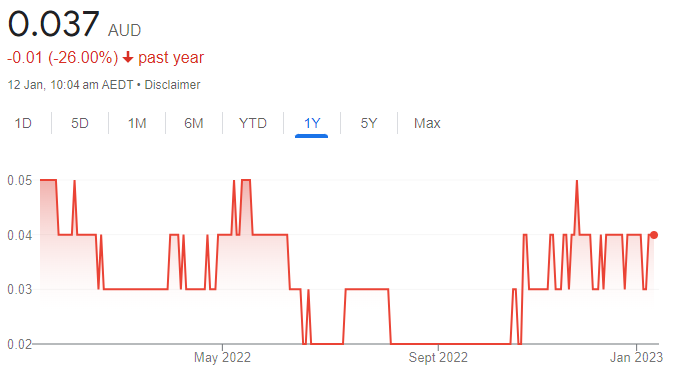

Jaxsta (JXT)

The music credit technology company recently announced a pre-launch of vinyl.com. Vinyl sales in the US continued to grow for 15 consecutive years to 2021, with revenues up 61 per cent to $US1 billion. JXT is innovative and the growing US vinyl market paints a bright outlook. The company is best suited to investors with an appetite for risk. The shares were trading at 3.7 cents on January 12.

HOLD RECOMMENDATIONS

Estia Health (EHE)

Estia is one of Australia’s biggest aged care providers. The company is still recovering from the impact of COVID-19, but is able to grow via acquisitions as smaller competitors are struggling with compliance burdens. We believe it’s worth holding EHE at this point to see if it can benefit from its acquisition strategy. Keep an eye on the news flow.

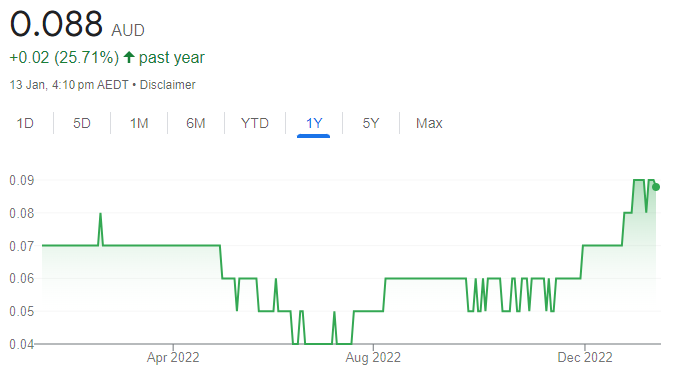

Retail Food Group (RFG)

RFG is a food and beverage company. Brands include Donut King, Crust Gourmet Pizza and Michel’s Patisserie. RFG recently reached an agreement to settle legal proceedings instigated by the Australian Competition & Consumer Commission in relation to franchisees. RFG will compensate franchisees and waive debts. RFG will pay about $10 million. The company’s shares have risen since the settlement to trade at 8.8 cents on January 12. It may make more gains, but keep an eye on the news flow.

SELL RECOMMENDATIONS

Air New Zealand (AIZ)

The airline recently upgraded earnings before other significant items and tax to between $295 million and $325 million for the first half of fiscal year 2023. This compares with previous guidance of between $200 million and $275 million for the half year. In our view, higher interest rates and rising cost of living expenses may curtail airline travel after the holiday season ends.

Domino’s Pizza Enterprises (DMP)

Underlying earnings before interest and tax fell 10.5 per cent to $262.9 million in financial year 2022. The company is up against rising inflation, so sustaining margins is another challenge. Also, consumers have much more choice in the food sector. The shares have fallen from $107.30 on January 13, 2022 to trade at $69.12 on January 12, 2023. Other stocks appeal more, in our view.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Ansell (ANN)

Ansell makes protective medical and industrial gloves. The share price has been trending higher since June 2022 and breached resistance at $28 in late October. The technical chart remains bullish, which is another positive for the stock. The stock is in a strong uptrend, with no signs of weakness.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Evolution Mining (EVN)

We’re bullish about the outlook for gold in volatile and uncertain times across the globe. EVN is one of the biggest gold miners on the ASX. The share price has risen from $1.81 on October 21, 2022 to trade at $3.33 on January 12, 2023. We expect the upward trend to continue. In our view, any short-term weakness presents a buying opportunity.

HOLD RECOMMENDATIONS

Sandfire Resources (SFR)

Copper is another commodity we’re bullish on in 2023. SFR is set to become the biggest pure play copper stock on the ASX if BHP Group successfully acquires copper company OZ Minerals. Shares in SFR have risen from $3.25 on October 20, 2022 to trade at $6.28 on January 12, 2023. The company has established a new uptrend on bigger trading volumes.

Bowen Coking Coal (BCB)

The company owns coking coal projects in Queensland’s Bowen Basin. It recently loaded its first train and is on track to export its first shipment. The share price has risen from 25 cents on November 22, 2022 to trade at 30.7 cents on January 12, 2023. Good trading volumes are returning to the stock. This indicates the share price may chase its 2022 high of 44.5 cents.

SELL RECOMMENDATIONS

Kogan.com (KGN)

Gross sales and gross profit significantly declined in the first quarter of fiscal year 2023 when compared to the prior corresponding period. The share price of this online retailer has significantly fallen in the past 12 months. Rising interest rates may make it more difficult to grow sales and retain margins.

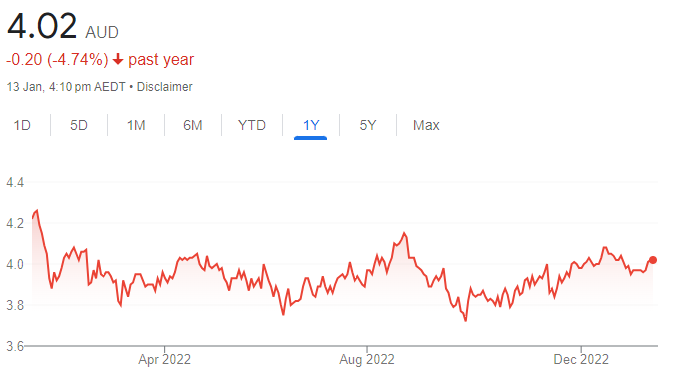

Orora (ORA)

In our view, the packaging giant’s share price still trades on an elevated price/earnings ratio compared to its earnings growth. The share price has fallen from $4 on April 29, 2022 to trade at $2.96 on January 12, 2023. The share price may remain under pressure if the global economy slows. Other stocks appeal more for capital growth, in our opinion.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Xero (XRO)

This cloud-based financial software company services about 3.3 million businesses across the globe. Selective exposure to technology stocks is likely to deliver value due to their ability to grow earnings faster than GDP, regardless of interest rate movements. We prefer high quality technology companies with net cash balance sheets and pricing power. We’re forecasting earnings per share to grow from 10.6 cents in fiscal year 2023 up to 30.2 cents per share in fiscal year 2024. Our current valuation is $77 a share. The shares were trading at $71.23 on January 12.

Telstra Group (TLS)

Demand for secure digital infrastructure remains robust. This telecommunications giant is expected to retain its attractive dividend yield, which appeals to income investors in volatile times. Telstra remains the dominant player in Australia’s telecommunications sector. The company has forecasted total income of between $23 billion and $25 billion in fiscal year 2023. In our view, the company is undervalued. We have a price target of $4.60. The stock was trading at $4.05 on January 12.

HOLD RECOMMENDATIONS

Transurban Group (TCL)

We continue to hold this toll road operator. Regulated revenues, resilient demand and defensive earnings also appeal. Infrastructure assets are relatively scarce on the ASX. Our valuation is $13.85. The shares were trading at $13.32 on January 12.

ANZ Group Holdings (ANZ)

We’re forecasting the bank’s grossed up dividend yield to be about 9 per cent this financial year. However, bank dividend yields may not be as appealing on a risk-adjusted basis when compared to government bonds, bank hybrids and term deposits. Our valuation is $25.91. The stock was trading at $24.32 on January 12.

SELL RECOMMENDATIONS

Seek (SEK)

Shares in this employment and education company have fallen from $31.03 on March 18, 2022 to trade at $22.05 on January 12, 2023. Valuations remain around historical averages post the sell-off. We believe other stocks offer more capital growth potential at this time. Investors may want to consider cashing in some gains by trimming their portfolios.

Woolworths Group (WOW)

The share price of this supermarket giant has fallen from $39.39 on August 17, 2022 to trade at $34.25 on January 12, 2023. We’re forecasting limited capital growth as thrifty shoppers carefully watch their spending as prices rise. In our view, the dividend yield is modest. Investors may want to consider taking some profits by trimming their portfolios.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.