Elio D’Amato, Spotee.com.au

BUY RECOMMENDATIONS

BetMakers Technology Group (BET)

Wagering and gaming company Tabcorp has rejected the BET takeover bid and other offers. This enables BET to focus on driving its software-as-a-service betting platform into greenfield opportunities, particularly in the US. It recently acquired Sportech’s racing, tote and digital assets in the US, the UK and Europe. The New Jersey legislature has approved the Fixed Odds Bill, and BET has an exclusive 10-year agreement on thoroughbred horse racing. We like these odds at current prices.

AF Legal Group (AFL)

Investors in law firm Slater & Gordon were left reeling several years ago in response to a company acquisition in the UK. AFL is at a much earlier stage of its journey and stands to benefit from the increasingly transient nature of long term relationships. AFL is growing via acquisitions. Acquiring companies in a fragmented sector reaps early rewards. AFL is cash positive and can generate more growth.

HOLD RECOMMENDATIONS

Family Zone Cyber Safety (FZO)

FZO is an emerging leader in the global cyber safety industry. The FZO platform enables collaboration between schools, parents and cyber safety educators. FZO added 1 million students to its platform in the June quarter. The company is expanding in the US and services 5.2 per cent of school districts. On July 8, FZO announced it had been awarded a European patent. We believe there’s more scope for further revenue growth.

Jervois Mining (JRV)

JRV recently secured $100 million in funding to construct and develop its 100 per cent owned Idaho cobalt operations in the US. The company is committed to becoming a vertically integrated producer. In my view, JRV has a management team that has proven it can execute and deliver results.

SELL RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

DMP is a well managed quality business that continues to expand across the globe. The share price has enjoyed a strong run in the past 12 months. The stock was recently trading on a price-to-forecast sales multiple of 31 times and a lofty forecast price/earnings multiple of about 50 times. In our view, investors can consider locking in gains.

Premier Investments (PMV)

Premier owns a portfolio of retail brands. PMV is a proven performer and has rebounded strongly since its COVID-19 lows. The broader retail industry continues to be exposed to rolling lockdowns, inventory issues, COVID-19 vaccine reluctance and thinner margins. PMV has recently increased its stake in struggling department store chain Myer. Consequently, the higher stake in Myer may change investor perceptions about the outlook for PMV.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Aurumin (AUN)

AUN has two key gold exploration projects in Western Australia. Mount Dimer results to date have been encouraging, but I was disappointed with Mount Palmer assay results released on June 3. The share price has been under pressure due to the results, and from investors re-adjusting their portfolios before the end of the financial year. Despite the weakness, I regard AUN as a medium-term growth opportunity.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

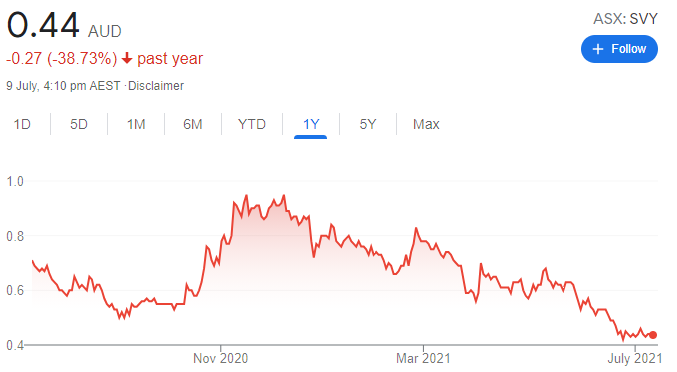

Stavely Minerals (SVY)

This copper and gold explorer recently reported encouraging results from the Cayley Lode discovery at Thursday’s Gossan prospect in Victoria. The drilling results continue to provide confidence on the potential to define a significant resource, while deeper drilling is aimed at a major porphyry target with significant upside. The share price has been under pressure and, at current prices, we believe it’s undervalued on growth potential.

HOLD RECOMMENDATIONS

Red Metal (RDM)

RDM has announced its intention to spin-out its Maronan project into a dedicated company, Maronan Metals. Speculative upside potential comes from the OZ Minerals alliance, a suite of large precious and base metals targets and strategic landholdings in the vicinity of Rio Tinto’s Winu copper discovery.

Zuleika Gold (ZAG)

This explorer is drilling multiple targets in Western Australia, which could potentially host gold resources. In my view, initial sampling and shallow drilling provides encouragement. ZAG is involved in a legal dispute with Vango Mining. ZAG remains speculative, with upside potential driven by exploration success. The shares were trading at 3 cents on July 8.

SELL RECOMMENDATIONS

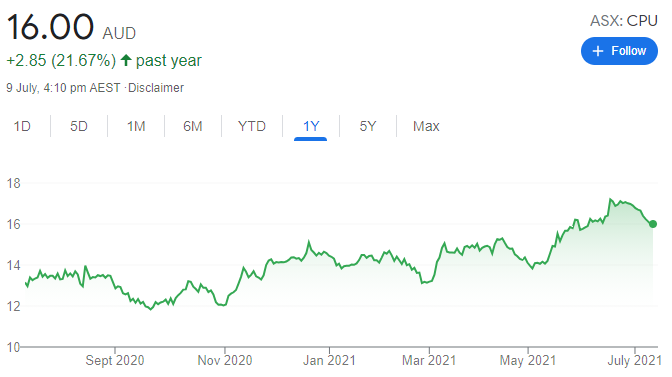

Computershare (CPU)

This share registry company has benefited from strong equity markets. The shares have risen from $13.19 on March 1 to trade at $16.135 on July 8. A risk is a retreat in indices at record high levels. At current prices, we believe investors can consider taking a profit.

BHP Group (BHP)

This diversified mining giant has benefited from stronger commodity prices following the COVID-19 sell-off in early 2020. Any retreat in commodity prices could impact BHP’s share price. BHP’s share price has risen from $45.61 on June 21 to trade at $49.54 on July 8. We believe BHP’s share price provides an opportunity for investors to consider taking a profit.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

Airtasker (ART)

This online market for services had a strong fourth quarter in the 2021 financial year. Gross marketplace volume of $153.1 million in full year 2021 exceeded its prospectus forecast and revised guidance provided in April of between $148 million and $152 million. While recent hard lockdowns are expected to have a temporary impact on the first quarter of fiscal year 2022, we see upside potential for strong full year results.

Autosports Group (ASG)

This luxury car dealer group has benefited from an increase in sales. ASG expects total revenue in fiscal year 2021 to range between $1.92 billion and $1.96 billion, an increase of between 13 per cent and 15 per cent on fiscal year 2020. Normalised net profit before tax is expected to range between $68 million and $70 million, an increase of between 199 per cent and 203 per cent on fiscal year 2020. Demand for new cars is expected to remain strong.

HOLD RECOMMENDATIONS

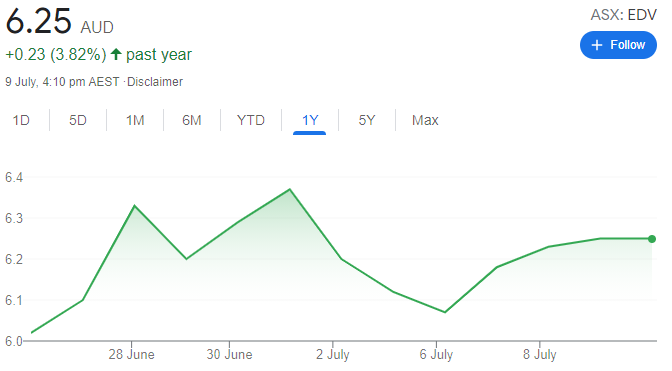

Endeavour Group (EDV)

This leading retail liquor and hospitality business has demerged from supermarket giant Woolworths and listed on the ASX on June 24, 2021. It has robust operating cash flow and access to liquidity to fund growth ambitions and capital returns to shareholders. We expect it to benefit from its niche position, with no clear listed competitors.

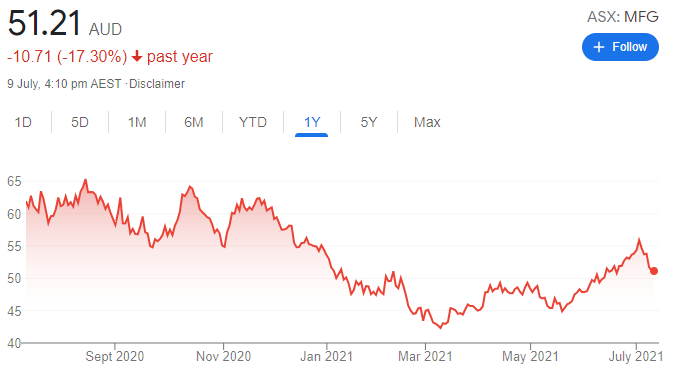

Magellan Financial Group (MFG)

This specialist fund manager experienced net outflows of $351 million in the June quarter. But MFG has a strong track record of performance. We expect its exposure to global markets and its well-regarded management team to support the share price. The shares were trading at $51.48 on July 8.

SELL RECOMMENDATIONS

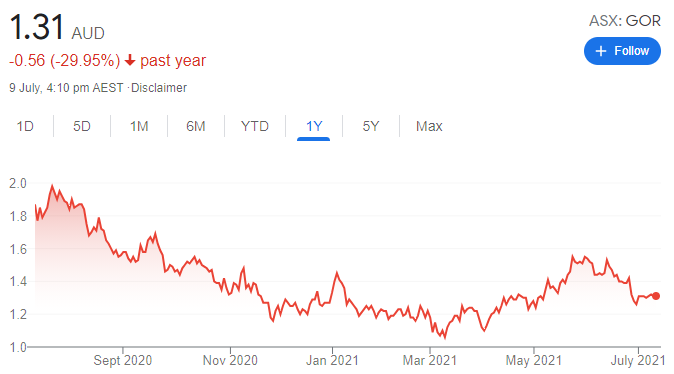

Gold Road Resources (GOR)

This gold miner expects calendar year 2021 production to be within the lower half of its guidance range of between 260,000 ounces and 300,000 ounces. Processing plant disruptions led to a revision of guidance. We believe there is downside risk to the share price in response to revised guidance and potentially softer gold prices.

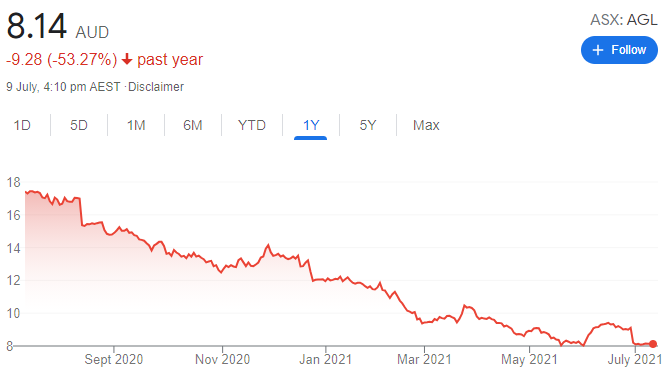

AGL Energy (AGL)

This utility announced it intends to separate into two businesses, Accel Energy and AGL Australia. The company has previously downgraded earnings guidance. The share price has halved in the past year to trade at $8.14 on July 8. AGL isn’t a compelling investment case, so we prefer others.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.