See our brand new top 10 broker reviews. Find your perfect platform!

Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

Telix Pharmaceuticals (TLX)

Chart: Share price over the year

TLX is a clinical stage biopharmaceutical company, focusing on diagnostic and therapeutic products within the nuclear medicine field. The company is currently selling its lead product for diagnosing and treating prostate cancer in the US. As the company progresses to regulatory approvals to market their products in the next 12 months and beyond, we expect revenues will multiply.

Lotus Resources (LOT)

Chart: Share price over the year

Lotus has acquired a majority stake in the Kayelekera uranium project in Malawi. Kayelekera has previously produced 10.9 million pounds of uranium using existing infrastructure and associated processing plant. Lotus has one of the shortest lead times to production, so it can leverage off any bull cycle in the uranium price.

HOLD RECOMMENDATIONS

K-TIG (KTG)

Chart: Share price over the year

K-TIG is a CSIRO developed key hole welding technology that’s 100 times faster and 80 per cent cheaper than traditional key hole welding techniques. The company has exported machines to more than 20 countries. We believe the company has a bright outlook.

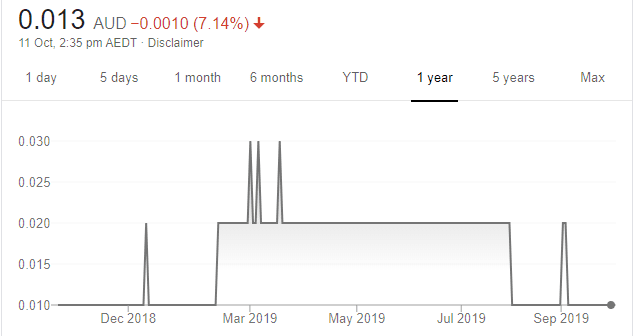

RBR Group (RBR)

Chart: Share price over the year

RBR is a training and labour hire company leveraged to the LNG construction industry in Mozambique. RBR has one of 12 labour hire licences currently issued in Mozambique. Four LNG facilities are planned to be built in Mozambique, and up to 40,000 full time employees may be required during the construction phase. RBR will train and place local staff onto projects.

SELL RECOMMENDATIONS

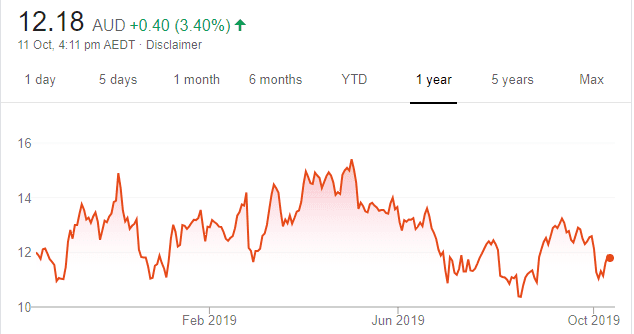

HUB24 (HUB)

Chart: Share price over the year

HUB operates a wealth management platform. It was recently trading on a lofty price/earnings ratio of more than 100 times. HUB continues to attract strong inflows to its core platform business. But HUB may be forced to cut margins it charges customers in response to lower interest rates on deposits.

National Australia Bank (NAB)

Chart: Share price over the year

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

NAB is the leading business bank in Australia. The Australian Government is encouraging small to medium sized businesses to closely examine their bank loans to ensure they are getting the best possible deal. In a fiercely competitive lending environment, banks may have to cut net interest margins. As a leading business bank, NAB potentially has the most to lose, in our view.

Elio D’Amato, Lincoln Indicators

BUY RECOMMENDATIONS

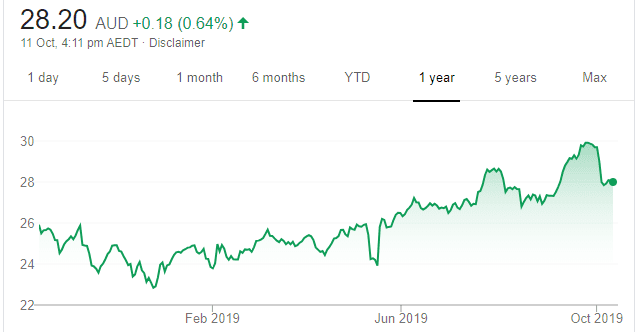

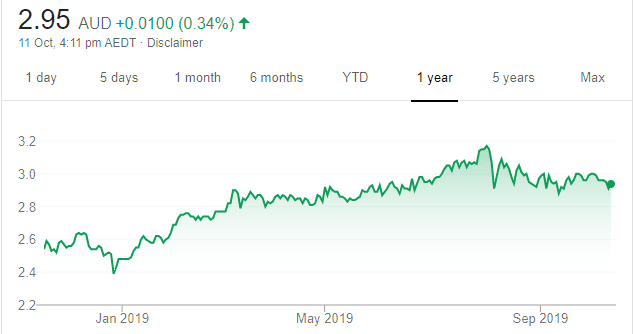

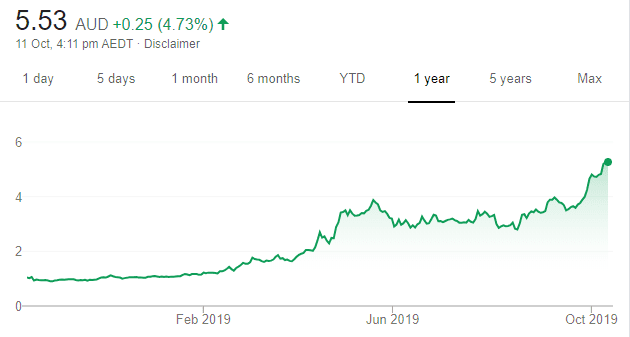

Altium (ALU)

Chart: Share price over the year

Develops and sells software and hardware used for designing electronic products. The company is on a strong growth trajectory and is set to become a market leader in printed circuit boards by 2020. ALU offers a strong return on equity, good margins, new product rollouts and robust financial health. Altium generates revenue across the globe.

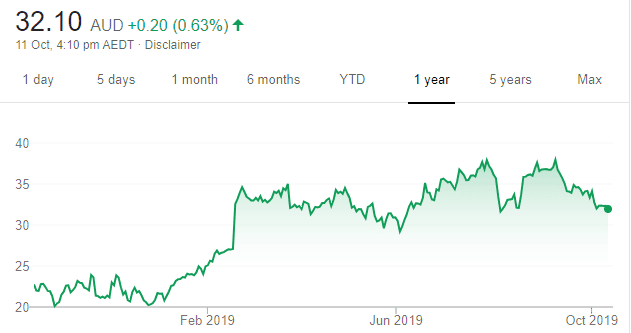

Integral Diagnostics (IDX)

Chart: Share price over the year

This digital imaging provider generates high profit margins. The company’s defensive earnings characteristics are underpinned by an ageing population requiring health care services. The company has been on the acquisition trail for the past five years. A grossed up dividend yield of 4.33 per cent is also a bonus.

HOLD RECOMMENDATIONS

Breville Group (BRG)

Chart: Share price over the year

Develops and distributes kitchenware, such as coffee machines and toasters. BRG generates much of its revenue overseas. We expect operating cash flow to improve despite a decline in its latest result. Given stable growth, we continue to support the business.

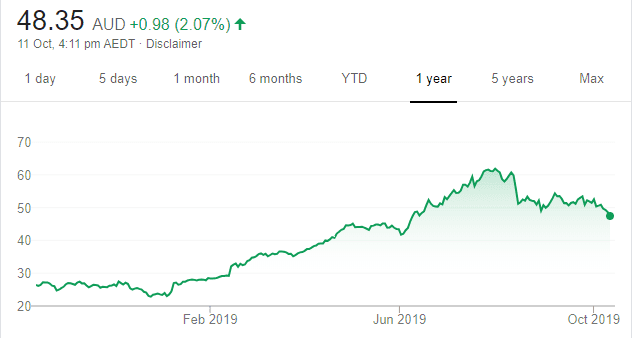

Magellan Financial Group (MFG)

Chart: Share price over the year

Shares in this global fund manager have fallen from $60.75 on August 9 to close at $47.37 on October 10. MFG tends to invest in quality stocks. In our view, there’s been a shift away from quality across the globe. Regardless of short term cycles, MFG is a quality business that continues to perform well. We expect it to be supported by an imminent product launch and a strong gross dividend yield of 4.76 per cent.

SELL RECOMMENDATIONS

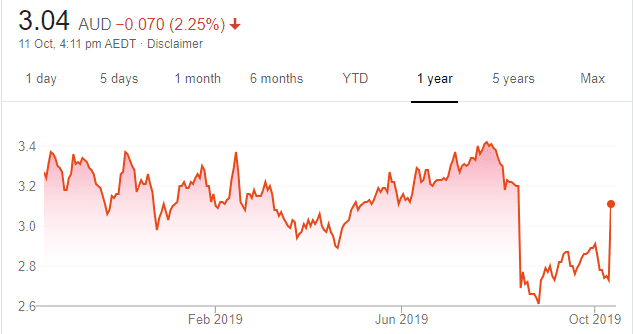

Orora (ORA)

Chart: Share price over the year

The latest results show this packaging firm’s net profit margin fell by 4.8 per cent. This was its second consecutive decline, reflecting stiffer competition. Return on equity fell from 14.02 per cent to 13.25 per cent. Despite the recent sale of the fibre business, overall market conditions remain challenging. We suggest taking the price bounce and waiting on the sidelines until a more precise picture emerges with regards to its earnings outlook.

BWX Limited (BWX)

Chart: Share price over the year

Following new management and a turnaround plan, this skin care product manufacturer has found support recently as the cycle has turned back in favour of value stocks. While early signs are good, we feel it’s still too soon to declare the worst is over, so recent price support may provide an elegant exit.

Simon Herrmann, wise-owl.com

BUY RECOMMENDATIONS

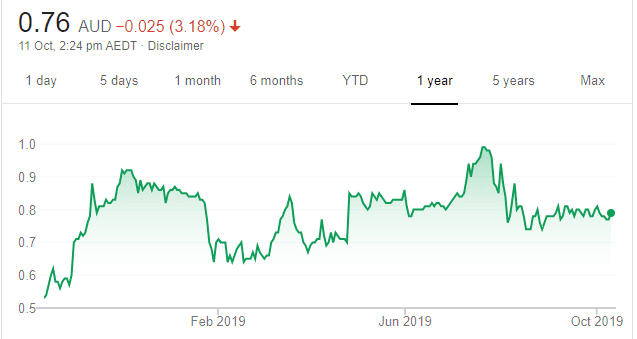

Freelancer (FLN)

Chart: Share price over the year

We like management’s strong record of creating value. FLN operates the world’s largest freelancing, outsourcing and crowd sourcing market. Following a period of stagnation and share price volatility, recent results suggest renewed growth momentum and a return to the company’s long term growth trend. We upgrade our view to buy.

Hearts and Minds Investments (HM1)

Chart: Share price over the year

Offers investors exposure to global equities from a select group of quality fund managers. The success and profitability of the Hearts and Minds fund depends on individual security selections, and there’s a risk of capital loss just as with any other fund. However, the concentration risk of the portfolio is somewhat limited due to the influence of a range of fund managers with different investment philosophies.

HOLD RECOMMENDATIONS

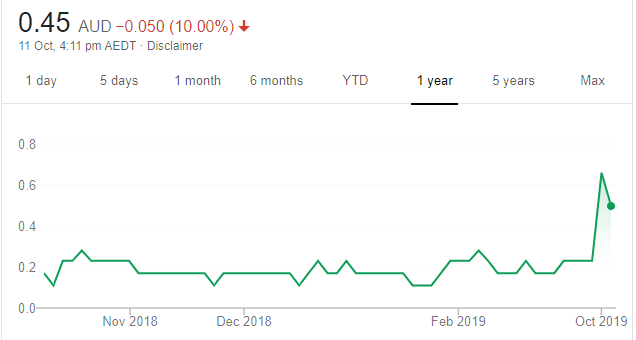

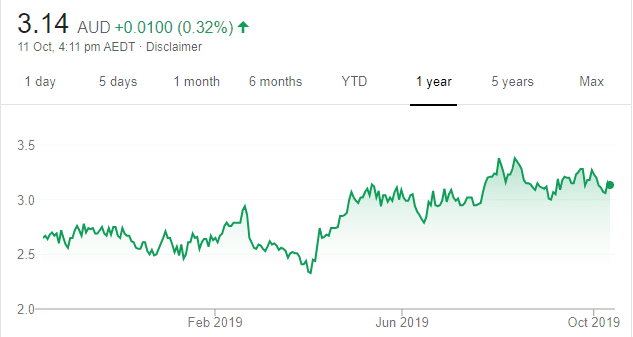

Australian Ethical Investment (AEF)

Chart: Share price over the year

The price has risen from $1.69 on July 2 to close at $2.44 on October 10. Continuing growth in funds under performance, a good track record and strong balance sheet is, in our view, behind the rally. Demand for its services is driven by a growing number of conscious investors seeking outperformance, while mindful of ethics and sustainability. Short term, the current valuation may be excessive, but the long term outlook remains favourable.

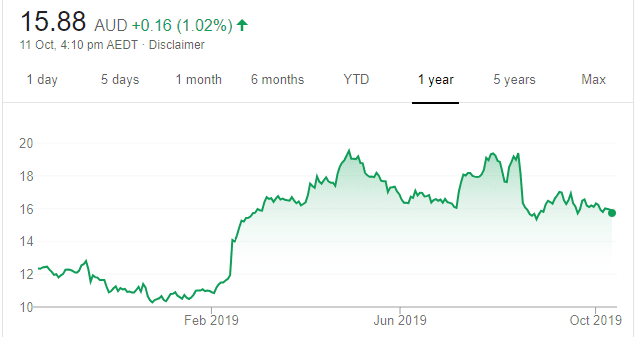

Codan (CDA)

Chart: Share price over the year

An electronic equipment and technology company. We’re attracted to its debt free structure and track record of double digit growth across all of its business units. Codan offers investors exposure to growth and income, but we note the stock is trading at almost year highs.

SELL RECOMMENDATIONS

Zip Co (Z1P)

Chart: Share price over the year

This consumer finance and payments company has been one of the star performers on the ASX this year, rallying five fold to reach a valuation of more than 20 times fiscal year 2019 revenues. While Z1P may continue its rally, I see it as momentum trap and investors should consider reducing their exposure. The stock has moved too high too rapidly.

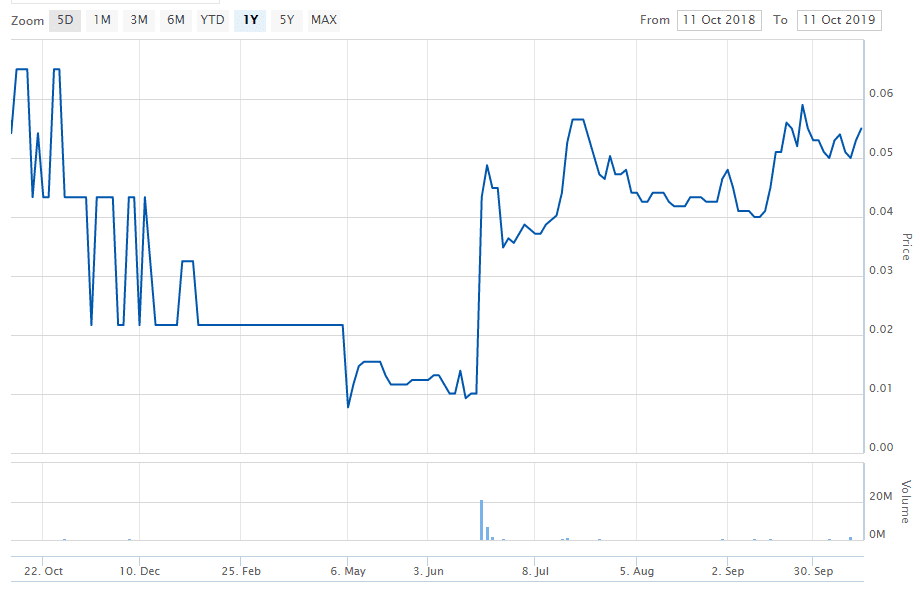

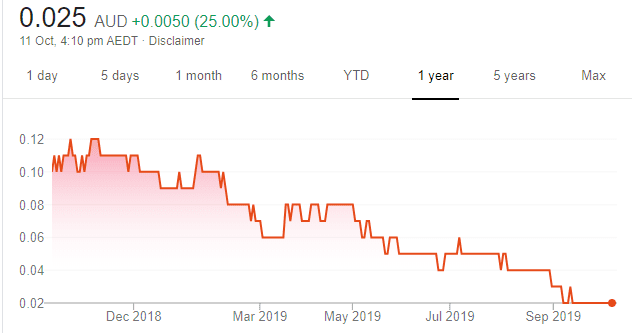

Buddy Technologies (BUD)

Chart: Share price over the year

BUD recently announced that its LIFX smart lights will be offered for sale in the Qantas Frequent Flyer Rewards store. However, we’ve been disappointed with the company’s performance and believe investors should consider selling. The shares have fallen from 12 cents on November 9, 2018 to close at 2 cents on October 10, 2019. Better opportunities exist elsewhere.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.