Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

BUY – Northern Star Resources (NST)

Northern Star is a global gold mining company. The company posted a strong 2024 first half result. Record cash earnings of $702 million were up 50 per cent on the prior corresponding period. Revenue of $2.248 billion was up 15 per cent. The record unfranked interim dividend of 15 cents a share was up 36 per cent. The company sold 781,000 ounces of gold and remains on track to meet full year guidance. The company’s assets are first-class, and execution has been impressive. We have a bullish view on gold in calendar year 2024.

BUY – Collins Foods (CKF)

CKF is executing well in the fast-food market, underpinned by the popular KFC franchise, while Taco Bell’s performance is improving. First half 2024 revenue and underlying EBITDA were up by a double-digit percentage. A big increase in same-store sales across Australia and Europe caught the market’s eye. The shares were offering a cheaper entry point on February 22 compared to the start of the year.

HOLD RECOMMENDATIONS

HOLD – Boral (BLD)

The building materials supplier has delivered impressive capital gains in the past year. Recently, the stock again surged following a significant increase in 2024 first half profit and a lift in guidance. Price increases drove a hefty margin improvement in earnings before interest and tax to 10.9 per cent. Seven Group Holdings is proposing to acquire the remaining shares it doesn’t already own in Boral.

HOLD – Amcor (AMC)

Amcor (ASX: AMC) reported lower sales and profits in the first half of fiscal year 2024 in response to softer consumer demand and customer destocking. Management noted some signs of a recovery in January, but it isn’t anticipating a quick rebound in the second half. A solid cost containment effort supports the investment case, and we believe destocking has likely reached a low point.

SELL RECOMMENDATIONS

SELL – SkyCity Entertainment Group (SKC)

On February 11, 2024, this New Zealand casino operator announced it had been informed by the New Zealand Department of Internal Affairs that it intends to file civil proceedings in the High Court against SkyCity Casino Management Limited (SCML), alleging non-compliance with the Anti-Money Laundering and Countering Financing of Terrorism Act 2009. SCML is a subsidiary of SKC. This issue could persist quite for some time and result in material costs. Underlying group EBITDA of $NZ146.3 million for the six months to December 31, 2023, was down 9.6 per cent on the prior corresponding period. Underlying group earnings are expected to be impacted in fiscal year 2024 as the company is obliged to pay additional casino duty from its Adelaide casino following a recent court of appeal judgment.

SELL – Sigma Healthcare (SIG)

The share price rose significantly on news of a proposed reverse listing merger with Chemist Warehouse Group Holdings – a robust and mature business. The share price has risen from 68 cents on November 30, 2023, to trade at $1.097 on February 22, 2024. A merge will create a healthcare wholesaler, distributor and retail pharmacy franchisor. However, the proposed merger is subject to conditions. Consequently, we view Sigma’s share price as fragile.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

BUY – Johns Lyng Group (JLG)

The group delivers building and restoration services in Australia and the US. The business has generated strong growth in revenue and net profit after tax during the past three years. Organic growth has been supported by its acquisition strategy. So far, expanding to the US has been positive. Recent natural disasters are providing a strong pipeline of work.

BUY – ReadyTech Holdings (RDY)

RDY provides software-as-a-service technology to businesses and educators. It offers robust growth, recurring revenues and a reasonable valuation. On February 22, the share price was still trading below a shelved takeover bid for RDY at $4.50 a share in late 2022, despite a growing business. Organic growth in the mid-teens has been previously forecast by the company. At recent price levels, we believe RDY offers value. The shares were trading at $3.73 on February 22.

HOLD RECOMMENDATIONS

HOLD – PolyNovo (PNV)

The company provides dermal regeneration solutions via its NovoSorb biodegradable polymer technology. Indicative first half 2024 results were positive. Total global revenue of $48.8 million was up 65.6 per cent on the prior corresponding period. The business appears on track to generate $100 million in revenue for the full year. PNV reported an unaudited net profit after tax for the first time and the business has plenty of cash on its balance sheet.

HOLD – Challenger (CGF)

CGF is the biggest provider of annuities in Australia. Higher interest rates not only help CGF’s margins, but its value proposition for sales moving forward. Half year 2024 results were marginally better than consensus expectations. Management expects full year normalised net profit before tax to be in the top half of previous guidance. We continue to see value in the business.

SELL RECOMMENDATIONS

SELL – Wesfarmers (WES)

This industrial conglomerate has proven to be a resilient business. The company posted a statutory net profit after tax of $1.425 billion in the first half of fiscal year 2024, an increase of 3 per cent on the prior corresponding period. Revenue of $22.673 billion was up 0.5 per cent. The company was recently trading near all-time highs. Investors may want to consider taking a profit. At recent prices, we see better value alternatives elsewhere.

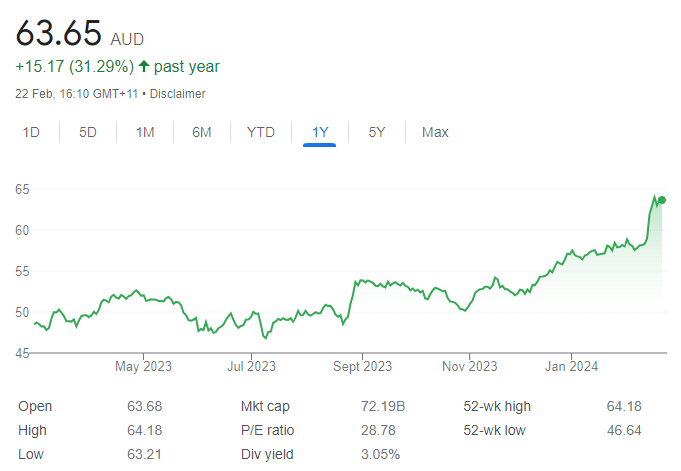

SELL – Commonwealth Bank of Australia (CBA)

The CBA is the best of the big four banks, in our opinion. However, in the absence of strong earnings per share growth, it’s difficult to justify CBA’s premium compared to the other banks. Statutory net profit after tax of $4.837 billion in the first half of fiscal year 2024 fell 8 per cent on the prior corresponding period. The net interest margin of 1.99 per cent was down 11 basis points. In our view, it will be difficult to pay out increasing dividends if earnings don’t improve.

Elio D’Amato, Stockopedia

BUY RECOMMENDATIONS

BUY – Temple & Webster Group (TPW)

This online furniture and homewares retailer keeps growing sales, profit and cash flow on a rolling 12-month basis. The company posted revenue of $254 million in the first half of fiscal year 2024, up 23 per cent on the prior corresponding period. EBITDA of $7.5 million was up 3 per cent. The latest financials show TPW is a quality company enjoying favourable momentum.

BUY – Stockland Group (SGP)

Stockland is a diversified property group, with strong occupancy rates. Assets are spread across town centres, residential communities, the office sector and logistics. SGP excites because of the recent transformative acquisition of 12 master-planned communities (MPC) for more than $1 billion. The acquisition ensures recurring income streams from its portfolio partnership with Supalai Australia Holdings.

HOLD RECOMMENDATIONS

HOLD – Vicinity Centres (VCX)

This retail property group has interests in 59 shopping centres across Australia. It has $23 billion in retail assets under management. Funds from operations of $345.6 million in the first half of fiscal year 2024 were down 3.2 per cent on the prior corresponding period. Statutory net profit after tax of $223.5 million was up from $176.3 million in last year’s first half. The company delivered a resilient performance in times of higher interest rates and soaring cost of living expenses.

HOLD – Lynas Rare Earths (LYC)

Sales revenue of $112.5 million in the second quarter of fiscal year 2024 was down from $128.1 million in the first quarter. Total rare earth oxide production in the second quarter was also down on the previous quarter. However, first feed of material from Mt Weld was introduced to the Kalgoorlie rare earths processing facility. US Department of Defence deals underpin its future.

SELL RECOMMENDATIONS

SELL – CSL (CSL)

This pharmaceutical behemoth deserves to be among the world leaders given a consistently strong track record. First half 2024 total revenue and net profit after tax were up on the corresponding period. However, the CSL112 cardiovascular drug trial didn’t achieve its goals amid the company delivering a weaker outlook for the Seqirus influenza segment. The shares have retreated from $305 on February 9 to trade at $285.14 on February 22. Investors may want to consider cashing in some gains.

SELL – Credit Corp Group (CCP)

CCP purchases debt ledgers in Australia, New Zealand and the US. The company reported a statutory loss of $12.1 million in the first half of fiscal year 2024. This was due to an impairment in the company’s US purchased debt ledger book. Operating and free cash flow remain volatile. The shares have risen from $13.09 on December 1, 2023, to trade at $18.50 on February 22, 2024. In our view, the recovering share price isn’t supported by the latest company fundamentals. Investors may want to consider taking a profit.

Related Articles:

- How to Trade CFDs in Australia

- How to Start Trading Stocks

- How to Start Forex Trading in Australia

- The Best Australian Cryptocurrency Brokers

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.