Elio D’Amato, Spotee Connect

BUY RECOMMENDATIONS

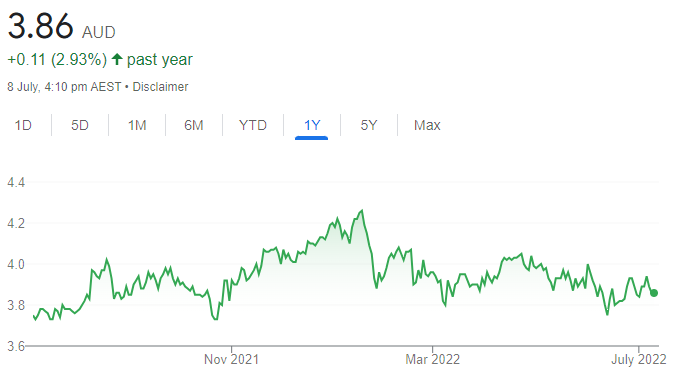

Dreadnought Resources (DRE)

The share price of this multi commodity explorer has been resilient despite smaller market capitalisation stocks retreating in recent months. Behind its resilience is a quality management team and news flow. Investors are waiting on assay results from the Tarraji-Yampi and Illaara projects and updates from other developments.

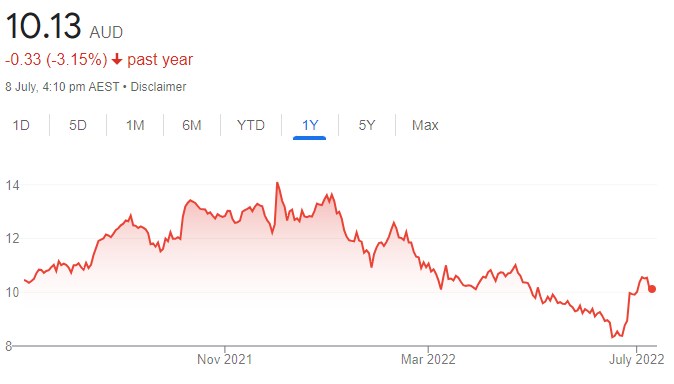

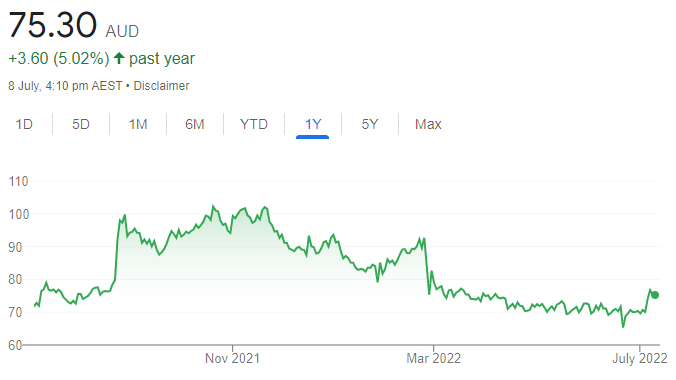

Collins Foods (CKF)

The KFC operator delivered a strong fiscal year 2022 result. It grew group revenue by 11.1 per cent on last year’s prior corresponding period. Earnings per share grew by 24.9 per cent and its fully franked dividend was up by 17.4 per cent. The European business is reporting same store sales growth of 12 per cent in the first seven weeks of the new financial year. The company has been reversing a downtrend from its peak.

HOLD RECOMMENDATIONS

4DMedical (4DX)

Company technology converts sequences of X-ray images into four dimensional quantitative views. Investors were rewarded recently when 4DX announced it could now sell its XV lung ventilation analysis software to 250 I-MED radiology clinics across Australia. The product is approved by the Therapeutic Goods Administration in Australia and the Food and Drug Administration in the US.

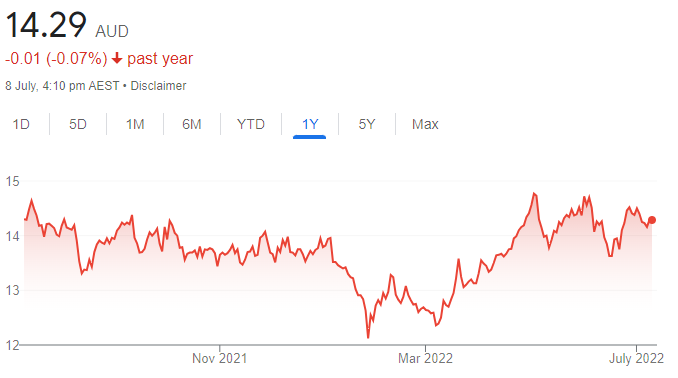

APA Group (APA)

APA operates several infrastructure assets, specifically focused on energy transmission, storage and processing. Inflation provisions in agreements will help distributions keep pace with interest rates. While the risks of possible government interference linger, the company remains focused on growth. It recently won a contract to develop a pipeline connection to the Snowy Hydro scheme.

SELL RECOMMENDATIONS

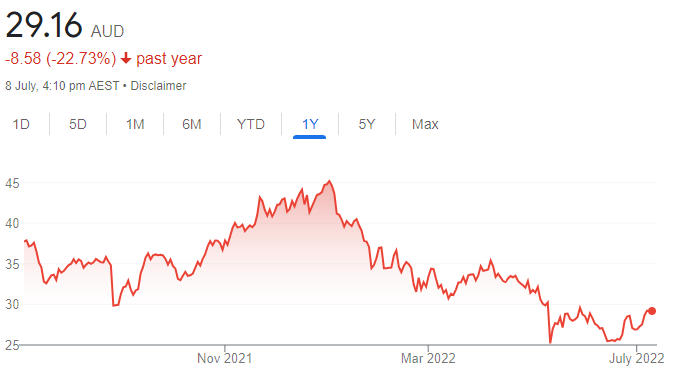

Rio Tinto (RIO)

The previous quarter revealed a fall in production in key commodities. But we still feel risks are to the downside, with lingering production issues and possibly softer commodity prices potentially disappointing the market. The shares have fallen from $118.92 on June 8 to trade at $96.67 on July 7.

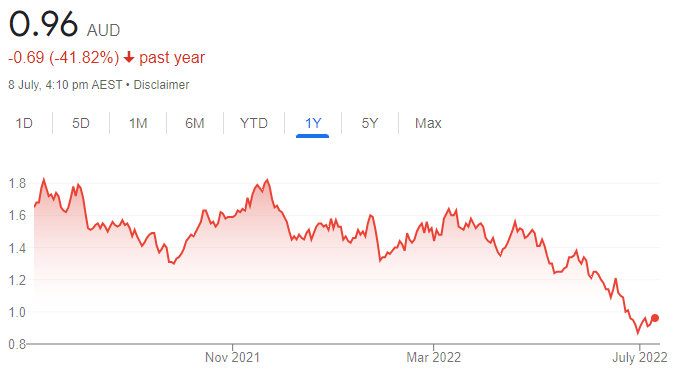

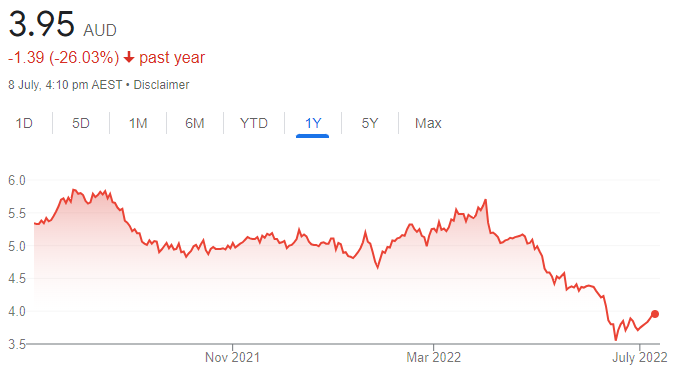

AMA Group (AMA)

After identifying AMA as a sell in TheBull.com.au in February 2021, this crash repair giant was recently experiencing issues with insurer contracts. However, new management is restructuring the business, with clear accountable goals. However, this will take time and, in our view, earnings are likely to remain under pressure. Investors will be looking for a recovery.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Ramelius Resources (RMS)

The gold producer marginally downgraded full year 2022 guidance to between 255,000 ounces and 260,000 ounces in response to rain, COVID-19, staff shortages and lower than forecast head-grade from the Tampia gold mine. It also flagged all-in-sustaining costs of between $A1475 and $A1525 an ounce, which should continue to generate strong margins, although at the upper end of guidance. We view price weakness as a buying opportunity.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Far East Gold (FEG)

FEG recently announced that an additional 7.5 kilometre epithermal vein length has been identified at the Hill 212 project in Queensland. Earthworks have started in preparation for drilling. At the highly prospective Woyla project in Indonesia, environment approval has been granted for advanced exploration activities, with recent sampling confirming potential bonanza grade mineralisation. FEG is to be considered highly speculative.

HOLD RECOMMENDATIONS

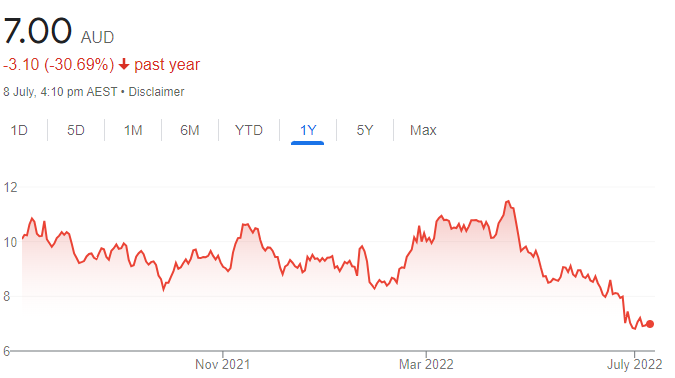

Northern Star Resources (NST)

The share price has fallen from $11.48 on April 19 to close at $6.93 on July 7. In our view, this is a response to gold price weakness and industry cost blowouts. The company’s operations are generating strong cash flows. Investors may want to consider holding for a recovery in the sector.

Proteomics International Laboratories (PIQ)

A company validation study has reported encouraging progress for treating women with endometriosis. According to PIQ, the research may lead to the world’s first non-invasive test for endometriosis. About one in nine women suffer from endometriosis. The company is also involved in treating diabetic kidney disease.

SELL RECOMMENDATIONS

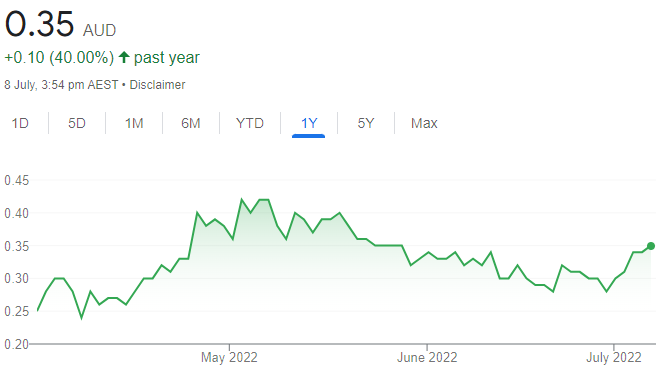

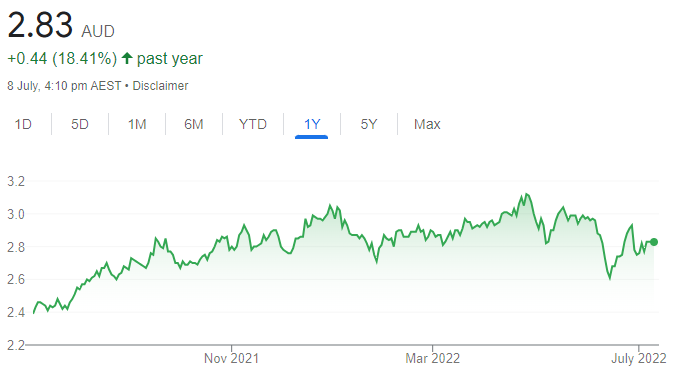

Bubs Australia (BUB)

The share price of this infant nutrition and dairy specialist has benefited from flying product to the US. The share price has risen from 34.9 cents on May 9 to close at 55 cents on July 7. In today’s volatile sharemarket, investors may want to consider locking in some gains.

Harvey Norman Holdings (HVN)

The retail giant’s share price has fallen from $5.09 on April 29 to close at $3.89 on July 7. The discretionary retail sector faces challenging headwinds from rising interest rates, cost of living pressures and declining property prices in Sydney and Melbourne. This is likely to impact spending in what may be a shrinking economy.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

Altium (ALU)

Altium is a high quality technology story. ALU has been steadily increasing its recurring revenue base over the past decade, with a shift to subscriptions. In our view, ALU is also a potential takeover target. US engineering software giant Autodesk lodged an indicative bid at $38.50 a share, but the deal failed to materialise last year.

James Hardie Industries PLC (JHX)

This building materials company mostly services the residential construction industry with its flagship fibre cement range. James Hardie’s wide economic moat should protect its ability to earn above its cost of capital over the economic cycle. Despite a challenging macro-economic backdrop, we view JHX as an attractive long term value proposition.

HOLD RECOMMENDATIONS

Transurban Group (TCL)

Transurban owns and operates toll roads in Melbourne, Sydney and Brisbane. It also owns toll roads in the US state of Virginia and the city of Montreal in Canada. Core Australian roads generate defensive revenue that grows with traffic volumes and toll price increases, which, at a minimum, are pegged to inflation. The stock looks fully priced at this time.

Telstra Corporation (TLS)

Telstra is able to direct more freed up capital to its higher growth mobile segment in response to an increasing number of households transitioning from the TLS copper network to the NBN. However, margin pressures remain a challenge, particularly in mobile, as competition is fierce.

SELL RECOMMENDATIONS

Blackmores (BKL)

Blackmores is a vitamins and supplement supplier. We view BKL’s position within the core Australian market as stable and well penetrated. However, supply chain challenges with China remain, and we believe it may have an impact in the short term. In our view, there could be downside risk to sales growth estimates as a result of BKL’s business with China.

Shopping Centres Australasia Property Group (SCP)

SCP is an internally managed real estate investment trust (REIT), owning a portfolio of shopping centres across Australia. It generates about half its rental income from tenants. In our view, retail REIT earnings are hard to predict in the current environment. We expect shopping centre foot traffic to decline in the longer term as more consumers transition to online retailers.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.